Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

US budget crisis over

President Barack Obama has signed into law legislation raising the Treasury Department’s borrowing authority, officially ending the government shutdown that has crippled the country since Oct 1.

His signature came hours after the US House of Representatives passed the legislation, the result of a deal that reopens the federal government with a temporary budget until January 15 and extends US borrowing authority until February 7.

Earlier, the Senate passed the bill by 81 votes to 18.

In the following article Dr Shane Oliver provides his insight into ‘what it all means’ and the associated implications.

Back to work and no debt default

In a rerun of past fiscal debates the US Congress has agreed to a last minute increase in the US Government’s debt ceiling and an end to the partial Government shutdown. Although this was already partly anticipated, share markets have naturally celebrated as the threat of a US debt default hitting confidence and global economic growth has been averted.

The agreement has seen Republicans achieve almost none of their demands but the big negative of the deal is that it only funds the Government through to January 15 and raises the debt ceiling to February 7. So expect a lot of talk about “kicking the can down the road yet again”.

Some positives

However, it’s probably not that simple and there is more reason for optimism.

- Firstly, while the run up to the decision indicated that brinkmanship is alive and well in the US, the clear message is that at the end of the day the majority of US politicians will not let the US default on its debt servicing or broader spending commitments. As Winston Churchill once said “you can always rely on the American’s to do the right thing – after they’ve tried everything else.”

- Second, while the brinkmanship seen in the US on a semi-regular basis is not good for confidence it is not all bad as it has led to a more balanced solution to US budget and debt problems than would have been the case if either side of politics had complete control.

- Thirdly, the legislation for the temporary fix appears to include the so-called McConnell Rule that would allow the President to increase the debt ceiling unless Congress voted against it with a 2/3rds majority in each chamber. Such an approach could allow the Republicans to vote against a debt ceiling increase in February but not stop it.

- Finally, having been so badly burned over the last few weeks Republicans may not be so willing to set off another Government shutdown and/or debt ceiling crisis early next year. Americans appear to have largely blamed them for the latest crisis and their favourable rating dropped to the lowest level in the last 20 years at just 28% according to a Gallup poll. With the mid-term Congressional elections coming up next year they may not be prepared to risk a re-run or worse as it could mean they will lose control of the US House of Representatives. So another shutdown and/or extreme bout of debt ceiling brinkmanship may end up being avoided early next year.

Implications

The ending of the shutdown and the raising of the debt ceiling have a number of implications.

First, the shutdown is only likely to have a minor impact on US economic growth. Probably only 0.2% or so shaved off December quarter GDP as only 450,000 workers were furloughed in the end and they will receive full back pay. Government spending will now play catch up and the negative flow on to confidence should reverse fairly quickly.

Second, even though the impact on growth from the shutdown is likely to be minor wariness of another round of fiscal debates in the US in January and February may see the Fed further delay tapering its monetary stimulus to its March meeting, particularly if economic data is still weak. In other words US monetary stimulus is likely to continue for a long while yet.

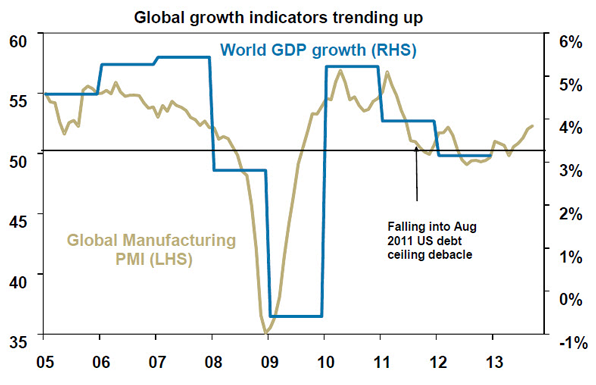

Third, the resolution of US fiscal issues for now has averted yet another threat to global growth. Just as issues and threats regarding Italy, Syria, the replacement of Ben Bernanke at the Fed, the Fed’s taper decision, the German election, etc, have all come and gone this year without causing major problems. This suggests that the global recovery can continue to strengthen.

Source: Bloomberg, AMP Capital

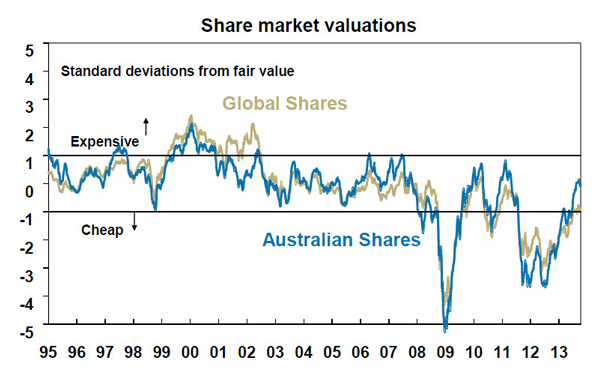

Fourthly, to the extent that the deal shows US politicians are not prepared to let America default and/or force an immediate balancing of its budget, it’s positive for investor confidence and hence positive for share markets and growth assets generally.

Source: Bloomberg, AMP Capital

With the worry list for investors continuing to diminish and US politicians showing yet again that they can work constructively when push comes to shove, our assessment is that shares will have a solid rally into year end with further gains next year. Share market valuations remain reasonable, monetary conditions are set to remain easy and profits are likely to improve next year as global and Australian growth picks up. Australian shares look they could hit 5500 by year end, with a little help from a Santa rally.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital