Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – 2021 Wrap and 2022 Outlook

|

Issue: 22nd December 2021 |

|

| 2021 opened with the good news that Covid numbers were slowing and the promise of vaccines. We distracted ourselves with the traditional summer of cricket and the new year carried with it the hope of renewal and better times ahead. It was easy to believe that the worst was behind us…

By March, our Covid statistics were still looking good. You couldn’t turn the TV on without seeing Annastacia, Gladys, Dan and Steven – our premiers and territory bosses seemingly had their shoulders to the wheel. In early July, Ash Barty won the women’s singles at Wimbledon. The timing of her win was not lost on anyone — 50 years on from Goolagong -Cawley’s first Wimbledon title, her victory as a proud Ngaragu woman is a significant achievement for Australian sport as a whole and for Indigenous Australians in particular. Soon after Federal government statistics revealed that Covid infections were not only on the rise but dangerously so – NSW announced a strict two-week lockdown for Greater Sydney. The lockdown would be months, not weeks. Delta was now on the attack, and Melbourne also shutdown (its fifth lockdown of the Covid era). By the end, the total of the city’s cumulative lockdowns would establish a world record of 262 days, pipping Buenos Aires at 245. We learnt the news that Brisbane had won the rights to host the 2032 Summer Olympics, and in late July, the announcement blossomed into an actual Olympics, those of the XXXII Olympiad hosted by Japan. For two weeks, we are transfixed, thrilled and moved to tears at the sight of athletes from around the world competing in everything from high jump to surfing, cycling to skateboarding. For those in lockdown (at the time, 50% of Australians), it is akin to taking a mental vacation; never has sport seemed so necessary. Fast forward to September, and newsfeeds were consumed with Australia’s cancelling of the $55 billion contract with the French to build our next fleet of diesel-electric submarines. Instead, we will pursue nuclear-powered submarines through a new trilateral enhanced security partnership with the US and UK – AUKUS. Primarily a military and intelligence sharing arrangement that seeks to bolster security in the Indo-Pacific, AUKUS piques global and, in particular, China’s attention. Meanwhile, cracks are starting to appear in both Melbourne and Sydney. Lockdown protests flare only to be compounded by mandatory vaccination orders across certain industries. Finally, we reach double vaccination targets – the people of Melbourne and Sydney are liberated from their lockdowns, and Australia (despite the new Omicron strain) commences its reopening. Throughout all of this, Australia’s economy staged a remarkable turnaround, albeit at considerable cost to the Federal Budget deficit (approx. $161 billion). Thankfully, this is below earlier forecasts, thanks to a better than expected economic recovery and the huge rise in the price of iron ore. Signs of Australia’s recovery were widespread, although understandably, some sectors remain constrained – the revival in the jobs market and hours worked saw the number of people employed recover to pre-pandemic levels (excluding Victoria). Record low-interest rates contributed to a 40% rise in housing construction approvals, and prices for dwellings increased across the country. 2021 brought the recovery many had hoped for. Businesses reopened, commuters returned to their desks, and the bravest of us even went on holiday. But no one could describe it as ‘getting back to normal’. Our pandemic induced way of life is here to stay with online shopping, videoconferencing and hybrid office/work at home arrangements now the regular. In last year’s review, we wrote that no one could have predicted how much 2020 would be shaped by the pandemic. However, the same has to be said for this year – Covid the sequel! |

|

| What one word best sums up everything that happened in 2021?

Here are the words the world think best reflects ‘the ethos, mood or preoccupations’ of 2021. Oxford Languages – Vax Merriam-Webster – Vaccine Collins – NFT (short for non-fungible token) Macquarie Dictionary – Strollout (as in ‘slow to rollout’)

|

|

2021 saw record highs across almost all equity markets. While some of this increase can be attributed to the rise in inflation, corporate earnings saw a boost from the pent-up consumer demand and the drivers of our new ‘norm’ (e.g. work-from-home, online ordering and teleconferencing) – A phenomenon that in itself was a direct result of ‘easy money’, AKA stimulus packages. By November of 2021;

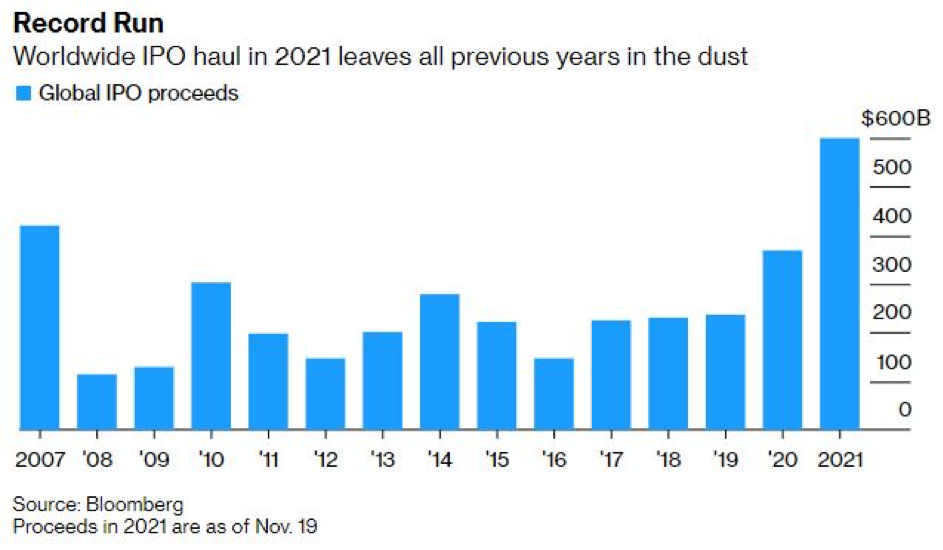

2021 has been a boom year for IPOs worldwide with a lot of company owners cashing in their chips. These included records from tech companies such as Toast, DiDi, Bumble, and AppLovin; financial platforms like RobinHood and Coinbase; as well as electric car manufacturer Rivian. 2021 is on track to see almost 1,000 IPOs, more than twice the number in 2020 and 4x the amount in 2019.

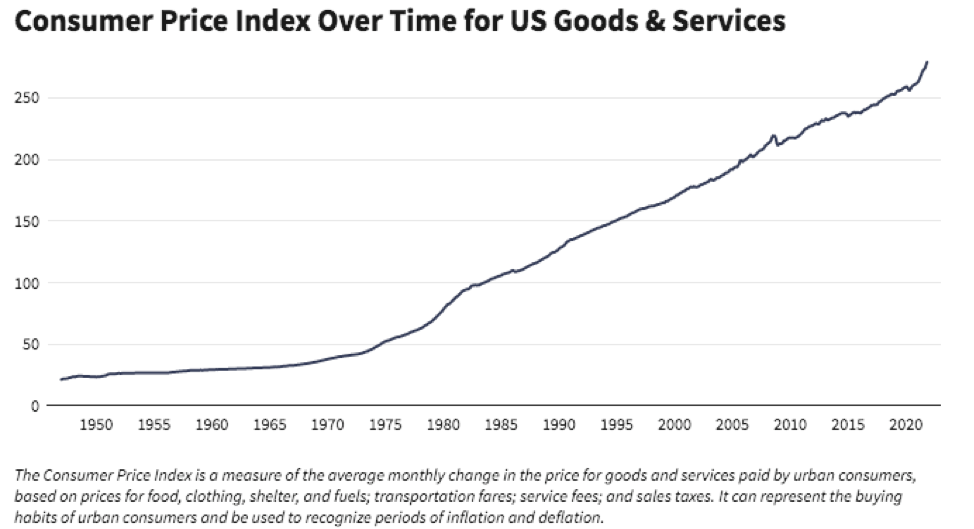

Since the financial crisis of 2008-09 and the Great Recession that followed, inflation in the US and in much of the world, has remained stubbornly low. Even as central banks cut interest rates to zero in order to spur demand, prices did not rise very much on an annual basis through 2020. As consumers began buying again in March of 2021, prices began to tick up. This has been attributed to producers who scaled back or were forced to shut down due to COVID in 2020 being unable to scale back up in time. At the same time, shipping costs and snarls at ports around the world caused further price increases, along with delays, a shortage of computer chips and frayed supply chains. By late June, it was clear that inflation was upon us, although some economists and central bankers urged caution that it should only be a temporary spike as economies ramp back up. By the beginning of December, it would seem the argument for ‘rising prices for longer’ is getting stronger. The US Bureau of Labor Statistics (BLS), which compiles the Consumer Price Index (CPI), saw prices increase by 6.8% in the 12-month period ended November 2021, a rate not seen since the early 1980s. As of the end of November 2021, the CPI index stands at a record-breaking high of 278.88.

Source: Federal Reserve Bank of St Louis

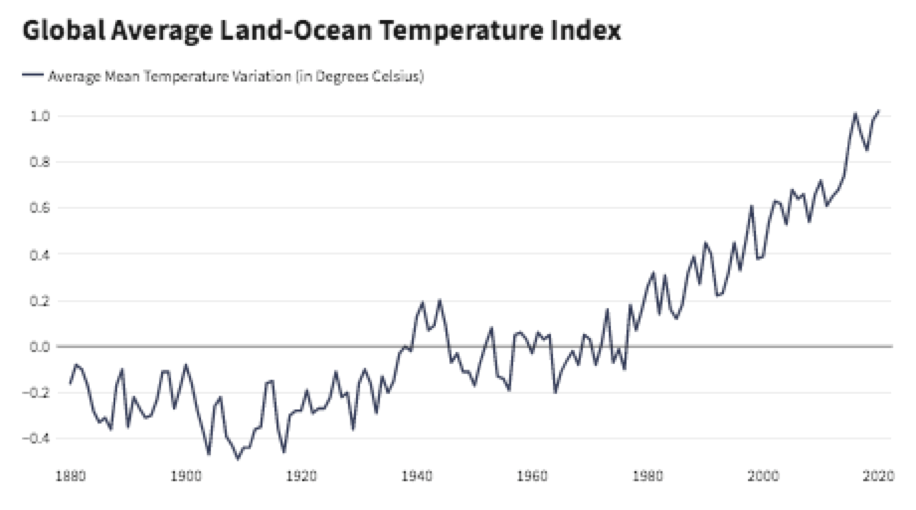

Aside from a record-breaking economy, some more dismal records were also set in 2021. Global warming continued to ominously produce new average high temperatures. According to the National Oceanic and Atmospheric Administration (NOAA), July 2021 was the hottest month on record. Moreover, NOAA predicts that 2021 will be among the top-ten warmest years on record.

Source: NASA’s Goddard Institute for Space Studies (GISS) Scientists and policymakers have urged action, and 2021 became a crunch year for tackling climate change. In November 2021, world leaders gathered in Glasgow for COP26, with 130 countries now having pledged to reach net-zero emissions by 2050 (China and Russia are aiming for 2060 and India for 2070). The message seems to really have hit home in 2021 – the falling cost of renewables and the growing public pressure for action is noticeably transforming attitudes across business and the minds of consumers.

As best we can tell, 2021 was the first year the word trillion came into common use. Everett Dirksen (RIL) is described as having penned the phrase, “A billion here, a billion there, and pretty soon you’re talking real money.” Now billions have been reduced to pocket change, and it takes trillions to amount to ‘real money’. Such is the scale of the number that most people struggle to explain what a trillion is. For perspective (using the context of time), there are 3 600 seconds in an hour, 86 400 seconds in a day, 31.5 million seconds in a year, one billion seconds equates to 32 years and one trillion seconds is the equivalent of 32 000 years. What comes next you may ask? Its a quadrillion (that is 15 zeroes) 1,000,000,000,000,000… |

|

| Many are calling 2022 the ‘policy paradox’. A year in which central banks and governments must try and navigate various conundrums without losing the trust of markets. How to tighten monetary policy and rein in inflation without killing off the recovery? How to cope with higher energy prices as the world transitions to a low-carbon economy? Fine-tuning policy settings to unravel these conflicting dynamics will not be easy.

The below is a summary of how our world of experts (fund managers and economists) see our world in 2022.

Inflation. It’s happening. Despite central bank rhetoric about inflation pressures being transitory, some price rises look set to persist due to the supply chain blockages and de-globalisation, and, longer-term, due to the cost of getting to net-zero emissions (even with growth in economic activity slowing, core inflation isn’t expected to peak in the US until late 2022). However, letting inflation spiral out of control would only make it a bigger issue later on, but clamping down aggressively could hamper growth when it is already stalling. On balance, interest rates are expected to remain lower for longer despite higher prices and central banks’ desire to taper asset purchases relatively swiftly. Ultra-low rates are needed to keep the system afloat, given debt levels are higher today than during World War Two. On the upside, a controlled inflationary environment will reduce real debt over time. China, where to from here? China emerged from COVID-19 stronger than Western economies and used the sharp rebound to tighten policy and initiate reform. As a result, China is slowing at a faster pace relative to the West. Given the substantial capacity to loosen, the view is China will re-stimulate once the downside risks from reform, especially in the property sector, become intolerable. Policymakers in China appreciate that to accelerate the transition to a consumption and services-driven economy – and lift the quality of economic growth – requires a vibrant private/ technology sector. It also requires household spending to grow at a faster pace than incomes. China’s extraordinarily high gross savings rate, at nearly 45% of disposable income and almost double that of the Western world, needs to be run down. The broad goal of policymakers will be to incentivise consumption today rather than saving for the future via improving the social safety net through affordable housing, education and healthcare. Recent policies around anti-competitive behaviour and data security are relatively rational and consistent with policies elsewhere in the world. Nonetheless, the country’s policy stance could weigh on global growth in 2022, and consensus expectations may be revised lower. Populism is here to stay The end of Donald Trump’s presidency is not the end of political populism or its causes in the US or more broadly. This likely means continued political and geopolitical volatility, but perhaps more importantly, it also makes additional fiscal stimulus more likely, as governments pursue borrow-and-spend policies seeking to address the causes of populist discontent. The efficiency and effectiveness of these policies will likely be key in assessing the likelihood of avoiding secular stagnation. What it all means for equities There are still more positives than negatives for equities. Looking at the risks first. Covid remains a negative, as does tensions with China. The economic recovery will slow, and that means weaker profit growth. And then there’s the short-term spike in inflation, which could become a long-term spike. The positives are that vaccines are helping. Monetary and fiscal policy remains ultra-easy and low rates make equities relatively attractive. There’s still plenty of government stimulus coming, and earnings expectations are still being revised up. In the United States, things are a bit calmer under President Biden, and that’s a positive for markets. Because interest rates are so low, bank deposit rates are also very low. Investors make the comparison – very low bank deposit rates or five per cent fully franked return on shares. That differential will remain for some time because when interest rates do start to rise, it should be a gradual process. Nonetheless, the expectation is there will be more volatility and more constrained returns in equity markets over the next year. Risks to the outlook The main risk remains Covid and how it plays out. Hospitalisation rates will obviously be very important here. If hospital systems get strained, that can lead to a collapse in the economy. There is a risk that inflation is less transient than expected, and central banks will need to raise interest rates faster than anticipated. That would lead to a big rise in bond yields and a repricing of assets that are sensitive to those yields. That includes real assets like property and infrastructure. In terms of global growth rates, what happens in China is extremely important. We know the Chinese economy is slowing down. Where it normally would be growing at five to six per cent, it might be closer to three or four per cent. That means that over the next few years, there will be lower growth in demand for Australian commodities. There’s also political risk globally. There are US midterm elections next year, and the incumbent party often loses seats in the Senate, which means the Democrats may not end up with a majority. That’s why the Democrats are trying to push through their stimulus packages this year. There’s also an election in Australia, but that is unlikely to be a major driver of financial markets. Geopolitics is also a big risk- including the relationship between the US and China and tensions between Australia and China (recently been demonstrated by moves to diplomatically boycott the Beijing Winter Olympics). |

|

|

| It has been another extraordinary year, and we would like to take this time to say thank you for your ongoing support. It has been a privilege to be of service.

From a FinSec perspective, 2021 has seen us enhance our specialisations with the addition of four new advisers, and we are delighted to announce that early in 2022, we will also welcome a personal risk insurance specialist to the team. We celebrated the retirement of industry stalwart Barrie Moyle and embraced (and implemented) a raft of new regulations (a product of the Royal Commission). We also enjoyed a full program as an ‘industry expert’ with SA Leaders, and the team continued their fantastic work serving breakfasts to school children through the Kick Start for Kids program. Whilst we acknowledge with pride all of these achievements, in the spirit of Kaizen, please rest assured that we are now looking to the future and continue our mantra of “small incremental improvements, every day”. The festive season reminds us once again of the importance of friends and family, of taking a well-earned break and embracing the spirit of the season. We hope you take a brief moment to appreciate and enjoy this seasonal ‘break’, and may you all have a happy and safe new year. As we too, recharge our batteries, we will be taking a brief editorial break through January and look forward to seeing what the world has in store for our first view in February 2022. |

|

|

Stay safe and look after one another. Enjoy the holidays, and as always, if you have any concerns or questions at any time, please reach out to your FinSec adviser. |

|

|