Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 9th May 2025

Investment markets and key developments

Shares were mixed over the past week. Despite the Trump administration talking up trade deals US shares fell slightly, but Eurozone shares rose slightly, and Japanese and Chinese shares saw strong gains. Given the mixed messages Australian shares fell around 0.1% with strong gains in utilities and IT shares offset by falls in health and finance shares. Bond yields were also mixed – up in the US, Japan and Australia but down in Europe. Oil prices rose but remained around $US60 a barrel as OPEC agreed to increase production. Gold and iron ore prices also rose but copper fell. The Australian dollar fell as the $US rose, but Bitcoin made it back above $US102,000 reflecting the risk on environment.

The past week has seen more good news on the trade war front with US/China talks starting up, the US announcing an agreement with the UK and a meeting between Trump and Canadian PM Mark Carney. But our view remains that its still too early to say that we have seen the bottom in share markets.

- Despite the tariff backdowns and 90 day delay the effective average tariff rate on imports coming into the US is still around 22% which is back to levels of early last century.

- While the US/UK trade deal saw the UK get welcome relief on sectoral tariffs (steel, aluminium and autos) which is a positive sign for other countries, a deal with the UK was easy as the US has a goods trade surplus with it, details were lacking indicating it’s still a work in progress and the 10% baseline tariff remains in place suggesting it will for other countries too. With the UK having to buy more US agricultural and industrial products its unclear why it signed up to the deal as the UK is still far worse off than prior to “Liberation Day”.

- The US/UK deal suggests that the best Australia might hope for is relief on the 25% tariff on steel and aluminium (and any future tariff on pharmaceuticals) but the 10% tariff will remain. So there is little point Australia giving anything up to the US, like easier biosecurity or social media laws.

- It’s unclear how much progress will be made in other trade deals. Some look like they are really just going to be agreements to negotiate which means the situation could flare up again. Negotiations with some countries, eg Japan and Europe, don’t appear to be going so smoothly. So far the US/China talks are not really “advanced trade talk” according to Treasury Secretary Bessent, although there are reports Trump is targeting lowering the China tariff below 60% as a first step. And Trump’s recent comments about take it or leave it offers on tariffs and that some countries with surpluses are “going to pay a 25% tariff or a 30% or a 50%…” suggest that there is a high risk of Trump throwing another tantrum.

- Just as Trump had to backdown as investment markets rioted in early April, their calming and the rebound in share markets since may embolden him to go hard on tariffs again.

- Trump has flagged more sectoral tariffs and is now talking about a 100% tariff on foreign made movies. The latter further muddies the waters as to the logic behind the tariffs as the US has a trade surplus in services and US made movies dominate globally. It adds to the perception that Trump just spins a roulette like wheel each day to decide who to threaten next.

- Hard economic data like retail sales, business investment and jobs will likely start to follow confidence down in the months ahead as the full impact of the tariff shock shows up with the risk of a US recession high. March quarter US profit reports have been strong but the hit from tariffs still lies ahead with many companies downgrading guidance.

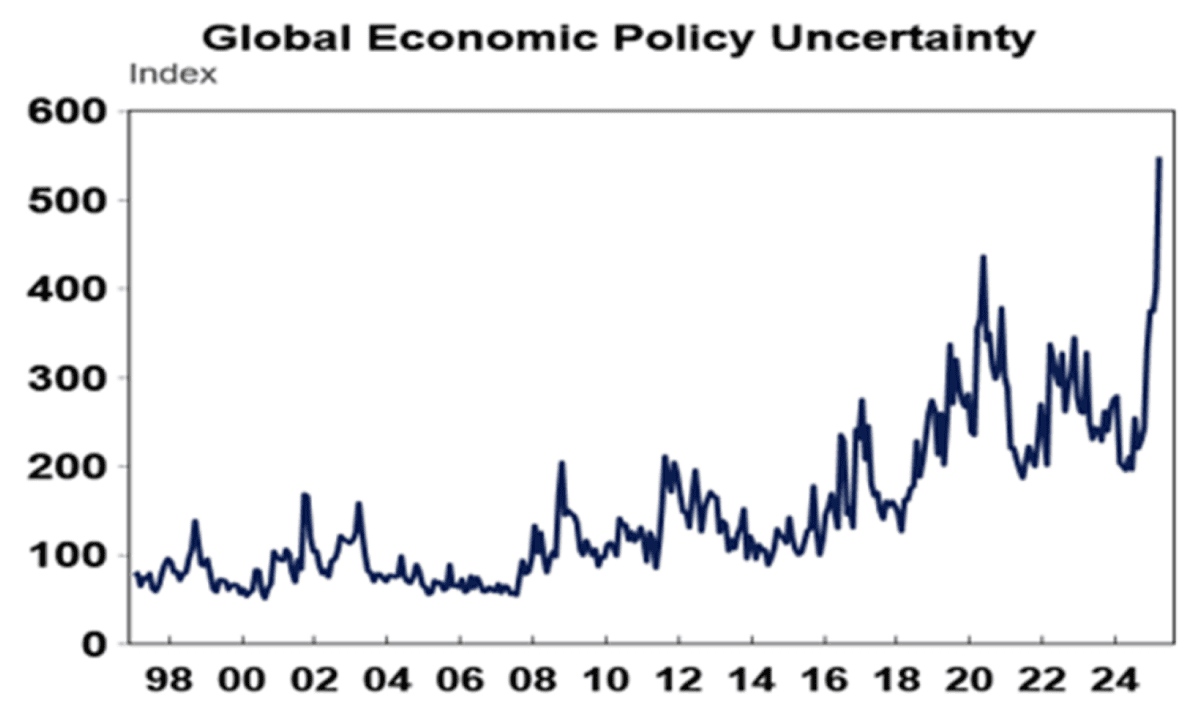

- The issue of Fed independence will likely flare up again as Trump looks for someone to blame for weakening economic conditions. After the past week’s meeting he ramped up criticism of Powell, calling him “a fool”. Related to this global investor faith in “US exceptionalism” likely has further to unwind which could be negative for the $US & US bond yields. This was highlighted by the surge in the Taiwan dollar in the last week, on the back of capital flows out of the US. Interestingly indicators of global policy uncertainty are still on the rise – led by the US.

Source: Macrobond, AMP

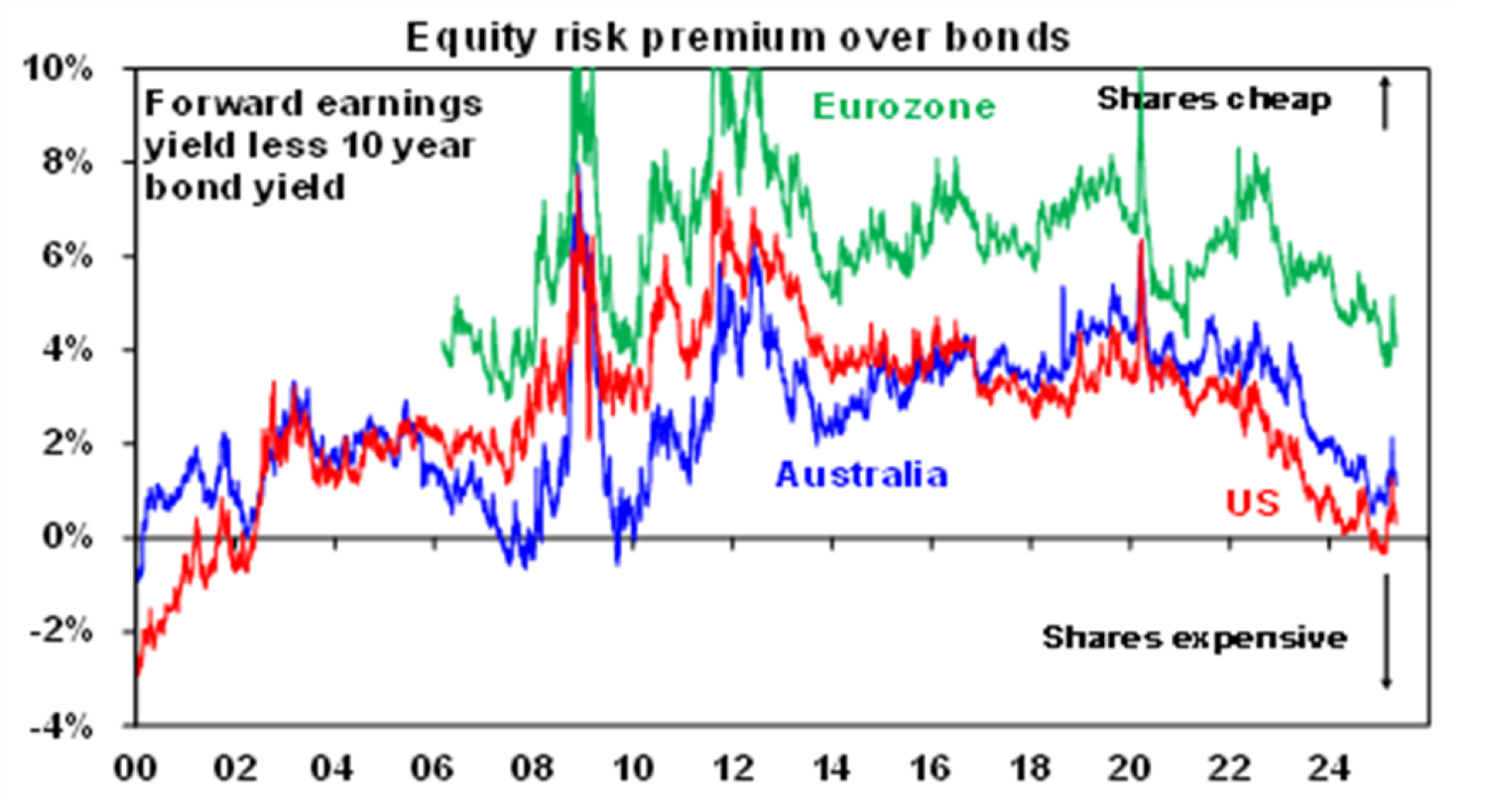

- US shares are back to a very low risk premium over bonds (as measured by the gap between forward earnings yields and the bond yield) which is probably inconsistent with the increased uncertainty facing the US. At least the risk premium on Australian shares is a bit better, but Europe is much better.

Source: Bloomberg, AMP

- Finally, geopolitical risks are on the rise again, with another India/Pakistan conflict and no peace in Gaza. The former has a habit of flaring up every so often leading to fears it may turn nuclear but both sides have in the past managed to avoid that. But the bigger risk remains US and/or Israeli action against Iran’s nuclear capabilities if diplomacy doesn’t work.

So, with more to go on the tariff front and the hit to economic conditions and profits it remains too early to say we have seen the low in US, global and Australian shares. Ultimately though we continue to see Trump settling at a far lower average tariff rate than the 22% currently – with China probably ultimately dropping back from 145% to a still high but less prohibitive 54% (which is the fentanyl and original reciprocal tariff) – and pivoting to focus more on tax cuts and deregulation which along with more central bank rate cuts, including from the Fed from the September quarter, should see shares stage a more sustainable recovery in the second half of the year.

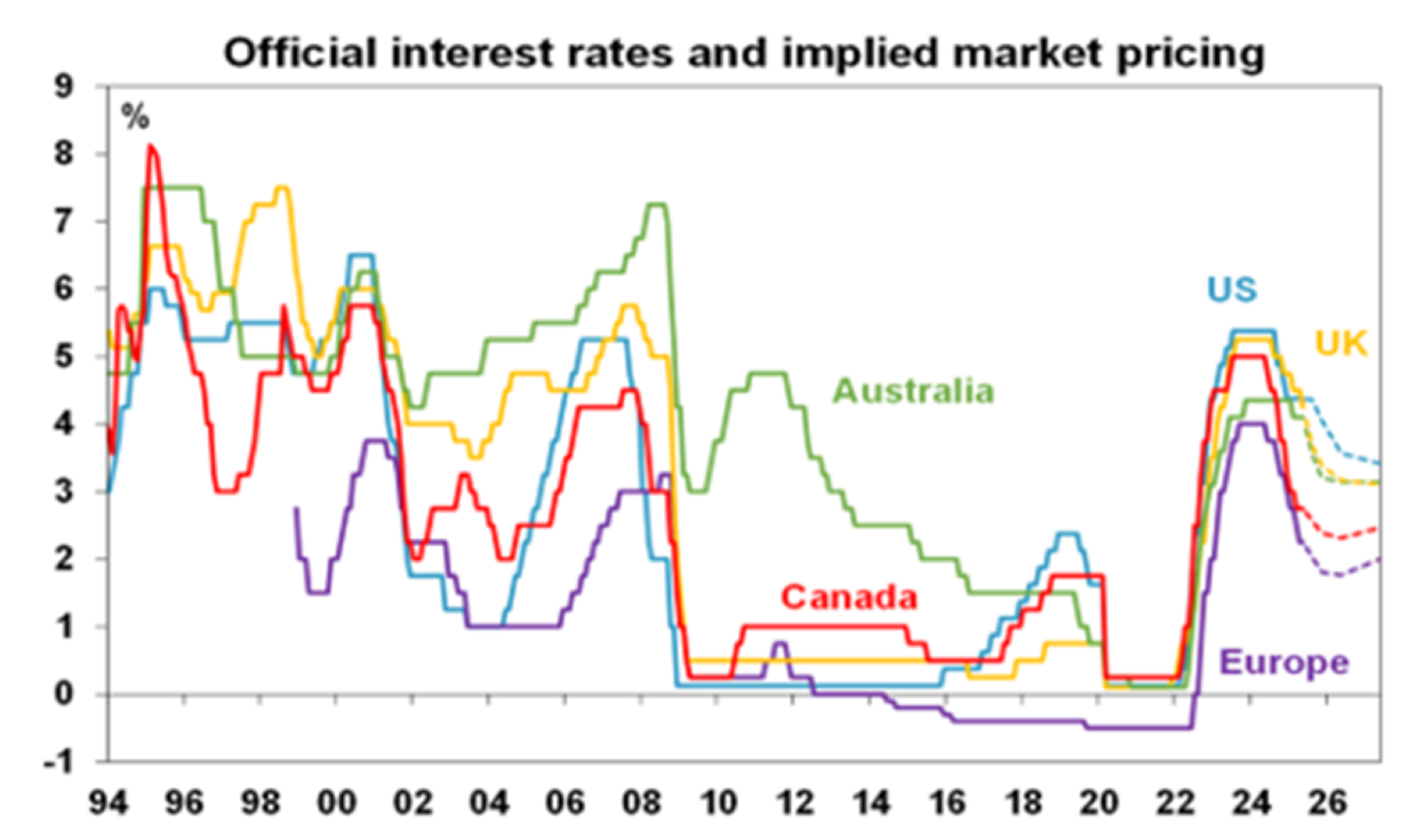

The Fed left rates on hold at 4.25-4.5%, remaining in wait and see mode, noting the tariffs have been larger than anticipated resulting in increased risks of both higher unemployment and higher inflation. Our assessment remains that the Fed will ultimately give primacy to a significant weakening in growth as that would lead to lower inflation and Powell noted a rapid deterioration in the jobs market could trigger a cut. But it will likely take to July or September before the Fed has enough information to start cutting again. This poses a risk to growth which is more Trump’s fault (as he is the one who put the tariffs on) as opposed to the Fed’s (which is charged with keeping long term inflation down), but Trump will continue to blame the Fed. The money market is allowing for three rate cuts by year end.

Source: Bloomberg, AMP

As widely expected, the Bank of England cut by 0.25% to 4.25% and revised down its inflation forecasts. But its guidance remained for “gradual and cautious” rate cuts, so the next cut probably won’t come till August. Its policy rate is still expected to fall to around 3.5% by year end. The Swedish central bank left rates on hold at 2.25% but was dovish and is still expected to cut to 2% or below by year end.

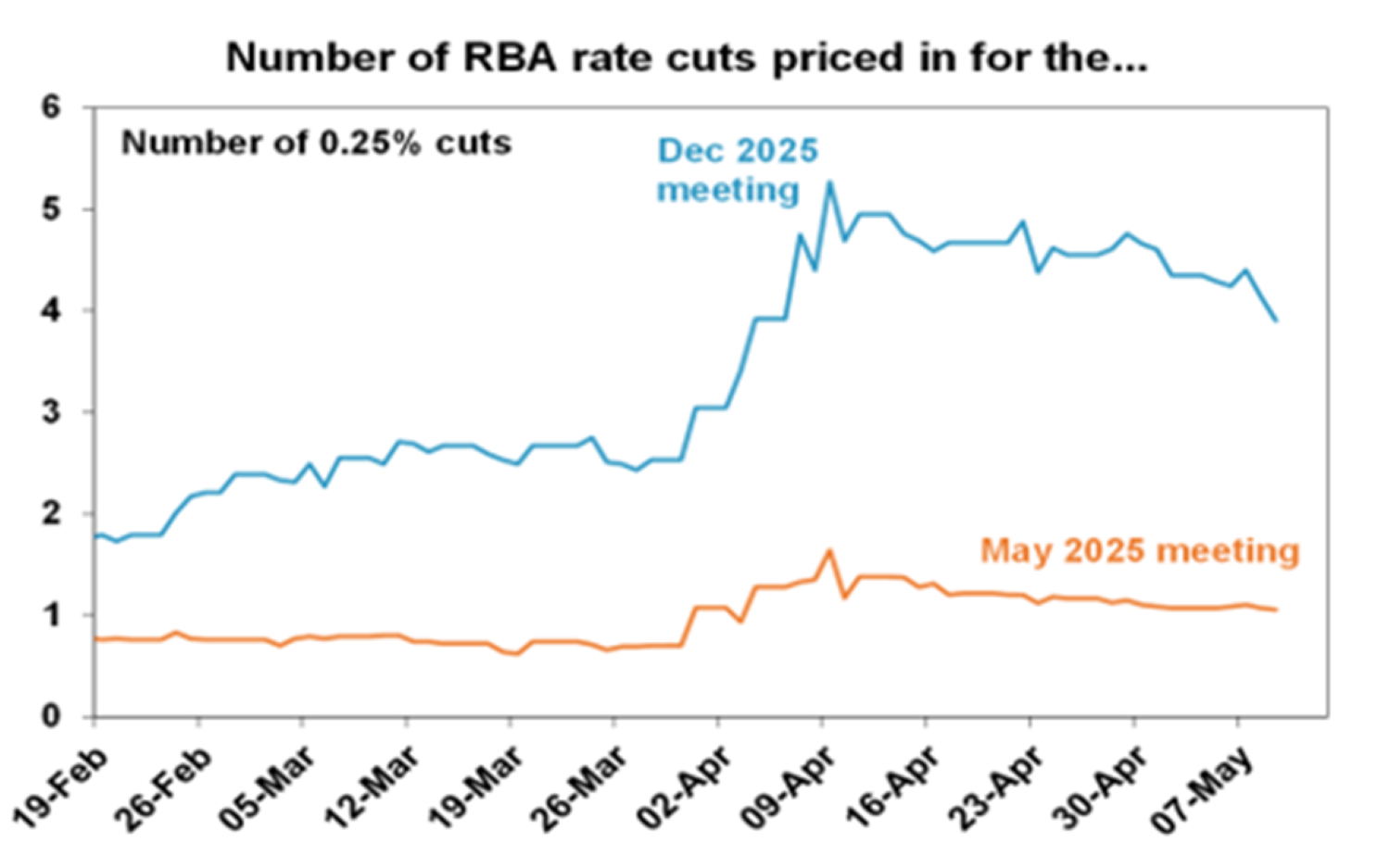

In Australia, the RBA remains on track to cut rates again by 0.25% at its 20th May meeting. The past week saw more data suggesting consumer spending is still struggling – with flat real household spending in the March quarter which along with a flat contribution to growth from trade points to softish March quarter GDP growth. And this on the back of March quarter inflation data showing that underlying inflation is trending down in line with the RBA’s forecasts. With monetary policy still tight and Trump’s trade war still pointing to downside risks to growth we expect a rate cut this month, again in August, possibly again in November and again in February next year taking the cash rate down to 3.1 to 3.35%. The money market is factoring in four more cuts by year end.

Source: Bloomberg, AMP

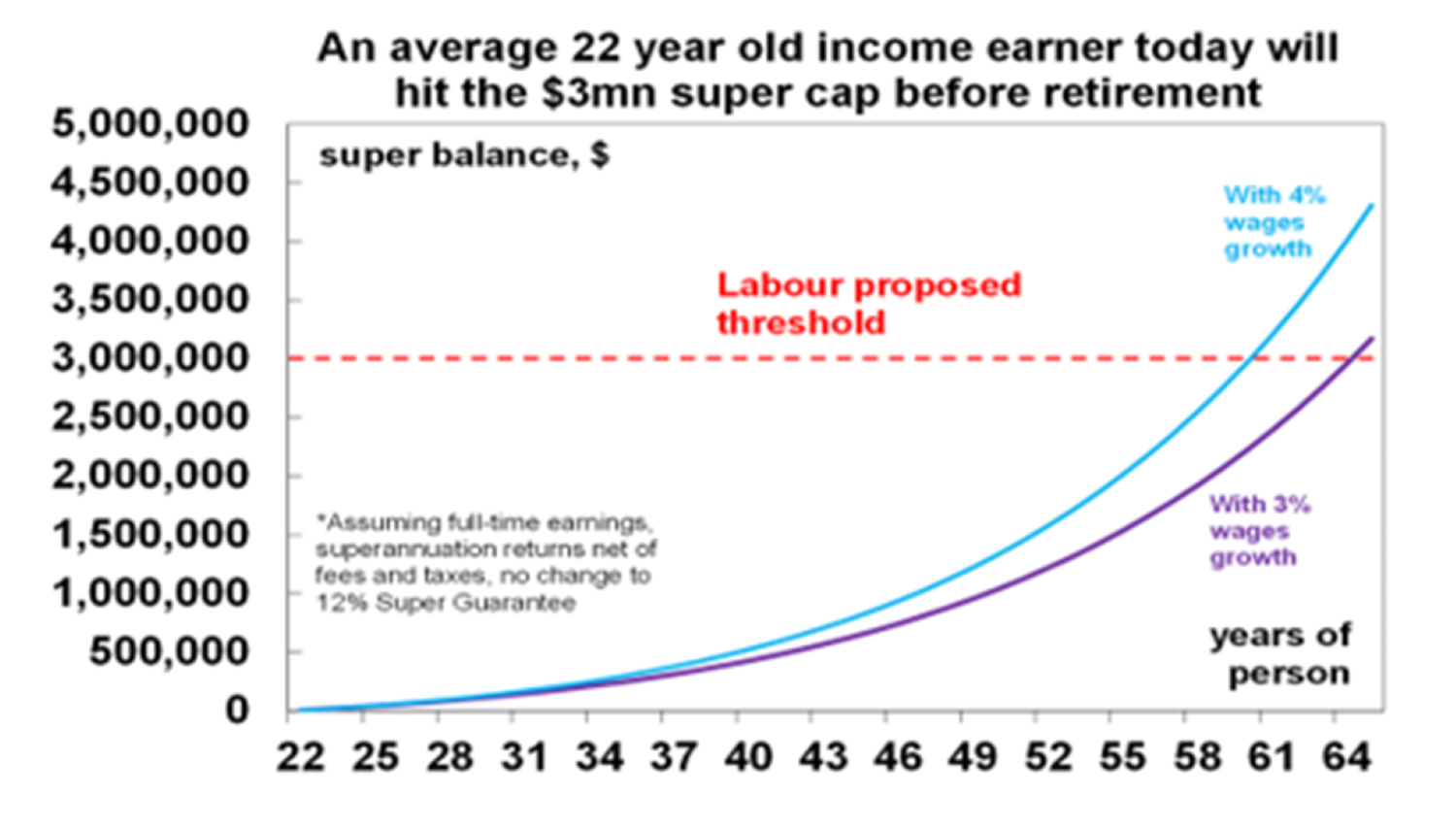

With the Labor Government returned in Australia and Labor and the Greens now having a Senate majority its likely the proposed 30% tax on earnings on super funds above $3bn balances will be passed into law. This was proposed to make the superannuation system more sustainable but two main concerns with it remain. First, it will tax unrealised capital gains meaning some may have to sell assets to pay the tax. This could particularly be an issue for farmers and SMSF’s that may have property in their super fund. Second, the $3m threshold won’t be indexed. The latter means that ever more members will be caught up in the tax over time raising increasing taxation revenue. So more bracket creep! Calculations by my colleague Diana Mousina show that a Gen Z worker on average full-time earnings will likely have to pay the tax before they retire. Hopefully it will be indexed before then.

Source: ABS, AMP

Major global economic events and implications

In the US, the ISM services conditions index improved in April to reasonable levels but within that business activity slowed and prices rose. Meanwhile, jobless claims remain low.

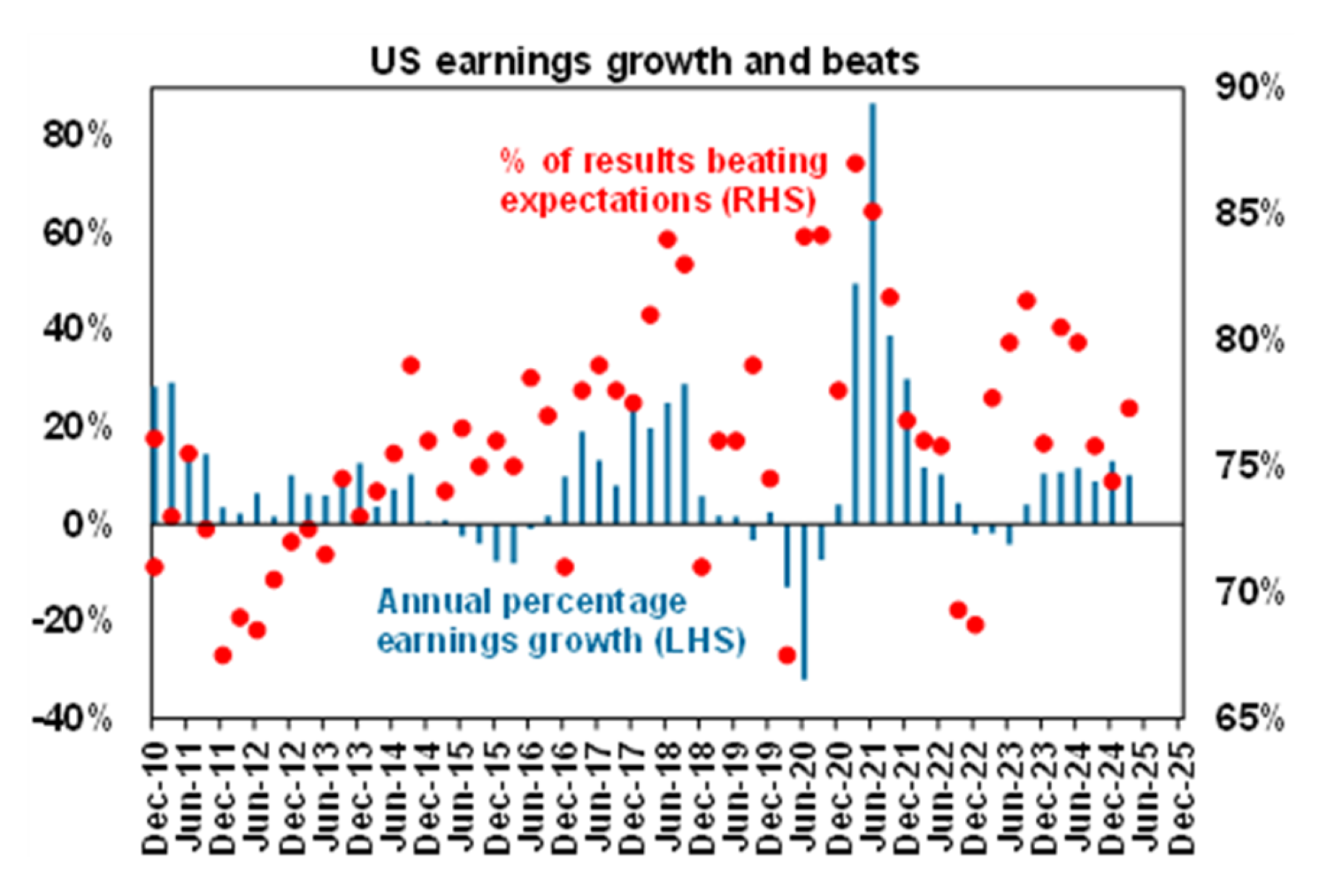

US earnings growth continues to hold up well in the March quarter, but signs of weakness are appearing. 90% of S&P 500 companies have reported March quarter results with 77% beating expectations which is just above average and consensus earnings expectations have risen to 10.1%yoy, up from 4.1%yoy four weeks ago. That said numerous companies have highlighted the threat from the tariffs and earnings expectations are being revised down.

Source: Bloomberg, AMP

In Germany, Friedrich Merz was elected German Chancellor, allowing him to proceed with the agreement to ramp up defence and infrastructure and broader moves to further strengthen Europe. So, it’s positive for European assets.

More Chinese stimulus. The PBOC announced more policy easing including cutting a key policy rate and the reserve ratio that banks must maintain along with more lending programs. This is aimed at supporting growth in the face of Trump’s tariffs and ahead of negotiations with the US, but more fiscal stimulus is needed. Meanwhile, Chinese exports slowed less than expected to 8%yoy in April with imports roughly flat on a year ago.

Australian economic events and implications

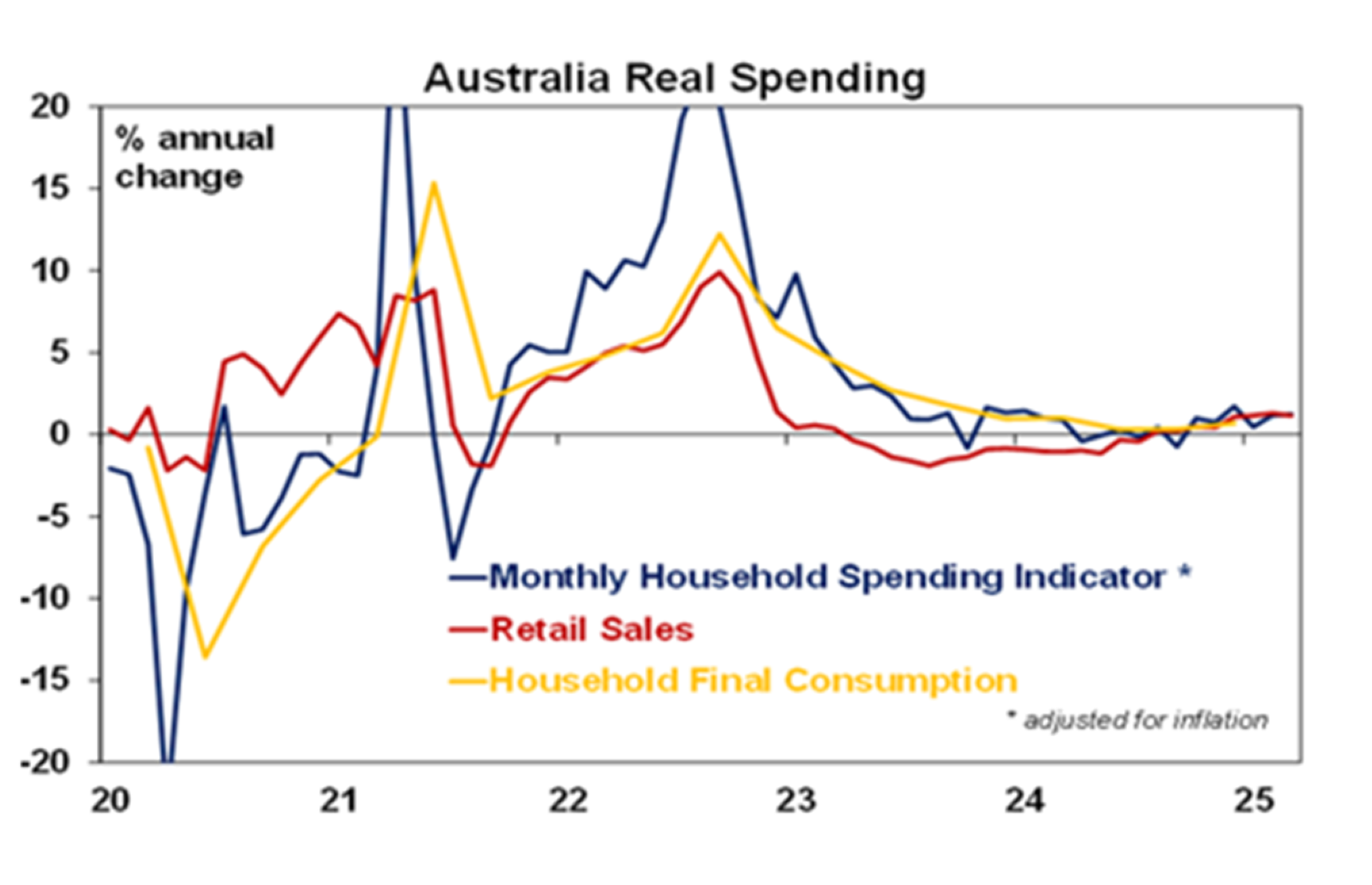

Australian data was soft. Household spending data confirmed the message from retail sales with flat real spending in the March quarter after discounting boosted sales in the December quarter, suggesting that households are still struggling. A gradual uptrend is likely to resume on the back of rising real wages, low unemployment and improved confidence but it’s likely to require more rate cuts. Weak household spending along with a weak contribution to growth from trade point to subdued growth in March quarter GDP.

Source: ABS, AMP

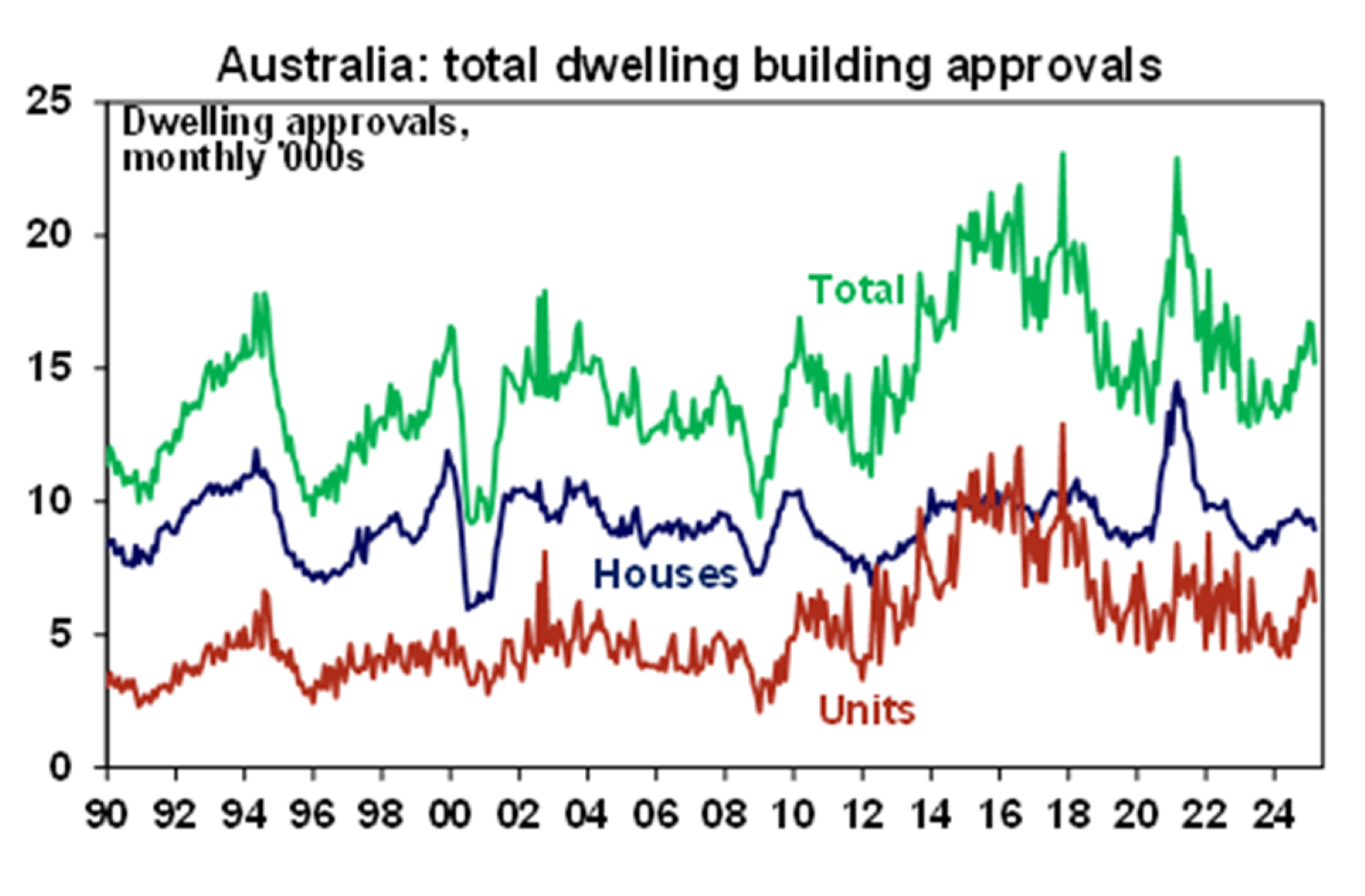

Australian home building approvals fell 9% in March mainly driven by volatile units and Victoria. While the trend is still up, approvals running around 195,000 annualised are well below the 240,000 annual home building target under the Housing Accord.

Source: ABS, AMP

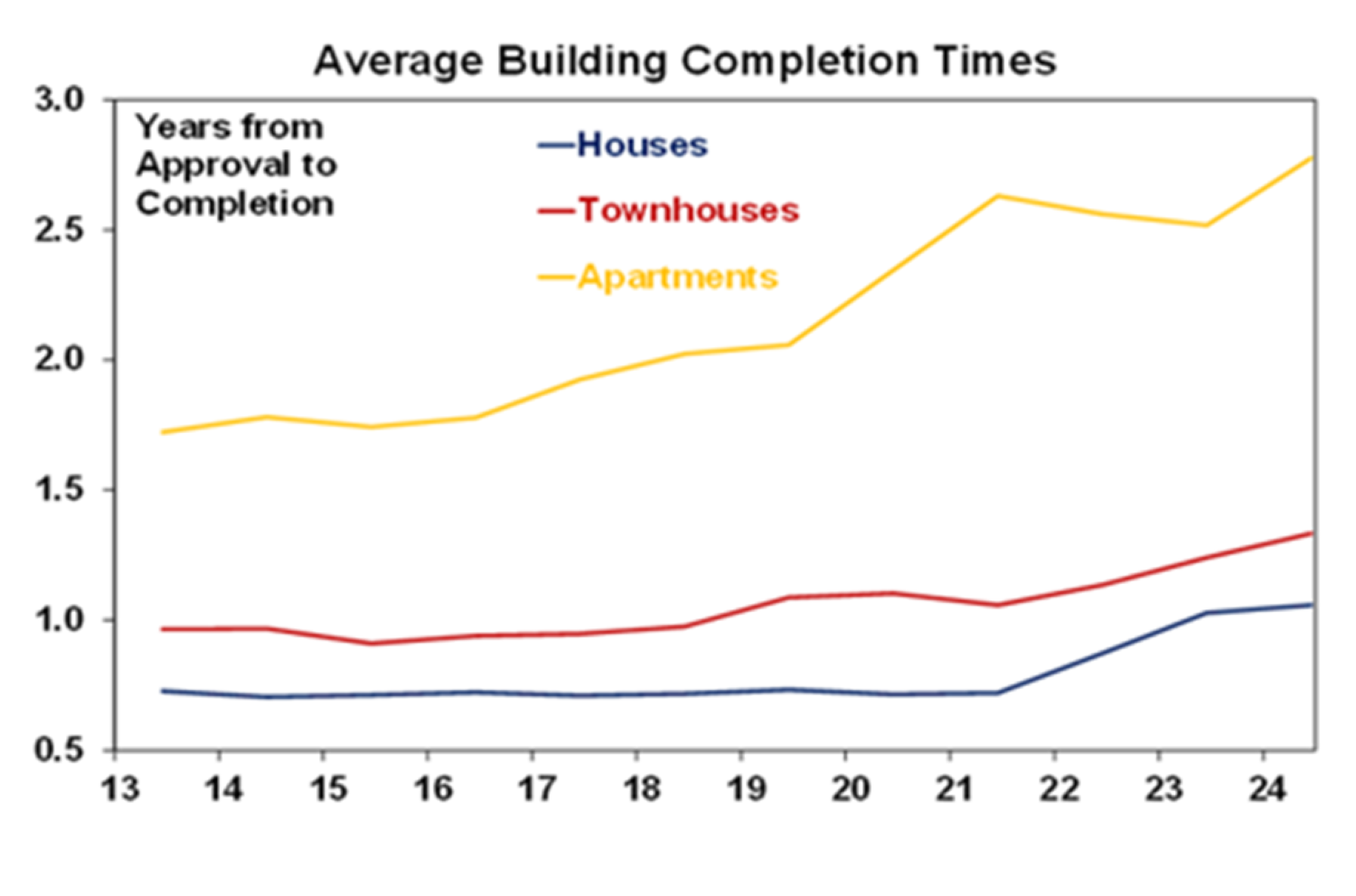

The rising trend in home building completion times doesn’t augur well for a quick resolution of the housing shortage.

Source: ABS, AMP

The Melbourne Institute’s Inflation Gauge for April showed a slight tick up for trimmed mean inflation but it’s still around 2%yoy pointing to more downside for the ABS’ quarterly trimmed mean which was 2.9%yoy in the March quarter.

Source: ABS, Melbourne Institute, AMP

What to watch over the week ahead?

The US CPI for April (Tuesday) is expected to show early impacts of the initial tariffs with the core CPI likely to rise 0.3%mom leaving it stable at 2.8%yoy. Retail sales are expected to be flat, industrial production is likely to rise slightly and home builder conditions are expected to remain subdued with regional manufacturing indexes remaining weak (all Thursday). Housing starts (Friday) are expected to bounce after a sharp fall in March.

Japanese March quarter GDP is expected to fall 0.1%qoq (Friday).

In Australia, the focus will be on confidence, wages growth and jobs. Consumer sentiment will be watched for a rise after a fall in April and business conditions and confidence in the NAB business survey are likely to remain subdued (Tuesday). March quarter wages growth are expected to show a 0.8%qoq rise seeing annual growth remain at 3.2%yoy and March quarter housing finance is expected to show a 3.5%qoq fall (Wednesday). Jobs data for April are expected to show a 25,000 gain with unemployment at 4.2%.

Outlook for investment markets

Shares are at high risk of further falls given the ongoing tariff uncertainties, increased recession risk particularly in the US and the risk of a US/Israeli strike on Iran’s nuclear capability if diplomacy doesn’t work. Even if the low has been seen volatility is likely to remain high. But with Trump likely to ultimately back down further on the tariffs (after declaring victory of course!) and pivot towards more market friendly policies like tax cuts and deregulation, and central banks, including the Fed and RBA, likely to cut rates further shares are likely to recover on a more sustained basis into year end. But it’s likely to be a rough ride.

Bonds are likely to provide returns around running yield or a bit more, as growth weakens, and central banks cut rates.

Unlisted commercial property returns are likely to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have likely started an upswing on the back of lower interest rates. But it’s likely to be modest with US tariff worries constraining buyers and posing a near term threat of a reversal in prices and affordability remaining poor. We see home prices rising around 3% this year.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted between the negative impact of US tariffs and the global trade war and the potential positive of a further fall in the overvalued US dollar. This could leave it weak around or just below $US0.60 in the near term. Undervaluation should support it on a medium-term view with fair value around $US0.73.

Source: AMP ‘Weekly Market Update’