Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 23rd June 2023

Investment markets and key developments

- Global share markets fell over the last week with renewed concerns about central bank rate hikes triggering global recession and a slump in profits, not helped by falls in surveys of business conditions. For the week US shares fell 1.4%, Eurozone shares fell 3.1%, Japanese shares fell 2.7% and Chinese shares lost 2.5%. Reflecting the weak global lead along with ongoing RBA hawkishness and concerns about Chinese growth, Australian shares fell 2.1% with falls led by IT, resources, consumer discretionary and industrial stocks. Bond yields fell as did oil, metal and iron ore prices along with the $A, with the $US up slightly.

- Global and Australian share markets have had a strong rebound over the last financial year on signs that global inflation has peaked, central banks may be near the top on rates and as worries about the war in Ukraine have receded. But the risk of a near term correction is high. Leading economic indicators continue to point to a high risk of recession in the US and the risk of recession in Australia is now around 50%. China’s recovery is looking less robust than expected and policy stimulus there so far has been pretty modest. Central banks are probably close to the top but they remain hawkish with a high risk of going too far. And the period from May to September is often rough for shares. Views remain that shares will do okay on a 12-month view as central banks ease up as inflation cools – with the ongoing decline in the US Pipeline Inflation Indicator being supportive in this regard – but the next few months are likely to be rough.

Source: Bloomberg, AMP

- The message from central banks over the last week remained relatively hawkish:

- Fed Chair Powell reiterated the message from the previous week’s Fed meeting that while it makes sense to moderate the pace of rate hikes, further rate hikes are likely.

-

- The Bank of England raised its key policy rate by a bigger than expected 0.5% to 5%, citing concerns about more persistent inflation pressures and strong wages growth and warning of more hikes to come. The UK money market now expects the BoE to hike above 6%.

-

- Both the Norwegian and Swiss central banks hiked rates again with both remaining hawkish and the Norwegian central bank citing concerns about wages growth

-

- While the minutes from the last RBA board meeting were oddly a bit less hawkish – noting that the decision to hike was “finely balanced” and omitting the guidance that further rate hikes “may be required” – the overall impression is that the RBA remains pretty hawkish driven by upside risks to inflation, worries about wages growth being tied to inflation and rising home prices resulting in less of a drag on consumer spending. What’s more a speech by Deputy Governor Bullock suggested that the RBA wants to see unemployment around 4.5% as being closer to a “sustainable balance” and consistent with some estimates of where the so-called Non-Accelerating Inflation Rate of Unemployment is – this is well above the current unemployment rate of 3.6%. And of course, Governor Lowe’s speech which came after the last meeting included the guidance towards further tightening.

- The risk of recession in Australia is now very high. The assessment remains that the RBA has already done enough to slow the economy and bring inflation back to target and we are seeing clear evidence of slowing demand in terms of falling real retail sales, falling building approvals, slowing plans for growth in business investment, slowing GDP growth and early indications of a slowing jobs market. As such the RBA should leave rates on hold for several months and allow more time to assess the impact of past rate hikes. But the RBA’s tightening bias, still high inflation and the rising impetus to wages growth – particularly flowing from the higher than expected minimum and award wage increases, more wage rises being tied to inflation and rising public sector wages growth all at a time of poor productivity growth – threatening to take wages growth beyond levels consistent with the inflation target – all point to the RBA raising rates again. Reflecting this, allowing for another 0.25% hike in either July or August and another one in September taking the cash rate to 4.6%.

- As a result, the risk of recession as now very high at around 50%. Consumer spending is almost certain to start going backwards later this year and into next year as the 4% plus cash rate will push debt servicing costs into record territory as a share of household income and on the RBA’s analysis 15% of households with a variable rate mortgage (which means about 1 million people) will be cash flow negative by year end at 3.75% cash rate and we are now well beyond this.

Economic activity trackers

- The Economic Activity Trackers fell in Australia over the last week but rose slightly in Europe and the US.

![]()

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

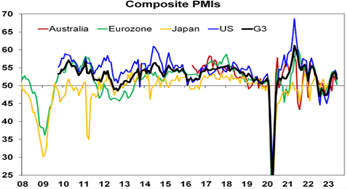

- June business conditions PMIs softened across the US, Europe, UK, Japan and Australia with manufacturing conditions falling further into negative territory and services starting to roll over again. Their rebound since late last year looks to be over as rate hikes continue to bear down on economic activity.

Source: Bloomberg, AMP

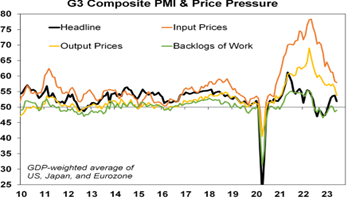

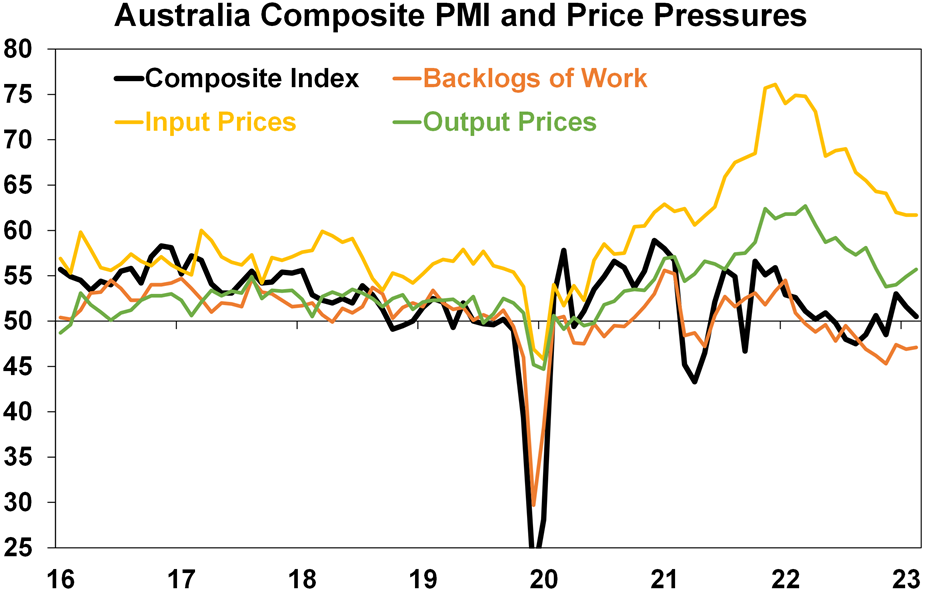

- Meanwhile the PMI’s show a continuing downtrend in input and output price measures, order backlogs well down from their 2021-22 highs and delivery times remaining much improved which is all consistent with an ongoing easing in inflationary pressures.

Source: Bloomberg, AMP

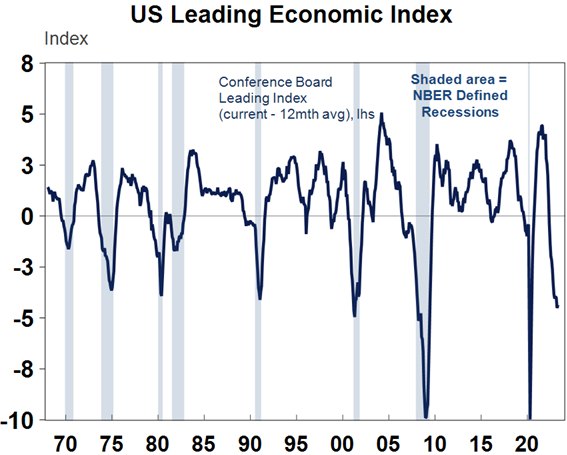

- Other US data has been mixed. Housing starts for May saw a sharp rebound continuing their recovery consistent with the NAHB home builders’ conditions index. However, existing home sales remained weak, the US leading index fell again in May and continues to point to a high risk of recession and initial jobless claims remained high with the four week average rising to its highest since late 2021.

Source: Macrobond, AMP

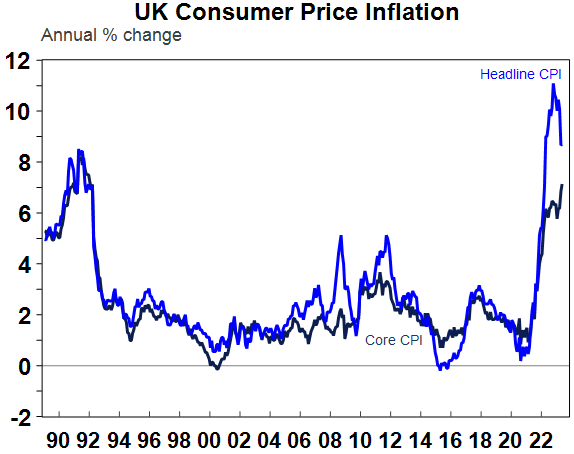

- UK inflation data for May surprised on the upside again with headline CPI inflation unchanged at 8.7% and core inflation rising further to 7.1%. This is consistent with accelerating wages growth in the UK (which is now running around 7%yoy) and signs of rising inflation expectations with the inflationary impact of Brexit not helping the UK relative to other countries. After hiking rates by another 0.5% in June further Bank of England monetary tightening looks likely.

Source: Macrobond, AMP

- Japanese business conditions PMIs fell in June but are still okay. Inflation fell back to 3.2%yoy in May but core inflation measures continue to rise with inflation excluding food and energy rising to 2.6%yoy from 2.5%.

- China followed up with more interest rate cuts, this time lowering its 1 year and 5 year loan prime rates by 0.1% to 3.55% and 4.2% respectively. Further policy easing is likely in China in the next few weeks although it’s likely to be modest compared to past easing cycles.

Australian economic events and implications

- Australian business conditions PMIs for June fell again but are still above the 50 growth/contraction level with services conditions slowing and manufacturing remaining below 50. Price pressures are well down from their highs, but input prices were little changed in June and output prices rose again due to services. Order backlogs are continuing to improve. Overall, price pressures are off their highs but still remain elevated.

Source: Bloomberg, AMP

What to watch over the next week?

- The European Central Bank’s annual forum in Sintra, Portugal, with a panel discussion comprising the Fed’s Jerome Powell, the ECB’s Christine Lagarde, the BoE’s Andrew Bailey and the BoJ’s Kazuo Ueda on Wednesday will likely see a reiteration of the “more work to do in taming inflation” message from the first three.

- In the US, expect data on Friday to show slower consumer spending in May and a further fall in private final consumption inflation, but core PCE inflation which is the Fed’s preferred inflation measure is likely to be unchanged at 4.7%yoy. In other data, expect a fall in May durable goods orders but gains in home prices and consumer confidence (all Tuesday).

- Canadian inflation for May (Tuesday) is likely to have fallen to 3.4%yoy.

- Eurozone data is likely to show a fall in economic confidence (Wednesday) and flat unemployment but a further fall in CPI inflation in June but flat core inflation at 5.3%yoy (both Friday).

- Japanese jobs and industrial production data for May will be released Friday.

- Chinese business conditions PMI’s (Friday) are likely to show a continuing divergence with strength in services but softness in manufacturing.

- In Australia, it will be back to focussing on inflation with the May Inflation Indicator (Wednesday) likely to show a sharp fall back to 6.0% after April’s rebound to 6.8%, partly reflecting a sharp fall in petrol prices in May and the base effect of a 0.7% monthly increase in May last year dropping out of the annual calculation. This could create space for the RBA to skip another rate hike in July and wait till August before moving again. Note however that the monthly Inflation Indicator is very volatile and is yet to really prove its usefulness beyond creating more noise for money market traders and something for economists and others to commentate on. May job vacancy data is likely to show its fourth quarterly fall in a row suggesting that the jobs market is slowly cooling, May retail sales are likely to rise just 0.1% adding to evidence of a consumer slowdown (with both due Wednesday) and credit data (Friday) is likely to show a further increase in housing lending.

Outlook for investment markets

- The next 12 months are likely to see easing inflation pressures and central banks moving to get off the brakes. This along with improved valuations should make for reasonable share market returns. But the next few months are likely to be rough given high recession and earnings risks, uncertainty around US banks and poor seasonality out to around September/October. This is likely to impact both global and Australian shares.

- Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become less hawkish.

- Unlisted commercial property and infrastructure are expected to see slower returns, reflecting the lagged impact of last year’s rise in bond yields on valuations. Commercial property returns are likely to be negative as “work from home” hits space demand as leases expire.

- With an increasing supply shortfall, the national average home price forecast for this year has been revised up from a fall of -7% to around flat to up slightly ahead of 5% growth next year. However, the risk is high of a further leg down putting us back on track for a 15-20% top to bottom fall on the back of the impact of high and still rising interest rates and higher unemployment.

- Cash and bank deposits are expected to provide returns of around 4%, reflecting the back up in interest rates.

- The $A is at risk of more downside in the short term, but a rising trend is likely over the next 12 months, reflecting a downtrend in the overvalued $US and the Fed moving to cut rates.

Source: AMP ‘Weekly Market Update’