Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View #12

Issue: Friday 10 July 2020

In recent weeks the stock market and its many participants have once again hung on to recent gains in the face of complete uncertainty. The S&P/ASX200 is only around 10% below its level at the start of 2020, but economic indicators paint a less positive picture.

Adding to the short-term volatility is the rise of a new phenomenon amongst the “corona- generation”.

‘Small trader calls’ (where people pay for the right to buy the market at a level higher than the current price) has exploded during COVID-19 lockdowns. Fuelled by new apps, offering zero commission on trades, the number of active trading accounts has increased by 70% (10 million new accounts have been opened with fee-free stockbrokers) in the US alone. One of these rookie share traders is quoted as exclaiming, “this is not right it should not be this easy”, mmm.. no it shouldn’t be. Bored millenials locked at home, no sport to bet on, stimulus check in hand… no moral hazard here!

June also marked the end of the financial year. In summing up Economist, Shane Oliver stated 2019-20 saw poor returns but it could have been much worse. His key messages for investors are: maintain a well-diversified portfolio; timing market moves is hard; beware the crowd; turn down the noise; and don’t fight the Fed.

In our view what lies ahead? We believe the main factors in play are:

- Coronavirus itself. Each country (and even state) is following its own path in the cycle of restrictions and easing. This path will probably continue until a cure or vaccine is found. As we have witnessed there is no formula for predicting the flow-on effects to economies and stock markets, we are in unchartered territory.

- Capitalist Governments have now become welfare states. Under orthodox practices, they cannot continue to lend and borrow forever and at some time the confidence bubble will burst. Nearly all countries in the world are carrying much higher levels of debt now than they were a decade ago. Most at risk are highly indebted developing countries reliant on commodities and tourism.

- The battle between fiscal policy and new monetary policy – what will become the new norm?

- The acceleration of macro-trends including: populist politics, nationalism, protectionism, the decline of oil, the cold-war style military build-up, the ramifications of the US retreating from multi-lateral arenas, just to name a few. These trends will have significant implications for long-term investors.

We are now operating in a pervasively different and changing world. At FinSec our portfolios remain on track to achieve their long-term goals for investors. We remain vigilant and agile and continue to monitor events as they unfold. Please stay tuned to these updates (or visit our website) for ongoing information and analysis.

Trump!

We can’t confirm the authenticity of this letter, but we are lead to believe it is a note penned by George Bush to Bill Clinton as he departed the oval office back in 1993. Can you imagine Trump leaving a letter like this for Joe Biden? No, a tweet (and not necessarily a gracious one) would probably be more his style. It is a reminder of just how much politics has changed.

With the US election less than 5 months away between now and November millions of words will be written and spoken about whether Trump can or should win. Less than two months ago the odds were overwhelmingly in his favour. Now they have moved against him. But this cycle could turn another dozen times or so.

Is there a real case in principle for Trump’s re-election? The case against him is of course substantial. The strongest argument is that his mouth is not only undisciplined and frequently crude, it is often malicious and damaging.

The Australian’s Greg Sheridan agreed with all these sentiments in a recent article he wrote for the Inquirer. However, he also writes about the fact that Trump is the man we all love to hate, and this almost always affects the way he is viewed. He states therefore that “the only way to properly judge Trump, is on the basis of what he has actually done. And here his record certainly has its negatives, but there is also a lot to say in his favour”.

He writes intelligently through fact to illustrate that much of what Trump has done domestically and internationally is exactly what he promised he would do. His list includes:

- The cutting of taxes and business regulation. This alone saw the US economy grow by 3% and unemployment drop to 3.5% (pre-COVID) – the lowest since records have been kept;

- In accordance with his America first policy, (rightly or wrongly) he rendered the Paris climate accords unfair and left exactly as he promised to do;

- He has displayed military prudence. In fact, if he gets to November without launching a large military campaign he will become the first President since Jimmy Carter to complete a term in office without invading someone or taking military action to change a regime;

- He has substantially increased the US military budget, also as promised;

- He is widely criticised, and with some justice, for not attending to US alliances more solicitously. Yet the bottom line is he has not closed any US overseas military bases or facilities (as promised);

- He has refused to tolerate countries “free-riding” on the US (past Presidents all complained but endured it – NATO & Europe by way of example);

- There may be no wall but, domestically Trump promised to secure America’s borders and he has almost done that; and

- When dealing with international relations his methods may be a little uncouth but (in a round-about way) he has got the job done.

There is no doubt that COVID and the Black Lives Matter demonstrations have hurt or destroyed some of his achievements, particularly the economy. But, come November US voters will have to ask themselves who is best to lead the economic recovery, who can safeguard them internationally and who can provide security and justice on their streets? The intention here is not an endorsement of Trump, rather Sheridan provides a refreshing perspective as to why “it is by no means clear, on the basis of his record, that Trump is the loser when those are the questions”!

You can read the full article here.

Please Note: The Australian doesn’t offer you a free look and you may require a subscription.

Charts of the Week and All Hail the Aussie Battler

Recent data has revealed that those earning less than $65k a year have carried the economy on their shoulders throughout the Covid-19 crisis. When the first payments hit bank accounts, Battler spending increased by 10%. In contrast, high-income earners (those earning more than $104k a year) retreated, reducing their discretionary spending by 36%. It is a trend that has continued.

According to the data, low-income earners have continued their discretionary spending at 20% above November 2019 baseline levels, with high-income earners still tightening spending at -15% baseline levels. With the Aussie battler responsible for keeping the economy going, it is becoming apparent that extending the policy stimulus past September, as the Treasurer is now talking, will be a necessary evil.

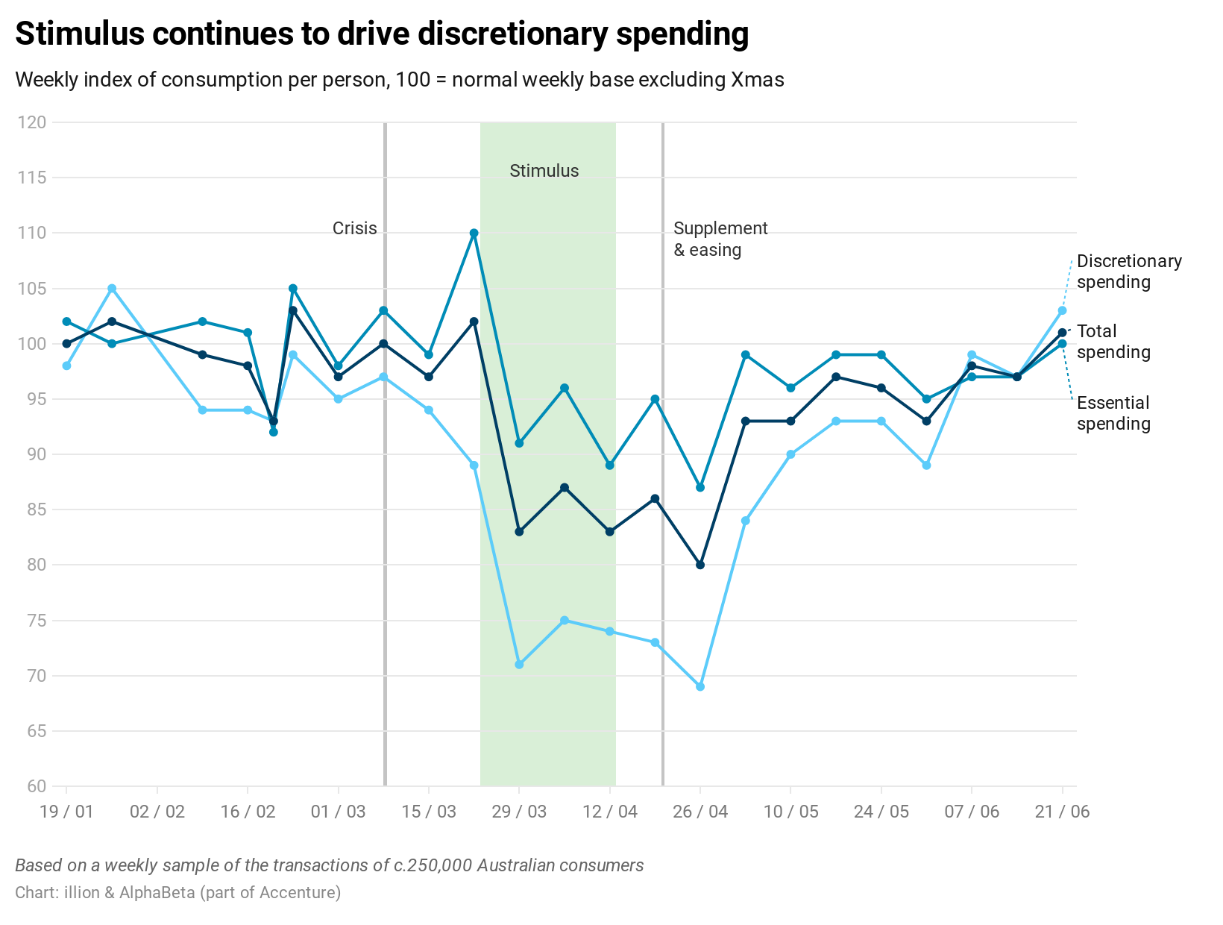

Our first chart of the week shows National spending ahead of the new Melbourne restrictions. It plots the huge spike in essential spending i.e. ‘the panic buying’ as the crisis hit, through to June when restrictions were lifted, we were allowed out and discretionary spending went mad.

This next chart provides an insight into what people are currently spending their money on. No surprise to see food delivery and furniture up significantly or even to see gambling and alcohol also experiencing sharp increases in spending. Travel, pubs and gyms taking a huge hit.

Things that Make you go ‘mmm…’

We were a little bemused by an article we read in the Australian Financial Review (AFR) this week. It tells the story of an Industry Super Fund, who substantially revalued its property portfolio a mere two days before the end of the financial year. The precise reasoning behind the revaluation is unknown but in doing so they were able to boost the performance of their “balanced” portfolio (“in name, if not asset allocation” the AFRs words not ours), on a day the performance of its Australian equities component was down by an almost equal amount. Mmm… given the importance of yearly fund performance lists to member inflows the revaluation was rather helpful for the fund as it closed out FY2020.

Alert: Please Open Correspondence from your Super Fund/s

A fortnight ago, we included an article about cybersecurity (click here). As a follow-up, we remind you to please open all correspondence from your superannuation funds, both electronic and written. Interestingly only 1 in 4 people open mail from their funds, which makes it very easy for the fraudsters and scammers to do their job!

Introducing Vance

If you happen to come across a big, inquisitive Labrador roaming the FinSec corridors next time you visit, do not be alarmed. This is Vance, CSO Rodney’s Seeing Eye Dog and the newest addition to the FinSec team. We are pleased to report that Vance is settling into FinSec life like a pro. Here are a few happy snaps of his first day on the job.

As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser.