Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 11th August 2023

Investment markets and key developments

Share markets were mixed over the last week, on the back of higher energy prices and ongoing upwards pressure on bond yields. For the week US shares fell 0.3% and Eurozone shares fell 0.4%. Chinese shares also fell 3.4% with weak data. But Japanese shares rose 0.9%. Australian shares rose 0.2% with gains led by consumer discretionary, energy and financial stocks partly offset by IT, consumer stables and materials. Bond yields rose in the US and Europe but fell in Japan and Australia. Oil prices continued to rise and gas prices surged on the back of a possible strike in Australia affecting global gas supplies. Metal prices fell and the iron ore price was little changed. The $A fell as the $US rose.

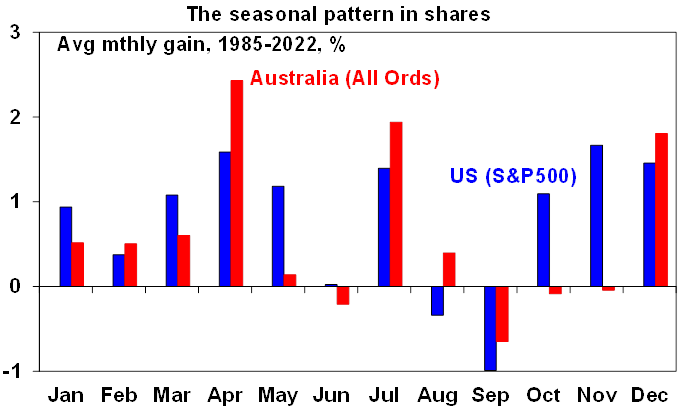

Shares remain at risk of a correction. July is often a strong month, but August and September are the weakest months of year in the US and Australian shares tend to follow. Key vulnerabilities are: the high risk of recession; China growth worries; a pause in disinflation in response to higher energy prices and sticky services inflation; central banks still at risk of more hikes; the high risk of another US Government shutdown from 1 October with the Fitch downgrade to US debt likely to embolden Republicans to press for measures to curtail the US budget deficit in budget funding negotiations; and higher bond yields if US growth actually starts to pick up and the BoJ moves further down the tightening path. But we retain a positive 12-month view on shares as inflation is likely to continue to trend down taking pressure off central banks and any recession is likely to be mild.

Source: Bloomberg, AMP

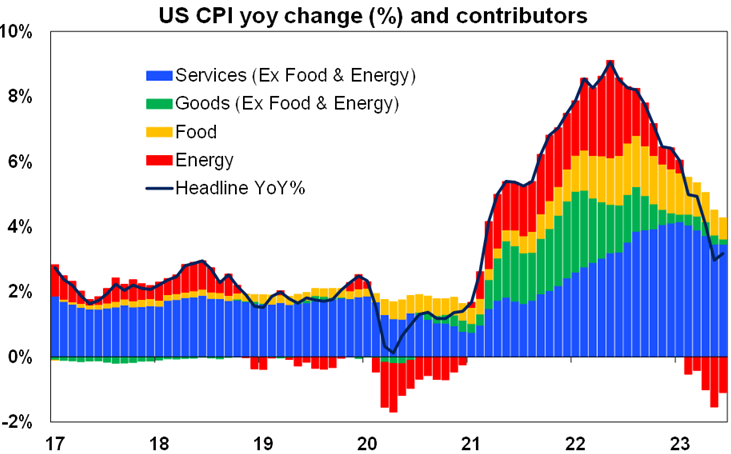

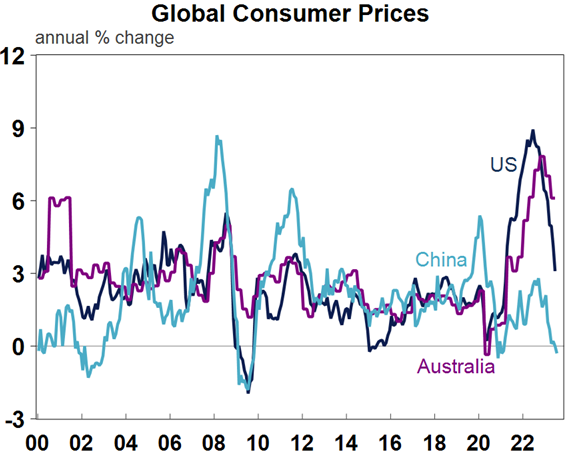

The good news on US inflation continued in July. CPI inflation rose to 3.2%yoy from 3% in June due to base effects as a lower monthly rise a year ago dropped out, but the rise was less than expected and core (ex food and energy) inflation fell further to 4.7%yoy. Core goods inflation was actually negative at -0.3%mom and just as goods price inflation led services inflation on the way up its also leading on the way down with services inflation continuing to slow.

Source: Bloomberg. AMP

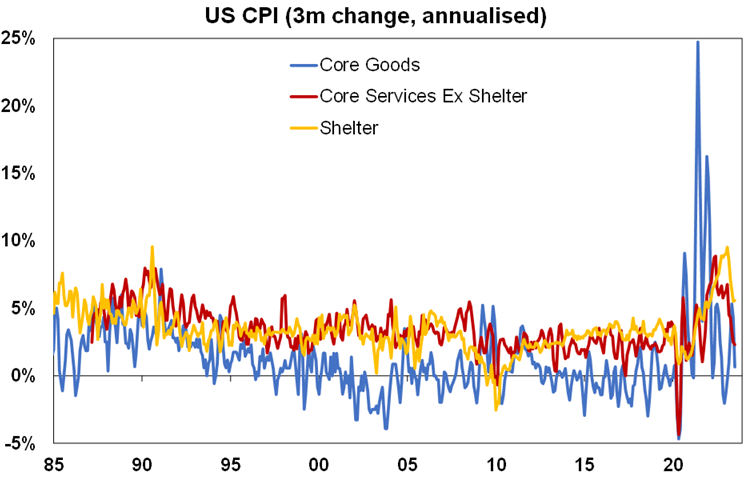

In fact, US core services inflation excluding shelter which the Fed has been focussing on has slowed to 2.3% annualised over the last 3 months and shelter inflation is continuing to roll over consistent with falling inflation in asking rents. Technical measures of underlying inflation such as the median and trimmed mean inflation are also rolling over and the breadth of price rises has fallen with only 44% of CPI categories now seeing monthly annualised inflation greater than 3%.

Source: Bloomberg. AMP

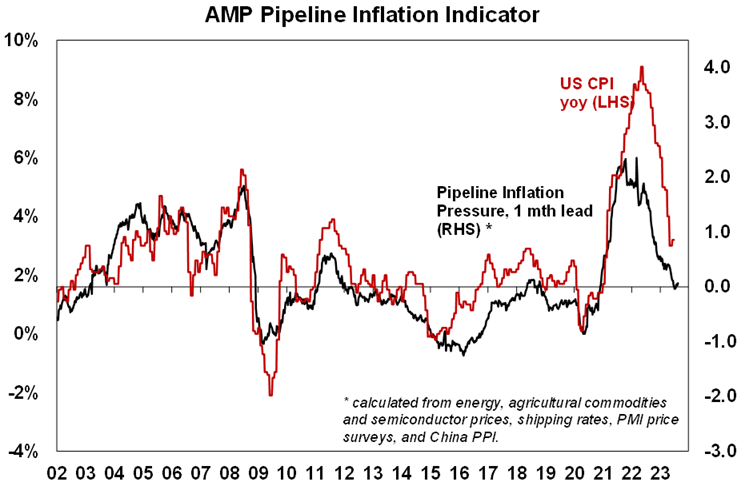

With the base effect of high inflation a year ago dropping out of annual calculations behind us, energy prices on the rise again and food price inflation unlikely to slow much further progress in lowering inflation may slow in the months ahead, but this could be offset by a continuing slowing in core inflation particularly as rent inflation slows. Our US Inflation Indicator continues to point down.

Source: Bloomberg, AMP

Continuing disinflation in the US is good news. While Fed speakers on average maintain a mild tightening bias, the July inflation data is consistent with the Fed remaining on hold at its September meeting although there is still another round of monthly jobs and inflation data before then. US inflation also led inflation in other countries on the way up so its decline augurs well for other countries including Australia.

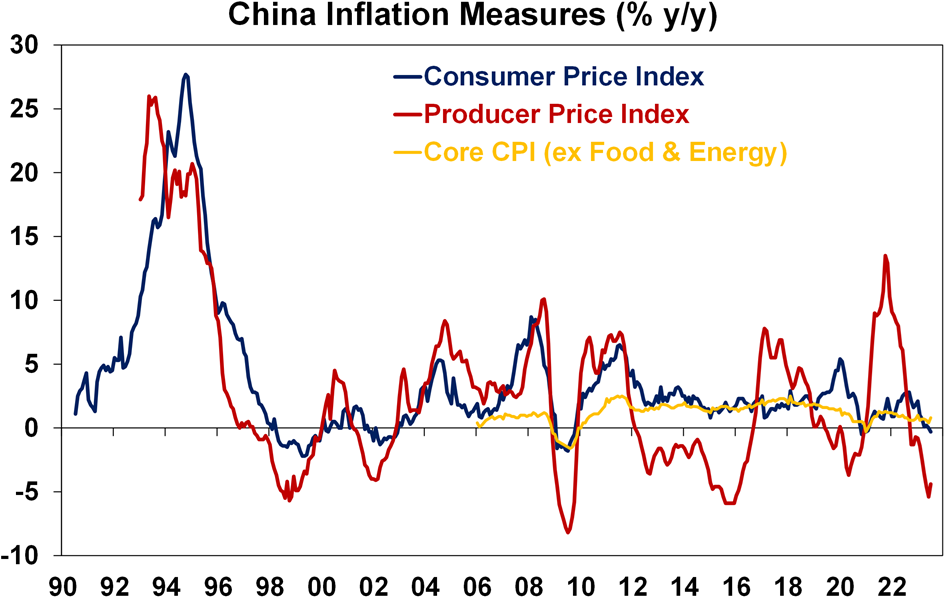

Continuing weakness in Chinese inflation is consistent with ongoing weakness in US and Australian inflation.

Source: Macrobond, AMP

RBA Governor Lowe’s House Economics Committee testimony reiterated the RBA’s softened tightening bias that “its possible that some further tightening in monetary policy may be required” and this will depend on economic data and the risks. His commentary continued to reflect the more balanced assessment of risks with uncertainties around the consumer and services inflation. He did note that if the expected pick up in productivity did not occur then high inflation could persist. Coming data on wages, jobs, retail sales and inflation ahead of the next RBA meeting will be critical.

In terms of the implementation of RBA Review, Governor Lowe is right to point that “it makes sense to take time to get the details right” around the proposed Monetary Policy Board. Being dominated by outsiders it could diminish RBA responsibility and authority and having all Board members out giving speeches on monetary policy will lead to confusion. There is no evidence that the Bank of England and Bank of Canada models, which are proposed for Australia, have delivered better outcomes.

Mixed messages on Australian interest rates in the last week from data releases – but our base case remains that we have seen the top or if not are now very close to it. On the one hand the NAB business survey reported a renewed surge in labour costs and selling prices in July likely reflecting the faster increase in minimum and award wages this year, the Superannuation Guarantee increase and higher power prices providing a reminder that the risks for interest rates are still on the upside. Against this though the ABS’ Household Spending Indicator has slowed to a crawl in nominal terms suggesting that overall real consumer spending may have gone backwards in the June quarter. This is telling us that demand is rapidly slowing and this will push inflation down as companies discount to clear stock and cut hiring and so the RBA should continue to exercise patience and so leave rates on hold. Our base case remains that rates have peaked (with 60% probability) but the risk of another hike is high (at 40%).

The Beach Boys go disco. Most would not associate The Beach Boys with disco music but in the late 1970s they had a brief foray taking a 1967 song from their Wild Honey album called Here Comes The Night and turning it into an 11 minute disco extravaganza on their 1979 LA (Light Album). The disco version came with lots of swirling strings, pounding electro & classic Beach Boys vocals. Other groups just put a disco beat to their existing songs but the disco version of Hear Comes The Night was an all out new production by Bruce Johnston (who had by then returned to The Beach Boys) and Carl Becher. Unfortunately, by 1979 the disco craze had already peaked and their fans were not into it so when they performed it they got booed and never played it again. Pity because its actually a bit of a hoot and well worth a listen. Carl Wilson’s vocals really rock. It’s a pity they didn’t do more disco!

Economic activity trackers

Our Economic Activity Trackers are trending flat to up in Europe and the US and down in Australia. Still no decisive indication of recession (or a growth rebound) here.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

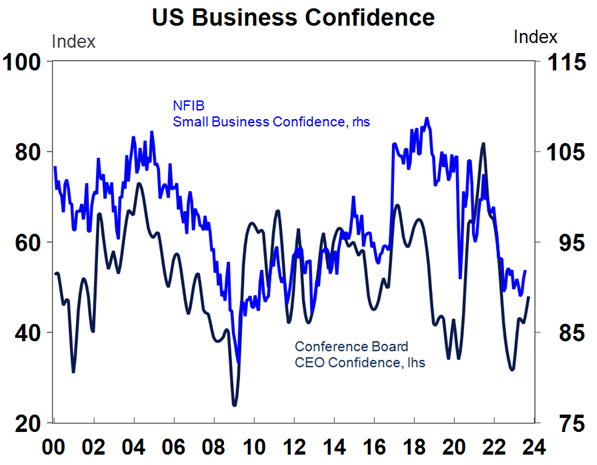

US business optimism up but still soft. This was evident in CEO confidence and small business optimism. The proportion of small firms raising prices fell further to 25%. Meanwhile, the leading index fell again in June and jobless claims rose but remain low.

Source: Macrobond, AMP

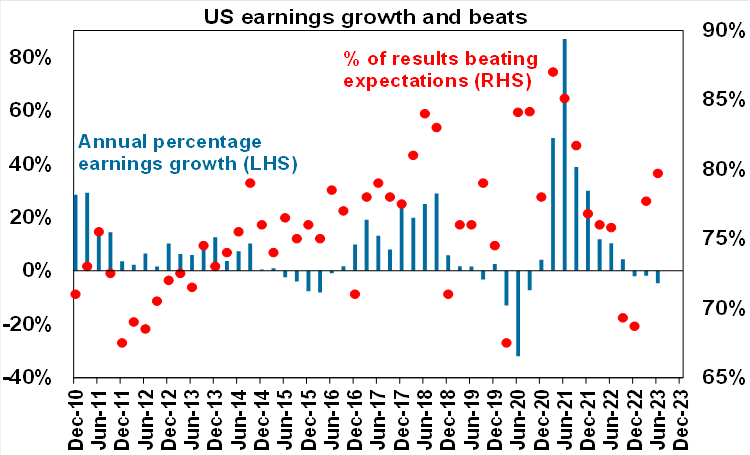

US June quarter earnings reports are now more than 90% complete with 80% beating earnings expectations (compared to the norm of 76%) with an average beat of 7%. Consensus earnings expectations for the year to the June quarter have been revised up from a 7% decline to a 4.7% and decline are likely to end up with a 4% fall. Non-US earnings look stronger at around +0.8%.

Source: Bloomberg, AMP

Soft household spending and wages data in Japan. After accelerating to 2.9%yoy in May wages growth fell back to 2.3% in June which is not enough to push the BoJ towards more tightening.

Chinese economic data continues to disappoint. Bank lending and credit came in much weaker than expected in July and the slump in exports and imports worsened with exports down 14.5%yoy and imports down 12.4%yoy with the latter indicating weak domestic demand. Meanwhile, China slipped back into deflation with the CPI down 0.3%yoy and producer prices down 4.4%yoy. It’s not quite as weak as it looks as core CPI inflation edged up slightly but it’s still weak at just 0.8%yoy. Despite ongoing indications of soft growth, details of actual policy stimulus remain weak and policy announcements have been modest. Meanwhile deflation in China is a positive influence on global inflation.

Source: Bloomberg, AMP

Australian economic events and implications

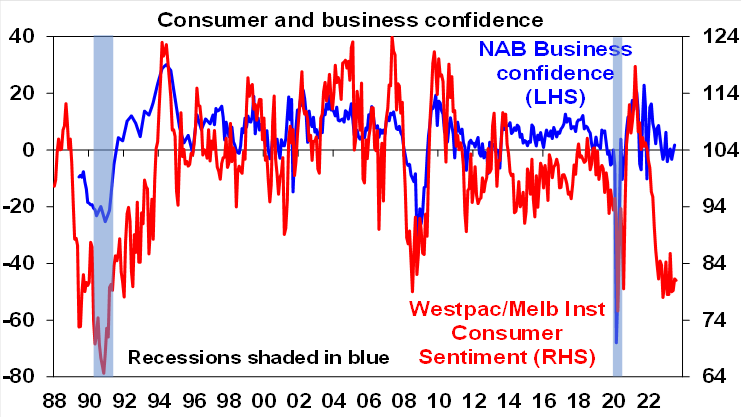

Australian consumers remain depressed, but business conditions remain okay. According to the July Westpac/MI consumer survey, consumer confidence fell slightly in August remaining at recessionary levels despite the RBA’s decision to leave rates on hold again indicating that the lagged impact of rate hikes and cost of living pressures continue to impact. By contrast business confidence according to the July NAB survey remains at average levels and business conditions remain okay.

Source: Westpac/MI, NAB, AMP

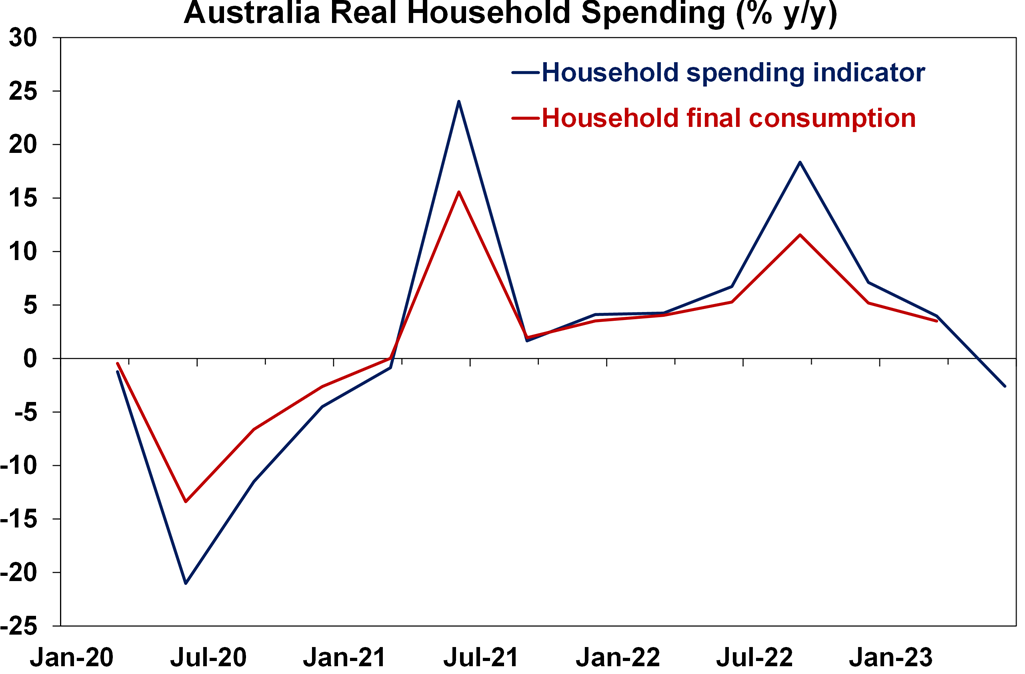

Rapidly slowing consumer spending. The ongoing weakness in consumer confidence and the hit to spending power is now showing up in weakening household spending growth according to the ABS’ Household Spending Indicator, which slowed to just 1.8% nominal growth over the year to June. This is based on bank transactions data and while it excludes rent, utilities, communications and education which leaves it more volatile than actual consumer spending it nevertheless points down suggesting a high risk of falling real consumer spending in the June quarter.

Household spending indicator has been adjusted for inflation. Source: ABS, AMP

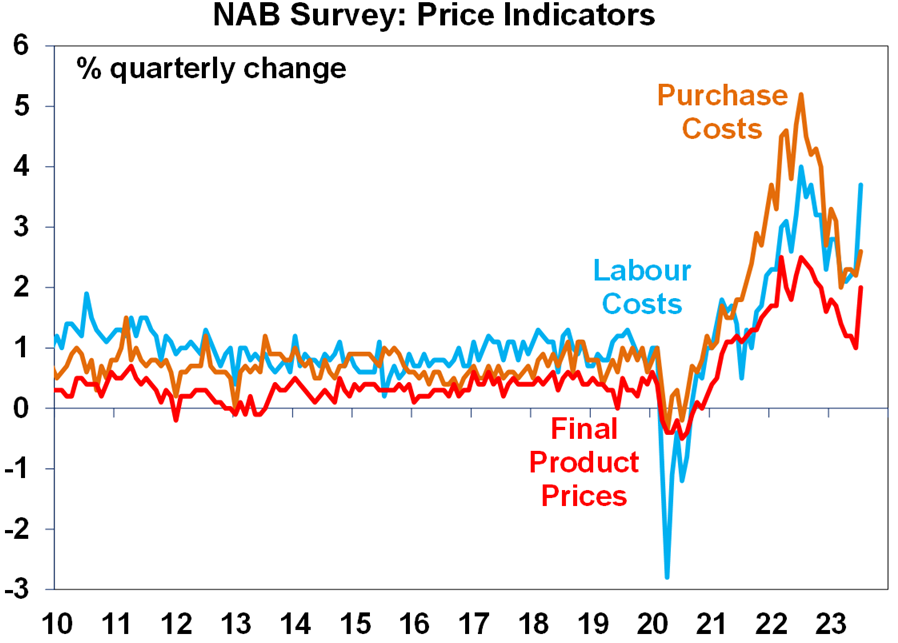

But is inflation pressure on the rise again? The NAB survey showed that while cost and price pressures are still down from their highs, they rebounded sharply in July. This was particularly the case for labour costs and likely reflects the flow through of faster minimum and award wage rises this year and their influencing effect on other wages, along with the increase in the Super Guarantee and higher power prices. Higher final product prices also suggests that faster labour costs may be getting passed on to consumers, threatening the wage price spiral the RBA has been so intent on avoiding. The spike in labour costs contrasts with RBA business liaison which indicated expectations for steady wages growth at around 4% and we won’t know for sure until September quarter wages data is released in November. The deepening weakness in consumer spending supports our view that RBA rate hikes are working in cooling demand and that this will help bring inflation back to target and hence that the RBA needs to continue to exercise patience and so leave rates hold. Nevertheless, the rebound in labour costs indicated in the NAB survey highlights that the risk of more rate hikes remains high.

Source: NAB, AMP

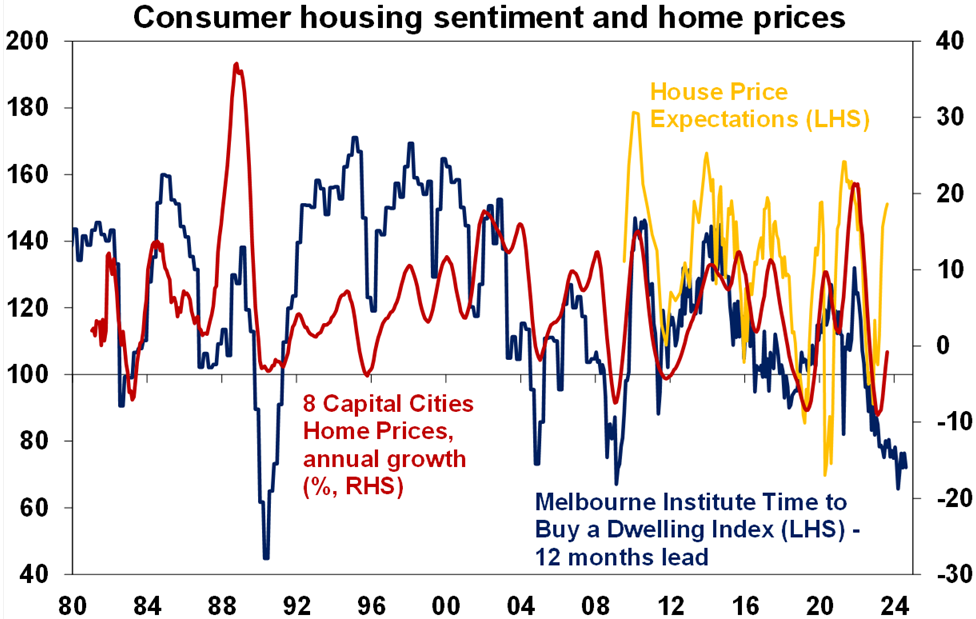

Consumer perceptions regarding housing remain mixed with home price expectations up in response to rising home prices but perceptions of whether now is a good time to buy a home remaining very weak. Normally the two move more closely together and their divergence now indicates greater than normal uncertainty regarding the outlook for home prices.

Source: Core Logic, Westpac/MI, AMP

So far so good for June half earnings. So far 53% of companies have beaten expectations (compared to a norm of 43%), 60% have seen earnings rise on a year ago and 55% have increased their dividends. These are all an improvement on the February reporting season, but less than 20 major companies have so far reported and companies with good news often report early. Key themes so far are that building material companies are still benefitting from strong activity, insurers are seeing margin improvement (although this is at the expense of their customers who are seeing big premium increases), so far home borrowers are keeping up their payments (but rate hikes have yet to fully flow through) and retailers are warning of tougher conditions.

Source: Bloomberg, AMP

What to watch over the next week?

In the US, the minutes from the Fed’s last meeting (Tuesday) are likely to confirm its tightening bias has been softened and is now data dependent. On the data front, expect July retail sales growth of around 0.4%mom and the NAHB home builders’ index to remain around 56 (both due Tuesday), industrial production to rise around 0.4%mom and housing starts to rise around 1% after weakness in both in June (both due Wednesday) and continued weakness in the Leading Index for July (Thursday). Manufacturing conditions indexes in the New York and Philadelphia regions (Tuesday and Thursday) respectively are likely to have remained soft with only minor improvement.

Canadian CPI inflation (Tuesday) is likely to have edged up to 2.9%yoy in July from 2.8% in June.

Japanese June quarter GDP (Tuesday) is expected to rise 0.7%qoq with flat consumer spending, weak business spending but a strong contribution from trade. Inflation for July (Friday) is expected to have remained at 3.3%yoy but with core ex food and energy inflation rising to 2.8%yoy from 2.6%.

The Reserve Bank of New Zealand (Wednesday) is expected to leave its policy rate on hold at 5.5%.

Chinese economic activity data for July (Tuesday) is expected to remain consistent with softish growth with a slowing in industrial production to 4.3%yoy, a slight pick-up in retail sales growth to 3.6%yoy and unchanged fixed asset investment growth at 3.8%yoy. Unemployment is likely to have remained unchanged at 5.2% but watch for a further rise in youth unemployment.

In Australia, the minutes from the last RBA meeting (Tuesday) are likely to confirm that the decision to hold rates in August was a close call and to reiterate the Bank’s softened tightening bias with more balanced risks around the inflation outlook. On the data front expect June quarter wages data (Tuesday) to show a step up in quarterly wages growth to 0.9%qoq from 0.8%qoq in the March quarter, but with annual growth remaining unchanged at 3.7%yoy. This is in line with RBA forecasts. This year’s faster increases in minimum and award wages won’t show up until the September quarter. July jobs data (Thursday) is expected to show a 20,000 gain in employment with unemployment rising to 3.6%.

The Australian June half profit reporting season will also kick off in earnest in the week ahead. Consensus earnings expectations are for a 2% rise in earnings over 2022-23, down from 22.4% in 2021-22. Key issues to focus on will be: how hard consumer spending is getting hit? are cost pressures easing or shifting to a blow out in labour costs? are rising interest rates causing debt servicing problems for companies? are profit margins coming under pressure? and how big a threat is slow growth in China to mining companies? 64 major companies are due to report in the week ahead including JB Hi-Fi and Lendlease (Monday), CSL and Treasury Wines (Tuesday), Dexus and Transurban (Wednesday) and Amcor, Seven and Southern Cross (Thursday).

Outlook for investment markets

The next 12 months are likely to see a further easing in inflation pressures and central banks moving to get off the brakes. This should make for reasonable share market returns, provided any recession is mild. But for the next few months shares are at high risk of a correction given high recession and earnings risks, the risk of still more hikes from central banks and poor seasonality out to September/October.

Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become dovish.

Unlisted commercial property and infrastructure are expected to see soft returns, reflecting the lagged impact of last year’s rise in bond yields on valuations. Commercial property returns are likely to be negative as “work from home” hits space demand as leases expire.

With an increasing supply shortfall, we revised up our national average home price forecast for this calendar year to around flat to up slightly ahead of 5% growth next year. However, the risk is high of a further leg down on the back of the impact of high interest rates and higher unemployment.

Cash and bank deposits are expected to provide returns of around 4%, reflecting the back up in interest rates.

The $A is at risk of more downside in the short term, but a rising trend is likely over the next 12 months, reflecting a downtrend in the overvalued $US and the Fed moving to cut rates.

Source: AMP ‘Weekly Market Update’