Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Fridayitis, Productivity problems, IWT fundamentals, RBA flip the script and more.

|

31st July 2023 |

| Esteemed readers, we extend our sincerest apologies for the postponement of our usual Friday newsletter. Alas, the elusive “Fridayitis” mischievously intervened, causing a slight disruption to our regular schedule.

While the allure of Friday’s impending weekend escapades is undeniably captivating, there’s a special charm to discovering something on Monday. Amidst the bustle of fresh possibilities and renewed focus, we hope delving into a captivating read can invigorate your week. With this we hope you embrace this Monday’s offering – Happy reading! |

|

|

| As the US reporting season kicks into gear, a quarter of companies have already revealed their Q2 earnings, showing an average beat of approximately 5% against estimates (note: upcoming reports from the energy and materials sectors are anticipated to reveal softer earnings, potentially exerting a drag on the overall aggregate performance.

The question on everyone’s mind is whether the impressive earnings surprises are a result of less ambitious estimates or a genuine display of robust earnings growth. The truth is companies often tend to beat their estimates, as they set cautious guidance, effectively keeping the bar low. So far, around 70% have surpassed expectations, a figure in line with historical averages. One standout in this season is the banking sector, which has defied expectations despite fears related to the Silicon Valley Bank panic. Being a crucial representative of the economy, the solid performance of banks has added to the optimistic sentiment seen in the equity markets, resulting in the US equities reaching its highest level since April 2022, almost a full recovery of last years losses (helped by tech of course)**. The resilience of the US economy is evident in multiple aspects, including good consumer confidence driven by a healthy jobs market (near-record-low unemployment) , easing recession fears, and a robust housing market with prices rising 1% in May, the fastest rise since May 2022. The lack of housing stock has helped as more people stay put and take advantage of their cheaper long-term fixed-rate mortgages (buying a new home necessitates refinancing at current rates, potentially forgoing the advantage of say a fixed 2% rate for 25 years on an existing loan, deterring home sales). All in all it gives the Federal Reserve a lot to think about. After a hawkish skip last month, it was not surprising that they raised interest rates by a quarter of a percentage point on Wednesday, already priced in by the market. Looking ahead, the markets are anticipating an additional 0.5% rate hike by October, though there remains uncertainty around the timing of further rate increases, with economists and markets differing in their expectations. Switching gears to domestic news, the sharp drop in inflation to 6% in the year to June (down from 7% in March) indicates some progress. The labour market remains strong, while consumer spending fell in June mostly due to seasonal factors. Food retail spending remains robust, mainly driven by inflation rather than increased consumer demand. China was very much back on our radar this week with the much anticipated Politburo meeting. Unfortunately, it left many economic headaches unaddressed, with a lack of significant announcements and no broad stimulus plan as previously hoped. After a strong start to the year since COVID-19 restrictions were removed (hailed the great ‘re-opening’), the world’s second largest economy barely grew in April-June, sparking worries it may be entering a new era of much slower growth and even Japan-like “lost decades” of stagnation. The main worry is the slowdown is more structural than cyclical and requires significant political will to change course on policies that have proven spectacularly successful for decades (mainly property investment) but now generate more debt than growth. Accounting for about a quarter of economic activity, the overextended property sector can no longer fuel growth. However, a rapid deflation could destabilise the financial sector and the real economy. China’s household consumption is also a concern, requiring transfers to the household sector such as tax cuts, building a social safety net with higher pensions, unemployment benefits and better, and more widely available public services. No such steps were flagged in the politburo readout. Markets will now look to the key Party conference in December in the hope of structural reform. ** For perspective – The ‘magnificent seven’s’ (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla) combined market capitalisation has soared 60% this year, or $4.1 trillion, to an eye-watering $11 trillion. They have accounted for more than 95% of the market gains this year. |

|

|

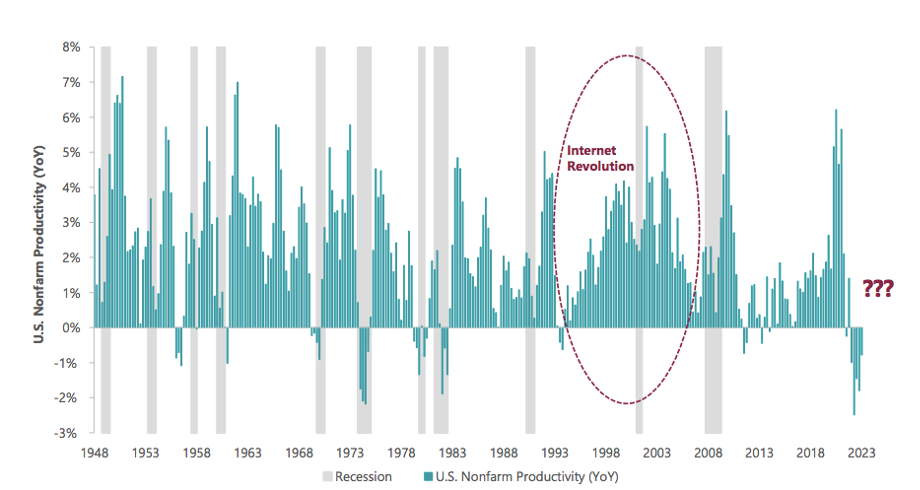

| Negative productivity levels to today’s degree are typically only seen during recessions, reinforcing the notion that companies are hoarding labour at the expense of profitability (businesses avoid layoffs at all costs and employees stay put due to job shortages).

The below chart depicts the current state of play in the US but it is a similar story in Australia.

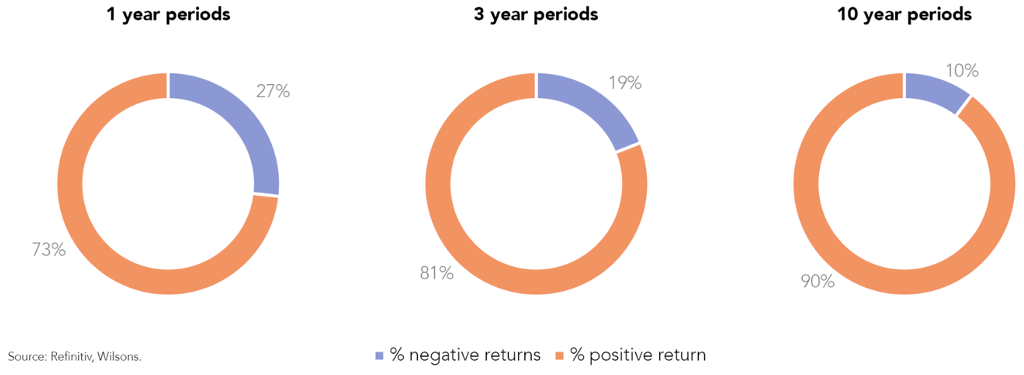

While AI could release a wave of productivity similar to the internet revolution – which would be a boost to both economic growth and corporate earnings – the benefit would likely come too late for the current expansion. Chart of the week #2 It’s a sad truth, but the average investor is terrible at investing. One of the biggest factors behind this poor performance is that emotion gets in the way and none more so when faced with economic and market downturns – People panic, others attempt to time the market (hoping to buy low and sell high). It is easy to get caught up in short-term volatility however the best strategy is to adopt a long-term perspective. This is crucial for investors if they want to benefit from the smoothing effects of longer-term rolling returns.

Chart of the week #3 History has shown that the longer the investment period is, the greater the chance of a positive outcome.

|

|

|

| A client review meeting this week unveiled a puzzling truth – intergenerational wealth transfer remains an enigmatic topic for many. Sure, most understand the general principle, but the actual strategy behind it?

It’s a term we frequently reference here at FinSec and thus, we deemed it fitting to provide a succinct summary of its fundamentals. The goal A comprehensive plan designed to facilitate the smooth transfer of assets and wealth from one generation to the next. This is essential for individuals and families who wish to pass on their accumulated wealth, properties, businesses, and financial resources in a tax-efficient, organised and timely manner. The strategy

|

|

|

| Amidst a backdrop of institutional introspection, the Reserve Bank of Australia (RBA) has unfurled an array of reforms, spurred by an independent review (commissioned by the federal government). Propelled by a vision of enhanced efficacy and engagement, these measures are poised to sculpt a new paradigm for the RBA’s operations, beginning in the year 2024.

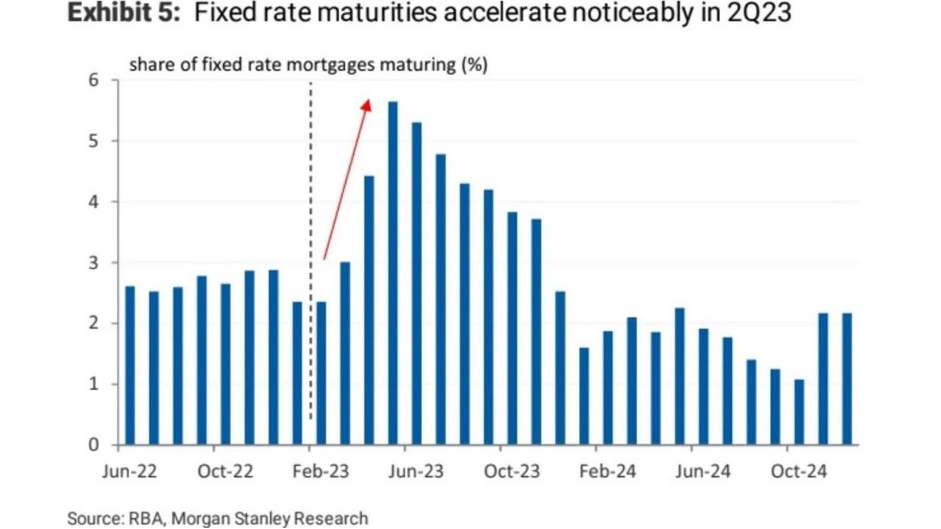

Foremost is the recalibration of the RBA board’s convenings. Once accustomed to gathering a diligent eleven times per annum, the board shall now embrace a more measured cadence, assembling only eight times a year to deliberate upon the cash rate. The significance of this reduction extends beyond a mere trimming of the calendar. These gatherings, extended in duration, are set to serve as a crucible for more robust contemplation and discourse. In step with the Fed, the governor will also now hold a media conference after each cash rate meeting, this “will provide a timely opportunity to explain the board’s decisions and to answer questions”. With the current deputy, Michele Bullock assuming the top job in September, she takes the reins at a sensitive and challenging time for the RBA. Firstly, Ms Bullock will be tasked with overseeing the Albanese government’s reforms to the Reserve Bank, which includes the abolition of the board and the establishment of two separate bodies. One that sets interest rates and another that oversees the bank’s governance as well as day-to-day operations. She will also step in to oversee the RBA’s response to persistent inflationary pressures amidst lingering discontentment on why (in hindsight) the RBA was unable to see high inflation coming during the days following the Covid pandemic when interest rates were apparently kept artificially low for too long. Of all the threats on the radar her most concerning immediate challenge will be the fixed-rate mortgage cliff. This year, approximately 800,000 home loans, totalling $350 billion, are estimated to be transitioning from a fixed interest rate to a variable rate that is approximately three times their prior commitment.

Even if the RBA decide to stop hiking rates, homeowners will continue to feel the impact over the next 12 months as the fixed rates roll off. It is a tumultuous time for many home owners. If you are feeling at all uneasy we recommend a health check of your mortgage (debt structures). Please contact FinSec Finance to organise a time. |

|

|

|

|

|

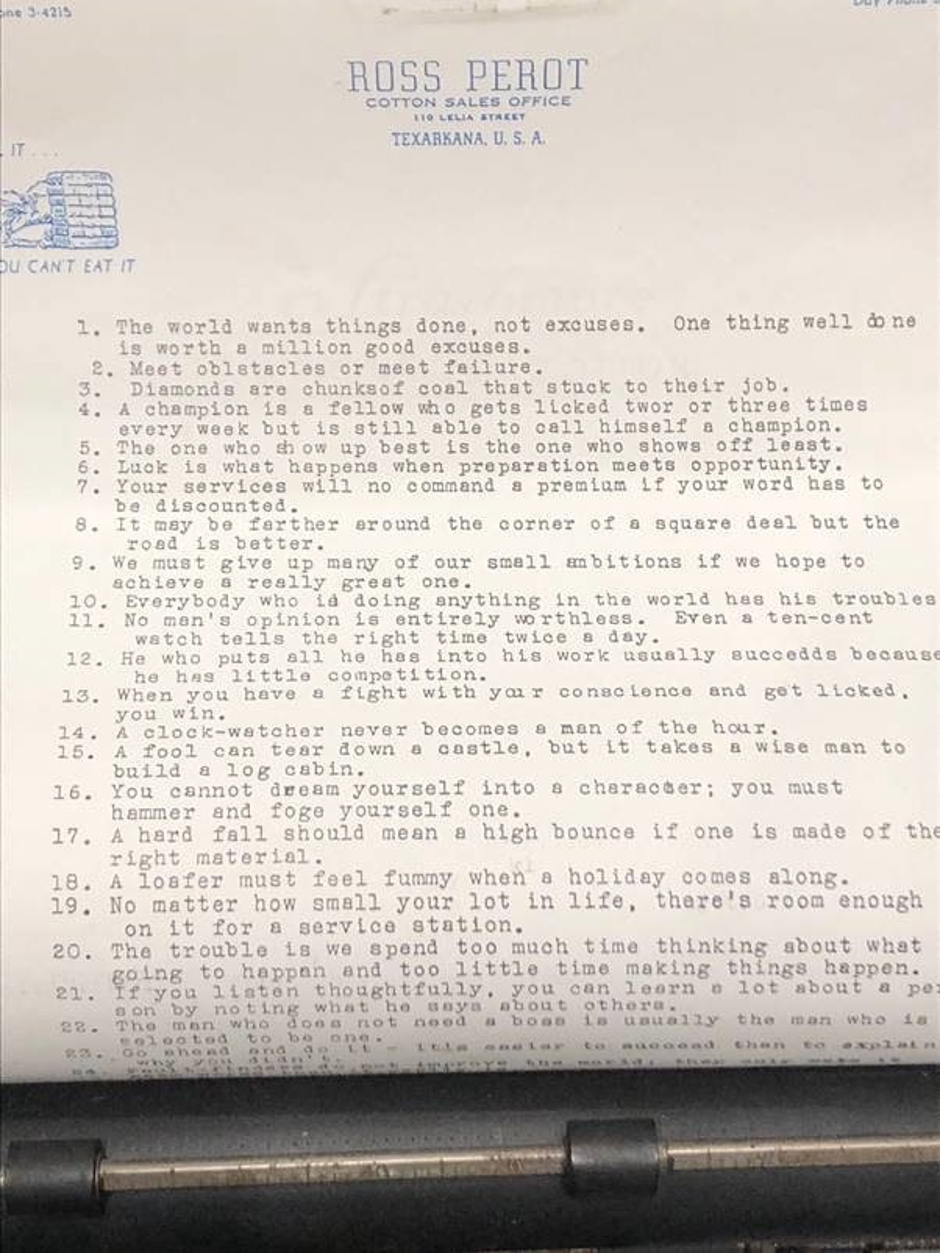

| One from the archives.

When former American business magnate and independent presidential candidate Ross Perot was growing up his father passed on the maxims below to succeed in business and life. Our favourite – “when you have a fight with your conscience and get licked, you win”. A treasure trove of wisdom to share with the youths in your life!

|

|

|

|

|

| This giggle-inducing excerpt from publication The Australian sparked our amusement.

Apparently the new Alfa Romeo you see before you is available as a non-fungible token. Or with a non-fungible token. Or on the back of one. All of which begs a question: what exactly is a non-fungible token? In my mind, the answer has always been simple. You pay for something that doesn’t exist, and in return, you get nothing at all apart from an email saying you own the thing that doesn’t exist. So this is how the conversation goes when you get home from the art gallery. “Hi, darling. I’ve just bought a Tracey Emin drawing.” “Have you?” “No.” Non-fungible tokens are nonsense. And it seems I’m not the only one to have arrived at this conclusion, because last year the NFT market lost 90 per cent of its value as everyone wised up to the fact that if you buy a painting that hasn’t been painted, you haven’t bought a painting. Jeremy Clarkson – The Australian

|

|

|

Playing around with ChatGPT again we asked it to find us some funny jokes with an investing or money theme. This is the best it had… When it comes to humour we think ChatGPT may have a way to go yet

Then we gave google a go. It gave us this tweet – slightly better. With inflation at 7.5%, you lose half your money in 9 years. The only way to outperform that consistently, that I have found, is crypto. Just this year I’ve already lost half my money. |