Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Markets, Currency Risks & More…

|

16th February 2024 |

Will the Year of the Dragon spell good luck for the Australian economy?

Just when we thought it was far too late to be wishing you a Happy New Year… we welcome the Chinese Year of the Dragon.

In Chinese culture, the Dragon holds a significant place as an auspicious and extraordinary creature, unparallelled in talent and excellence. It symbolizes power, nobility, honour, luck and success – and 2024 is forecast to bring about opportunities, changes and challenges.

Precisely what challenges and opportunities it will bring for global economies more broadly – and Australia’s specifically – is already the subject of much discussion and crystal ball gazing.

As the US heads into a highly-charged election year with the potential return of a President Trump, the US Federal Reserve has indicated rate hikes were likely at their peak for this cycle (and held rates at 5.25-5.55 per cent), although central bankers were still in ‘risk management mode’.

They’ve been happy to see that inflation is coming down and accompanied by strong economic growth, while unemployment is starting to tick up, but talk of rate cuts in March or May may be premature. Markets are already pricing in a substantial cutting cycle, though traders adjusted their expectations that the easing of interest rates might be more gradual than anticipated.

Economist Jeffrey Frankel, James W Harpel Professor of Capital Formation and Growth at Harvard Kennedy School, told the Harvard Gazette that he was inclined to think the US has already had a soft landing.

“We’ve had better economic news in the last year or two than anyone could possibly have forecast,” he said. “All the numbers: unemployment, job growth, real growth, inflation, over the last year, it’s been amazingly good.”

Of concern, of course, is the fallout of geopolitical unrest, for example the ongoing conflict between Israel and Hamas, and Russia’s invasion of Ukraine, as well as the economic effects of climate change.

Panama, the fifth wettest country in the world, is going through one of the driest seasons on record due to climate change and inefficient water management. An estimated 5% of international trade and 40% of all US container traffic pass through the Panama Canal.

The Panama Canal – a manmade 82km waterway connecting the Atlantic and Pacific Oceans – consists of a lock system at each end that lift ships up to Gatun Lake (an artificial freshwater lake 26 meters above sea level).

The severe drought has caused a lack of water for the locks, forcing authorities to reduce ship crossings by more than a third in the Canal.

According to Focus Economics, China-US spot shipping prices have already surged over 30% following recent restrictions – and shipping charges may spike further if the drought extends and more restrictions are put in place, as vessels are rerouted through less efficient and more expensive routes.

When combined with the troubles in the Suez Canal, these logistical disruptions could reignite global price pressures, particularly for food and power and gas.

Back home, and RBA Governor Michele Bullock is sticking to her guns, unfazed by financial markets pricing in rate cuts in the second half of 2024, adding the RBA would only begin lowering rates when it was confident inflation was on a path to sustainably return to the 2 to 3 per cent target, which it did not expect until late 2025.

There’s no question that 2023 was a better year for markets than anyone had ever imagined.

We ducked a recession that many predicted, house prices remained buoyant… but we are not out of the woods just yet.

The economy will need a goldilocks outcome to justify the current growth trajectory. Markets have priced in profit growth assumptions that must materialise to sustain current levels, while any dent to consumer confidence, unemployment, interest rates or inflation could see a retrace of the last 6 months’ gains.

There is also a bit to play out as a result of the Government’ s backflip on Stage 3 tax cuts – with the reintroduction of the 37% rate set to result in an extra $28 billion in bracket creep being collected over the next decade.

Will a one-off sugar hit for middle Australia in the midst of a cost-of-living crisis outweigh the long-term higher tax impost for those Australians bumped into the higher tax bracket? And chatter persists around possible Government changes to negative gearing and franking credits, despite the Treasurer flatly insisting this is not under consideration.

And the bigger question remains whether these changes are really just tinkering around the edges for political expediency, when some would argue Australia should be considering more meaningful long-term tax reform.

The 2024 Year of the Dragon may indeed herald luck and success – but there’s still a lot of water to go under the bridge.

Wealth Markets – Currency Risk a Challenge |

If you’ve ever been on holiday overseas and caused yourself mild heart palpitations when converting the cost of your glass of champagne in France back into Australian dollars – then you’ll understand the premise behind Currency Risk. The latest in our ‘Risk Series’ – Currency Risk is a critical consideration when it comes to wealth management. Put simply, exchange rate fluctuations can have a potential impact on investment returns and this should be considered when buying – and then selling – a stake in investments. For example, an Australian investor might elect to diversify their portfolio by allocating funds into US stocks. Should the AUD strengthen against the USD, the returns on those US investments, when converted back into AUD, might appear diminished. Conversely, a weakening AUD could amplify returns. To effectively manage this risk, investors might choose to employ various strategies, such as currency hedging or diversification across currencies. In essence, currency risk highlights the interplay between global markets and underscores the need for a balanced and proactive approach to wealth management. By staying informed, embracing diversification, and adopting prudent strategies, investors can navigate the complexities of currency risk with resilience and confidence. |

Inherent risks in the Magnificent Seven’s market concentration |

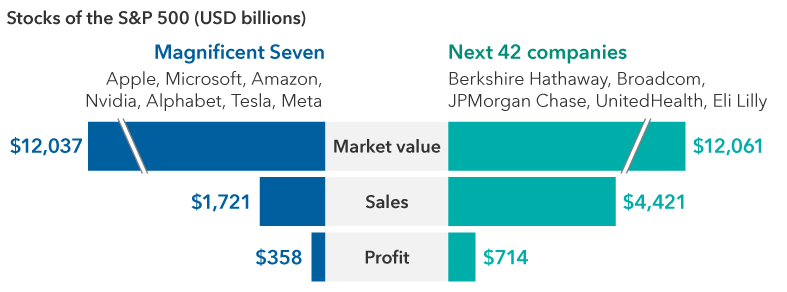

We talk a lot about the Magnificent Seven. And here’s why: new data around these tech and AI-related giants underscore just how powerful they are in obscuring the narrowness of the broader S&P 500 stock market.

The stock prices of these companies – Nvidia, Tesla, Apple, Microsoft, Amazon, Meta/Facebook, and Alphabel/Google – appreciated an unprecedented average of 111% last year, according to Forbes.

In fact, the Magnificent Seven grew to the “largest concentration the S&P 500 has ever had at 29%. The Equal Weight Index only earned 12%. Without the Magnificent Seven, the index would have risen only 8%”.

The group now sports a market cap of around $12 trillion. Looking further into the market, the sales and profitability of the next $12 trillion in market cap are represented by 42 companies from a broad set of industries ranging from tech and healthcare to financials and consumer companies.

According to Capital Group Equity Investment Director, David Polak, both the 12-month forward sales and earnings for this next set of companies making up the $12 trillion market cap are higher than for the Magnificent Seven.

Polak notes that while the Seven have sound balance sheets and strong cash generation to invest in research and development and AI to potentially drive growth, “risks to the group include elevated investor expectations after strong earnings in a choppy economic environment”.

“Additionally, signs of global economic weakness could impact certain big-cap tech stocks more than others. Heightened geopolitical tensions and regulatory questions may also linger throughout 2024”, Polak says.So, while there’s no denying their dominance, the risks of a Magnificent Seven correction would send shockwaves throughout the rest of the market, even if those stocks are performing well.

| _____________________________________________________________________________________________________________ |

Charts of the Week |

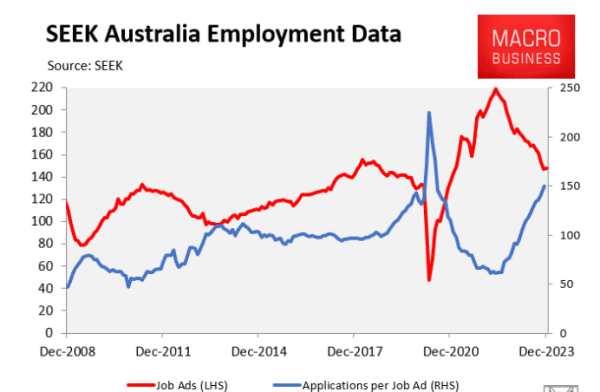

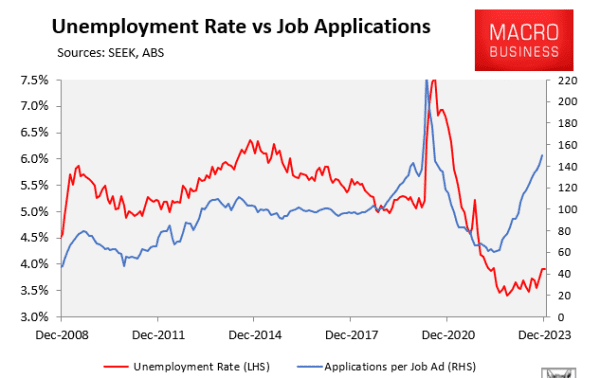

The unemployment rate has risen above 4 per cent (to 4.1% from 3.9%) for the first time in two years, as the nation’ s jobs growth slows off the back of higher interest rates.

The number of unemployed people officially increased by 22,000 in January.

These charts also paint an interesting picture of the Australian job market, as inflation continues to be reigned in.

The latest jobs data from SEEK (January) shows that the number of job ads fell significantly late last year, while the number of applicants per job ad surged well above pre-pandemic levels.

The surge in applicants per job ad implies that Australia’s unemployment rate will continue to lift materially in 2024.

Indeed, Deloitte recently noted that most ‘labour market indicators suggest a tipping point’ and tipped Australia’ s official unemployment rate to rise further to 4.5% by June 2024. (it has held steady at 3.9%)

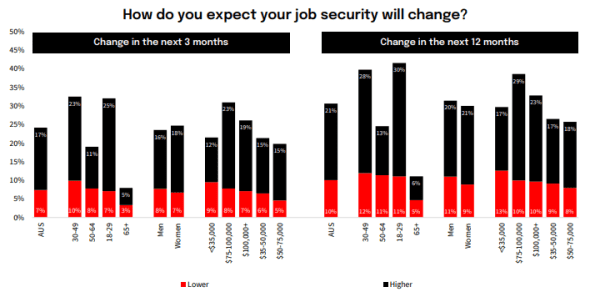

NAB’s latest Consumer Stress Index now sits at its highest level since the March 2020 quarter, with more Australians worried they will lose their job at some point this year.

“We asked Australian consumers for the first time if they thought their job security would be higher or lower in the next 3 and 12 months,” the NAB report said.

“Overall, 7% expect it to be lower in the next 3 months, but this increases to 10% in the next 12 months. By age, the number expecting it to be worse in the next 3 months was highest in the 30-49 group (10%) and lowest in the over 65 group (3%). All age groups expect their job security to be lower in the next 12 months…”

|

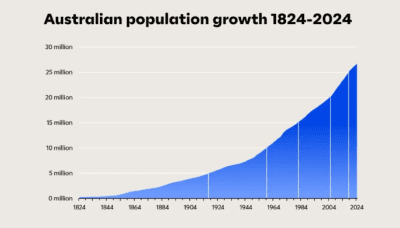

The Australian Bureau of Statistics’ Population Clock shows that Australia’s population has surpassed 27 million people, driven by record net overseas migration and more than thirty years ahead of predictions.

This projection is based on the estimated resident population as at Fri, 30 June 2023 and assumes growth since then of:

*One birth every 1 minutes and 42 seconds

*One death every 2 minutes and 52 seconds

*One person arriving to live in Australia every 0 minutes and 45 seconds

*One Australian resident leaving to live overseas every 2 minutes and 43 seconds.

*An overall total population increase of one person every 0 minutes and 50 seconds.

McCrindle research says: “Australia’ s population has increased by 624,100 over the past 12 months, equivalent to adding the population of the entire state of Tasmania (572,800) in just one year,” he said.

“Based on the latest annual growth rate of 2.4%, Australia’s population will be 41 million by 2042, 16 million more than the 2002 forecasts.

“It is the balance of 737,200 overseas arrivals and 219,100 departures which has led to record growth.”

It begs the question of how much this is going to exacerbate the already significant housing supply crisis and what impact it will have on the nation’s already languishing productivity.

Recent data shows Australia has recorded the lowest labour productivity growth among advanced nations, ahead of second worst Canada – growing at a near-zero rate since 2015 compared with the United States which has increased its productivity by 13% over the same period.

Chief Economist at the MB Fund and MB Super, Leith van Onselen, writes in MacroBusiness that ‘Australia is a productivity sinkhole’.

While Australia’s labour productivity growth ‘soared’ when Australia’s net overseas migration turned negative during the pandemic, business investment infrastructure investment and housing have not kept up with a return to high net overseas migration, which has led to a reduction in capital stock per worker, leading to ‘capital shallowing’ and reduced productivity.

“The increased labour supply caused by high immigration drives down wages, causing businesses to avoid investing in labour-saving technologies and automation, lowering productivity,” he writes.

The secret to happiness – fewer worries

Can money really buy happiness?

This was a thought running through our heads recently when going out to purchase a Powerball ticket for the record $200 million prize offer the other week.

And, as we dreamt about all the things we could do with our imagined winnings, we wondered whether, in fact, $200 million would make us 200 million times happier than we already are.

Researchers have studied the link between money and happiness and determined that – it may be less a matter of all the luxuries it can provide – luxury homes, lavish holidays, expensive jewellery – but its ability to help people avoid many of the day-to-day hassles that cause stress.

Research by Harvard Business School professor Jon Jachimowicz shows money can provide calm and control, allowing us to buy our way out of unforeseen bumps in the road, whether it’s a small nuisance, like dodging a rainstorm by ordering up an Uber, or a bigger worry, like handling an unexpected hospital bill.

“If we only focus on the happiness that money can bring, I think we are missing something,” says Jachimowicz, an assistant professor of business administration in the Organizational Behavior Unit at HBS.

“We also need to think about all of the worries that it can free us from.”

To read more about the study: More Proof That Money Can Buy Happiness (or a Life with Less Stress) – HBS Working Knowledge

Mad March is your reminder to start preparing for tax time

We are now well into February, and – believe it or not – that means that you should start thinking ahead to tax time.

Laying the groundwork now can create a significant advantage ahead of June 30, by enabling enough time to consider what strategies may be beneficial to your outcomes.

A well planned and patiently executed strategy will always deliver a better result and less stress than a last minute thought bubble delivered in haste.

Whether you’re exploring investment opportunities, maximizing retirement contributions, or implementing charitable giving strategies, proactive planning now enables you to optimize your tax position and potentially mitigate liabilities.

As the saying goes, preparation prevents poor performance.

And tax time is no different.

Friday Funny

If, sometimes, you long for simpler days before Siri, or AI, or Chat GPT, this cartoon is for you.

At least there’s always technology to blame…