Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Fear, Aspiring prosperity, Markets and more

14th July 2023

Fear drives many facets of our lives.

In her book “Fear Less”, Dr Pippa Grange, a renowned psychologist who works extensively with elite athletes and sports teams (including the Australian Olympic team), highlights the pervasive role fear has in our lives. She argues that fear is often what holds us back from fulfilment and true success, and the ability to recognise and diminish its influence can lead to a transformative change.

According to Grange, there are two types of fear: ‘in-the-moment’ fear experienced during crises and stress and the lingering ‘not-good-enough’ fear that shapes our choices and behaviours. This latter fear stems from past experiences and future uncertainties, manifesting as perfectionism, jealousy, isolation, and playing small.

Confronting these fears is an essential part of personal growth, and in doing so, we liberate ourselves to pursue our ambitions and redefine what success means to us.

What’s this got to do with investing and financial advice?

If you think about the common mistakes that people make with their money, many relate to fear. For example, selling stocks after market downturns due to fear of further losses or chasing trendy stocks out of fear of missing out. Giving in to fear can lead to irrational decisions resulting in financial losses.

As financial advisers, our role is to help our clients live their best life by prudently guiding their financial decisions. This entails helping to battle against these fears by heeding the wisdom of Dr Grange and working with clients to set clear financial goals, meticulously craft a plan, and provide the unwavering discipline to adhere to it.

—————————–

In the realms of chief economist and RBA governor, fear finds no abode. As we extend our well wishes to Luci Ellis, the incoming Chief Economist at Westpac, and Michele Bullock, the incoming RBA governor, we also express our gratitude to Bill Evans, the outgoing chief economist of Westpac, and the esteemed current RBA governor, Philip Lowe. Their words of wisdom have graced the pages of the View on many occasions, and we eagerly await their future endeavours with the utmost admiration.

Market update

Resilient economic data, easing inflation, and stabilised banks (US and Europe) have begun to ease global recession worries and fuel market growth.

Cautious investors anticipating a central bank-induced recession have been left surprised as the US equity market has risen more than 20% off its October 2022 lows. The market rally expanded beyond the dominant companies (recently labelled the ‘magnificent seven’ – Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla), indicating a broader upturn.**

While some major economies show signs of slower spending and business activity, they have largely defied concerns over high-interest rates and increased consumer prices. As we’ve touted previously, resilient consumer spending and investment activity suggest that households and businesses may be less sensitive to interest rates than in previous cycles. Low rates prior to the pandemic and during the financial crisis did not significantly boost inflation or economic growth, implying that higher rates may have a milder impact. This could be due to borrowers locking in long-term borrowing costs, ongoing pandemic savings, or supply shortages in interest-sensitive assets like houses and cars. Additionally, studies suggest that businesses make long-term investment decisions based more on confidence in the medium-to-long-term business environment than short-term interest rate fluctuations.

Major central banks are reminding consumers that the battle against inflation is ongoing, signalling the likelihood of further interest rate increases, albeit as they approach the peak, they are adopting a more cautious approach in order to better assess lags in incoming (economic) data. The exact number of future hikes remains uncertain, with most forecasters and central bankers expecting one to three more quarter-point rate increases in major economies. However, many anticipate an inclination toward more rate hikes rather than fewer.

Investors are also trying to gauge whether central banks will be willing to cut interest rates once inflation reaches the three per cent range, possibly in 2024. Bond markets are already pricing in rate cuts, assuming sustained downward inflation trends alongside steady or falling interest rates or a potential recession within the next year. Rate cuts would only be considered if rising unemployment becomes a significant issue, favouring low and stable inflation over full employment. If the labor market remains tight and inflation falls back to around 3.5%, interest rate cuts would be unlikely as central banks may worry about inflation remaining elevated or climbing higher again. Central bank policymakers may also aim to maintain a sufficient interest rate buffer above zero, enabling aggressive rate cuts during the next recession without resorting to money printing and bond buying.

Despite the potential need for extended higher interest rates, it may not significantly hinder forward-looking financial markets if inflation continues to trend lower and bond yields remain stable below the cash rate. This stable disinflation scenario could support continued equity growth. However, there remains a risk that resilient economies may reveal cracks, and some investors still view the scenarios of immaculate disinflation or a soft landing as highly improbable. Timing the start of a recession is challenging, and equity markets often perform well during the early stages.

** For perspective – the magnificent seven’s combined market capitalisation has soared 60% this year, or $4.1 trillion, to an eye-watering $11 trillion. That is almost triple the size of Germany’s economy alone. And, until the last few months, they have accounted for more than 95% of the market gains this year.

Chart(s) of the week

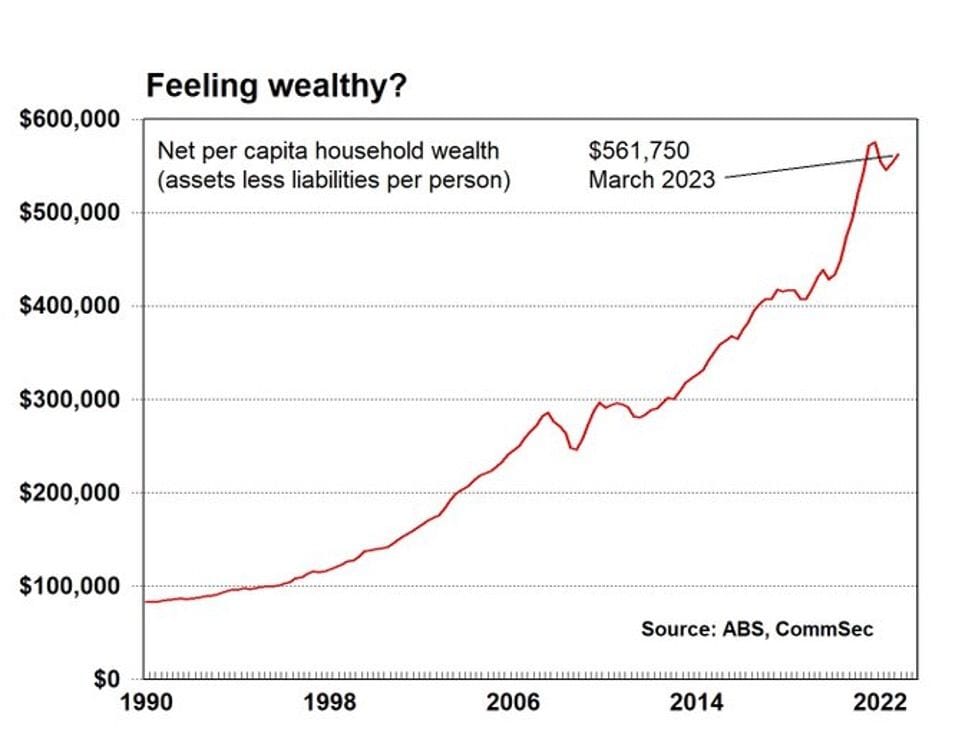

The cost of living crisis gets touted a lot by the media, and there is absolutely no doubt that there are many Australians that are doing it very tough.

But the Bureau of Statistics highlights that many are actually still doing it OK. Household wealth is near all-time highs.

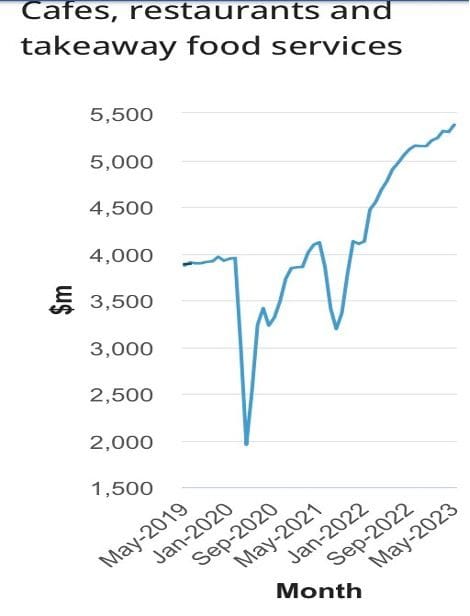

Services also look very strong.

Stocks and interest rates are inversely correlated, which makes sense. As rates rise, investments (like term deposits) start to look attractive. Meanwhile, costs of capital put pressure on company profits, so dividends tend to get compressed.

As the below chart shows this correlation is very tight from 2016 to late 2021 when the jaws widen. Share prices have held up very well, but 10 year bond yields (yellow and inverted) have risen faster. Mmm… we find ourselves in irrational times indeed.

Do not click this button…

Last View, we highlighted the ATO’s ‘Super Health Check’ initiative. This week we bring attention to a potential unintended consequence. On logging into your MyGov account, you may be tempted to consolidate your super funds.

MyGov makes this very easy (maybe too easy) by allowing you to do this in one click. They even encourage you to do so, saying, ‘You can save on fees!’.

But please exercise caution and DO NOT click this button without properly understanding the consequences. Once you consolidate, you will lose the insurance you hold in the previous super funds and may not be able to get it back.

If you’ve had any health issues (which can be as minor as a trip to the physiotherapist), you may not be able to get the same insurance, and this could be devastating.

Before consolidating, always review the super funds and the differences between them. You should pay careful attention to what insurance you have and what you need.

If you’re unsure where to start or are in any doubt, please do not hesitate to contact us.

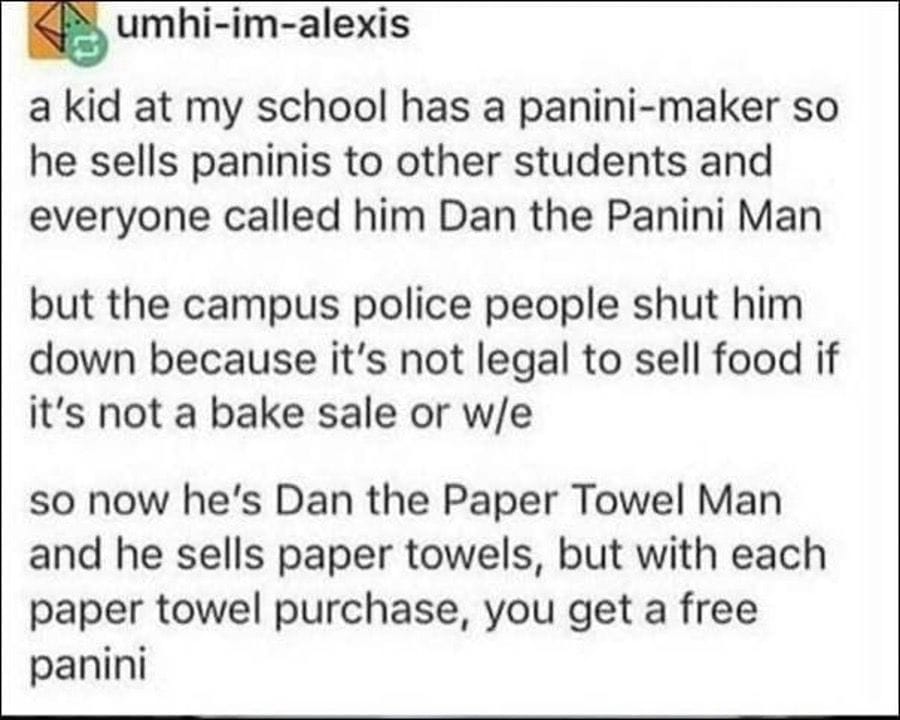

Entrepreneurs will always find a way!

One of our favourite sayings at FinSec (in fact, it adorns the front page of our website) is Albert Einsteins’ quote on thinking outside the square:

“If you always do what you always did, you will always get what you always got.”

We are privileged to call many entrepreneurs our clients, and their constant ability to innovate and adapt is a marvellous thing indeed!

4 behaviours for aspiring prosperity

As financial advisers, we have the profound privilege of helping people to manage their money. Embarking on this endeavour entails delving deep into the intricate workings that lie beneath the surface.

Here are a few of the recurring behaviours that we frequently observe among individuals who have achieved prosperity.

1. They maximise their super

Wealthy individuals delay accessing funds now to gain future benefits, like making contributions to superannuation with significant tax savings. For example, for an earner in the top tax bracket (47% incl. Medicare levy), any money you contribute to super (under the concessional contribution cap of $27,500) is taxed at 15%. That is an immediate return on your money of 32%. They also invest this money at a lower tax rate.

2. They have a vigorous approach to mortgage elimination

While most individuals are unconcerned with their mortgages as long as they meet monthly payments, financially savvy individuals understand that non-deductible debt hampers wealth-building and aggressively tackle their mortgages. Maximising repayments early on minimises interest and minimises long-term principal payments.

3. They know their numbers, and they spend confidently

The discerning adhere to a prudent budget, embracing a realistic outlook. They confidently spend within their predetermined limits without resorting to deceptive tactics such as afterpay products. Understanding the true costs, they align their expenditures accordingly. This realisation may initially challenge those unaccustomed to proper budgeting, as their lifestyle may not align with their income and aspirations. Nevertheless, the wise accept the inherent human desire for more and establish effective safeguards, ensuring they never exceed their planned expenditure.

4. They have an investment strategy outside of superannuation

Even amidst the satisfaction, many individuals derive from their work, prudent people acknowledge the possibility of a future change in their aspirations. Anticipating a potential desire to retire or shift careers before reaching the superannuation access age, they diligently formulate and execute robust investment plans. These plans may encompass investment properties, shares, or a combination thereof.

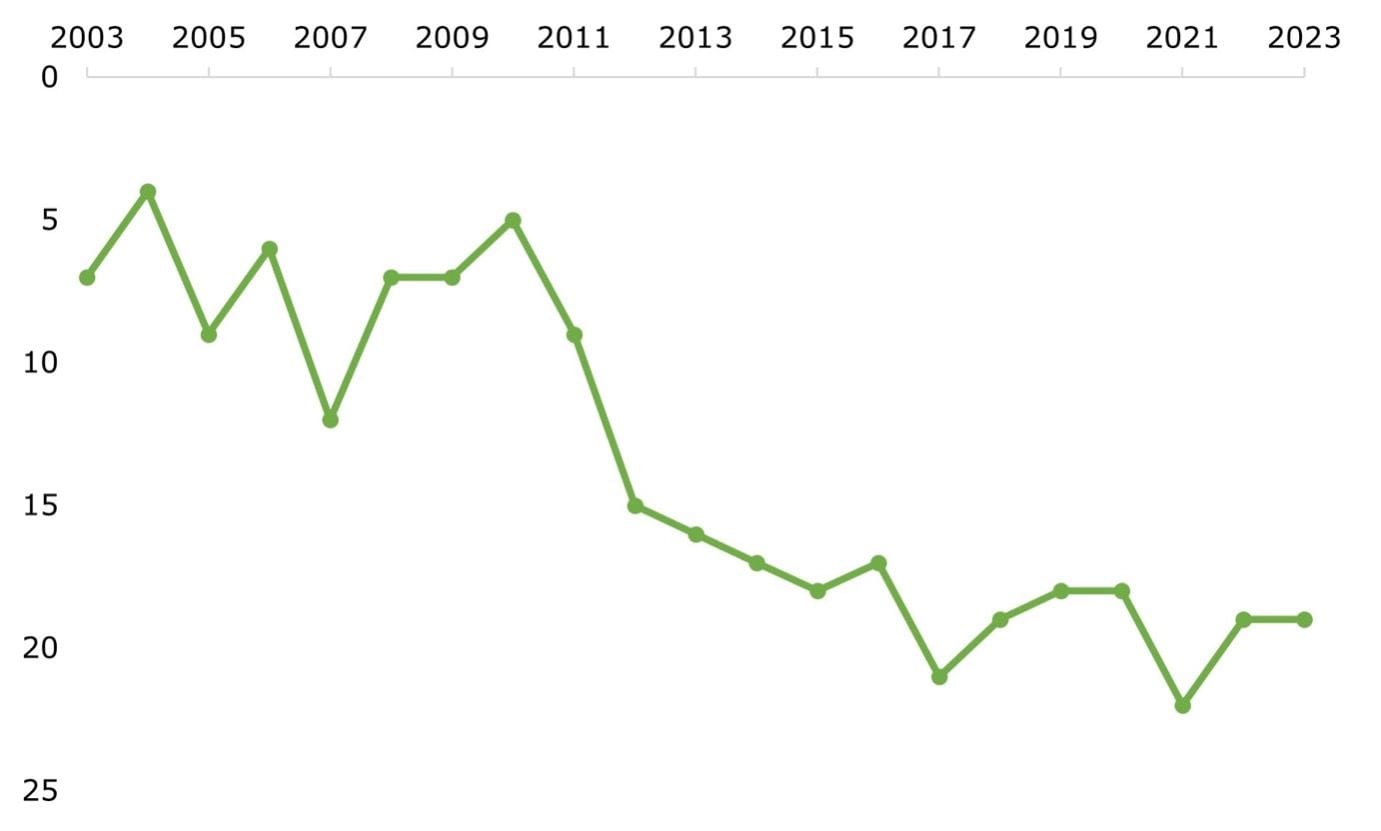

Whilst placing 19th over the last two years, this rating represents a decline from the consistent top 10 rankings Australia held for much of the 2000s.

Australia’s historical performance in the World Competitiveness Rankings

The IMD evaluates competitiveness based on economic performance, government efficiency, business efficiency, and infrastructure. According to the report, Aussies excel in terms of trade, the labor market, and international investment due to strong employment growth and commodity prices.

However, both government efficiency and our tax regime’s competitiveness are considered weak spots. Business efficiency, particularly entrepreneurship and workforce productivity, have also declined.

In terms of infrastructure, Australia performs well in health and environment but lags in technology and cyber security.

Not surprisingly, key challenges for 2023/24 are listed as inflation, navigating a possible recession, improving productivity, and working towards a net-zero economy.

Friday funny

A Scotsman, an Englishman, a Welshman and an Irishman find themselves in a challenging situation. A genie appears and offers them all a wish each. The Englishman says, ‘I wish I was back in the lovely countryside of Derbyshire with my family’. The genie grants his wish and the Englishman disappears. The Scotsman says, ‘I wish I was back in Glasgow with all my muckers’. The genie grants his wish and the Scotsman disappears. The Welshman says, ‘I wish I was back in Snowdonia, with my beautiful wife.’ The genie grants his wish and the Welshman disappears. The Irish man says, ‘I’m lonely, I wish I had my 3 pals back.