Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Election Season, Australia on the Move, Modest V Comfortable and More…

|

6th May 2022 |

| ‘Tis the season to be voting’, and we are often asked which side of politics has been better for investors – left or right? In the words of any good economist, the answer is – it depends.

In Australia, global trends tend to dominate the direction of local capital markets and economic conditions. Still, the impact of these trends is much dependent on the actions of our government. We have been lucky in that, over the years, ours have managed to stay clear of the traps that have ended in economic disaster for so many around the world at some time – as they say, credit where credit is due. Both sides of politics in Australia have been pro-growth, pro-development, pro-immigration and pro-business (more or less…). Only Australia, New Zealand, Canada and the US have delivered a consistent run of high returns to shareholders since 1900 (albeit with some ups and downs along the way). We make no predictions about the upcoming election. The system is now trending towards what happens in other democracies, whereby parties can win with less than 50% of the vote because of the impact of offshoots and minor parties. The bottom line is that it shouldn’t matter who comes next; good companies should survive and thrive whatever government is in power, it will most likely have little bearing on investors. We finally have lift-off with interest rates to counter inflation. There has been much conjecture in the office this week about whether inflation is in fact demand or supply driven (yes, that old chestnut). A good article from Macquarie can be found here that (dare we say) indicates perhaps inflation does still sit in the transitory camp. Beyond the temporary effects, however, we are probably seeing some inflation driven by a trend to partially unwind globalisation, the rise of populist politics/ nationalism and some re-on shoring of jobs. However, there are several reasons why inflation and interest rates are unlikely to go to high, more on this below. |

|

| Global share markets were mostly down in April, led by the US market, which was dragged down by the big tech/ online/ social media stocks (markets continue to re-price these stocks in the fear that they will be more negatively affected by rate hikes than value stocks i.e. more established companies with more stable balance sheets). This pulled the NASDAQ index down 13% in April and the broad US market down 9%.

Although ending flat in April (and flat for the calendar year so far), the Australian share market continues to hold up better than most. Winners for the month were oil/gas majors and transport stocks (e.g. Qantas and Transurban) as borders continue to re-open. The Australian dollar reversed March’s jump and fell 4% in April against the strong US dollar, which rose against the much weaker Yen and Euro. As the US Fed raises rates rapidly and the dollar is further buoyed by its safe-haven status, global investors are racing to make the best of good (relatively speaking) returns on US cash. Off the back of the RBA and Fed’s interest rate rises this week, not surprisingly shares dropped as fears of elevated inflation and slowing growth intensified. Considering the current environment, where markets are susceptible to any sort of good or bad news, we expect the situation will remain choppy for some time to come.

|

|

| An hour into the media conference following Tuesday’s increase in the cash rate to 0.35%, the Reserve Bank Governor Philip Lowe delivered a mea culpa. He said there would be an internal review later in the year of how the Reserve Bank provides forward guidance, that is, its predictions about the future course of interest rates.

To use Lowe’s own words, he “should have done better” in his attempt to make a prediction about rates two to three years ahead when circumstances are still unpredictable and changing quickly. He was, of course, expecting inflation to moderate by the middle of 2022. “Cast forward six months, what’s likely to happen? I suspect we won’t be buying as many electronics, we’ll be going to cafes and travelling and the supply side problems in the chip market are now being resolved and the price of chips are coming down. I suspect on that category we’ll go back to more normal rates of increase. The same with cars.” Philip Lowe Press Club, 2 February 2022 Now, the forecast for 2022 headline inflation is 6% and underlying inflation of around 4.75% versus the Reserve Bank range of 2% to 3%. In Lowe’s defence, on 2 February, there were no lockdowns in China or war on Ukraine. Both events have been significant contributors to inflation. The markets have, of course, been factoring substantial rate rises in for some time, but for some reason, it is a message that Lowe has not been up for. “We keep looking at the markets and trying to understand what they’re telling us, but I still struggle with how the same interest rate reaction is priced in for Australia and the US.” The main lesson from all this, as Philip Lowe admits, is not to hang on his every word each month. Interest rate guidance is based on forecasts which can be wrong. In fact, there is a good chance that central banks will be forced to reduce interest rates within a year or two to stimulate a slowing economy. There is now considerable speculation about the so-called ‘neutral’ cash rate, the point which neither stimulates nor contracts the economy. According to a press release from KPMG “Quite recently the cash rate in Australia was considered to be at a neutral level – neither expansionary nor contracting, the ‘goldilocks’ official rate – when it was sitting at around 3 percent. Some economists are now suggesting, that given the level of debt being carried across households, this neutral rate is now somewhere around mid-1 percent. It is difficult to accurately say the precise level of a non-stimulatory/non-contracting official interest rate – however KPMG considers it is most likely to be lower than historical levels, and probably closer to 2 percent to 2.5 percent . Which is well under current market rate expectations. What does it mean for the economy?

What does it mean for markets?

|

|

| For perspective – here’s what the S&P500 looks like with (red line) and without (blue line) the FAANGM. With the recent re-pricing of tech stocks, it is little wonder that the index has experienced some volatility of late.

|

|

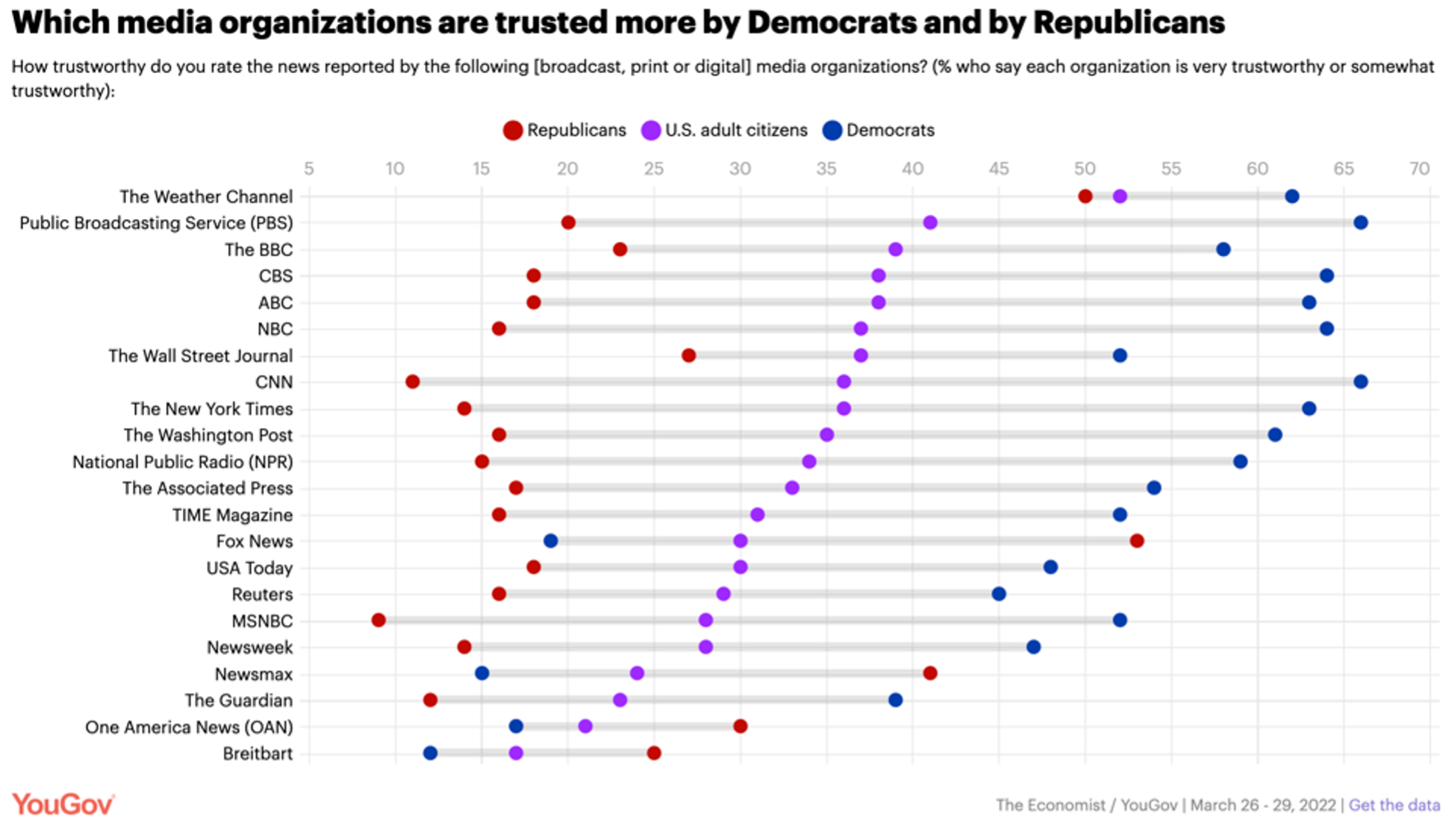

| With unlimited sources of news, we naturally all choose our favourites. Our carefully-chosen social media feeds and conversations with friends and family can make it worse. It is a phenomenon known as confirmation bias.

But, once again, the US takes it to a new level. As the below chart depicts, the divide between Democrats and Republicans in trust of media organisations is staggering. And, with adult citizens plotted in between, it could be concluded that a point has been reached whereby people need to know the politics of their countrymen and what they read/watch before they can have a conversation. Mmm… How differently political campaigns are framed in 2022 Vs fifty years ago…

|

|

| When measuring retirement outcomes, the terms’ modest’ and ‘comfortable’ has become the barometer of most media. And whilst many Australians may think both options sound reasonable (after all, ‘comfortable’ means different things to different people), it may be of interest to find out contextually what this actually means.

For interest sake, according to a national survey conducted by the ABC in late 2021, a staggering 55% of men and 64% of women don’t hold out high hopes of retiring comfortably. The below figures assume that retirement is at age 67 and that the retiree owns their own home. Pensioners who don’t own their homes may suffer great hardship, and that group will only get bigger as housing affordability worsens and homeownership falls. The fact that 85% of Australians do not receive financial advice certainly compounds the issue.

Source: The Association of Superannuation Funds of Australia (ASFA) – Retirement Standard December 2021 |

|

| As promised, here are the answers to last View’s ‘Figure of Speech’ puzzle. How did you fare? The record here at FinSec was an acceptable 17.

|

| Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser. |

|

|