Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 14th July 2023

Investment markets and key developments

- Global share markets rebounded strongly over the last week as US inflation fell sharply adding to expectations that the Fed and other central banks are at or near the top on rates. For the week US shares rose 2.4%, Eurozone shares gained 3.5%, Japanese shares were flat and Chinese shares rose 1.9%. The strong global lead along with less hawkish comments from RBA Governor Lowe saw the Australian share market rise by 3.7% with gains led by IT, material, property and energy stocks. Consistent with the risk on tone bond yields fell sharply, oil, metal and iron ore prices rose and the $A rose as the $US fell sharply.

- Shares are still at risk of a short-term correction given the high recession risk, worries about Chinese growth, the risk of more rate hikes with central banks still remaining wary (as evident by Fed speakers after the US CPI release) and the seasonally rougher patch often seen out to September/October but the ongoing fall in global inflation consistent with the positive 12-month view on shares appears to be dominating for now. So, any pull back may be shallow.

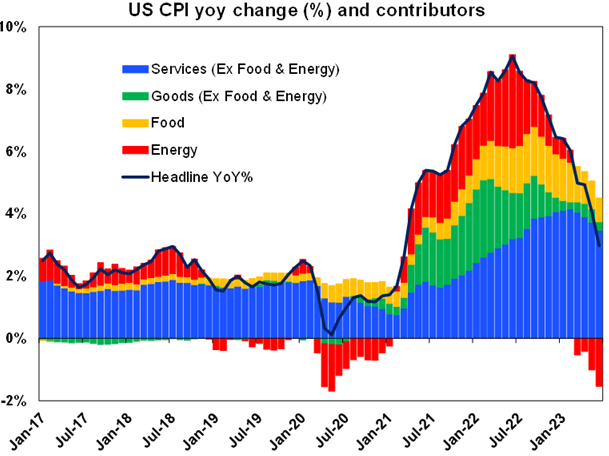

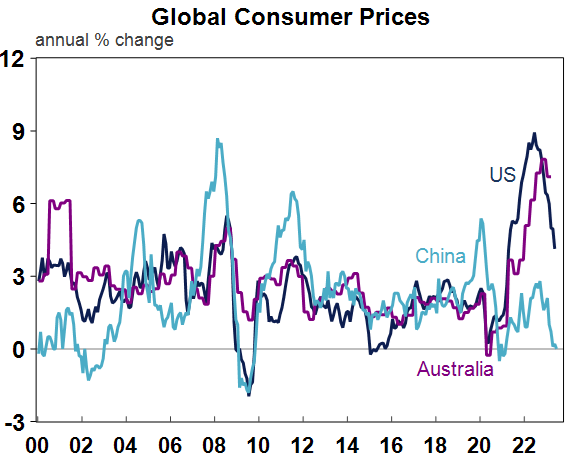

- US inflation falling as fast as it went up will take pressure off the Fed. US inflation surprised on the downside again in June falling to 3%yoy, which is down from 9.1% a year ago. Core inflation fell to 4.8%yoy. This was helped by base effects as high monthly increases a year ago drop out but the monthly pace of inflation has also slowed with 3 month annualised core inflation slowing to 4.1%. Just as goods price inflation led services inflation on the way up its also leading on the way down with services inflation now slowing.

Source: Bloomberg. AMP

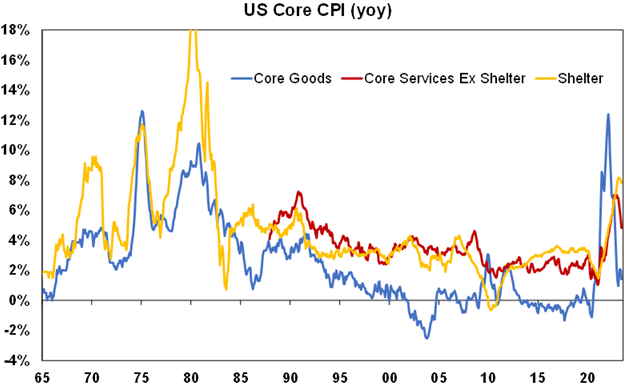

- In fact, the core services inflation excluding shelter which the Fed has been focussing on has slowed to 2.4% annualised in the last 3 months and shelter inflation is now also rolling over consistent with falling inflation in asking rents. Technical measures of underlying inflation such as the median and trimmed mean inflation are also rolling over and the breadth of price rises is now collapsing with only 45% of CPI categories now seeing monthly annualised inflation greater than 3%.

Source: Bloomberg. AMP

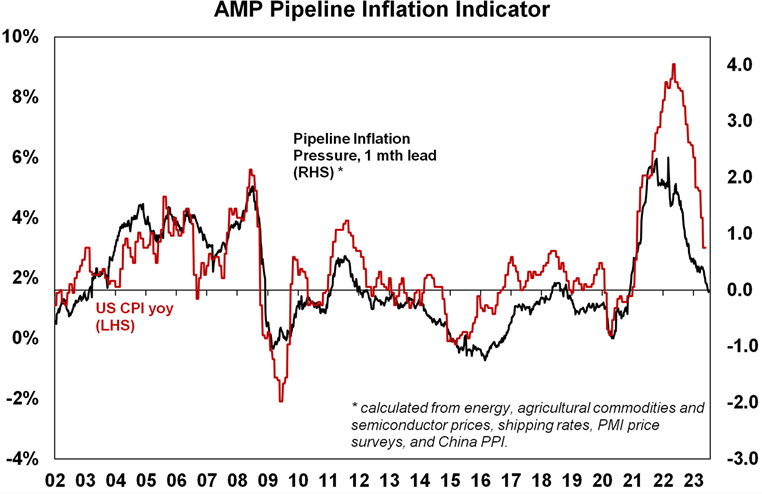

- US inflation has been catching down to the Pipeline Inflation Indicator. With the base effect of high monthly inflation a year ago dropping out of annual calculations behind us, progress in lowering inflation will slow in the months ahead but the Inflation Indicator still points down. As does the continuing fall in US producer price inflation which fell to just 0.1%yoy in June.

Source: Bloomberg, AMP

- The plunge in US inflation is good news and adds to confidence that the Fed and other central banks are at or near the top on rates. The Fed is still likely to hike another 0.25% this month on concerns that services inflation is still too high and worries that stopping too early when the labour market is still tight could see inflation reignite. But that maybe it. US inflation also led inflation in other countries on the way up so its decline augurs well for other countries including Australia.

- RBA Deputy Governor Michele Bullock to replace Governor Lowe once his term expires in mid-September. While there was a strong case to reappoint Lowe for another 3 years or so in order to finish the job of taming inflation, the appointment of his Deputy, Michele Bullock is an excellent choice given her experience at the RBA and her monetary policy credibility. Because she is well known and highly experienced in communicating RBA views it means less risk of the initial uncertainty that can come with new central bank governors and hence less need for her to prove herself by, for example, coming out even more hawkish on interest rates. Michele Bullock has been on the Board since April last year and has presumably agreed with the rate hikes and her public comments have been consistent with Governor Lowe’s strategy. As such and given that Michele Bullock still has to return inflation to the RBA’s 2-3% inflation target it’s unlikely the change in governor will result in any significant change in the outlook for interest rates. The good news is that all the heavy lifting on interest rates has already been done and with inflation falling globally and in Australia we are likely at or close to the top on interest rates. In fact, the new Governor’s first big decision will likely be to cut interest rates starting next year, although she will have to deal with the fallout from the rate hikes including the high risk of recession.

- Governor Lowe’s legacy. While Governor Lowe made a few mistakes in the aftermath of the pandemic so did many other policy makers through what were extraordinary times and his mistakes were greatly overshadowed by his massive contribution to helping the Australian economy weather and recover from the pandemic shock without major long term costs, the achievement of a near 50 year low in unemployment and his decisive response to the inflation problem and clear explanation of why we need to bring inflation back under control in a reasonable timeframe. But he has also sought to bring inflation back under control in a far more balanced fashion than seen by many other global central banks.

- On interest rates, it’s noteworthy that Governor Lowe softened the RBA’s tightening bias in the last week, noting that “It remains to be determined whether monetary policy has more work to do. It is possible that some further tightening will be required to return inflation to target within a reasonable timeframe” but “this will depend on how the economy and inflation evolve”. The RBA may just be waiting for more information and revised forecasts next month but Governor Lowe’s softer language suggests he thinks we may be at or close to top. Given the assessment that the RBA has already done enough, it’s hard to argue with his relaxation in the tightening bias, although it’s likely the RBA will still do more given risks on wages and sticky services inflation and Governor Lowe may want to get any rate hikes out of the way before Michele Bullock takes over in mid-September. Jobs data in the week ahead, inflation data at the end of the month and revised RBA wages growth forecasts will likely be key.

- RBA Governor Lowe also announced a shift to less meetings & more press conferences in line with RBA Review recommendations. In response to the recent RBA Review, the changes announced by Governor Lowe at the RBA to commence in February include: a move to 8 meetings a year instead of 11; the quarterly Statement of Monetary Policy to be released on the same day as the meeting in February, May, August and November; press conferences after each meeting at 3.30pm; and the Board signing off on decisions rather than just the Governor. Governor Lowe left other Review recommendations such as the publication of vote counts and Board members each making regular speeches to the new Monetary Policy Board once it’s set up which makes sense. None of the moves are likely to result in a significant change to the profile over time for interest rates as the RBA’s 2-3% inflation objective is unchanged. The move to less meetings though could lead to more considered decisions but may come with more bigger moves at times (either up or down) as we have seen in other countries with less meetings. The press conferences are unlikely to add much as the RBA already communicates a lot. And having the Board sign off on moves possibly dilutes the accountability of the RBA and may make it hard in times of uncertainty for the RBA Governor to lead the current Board (and even more so the proposed Monetary Policy Board) to decisive decisions and guidance.

- Our broader concern though is that the RBA’s move to Bank of England/Bank of Canada model with a Monetary Policy Board dominated by outsiders and taking votes with a potential to overrule the RBA as recommended by the Review without any evidence that it’s achieved better outcomes than the RBA does not make much sense. In particular, there is a strong argument that the structure of the BoE’s Monetary Policy Committee may be contributing to the problems the UK is now having in trying to reduce inflation because its making it harder for the BoE to provide decisive anti-inflation guidance. It’s concerning that having each Board member giving regular speeches on their views will just add to confusion as it does in the US.

Economic activity trackers

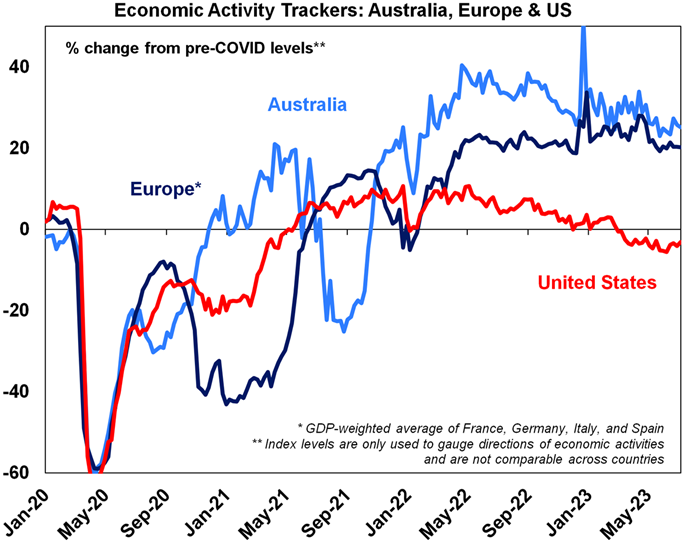

- The Economic Activity Trackers ticked down in Europe and Australia in the last week but rose in the US. They are yet to indicate any significant fall in economic activity though.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

- US data releases over the last week were mixed. Initial jobless claims fell, but continuing claims rose again continuing their rising trend. Consumer sentiment rose. Small business optimism as measured by the NFIB improved slightly but remains very weak with the proportion of firms raising prices falling to the lowest since March 2021.

- The Bank of Canada raised rates again by another 0.25% to 5%, with the BoC leaning a bit hawkish on the back of elevated demand and core inflation proving “more persistent”. It’s likely at the top though.

- Surging UK wages will maintain pressure on the Bank of England – but the UK looks different. While the UK jobs market appears to be cooling with unemployment rising to 4% in May its still tight and with wages growth now at 7.3%yoy will maintain pressure on the BoE with possibly another 0.5% rate hike in August. But note that the UK’s problems in controlling inflation and inflation expectations appear to be partly country specific with the inflationary Brexit shock and the difficulty of the BoE in agreeing and then communicating a strategy to contain inflation expectations under its Monetary Policy Committee framework adding to the post pandemic global inflation boost. The UK’s experience does nothing to support the application of the same Monetary Policy Board approach to the RBA.

- Japanese producer price inflation slowed further to 4.1%yoy in May – another indicator of falling inflation. Last year it peaked at over 10%yoy.

- The Reserve Bank of NZ left rates on hold as widely expected. Just remember though that they were already out front at 5.5%. They left their guidance for no change to rates until rate cuts in second half 2025 unchanged though. It’s likely they will have to cut before then.

- The Bank of Korea also left rates on hold, at 3.5%, but has a mild tightening bias.

- Chinese economic data for June was soft with exports and imports both falling more than expected, June CPI inflation falling to zero and producer prices down 5.4%yoy. While Chinese inflation has been running well below that in the US and Australia its cycle lately has lined up across all three countries with the plunge in Chinese inflation particularly for producer prices pointing to a further fall in US and Australian inflation. Meanwhile, bank lending and credit both rose sharply in June but annual credit growth fell further to 9%yoy from 9.5%.

Source: Macrobond, AMP

Australian economic events and implications

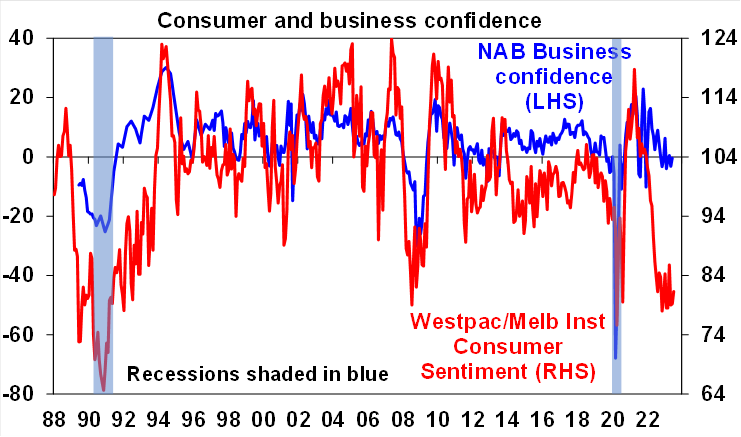

- Australian consumer confidence remains very weak, but business conditions remain resilient so far. According to the July Westpac/Melbourne Institute consumer survey, consumer confidence rose 2.7% possibly helped by news of lower inflation and the RBA’s decision to leave rates on hold. However, the alternative ANZ/Roy Morgan consumer sentiment survey shows a fall since the RBA meeting and in any case measures of consumer confidence remain around recessionary levels.

Source: Westpac/MI, NAB, AMP

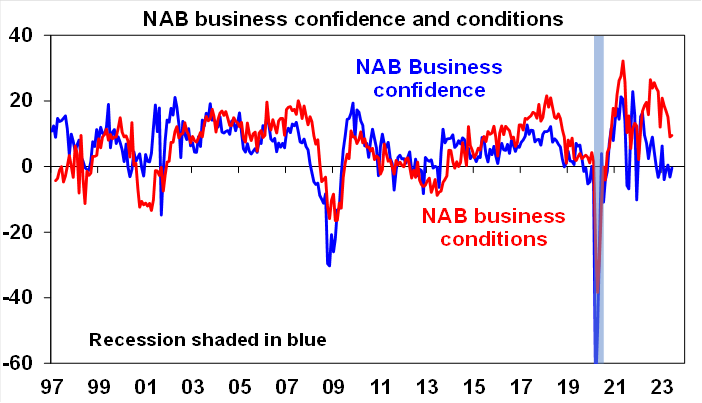

- By contrast business confidence remains around average levels and business conditions remain resilient, which is surprising given recent weakness in the PMI business conditions surveys.

Source: NAB, AMP

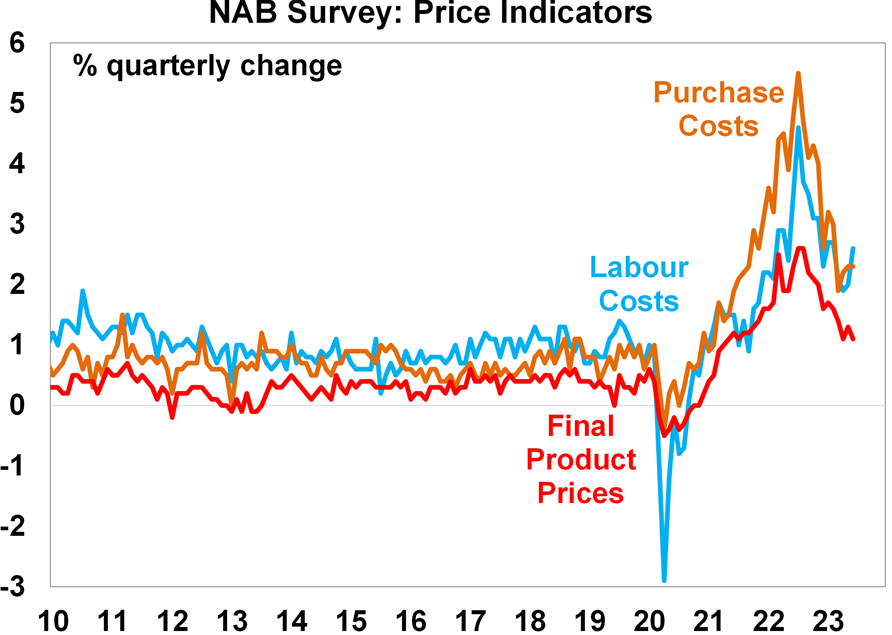

- The NAB survey also showed that while price and cost pressures are well down from their highs, they are still elevated with a rise in labour costs -possibly reflecting the late May announcement of faster award and minimum pay rises this year.

Source: NAB, AMP

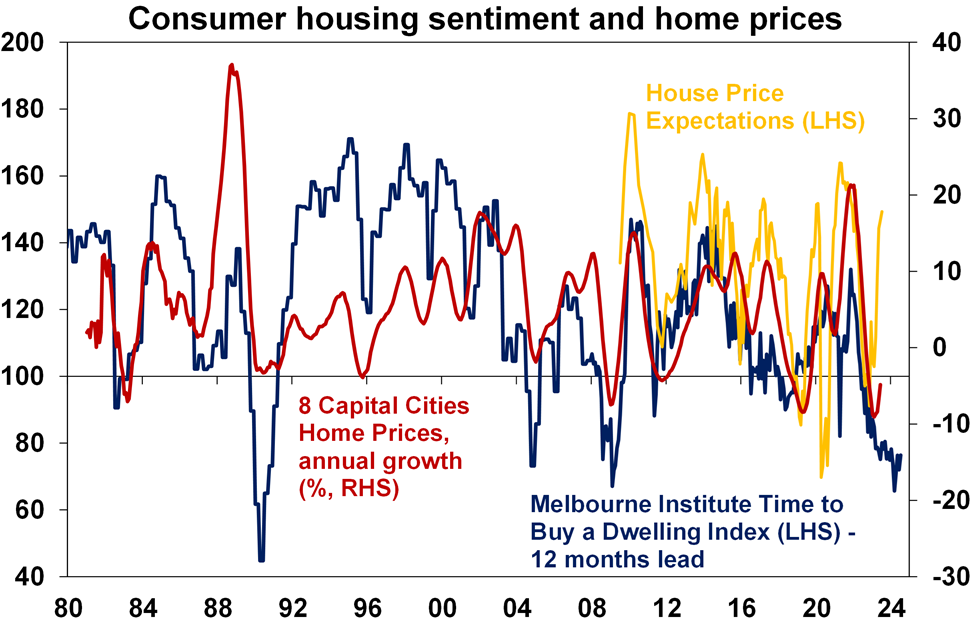

- Consumer perceptions regarding housing remain mixed with home price expectations up (probably in response to rising home prices) but perceptions of whether now is a good time to buy a home remaining very weak.

Source: NAB, AMP

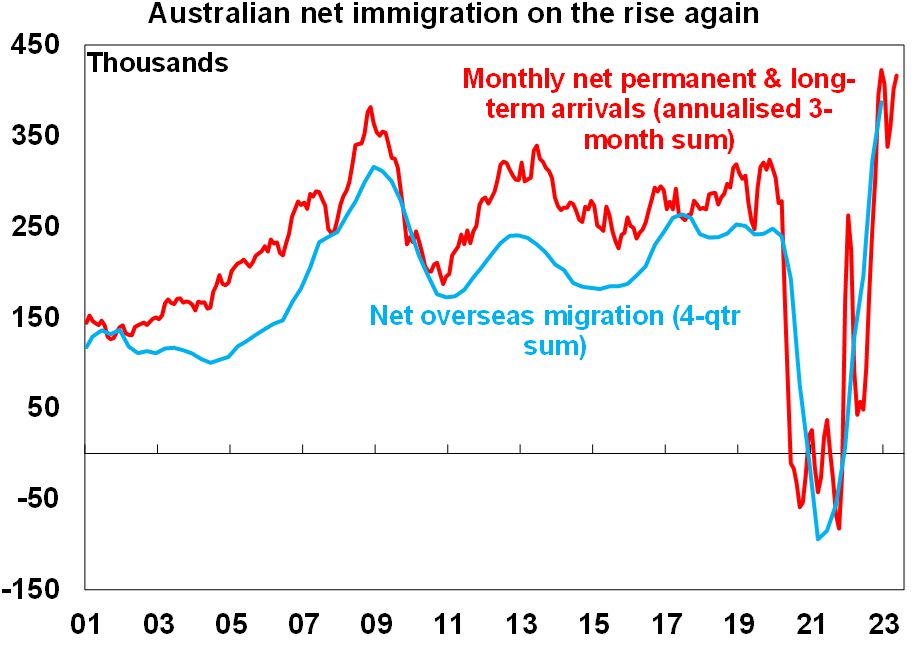

- Meanwhile permanent and long term arrival data up to May shows that immigration is likely still running around record levels, with population growth this year likely to be around 2% or more.

Source: ABS, AMP

What to watch over the next week?

- In the US, expect June retail sales growth of 0.5%mom but flat industrial production and the July home builders conditions index to fall back from 55 (all due Tuesday), June housing starts to fall 11% (Wednesday), existing home sales to fall 2% (Thursday) and ongoing softness in manufacturing conditions in July in the New York and Philadelphia regions. The US June quarter profit reporting season will start to ramp up with the consensus expecting a 7% fall in profits on a year ago. However, excluding energy and materials the consensus expectation is for a 1.4%yoy rise and hefty downwards revisions to earnings expectations along with strong beats so far from companies that report early including several banks point to a strong upside surprise.

- Canadian, UK and NZ inflation data for June will be released on Tuesday and Wednesday.

- Japanese June CPI inflation (Friday) is expected to fall back to 3.1%yoy from 3.2% with core inflation also falling slightly to 2.5%yoy.

- Chinese economic data is expected to show some slowing in growth after the reopening rebound. June quarter GDP growth is expected to come in at 7%yoy up from 4.5%, but this will be off the lockdown depressed base of June quarter last year with sequential quarterly GDP growth slowing to 0.8%qoq from 2.2%qoq. June monthly data is expected to show a slowdown in industrial production to 2.5%yoy, retail sales to 3.3%yoy and investment to 3.4%year to date.

- In Australia, the minutes from the last RBA board meeting (Tuesday) will be watched to see how close the decision to leave rates on hold was but are likely to reiterate the RBA’s now softer tightening bias. Jobs data on Thursday is expected to show a sharp slowing in employment growth to 5,000 after the 75,900 gain in May but with unemployment rising to 3.7%.

Outlook for investment markets

- The next 12 months are likely to see a further easing in inflation pressures and central banks moving to get off the brakes. This should make for reasonable share market returns, provided any recession is mild. But the next few months could still see a correction given high recession and earnings risks, still somewhat hawkish central banks and poor seasonality out to around September/October.

- Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become dovish.

- Unlisted commercial property and infrastructure are expected to see soft returns, reflecting the lagged impact of last year’s rise in bond yields on valuations. Commercial property returns are likely to be negative as “work from home” hits space demand as leases expire.

- With an increasing supply shortfall, the national average home price forecast for this calendar year has been revised up to around flat to up slightly ahead of 5% growth next year. However, the risk is high of a further leg down putting us back on track for a 15-20% top to bottom fall on the back of the impact of high and still rising interest rates and higher unemployment.

- Cash and bank deposits are expected to provide returns of around 4%, reflecting the back up in interest rates.

- The $A is at risk of more downside in the short term, but a rising trend is likely over the next 12 months, reflecting a downtrend in the overvalued $US and the Fed moving to cut rates.

Source: AMP ‘Weekly Market Update’