Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 27th January 2023

Investment markets and key developments

Global shares rose over the last week continuing their rally so far this year on signs global inflation has peaked and hopes central banks will become less hawkish and that there will be a soft landing. For the week US shares rose 2.5%, Eurozone shares rose 1.4% and Japanese shares gained 3.1%. Despite worse than expected CPI inflation data and increased market expectations for RBA rate hikes (with the market’s expected cash rate peak this year rising from 3.45% to 3.79%) the Australian share market rose 0.6%, is up for the fourth week in a row and is now just 1.8% below its all-time high. Gains in the ASX 200 were led by IT, consumer discretionary, property and utility shares. Bond yields mostly rose. Oil and copper prices fell, but iron ore rose. The $A rose to its highest since June last year.

The good news over the last week is that global business conditions (PMIs) improved slightly in January and global inflation pressures continue to ease. Europe continues to hold up far better than expected (green line in the next chart) suggesting that it may avoid recession, whereas the US is continuing to run very soft (blue line) suggesting a higher risk of recession there. Overall, the PMIs along with China’s reopening suggest that the risk of global recession has receded a bit. (Note that the PMIs are business conditions surveys, and the composite refers to all business sectors.)

Source: Bloomberg, AMP

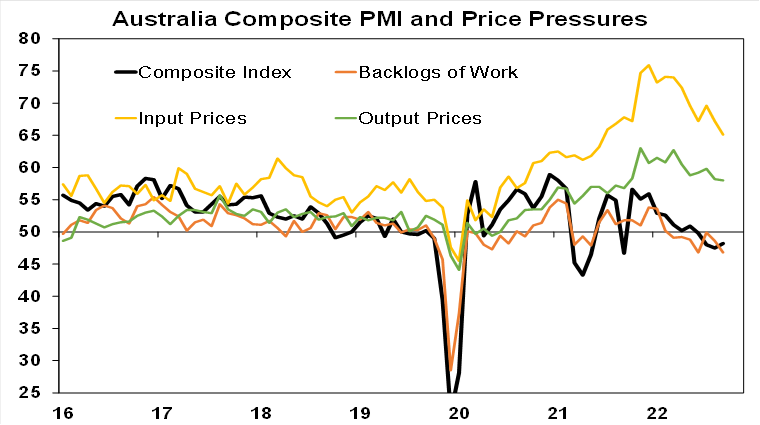

The PMIs showed a continuing downtrend in input and output prices and reduced work backlogs and delivery times compared to 12-18 months ago. This adds to signs that inflation pressures are easing.

Source: Bloomberg, AMP

This feeds into the Pipeline Inflation Indicator which is continuing to point to a further sharp fall in US inflation ahead.

Source: Bloomberg, AMP

While US recession risks remain high, the January PMIs continue the somewhat better growth/inflation news flow trade off seen so far this year which is supportive for investment markets.

The bad news in Australia though is that inflation surprised on the upside again in the December quarter and this is likely to tip the RBA into another 0.25% rate hike in February. Inflation rose to 7.8%yoy, its highest since the March quarter 1990, with key drivers being a surge in holiday travel costs, electricity and new dwellings. While just below the RBA’s forecast for an 8% rise, the further blow out in the trimmed mean measure of underlying inflation to 6.9%yoy (its highest since 1988 against RBA and expectations for a rise to 6.5%) is concerning. There is still a strong case for the RBA to pause on rate hikes given the rapid rate hikes to date, to allow for the lagged impact of rate hikes to work and given the risk of unnecessarily knocking the economy into recession. And it’s likely they should pause in February. However, given the stronger than expected rise in underlying inflation in the December quarter, the RBA is likely to want to reinforce its inflation fighting credentials again to keep inflation expectations down particularly given the risks of wages breakout. As a result of this, coming on the back of still strong retail sales, expect the RBA to raise its cash rate again by another 0.25% at its February meeting.

Source: ABS, AMP

However, it’s likely we have now seen the peak in Australian inflation, and it’s likely to continue to see inflation falling to just below 4% by year end as a result of improving global goods supply, a dissipation of post pandemic reopening distortions and as demand slows in response to higher interest rates:

- The US led Australian inflation on the way up by around 6 months and its likely to do so on the way down. US inflation peaked six months ago at 9.1%yoy and has now fallen to 6.5% with improved supply, falling freight costs, the fall in commodity prices from their high and slowing demand. And as noted above the US Pipeline Inflation Indicator points to a sharp further fall ahead in US inflation.

- Just as we are seeing globally, the January PMI survey in Australia continues to point to a downtrend in input and output price pressures with low work backlogs.

Source: Bloomberg, AMP

- Similarly, the December NAB business survey showed a further decline in cost & price pressures with even labour cost growth slowing. Consistent with this, the NAB survey also shows a slowing in capacity utilisation to 83.7% from a high of 86.3% which implies reduced pricing power. They are likely to slow further as the economy cools in response to higher interest rates this year. Producer price inflation also slowed in the December quarter from 6.4%yoy to 5.8%yoy, providing another sign that CPI inflation is likely to have peaked.

- Most of the upside surprise in December quarter CPI inflation came from a 10.9% rise in travel and accommodation costs (which accounted for about one quarter of the quarterly CPI rise) but this is most unlikely to be repeated as travel demand normalises and travel industry capacity returns. Similarly, there are signs that new dwelling purchases costs (up 18%yoy) are slowing and electricity price rises this year may be lower than previously expected with falling global gas and coal prices.

While the Australian December quarter inflation outcome was disappointing, with supply now improving and demand slowing the inflation backdrop is far more positive than it was a year ago, indicating we are near the end of the monetary policy tightening cycle. Inflation is also a lagging indicator and so there is a big danger in the RBA responding too aggressively to the upside surprise in the December quarter, by eg shifting back to a 0.5% hike in February as some are suggesting. If the RBA raises the cash rate by another 0.25% in February as is expected, this would take the cash rate to 3.35% and it’s expected that this will probably be the peak.

In a sign of things to come for the RBA and the Fed, the Bank of Canada hiked its policy rate by 0.25%, but signalled a pause. In hiking. The BoC cited “persistent excess demand” putting upward pressure on prices but it indicated that if economic conditions evolve as it expects then it expects to hold the policy rate while it assesses the impact of rate hikes so far.

Is the US debt ceiling a problem? Yes, but not yet. The US Congress imposes a ceiling on US Government debt that needs to be raised every so often given its ongoing budget deficit. If it’s not raised once reached spending would have to be slashed back to the level of revenue (leading to talk of the US defaulting on its debt servicing and spending commitments). Normally raising it was easy, but as we saw in 2011 and 2013 it can lead to brinkmanship as fiscally conservative Republicans (the Tea Party back then) seek to reduce the budget deficit and as always Washington leaves things to the last minute to resolve. Back then it was resolved but only in the nick of time and not before investment markets had started to worry about the impact of not raising it causing sharp falls in share markets and a downgrade to the US’ credit rating in 2011. The process then caused damage to Republican’s political standing so in subsequent years it was resolved smoothly and when Trump was President, Republican’s mostly gave up worrying much about the budget deficit anyway. However, with Republican’s regaining control of the House of Representatives and fiscally conservative Republican’s demanding a commitment to spending cuts in return for supporting Kevin McCarthy as House speaker it looks like it will be an issue again this year. The US has already hit its debt ceiling but cash balances mean that it can probably hold out to June at the earliest without needing to raise it so it won’t really be an issue until June or in the third quarter. Raising it will be a long process where the House passes a bill with spending cuts that’s rejected by the Senate and Biden ahead of inevitable negotiations at some point. But any resolution will again be last minute and markets will fret at the prospect of no deal and a default causing the potential for share markets falls at the time. But odds are a deal will be reached or Republican’s will get the blame for any default and big cuts to spending which won’t look good for them ahead of next year’s election.

Coronavirus update

New global Covid cases continued to trend down over the last week, but new deaths are yet to decisively roll over. The level of new case data has become less reliable with reduced reporting, but the direction of new case data probably still tells us something and death data is still reliable.

Source: ourworldindata.org, AMP

China ceased providing regular data but high frequency data on traffic, subway usage, airflights, etc, continues to suggest that the initial wave peaked. Another wave flowing from the Lunar New Year Holiday is a risk.

Reported new cases and hospitalisations in Australia have continued to slow. Deaths are still rising though.

Economic activity trackers

The Australian Economic Activity Tracker fell again in the last week after its Christmas/New Year spike but the European and US Trackers rose slightly. In a big picture sense Europe continues to hold up far better than expected.

Levels are not really comparable across countries. Based on weekly data for e.g. job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

Apart from the small rise in the US PMI, US economic data was a mixed bag. December quarter GDP came in stronger than expected at 2.9% annualised, but it was largely driven by net exports and inventory. Private final demand rose by just 0.2% annualised with weaker than expected consumer spending, near flat business investment and a plunge in housing investment. Home sales unexpectedly rose but remain well down from their highs. Durable goods orders rose more than expected but underlying capital goods orders fell again. Initial jobless claims fell but continuing claims rose. And the US leading economic index continues to point to a high risk of recession. On the positive side consumer sentiment rose slightly. Meanwhile, core private final consumption deflator inflation fell again to 4.4%yoy in December and the University of Michigan survey showed a further fall in 1 year ahead expected inflation to 3.9%, with 5-10 year inflation expectations falling back to 2.9% which is in their range for the last few decades, all of which supports a less hawkish Fed.

Nearly 30% of S&P 500 companies have now reported December quarter earnings. 70% of results have come in better than expected which is well below the norm of 76%. Consensus earnings expectations are for growth of -2.4% on a year ago, but given the average beat rate of around 2.5% its likely to end around flat. Energy and industrials are coming in the strongest but with materials, telcos and tech seeing falls in earnings with warnings of softer demand from the latter.

Source: Bloomberg, AMP

Apart from the improvement in Eurozone business conditions PMIs in January, the German ifo business index and Eurozone consumer confidence also rose slightly with lower gas prices clearly helping all these moves.

Tokyo CPI inflation rose to 4.4%yoy in January, adding to pressure for the BoJ to tighten further although core (ex food and energy) inflation is just 1.7%yoy.

New Zealand inflation came in unchanged at 7.2%yoy in December. While it remains high with the trimmed mean underlying inflation rate at 6.1%yoy, it looks to have peaked with the seasonally adjust quarterly rise stepping down from 1.8%qoq to 1.5%qoq and below what the RBNZ was expecting. This is likely to see the hawkish RBNZ downshift its next rate hike to +0.5%.

Australian economic events and implications

Business surveys point to growth slowing, but not collapsing. While the December NAB survey showed a slight improvement in business confidence and the more timely January PMI rose slightly both remain soft and the NAB survey showed a fall in business conditions. The overall impression from these business surveys is that growth has slowed since mid-last year, but not collapsed. The NAB survey also shows a sharp slowing in profitability, employment and forward orders. Of course, the full effect of rate hikes is yet to impact.

Source: NAB, AMP

Meanwhile, home sales fell another 4.6% in December and are down 42%yoy according to the Housing Industry Association, as the surge in interest rates continues to impact.

What to watch over the next week?

In the US, the Fed at its first meeting of the year on Wednesday is expected to further downshift its rate hike to +0.25% taking the Fed Funds rate to the range of 4.5-4.75% reflecting the significant policy tightening that has already occurred and evidence of slowing inflation and growth. Fed Chair Powell is likely to indicate that inflation remains too high and that there is more to do but his comments are likely to be less hawkish than was the case back in December as the Fed’s inflation forecasts look too high.

On the data front in the US, expect January jobs data (Friday) to show a further slowing in payroll growth to 175,000, a slight rise in unemployment to 3.6% and a further slowing in wages growth. In other data releases, expect December employment cost growth to remain around 1.2%qoq, January consumer confidence to rise slightly and home prices to fall again in November (all Tuesday) and the January ISM business conditions surveys to fall a bit further (Wednesday and Friday) and job openings data (Wednesday) to show a further fall. The December quarter earnings reporting season will continue.

The ECB (Thursday) is expected to raise rates by another 0.5% taking its main refinancing rate to 3% with its guidance likely to remain hawkish (noting that it has lagged the US in monetary tightening). Eurozone December quarter GDP (Tuesday) is expected to have slowed to +0.1%qoq, January CPI inflation is expected to slow to 9.1%yoy (from 9.2%) with core inflation falling to 5%yoy (from 5.2%) and unemployment is expected to have remained unchanged in December at 6.5%.

The Bank of England (Thursday) is also expected to hike by another 0.5% taking its policy rate to 4%.

Japanese jobs and industrial production data for December will be released Tuesday.

Chinese business conditions PMIs for January (Tuesday) are expected to bounce reflecting the recent reopening.

In Australia, December retail sales (Tuesday) are expected to have fallen -0.5% partly as payback for the 1.4% rise seen in November as a result of seasonal distortions due to Black Friday and Cyber Monday sales, CoreLogic data (Wednesday) is expected to show a further 1.1% fall in home prices in January, December building approvals (Thursday) are expected to rise by 4% after falling 9% in November and housing finance (Friday) is likely to fall another 2.5%.

The December half earnings reporting season will begin to get underway but with only a few companies reporting including Lynas, Origin, OZ Minerals, Beach Energy and Newscorp. Following recent upgrades, consensus earnings expectations for 2022-23 are for growth of 7.3%, but this is concentrated in energy, industrials, IT and utility stocks.

Outlook for investment markets

2023 is likely to see easing inflation pressures, central banks moving to get off the brakes and economic growth weakening but proving stronger than feared. This along with improved valuations should make for better returns in 2023. But there are likely to be bumps on the way – particularly regarding recession risks and raising the US debt ceiling around mid year – & this could involve a retest of 2022 lows or new lows in shares before the upswing resumes.

Global shares are expected to return around 7%. The post mid-term election year normally results in above average gains in US shares, but US shares are likely to remain a relative underperformer compared to non-US shares reflecting still higher price to earnings multiples (17.5 times forward earnings in the US versus 12 times forward earnings for non-US shares). The $US is also likely to weaken which should benefit emerging and Asian shares.

Australian shares are likely to outperform again, helped by stronger economic growth than in other developed countries and ultimately stronger growth in China supporting commodity prices and as investors continue to like the grossed-up dividend yield of around 5.5%. Expect the ASX 200 to end 2023 at around 7,600.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows and central banks become less hawkish.

Unlisted commercial property and infrastructure are expected to see slower returns, reflecting the lagged impact of weaker share markets and higher bond yields (on valuations).

Australian home prices are likely to fall another 8% or so as rate hikes continue to impact, resulting in a top to bottom fall of 15-20%, but with prices expected to bottom around the September quarter, ahead of gains late in the year as the RBA moves toward rate cuts.

Cash and bank deposits are expected to provide returns of around 3.25%, reflecting the back up in interest rates through 2022.

A rising trend in the $A is likely over the next 12 months, reflecting a downtrend in the now overvalued $US, the Fed moving to cut rates and solid commodity prices helped by stronger Chinese growth.

Source: AMP ‘Weekly Market Update’