Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Recession, Debt ceilings, SLOOS, Federal Budget and more

19th May 2023

Former Reserve Bank governor Glenn Stevens knows all too well how long inflation can hang around. This week he warned Australians of the difficult road ahead.

The current Macquarie Bank chairman told a conference this week that so-called ‘soft landings’ are pretty uncommon. When they have happened, he said, they have been in the context of “more favourable trend developments in supply than we appear to see at present”.

He was speaking at the Australian Petroleum Production and Exploration Association conference in Adelaide on Tuesday (16 May).

It’s worth listening to Glenn Stevens. He succeeded Ian Macfarlane, who retired in September 2006 and served as RBA governor for a decade until September 2016. His tenure covered the global financial crisis, European sovereign debt crisis, and oversaw 29 cash rate adjustments.

Under his leadership, the RBA moved the cash rate from 6 per cent in October 2006 to a high of 7.25 per cent in August 2008. When he retired, it was 1.5 per cent – Certainly couldn’t be accused of being asleep at the wheel.

While Stevens agrees it was a “no brainer” that interest rates had to rise sharply last year in response to high inflation (fuelled by government stimulus in the pandemic), he said central banks now have the hard task of balancing the fight against inflation and ensuring financial stability.

“The way monetary policy works isn’t by somehow miraculously affecting final spending and nothing else. It works by affecting financial conditions and the viability of a range of financial structures, business models, asset valuations and so on. So policymakers find themselves in the position of making very difficult judgments as they seek settings that restrain real spending to reduce inflation, without causing non-linear and unintended effects on financial stability.”

His bottom line.., “it’s optimistic to think that all the problems have emerged as yet”.

Everywhere across the world, recession warnings abound. In this increasingly integrated global economy, it is hard to see how Australia can dodge at least a meaningful slowdown with recession a genuine risk (even if it is purely technical).

But that doesn’t always mean heavy pain. If unemployment doesn’t surge, and if we recover quickly thereafter, Australia could get back to the sweet spot: low unemployment, strong growth, and inflation under control. Given the money that is going to be spent on defence and our energy transition, we may well be setting ourselves up for another period of extended prosperity.

Economic & Market Update

Inflation worries abate as debt-ceiling concerns lurk

Inflation and Fed worries may be starting to ease, however debt-ceiling concerns (US) are poised to intensify as the so-called “X-date” in early June approaches. Unlike growth, inflation, and interest rates, political brinkmanship is not a long-term driver of market performance. Yet it can still be disruptive and have short-term market consequences.

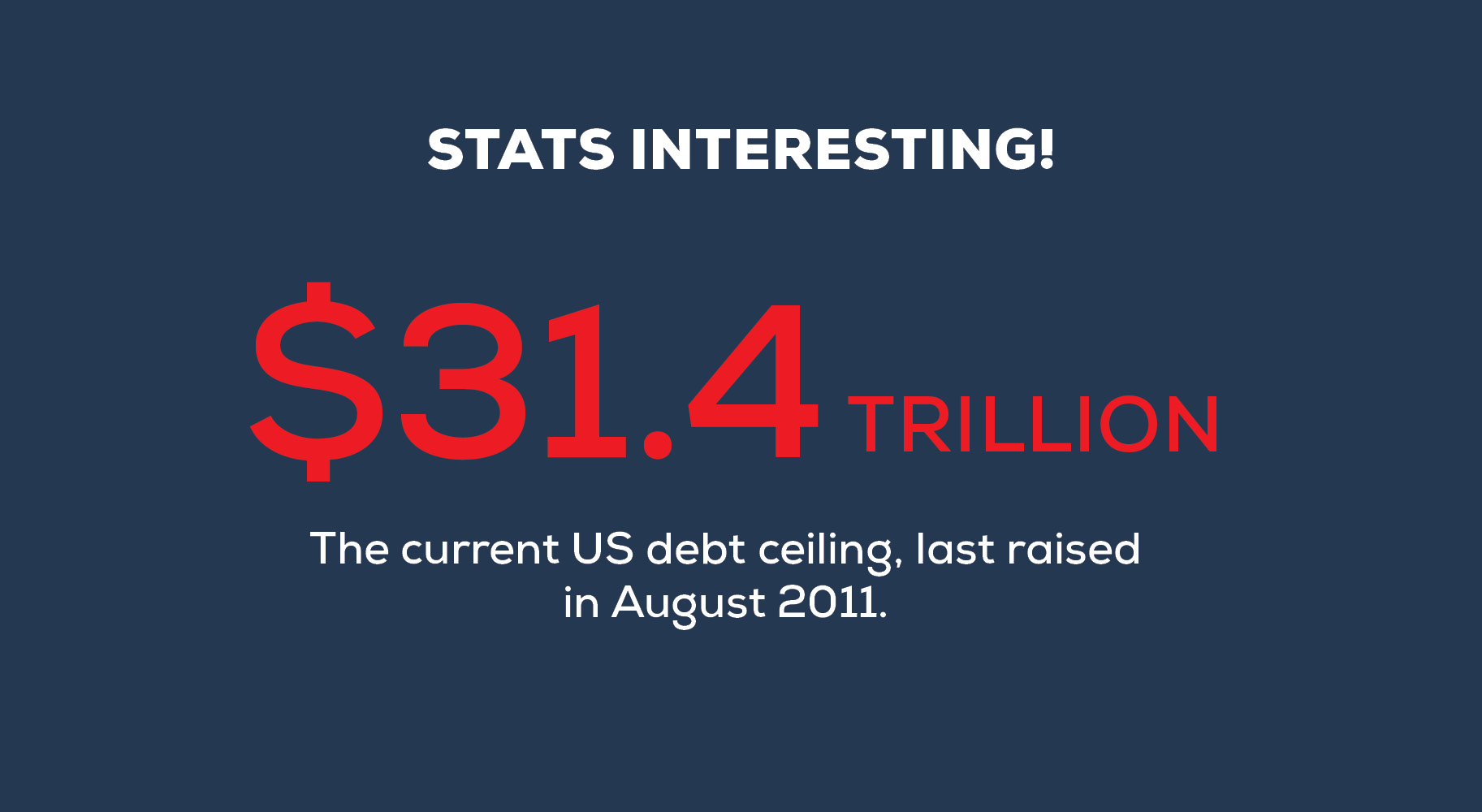

The U.S. is one of two countries in the world (Denmark being the other one) that has a statutory limit on the total amount of debt (ie. money printing) that the government can issue at any given time. The existing debt ceiling was hit on January 19, and since then the Treasury has initiated ‘extraordinary measures’ to pay for the country’s bills. Those efforts are expected to be exhausted by 1st June. This so-called “X-date” is when the U.S. would need to raise or suspend the debt limit to avoid a default.

A historical perspective helps ease some of the anxiety here. Since 1960 Congress has raised the debt ceiling 78 times, which includes 20 times in just the last two decades. As has happened several times in the past, there will likely be an eleventh-hour solution, but that won’t prevent market anxiety as this process plays out.

While there have been several debt-ceiling fights over the years, we can draw some insights from the summer of 2011 when the country came the closest to default. Like today, there was a divided Congress and a Democratic president. Eventually, a default was narrowly avoided, but volatility spiked.

From when the Treasury initiated ‘extraordinary measures’ until the ‘X-date’ on August 2, 2011, the S&P 500 declined around 6%. The House passed the debt-ceiling deal a day before the deadline, and the Senate approved it, with President Obama signing it on August 2. However, as a consequence, the U.S. credit rating was downgraded from AAA to AA+ on August 5, and markets sold off another 10%. Volatility remained elevated for about two months and markets recovered their losses by year-end.

The bigger picture

Beyond the short-term noise of the debt-ceiling headlines, markets are going to narrow in on the outlook for growth, inflation and Fed policy. Two of the biggest headwinds for markets, inflation and Fed policy, are making a more favourable turn. However, economic growth could underwhelm as the lagged impact of the Fed’s rate hikes filter through the economy.

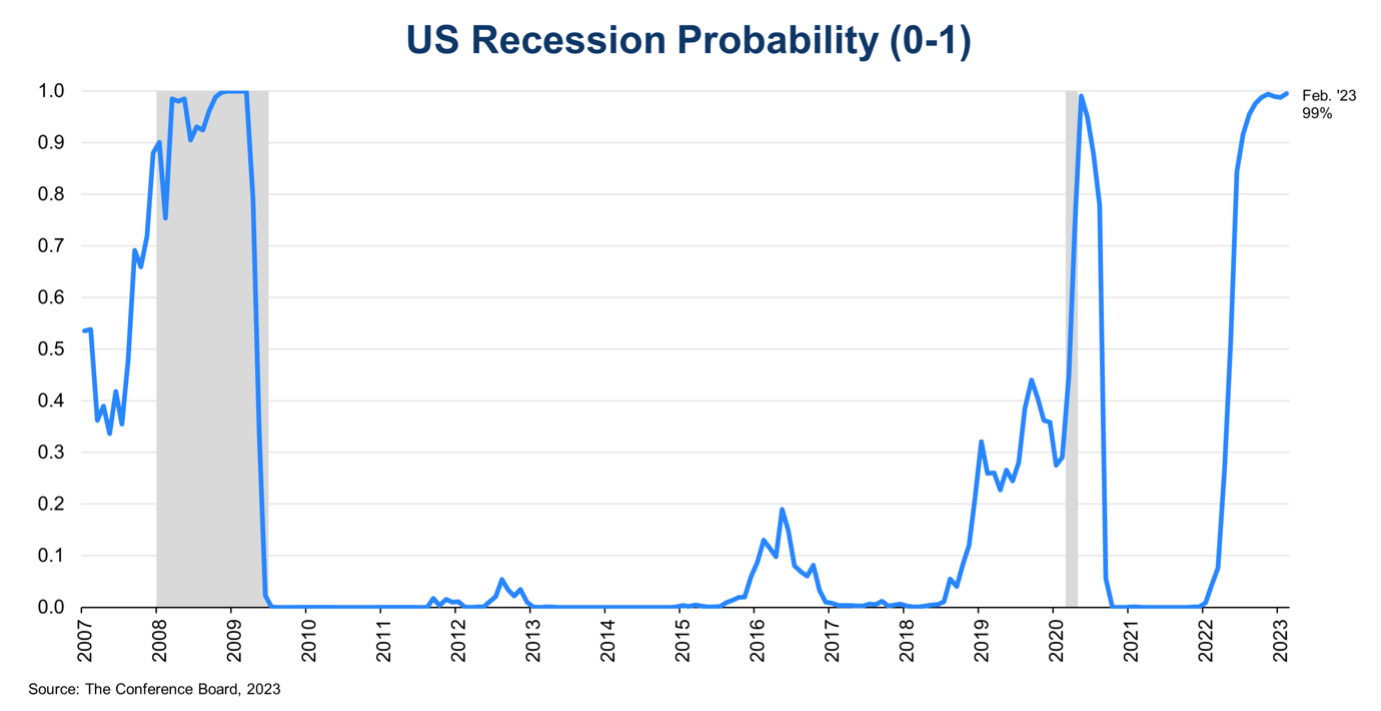

The Fed’s latest quarterly Senior Loan Officer Opinion revealed last week (refer chart of the week below) shows that banks continue to tighten lending standards. With banks less willing to lend, and with the demand for loans weakening, economic activity will slow and possibly turn negative in the quarters ahead. Probability of a US recession remains likely.

Chart(s) of the Week

What is SLOOS?

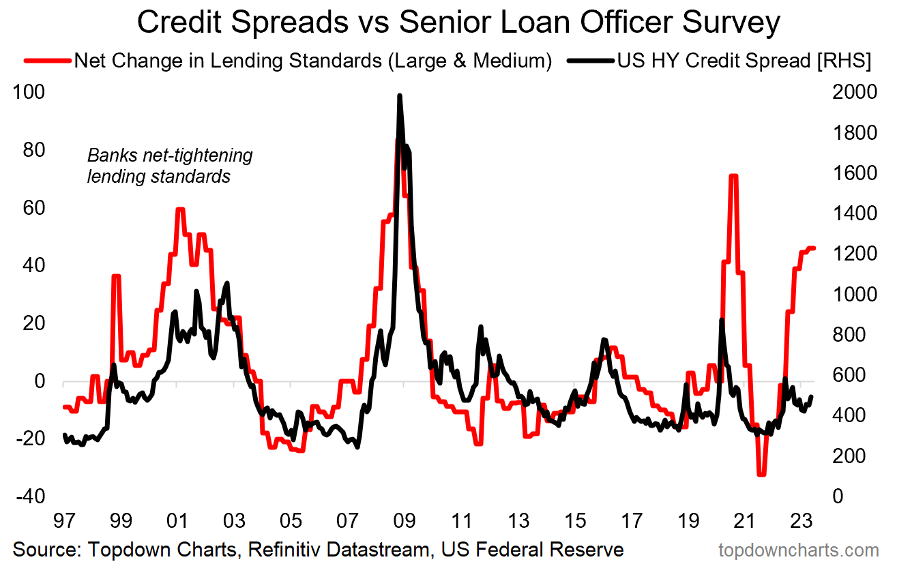

Quite often, the difference between an average recession and a bad one comes down to how well credit continues to flow. The US is starting to look a bit shaky on that score. The graph below shows the historical results of the Senior Loan Officer Opinion Survey (SLOOS) alongside high yield credit spreads. The SLOOS measures whether lending standards are getting tighter or looser. The higher the number, the harder it is to get a loan.

As this chart depicts, loans in the US are getting harder to come by. If that continues, it is likely to result in higher credit spreads eventually. The result is a lot fewer loans at a higher price tag for borrowers. This is not good for economic growth.

US Commercial Property

A key reason for the increased difficulty getting a loan is the problems facing US regional banks. Not long ago, we saw the failures of SVB and Signature Bank due to mismatches between short-term deposits and longer-term bond investments. More recently, another large US regional bank (First Bank) found itself on the precipice of failure and was gobbled up by JP Morgan.

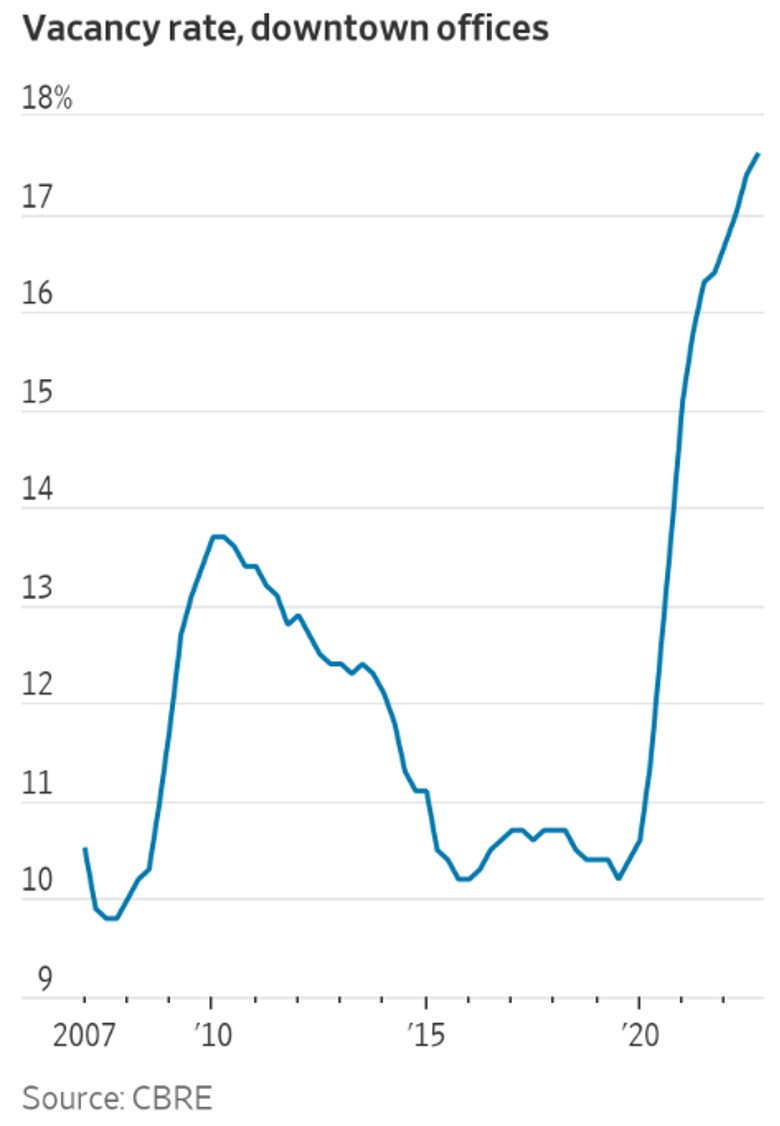

There’s now a newly emerging issue with US regional banks that could lead to more widespread problems. Many of these banks have lent a lot of money to local customers, secured over commercial (non-residential) property. In many cases, these loans make up a significant part of the banks’ assets. And right now, commercial property is not going very well. For example, here’s the vacancy rate for US city office buildings. Fuelled by the ‘work from home’ phenomenon, it’s now well above levels seen during the GFC.

In short, many US regional banks are having to pay more to retain customer deposits. Now, higher vacancy and a slowing economy mean commercial property valuations are falling, putting pressure on their loan books. This almost certainly means that fewer loans will be made, and the cost to borrowers must go up. This translates to fewer buyers for commercial property, leading to further falls in valuations. It can take years to play out fully and is now a real risk for the US.

Luckily, Australian bank loans are much more focused on residential real estate, with only around 10% of bank lending on commercial property.

Federal Budget 2023

The biggest day of the year for the nation’s fiscal enthusiasts, the Federal Budget, has come and gone. What ensues is the debate about how good or bad it is.

It is interesting to see the media attack the Budget from every angle. Politics aside – the difficult trade-offs that undoubtedly go into delivering a budget seem to be forgotten. It is the media’s choice on how they report on the Budget. Unfortunately, it is mostly a negative approach as this arguably gets the most reads.

The windfall gains (in resources and employment) were perfect timing for a Government looking to establish its economic credibility. But, with heavy indebtedness and structural challenges – just like the rest of the developed world – the really big decisions lie ahead.

Decisions will need to be made on key areas of expenditure (such as aged care, health, housing and defence) and revenue (formulation of the tax base). And, whilst only forming a small part of this budget, we assume that super and retirement income policy settings will be considered in addressing many of these challenges.

Hopefully, quality media is there to facilitate a quality, balanced conversation…

As mentioned, from a financial services perspective, it was a relatively tame budget with the broad Budget position known in the weeks and days leading up to the official release, much of which we have commented on in previous views.

As always, our report is a high-level summary of the Budget relevant to our clients.

Inside ‘Woodstock for Capitalists’

Dubbed ‘Woodstock for capitalists’, – on Saturday 6th May, Warren Buffet (92 years) and Charlie Munger’s (99 years) investment company Berkshire Hathaway held its 59th annual general meeting, drawing a crowd of more than 40,000 to Omaha, Nebraska.

The investing legends talked about everything from the recent banking crisis and growing tensions between China and the United States to how much they love Apple. We’ve outlined some of the more interesting statements below.

#1 Get used to making less

“I think value investors are going to have a harder time now that there are so many of them competing for a diminished set of opportunities … So my advice to value investors is to get used to making less.” [Munger]

#2 Competing for “diminished opportunity”

“New things coming along don’t take away the opportunities. What gives you opportunities is other people doing dumb things. In the 58 years we’ve been running Berkshire, I would say there’s been a great increase in the number of people doing dumb things. And they do big dumb things. And the reason they do it, to some extent, is because they can get money from other people so much easier than when we started.” [Buffett]

#3 Buffet is an Apple fan….

Apple accounted for nearly 40% of Berkshire’s portfolio as of 31 December 2022.

“It just happens to be a better business than any we own … I made a mistake a couple of years ago when I sold some shares when I had certain reasons why gains were useful to take that or from a tax standpoint. It has a position with consumers where they’re paying, maybe $1,500 or whatever it may be for a phone. And these same people pay $35,000 to have a second car. And if they had to give up a second car or give up their iPhone, they’d give up their second car.” [Buffet]

#4 On US and China Relations

“If there’s one thing we should do is get along with China, and have lots of free trade with China … it’s in our mutual interest,”

“Attempts by either side to rattle the other should be responded to with reciprocal kindness”. [Munger]

#5 On AI

“When something can do all kinds of things, I get a little bit worried. Because I know we won’t be able to un-invent it and, you know, we did invent, for very, very good reason, the atom bomb in World War II … It was enormously important that we did so. But is it good for the next 200 years of the world that the ability to do so has been unleashed? … [AI] will change everything in the world, except how men think and behave.” [Buffett]

#6 On bad investments

“We had as much fun out of deals that didn’t work as the ones that did work. If you knew you were going to play golf and you were going to hit a hole-in-one on every hole, nobody would play golf. Part of the fun of the game is the fact that you hit them into the woods and sometimes you get them out and sometimes you don’t.” Just remember, “The weeds wither away in significance as the flowers bloom. Over time, it takes just a few winners to work wonders.” [Buffett]

Attendees arrive at the auditorium of the CHI Health Center during the Berkshire Hathaway annual meeting in Omaha, Nebraska, US, on Saturday, May 6, 2023.

David Williams | Bloomberg | Getty Images

Lessons We Can Learn From Past Recessions

Ever wonder why we talk so much about ‘defensive assets’ and ‘downside protection’ in our portfolio positioning? The answer… the best offence is a good defence!

While not possible to 100% accurately predict the next recession, adherence to the importance of offence and defence when it comes to investment strategy and asset allocation can protect investors from what lies ahead.

Investment house Mercer have created a valuable ‘quick guide’ outlining these very principles – found here. The basic ‘playbook’ goes something like this:

- Have a strategic allocation to liquid downside protection assets (i.e., cash, gold, hedge funds, short-duration bonds) that become dry powder in times of market drawdowns.

- Set valuation triggers for out-of-cycle rebalancing or deployment of dry powder:

- If equities fall by x% or if yields go above y%, allocate all or some dry powder to this asset class.

- Once markets recover, rebuild dry powder by taking profits from risk assets to prepare for the next downturn.

- Set up a governance framework that allows for the monitoring of opportunities and swift execution. Assign or outsource clear responsibility to individuals to identify when pre-determined triggers are hit (for the deployment of dry powder) or to execute the agreed rebalancing accordingly.

Your Life isn’t a One-Act Play

In the time-honoured tradition of the Commencement Speech loved by US universities, Bill Gates gave the 2023 version to North Arizona students last week. As Gates says, he never actually graduated from any university, as he left Harvard after three semesters to start Microsoft. He’s done well, regardless. The advice he shared is worth a quick read (click here), making these five points:

- Your life isn’t a one-act play.

- You’re never too smart to be confused.

- Gravitate toward work that solves an important problem.

- Don’t underestimate the power of friendship.

- You’re not a slacker if you cut yourself some slack.