Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Markets, Wealth Wisdom, Retirees’ Super and more…

|

17th November 2023 |

Market Update

Christmas may be around the corner, but it’s been hard to escape the depressing reality of the news cycle in recent weeks.

The war between Israel and Hamas is stoking growing fears of a wider Middle East conflict and far-reaching impacts on energy and food markets, global trade and geopolitical relationships.

These fears, understandably, are casting a dark shadow over the global economy as it limps out of the shocks of COVID-19 and the Ukraine war.

Jamie Dimon, chief executive of JPMorgan Chase says: “now may be the most dangerous time the world has seen in decades”.

With nearly $3.9 trillion in assets, JPMorgan Chase is the largest bank in the United States and a bellwether for the US economy.

Still, he says despite the fears his economists say a soft landing – where the economy slows down without triggering a severe downturn and high unemployment – is now more likely than a recession. He was less concerned about the economic effect than the geopolitical.

“Currently, US consumers and businesses generally remain healthy.”

A Christmas miracle in itself, some would argue.

Strong spending by US households has been one of the main reasons the economy has avoided a long-predicted recession, but it could also be adding upward pressure on inflation, which is at the centre of the Fed’s interest rate decisions. However, as we know, the Fed kept rates unchanged at its meeting earlier this month and is widely expected to pause again in December.

Here in Australia, our Treasury calculations show that petrol prices rose more than 7 per cent in the September quarter, adding around 0.25 percentage points to inflation from the previous quarter.

RBA governor Michele Bullock has said she was worried the escalating war between Hamas and Israel could keep inflation and oil prices higher for longer and indicated a low tolerance for a slower return to target inflation than anticipated.

In Australian dollar terms, oil prices have jumped 35 per cent higher since July 1 as major producers Saudi Arabia and Russia support oil revenues with production controls and the prospect of Iran becoming embroiled in the Middle East injecting extra volatility into oil markets.

So, will rising oil prices prove inflationary or deflationary?

On the one hand, higher fuel prices feed into almost everything that is produced, from tradeable goods to services. That will push prices up and stoke community fears of long-term inflation, sparking calls for higher wages. The RBA, some say, will have little option but to jack up rates even further to dampen demand.

On the other hand, after 12 rate hikes in 18 months, household spending was in decline and more Australian households were suffering mortgage stress. Therefore, more businesses may be forced to absorb the costs – protecting the flow-on impact to consumers – which will hit company profits and put pressure on businesses to cut costs, such as staff. Which is precisely what the RBA wants and yesterday’s numbers tend to support this.

In the end though, the RBA’s Melbourne Cup Day decision to lift the cash rate by another 25 basis points to a 12-year high of 4.35% ended its four-month pause, with Bullock citing the need to further reign-in inflation which was declining at a rate ‘ slower than earlier expected’.

An unlucky 13th rate rise for many households and businesses ahead of the festive season.

| _____________________________________________________________________________________________________________ |

|

A week may be a long time in politics, but the decisions made by those in power have much longer term ramifications. It can take months from announcement to legislation. It can take even longer to understand the true long-term implications on investors’ estates and financial security. Any change in government will inevitably bring changes in government policy (as well as the aforementioned obvious impact of geopolitical tensions and regulatory shifts on oil prices, inflation and global markets) and, therefore, it’s critical to be proactive and agile as much as possible in order to protect your wealth from the risk of the shifting landscape. We call this ‘Political Risk’ – and in the same vein as our recent musings on Longevity Risk and Sequencing Risk – it can alter tax structures and hit nest eggs and retirement income streams, hard. You only need to look at Treasurer Jim Chalmers’ proposed new tax on people with more than $3 million in total super (from 2025), lifting it from 15 per cent to 30 per cent. 80,000 Australians will be impacted initially (it’s not indexed so, over time, more will be captured as inflation reduces the value of $3 million), and many of them who have retired have put the maximum permissible transfer balance cap of $1.9 million into a separate Account Based Pension whose earnings are entirely tax-free. You can see why they would feel aggrieved and may feel as though they’re now being punished for doing nothing wrong other than following the rules. But the rules are slated to be changing, as they did back in 2017, when then Treasurer Scott Morrison unilaterally and retrospectively introduced a $1.6 million cap on the total amount of super that could be transferred into a tax-free retirement account. People had to restructure their affairs to take into account the new limits and, many understandably felt upset at the retrospective changing of the goal posts. Well brace yourself, because there may be more uncertainty to come, with Treasurer Chalmers flagging planned changes to franking credits (though he’s at pains to distinguish these from the policy that helped cost Bill Shorten the 2019 election). As they say, a week’s a long time in politics. But investors also have long memories. |

| _____________________________________________________________________________________________________________ |

|

Ask almost anyone how they are these days, and chances are you’ll get a simple one-word response: “Busy!”

Busy. It seems we’re all busy being, well, busy.

We wear it as a badge of honour. It’ s become a status symbol of influence. The busier we are, the better workers we must be. Right?

Not necessarily.

In fact, experts are increasingly warning against what they describe as a burgeoning ‘Culture of Busyness’ – an obsession or fixation on activity over output, which actually masks an underlying productivity and creativity problem for businesses.

Recent studies, including research by American psychologist Gloria Mark, PhD – Chancellor’s Professor of Informatics at the University of California whose book ‘Attention Span’ dives deep into the perils of distraction and multitasking – shows that the modern worker’s attention is being hijacked constantly:

- They check their phones on average a staggering 344 times per day (that’s once every 3 waking minutes!);

- Spend an average 2.4 hours each day scrolling social media platforms; shopping

- Are on an average 6 communication platforms (eg Slack, Teams, etc); and

- It takes approximately 23 minutes to refocus after being distracted.

Our attention spans are being eroded as we chase the next dopamine spike that comes from new information, a notification, ping or a text message.

A recent article in the Harvard Business Review by Adam Waytz argued the need to eliminate low-value work for ‘deep work’ or sustained attention to cognitively demanding tasks.

A recent article in the Harvard Business Review by Adam Waytz argued the need to eliminate low-value work for ‘deep work’ or sustained attention to cognitively demanding tasks.

He says a large body of research shows that “multitasking reduces productivity by as much as 40 per cent. Because multitasking feels more productive than doing just one thing, it’s easy to overlook the accumulation of “switching costs” (shifting between tasks). To truly overcome the busyness epidemic, organisations should perform audits of whether work does in fact engage employees rather than simply keep them on the clock.”

Of course, all this comes at a time when more Australian companies are trialling a 4-day work week for the same pay.

Medibank has recently launched a six-month trial of a four-day work week for 250 of its employees, which it says is ‘supporting the company’s ambition to be the healthiest workplace in Australia’ .

According to Medibank’s press release, the trial is dubbed “The Gift”, whereby employees taking part “will be provided the gift of time to do anything that brings them joy, in return for their efforts to remove low value work from their day and create capacity.”

The experiment is based on the 100:80:100 model whereby employees maintain 100 per cent of their pay, reduce their working hours to 80 per cent, while maintaining 100 per cent productivity.

And there’s the rub.

At a time when workers’ productivity is being increasingly hijacked by the never-ending stream of social media notifications, teams meetings, google searches and multi-tasking, a day less of work – while headline grabbing – has the potential to erode productivity even further.

Call us old fashioned, but perhaps we ought to successfully tackle productivity first, and our work days second.

|

Chart of the Week #1 |

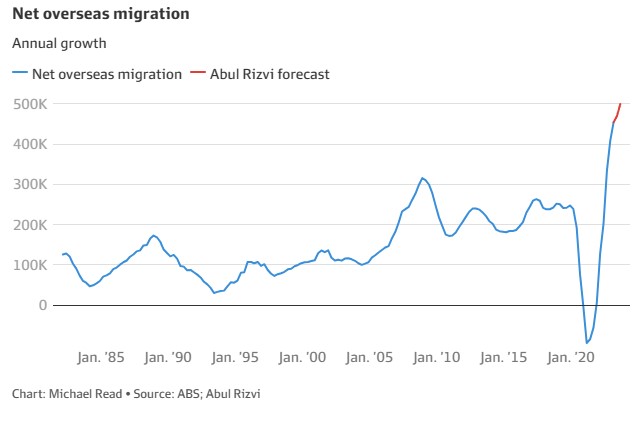

This chart caught our eye in the AFR last month, showing a suspected surge in net migration in Australia beyond official stats.

This chart caught our eye in the AFR last month, showing a suspected surge in net migration in Australia beyond official stats.

Abul Rizvi, a former deputy secretary at the Immigration Department and now independent media commentator, estimates net overseas migration hit 470,000 in the 12 months to June and probably reached 500,000 in the 12 months to September.

His forecasts, based on overseas arrivals and departures data, exceed Treasury’s projection for net overseas migration of 400,000 in the year to June, and make it unlikely Treasury’s forecast for the intake to fall to 315,000 by June 2024 will be realized.

Former Federal Treasurer Peter Costello weighed into the debate this week, insisting that while he believed immigration is good for the country, on balance it is adding to demand stresses through the economy, particularly in housing and infrastructure.

“My own view is overall it’s inflationary,” Costello told The Australian.

It’s a catch-22.

While this uplift in migration is no doubt contributing upward pressure on house prices and rents and amplifying a national housing supply crisis, it’s essential.

|

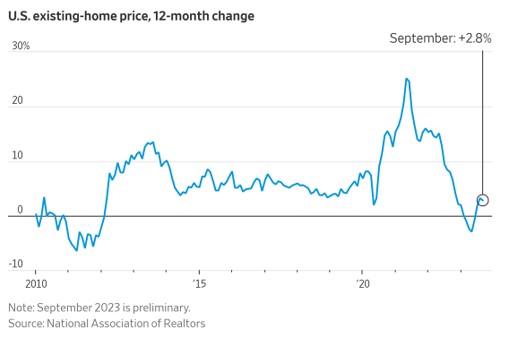

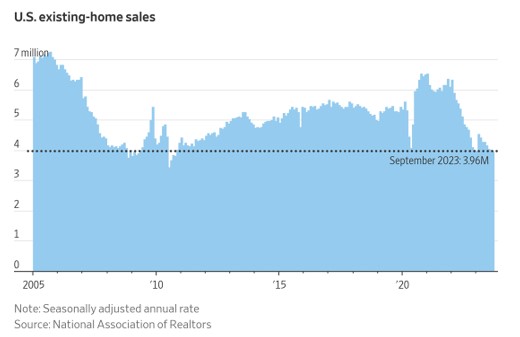

Charts of the Week #2 & #3

Housing Market activity in the US in decline US home sales fell in September to the lowest rate in 13 years, according to the National Association of Realtors. Existing home sales, which make up the biggest slice of the housing market, decreased 2 per cent in September from the previous month to a seasonally-adjusted annual rate of 3.96 million – the lowest since October 2010. The Wall Street Journal also reports that for all of 2023, sales of previously owned homes are on track to be the lowest since at least 2011, because increased rates are weighing on demand. High rates are also limiting the number of homes being listed on the market, because homeowners with low fixed mortgage rates are unwilling to sell and move as their new loan will be at the current variable rate. The small supply is therefore pushing home prices higher in much of the US. |

|

| That’ s the initial forecast power consumption of global software giant Microsoft’s proposed new data centre in Wisconsin – as it seeks approval to connect to the local WEC electricity grid.

For context, WEC’s entire electricity load in the state is around 8GW so this is enormous additional power demand. (1GW is the output from a typical nuclear reactor, and South Australia uses 11.6GW annually). Microsoft confirmed it’s all about AI-related demand and this 1GW is for phase 1 only, with further phases under investigation. Amazing when you consider that 10% of global electricity is used by computing – which didn’t exist 30 years ago! AI isn’t just something legislators and businesses are grappling with in relation to its application, it is poised to become a major driver of increased electricity demand for utility companies worldwide. It’s an excellent example of Jevons’ Paradox, the concept that improving efficiency in the use of any energy source will result not in less consumption, but in more. Jevons’ Paradox is named after the English economist William Stanley Jevons, who in the mid-19th Century noticed that improved steam engine efficiency resulted in higher coal consumption through broader usage, rather than conservation. It also highlights the complexity of the challenges ahead amid the global race for net zero emissions.

Which brings us back to the balancing act of AI. While ongoing technological advances are inevitable and will clearly lead to big economic and productivity gains and higher profitability in many sectors, they also come at a potential cost. And one of those costs is their big drag on electricity at a time when the world is trying to remove old generation technology from the grid. Trillions of dollars will be invested in this sector across government and private enterprise over the next 30 years. It is a space that we are watching intently for investment opportunities but with ever evolving technologies, uncertain legislative landscape and the long lead time on R & D, it is not a world for the fainthearted. |

Could Black Friday cause the RBA to see Red?

It’s officially 38 days until Christmas, but it’s the upcoming Black Friday sales next week (November 24) that could prove the bellwether event for the RBA as to whether it pulls the trigger and hikes interest rates again.

The increasing popularity of Black Friday sales (in 2019 it was the then busiest recorded day in the history of Rundle Mall) will prove the early test of Australians’ appetite for retail spending amidst a cost-of-living crisis.

Australian Bureau of Statistics data shows retail spending increased by a stronger-than-expected 0.9 per cent in September, driven by a lift in purchases at department stores and household goods, including gardening equipment, as shoppers made the most of unseasonably warm weather.

But for the nation’s $420bn retail sector – the largest private sector employer in the country – these are nervous times as stores try to anticipate what Christmas spending will look like and how much stock to have on their shelves and in their warehouses.

The Australian Retailers Association predicts Australians will spend $66.8 billion between November and Christmas Eve, just 0.1 per cent more than last year, despite big rises in the prices of goods and services across the economy.

“The marginal increase in spending this year is being inflated by supply chain price increases, particularly in food, and an overall increase in Australia’s population,” Mr Zahra told the Australian Financial Review.

“If you exclude these factors, overall Christmas spending is in decline.”

Kmart Group managing director Ian Bailey (who now oversees Target in its stable) is unsurprisingly talking up the season and the prospect of an “awesome’ Christmas, notwithstanding the rising cost-of-living pressures facing families.

He said Kmart and Target were watching the demographic trends that flowed through its twin retail businesses and he had noticed a more pronounced broadening of the customer base that now stretches across all income levels – not just the traditional base of low and middle-income households.

“What we are seeing is increased spend with us across all income levels, but especially so and to an even greater extent at the higher income levels,” he said.

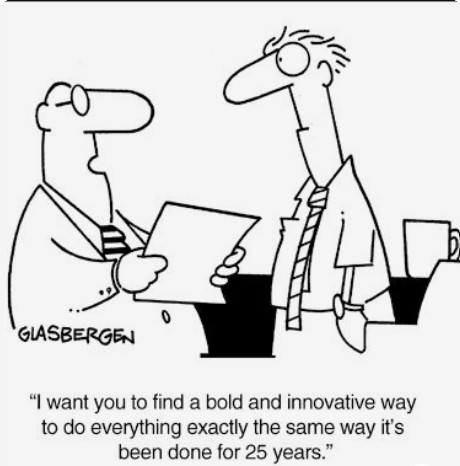

Friday Funny

In keeping with our theme of the need to focus more on deep-work, rather than non-productive, attention-sapping ‘busy work’ we bring you this Friday funny.

| Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser. |