Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 3rd September 2021

Investment markets and key developments over the past week

- Global share markets saw continuing gains over the past week helped by expectations that the Delta outbreak won’t lead to lockdowns in major developed countries and that the Fed would be gradual in scaling back monetary stimulus. Helped by the positive global lead and rapidly rising vaccination rates, the Australian share market also rose despite rising local coronavirus cases, with the gains led by energy, property, industrial and IT stocks. Bond yields fell in the US but rose elsewhere. Oil prices rose but copper and iron ore prices fell. The $A rose back above $US0.74 as the $US slipped.

- From their March 2020 lows US shares are up 14 of the last 17 months and Australian shares are up 16 of the last 17 months. But while shares keep powering on month after month, the risk of a short-term correction remains – with threats from coronavirus, the approach of Fed tapering, the US debt ceiling and tax hikes and supply constraints and as the next six weeks is often rough for shares. However, the likely continuation of the economic recovery beyond near term interruptions, vaccines ultimately allowing a more sustained reopening and still low interest rates with tight monetary policy a long way off augurs well for shares over the next 12 months.

- New global coronavirus cases started to decline in the last week. South America continues to trend down, Asia is of its highs and the US and Europe are showing signs of stabilising.

Source: ourworldindata.org, AMP Capital

- The really good news is that despite the increase in cases from mid year lows the UK, Europe and Canada have continued to see hospitalisations and deaths remain relatively low – indicating that vaccines continue to work in heading off serious illness. For example, the next chart shows deaths in the UK (the red line) are running well below the level predicted on the basis of the previous wave (dashed line).

Source: ourworldindata.org, AMP Capital

- Meanwhile, Israel’s less favourable experience highlights the need for booster shots. Israel was early to vaccinate but saw declining vaccine efficacy for those vaccinated early this year contribute to a surge in new cases. There is some evidence that efficacy against Delta infection declines faster for Pfizer than AstraZeneca and it may also reflect the shorter gap between Pfizer doses compared to AZ doses (both of which may have benefitted the UK). Israel is now rapidly rolling out booster shots (with 25% of the population boosted) – which may be helping to stabilise hospitalisations and deaths.

Source: ourworldindata.org, AMP Capital

- Early evidence from Israel indicates a 10-fold decline in the risk of infection for those with a booster compared to those with two doses. While there may be various differences, the Israeli experience warns that the US, UK, Canada and Europe need to rapidly ramp up booster shots ahead of winter. Australia will need to do the same by year end. Interestingly, some studies show Moderna’s vaccine provides even higher protection against infection & hospitalisation than Pfizer and AZ.

- The US is continuing to experience mostly a “pandemic of the unvaccinated” with the lowly vaccinated South faring the worst. However, there are some signs it may be slowing.

Source: ourworldindata.org, AMP Capital

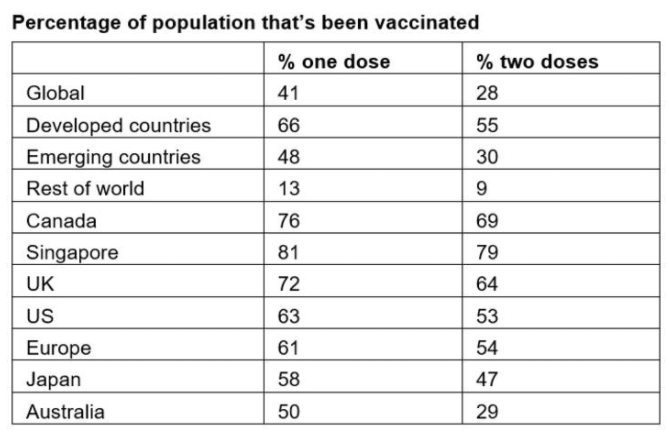

- Vaccination is continuing to ramp up globally. So far 41% of people globally and 66% in developed countries have now had at least one dose of vaccine.

Source: ourworldindata.org, AMP Capital

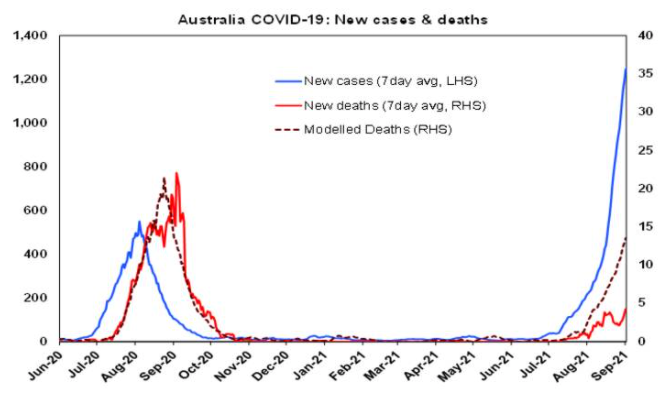

- Unfortunately, the bad news in Australia is that the number of new cases continues to surge in NSW and Victoria and there have been new covid scares in SA and Queensland.

Source: covid19data.com.au, AMP Capital

- The good news is that Australia now has around 50% of its whole population with one dose. The past week saw nearly 2 million people vaccinated with one jab. At this rate, we will reach the national goal of 70% of adults being fully vaccinated around mid-October and 80% of adults in November. Of course, this will still leave 44% & then 36% of the whole population respectively unvaccinated and at risk. And combined with the higher transmissibility of the Delta variant, the reality that vaccinated people are not fully protected against infection and the higher number of cases in NSW and Victoria it’s unclear as to how much we can safely reopen at these targets. This is reflected in the understandable position of some Premiers in “covid zero” states. It may mean that some states still keep their borders closed once the targets are hit, that the reopening is mainly for the unvaccinated for a while at least and that some people remain wary about getting out from “under the doona”. However, the attainment of even higher vaccination targets is not that further away. If we keep going at the current rate of vaccination, helped along by vaccine passports (no jab/no entry requirements) to get the vaccine hesitant over the line along with the vaccination of 12-15-year-old children, then we will reach 80% of the whole population being vaccinated in December.

- There is also good news in that despite the surge in cases in Australia, hospitalisations and deaths are more subdued in this wave. The next chart shows deaths (the red line) are running well below the level predicted on the basis of the previous wave (dashed line). Unfortunately, the rise in new cases points to a big rise in deaths in the weeks ahead, but so far at least deaths are running about 30% of the level suggested by last years’ experience. So, the relatively high vaccination rate for older people already appears to be helping.

Source: ourworldindata.org, covid19data.com.au, AMP Capital

- The Australian Economic Activity Tracker fell again over the last week reflecting the economic impact of the lockdowns. However, after its plunge since June views remain that it’s likely at or close to the bottom as NSW and Victoria have probably hit bottom – providing of course that other states don’t enter extended hard lockdowns too.

Source: AMP Capital

- Fortunately, June quarter GDP rose a stronger than expected 0.7% in Australia indicating that demand growth was still solid prior to the latest lockdowns even though stocks and trade detracted from growth. And of the course the rise avoids, for now, headlines of a double dip recession.

- However, the hit to the economy in this half year from the lockdowns is escalating. Based on the extension of the Melbourne lockdown to at least around 23rd September and the ACT lockdown by another two weeks the estimate of the cost of the hit to economic activity from the lockdowns since May has now blown out to $28bn which will mean a big decline in GDP this quarter. Expect September quarter GDP to fall by at least -4%. And a likely constrained initial reopening even when the vaccine targets are hit points to only a weak recovery in GDP in the December quarter. Added to this is the risk that other states may have lockdowns too. The bottom line is that growth through this year could now come in around zero, which is well below the RBA’s assessment for 4% growth.

- That said while the near-term outlook is bleak there is good reason to expect a strong rebound in growth through next year as vaccination rates ramp up, we learn to live with covid as vaccines help keep hospitalisations and deaths down, pent up demand is ultimately unleashed, Australia benefits from strong growth globally and monetary policy is easier for longer. As a result, we see 6.5% or so growth through next year.

- However, it is likely to continue to see the RBA deciding to delay its decision to slow its bond buying at its September meeting and to continue at the rate of $5bn into early next year. This is because the bigger hit to near term growth now means that even with a strong rebound in the economy through next year the profile for GDP and unemployment in 2022 will be significantly weaker than the RBA was assuming a month ago.

- The US Economic Activity Tracker rose over the past week as Delta fears receded a bit, but the European Tracker edged down slightly. The absence of lockdowns has headed off steep declines like what was seen in last year’s outbreaks.

Based on weekly data for eg job ads, restaurant bookings, confidence, mobility, credit & debt card transactions, retail foot traffic, hotel bookings. Source: AMP Capital

- On the fiscal policy front in the US, it’s looking increasingly clear that the Democrats plans for $US3.5trn in spending over eight years will be scaled back. To get Democrat Senators Manchin and Sinema (who both continue to say they won’t support $US3.5trn) on side and raise the debt ceiling its likely to be scaled back to maybe $US2trn, and with tax hikes (on high earners, corporates, capital gains and dividends) will mean net new spending of maybe $US1trn but that’s spread over 8 years. The process of trying to wrap this up in the next few months – and particularly raise the debt ceiling and the tax hikes – could cause some gyrations in shares.

Major global economic events and implications

- US data was mixed. The August ISM manufacturing condition index surprisingly rose to a very strong 59.9, albeit its down from its high a few months ago. Construction spending rose more than expected and home prices continue to surge. Jobs data was mixed with the ADP survey softer but jobless claims down. And consumer confidence fell. On the inflation front the prices paid component of the ISM survey fell but remains high.

- Eurozone unemployment fell in July as economic recovery resumed and inflation rose more than expected in August, albeit with core inflation only at 1.6%yoy (despite producer price inflation of 12.1%yoy). Partly in response hawkish ECB officials are talking of an ECB taper, although the ECB is likely to be even more patient than the Fed.

- Japanese industrial production fell back in June but by less than expected, consumer confidence fell less than expected and unemployment fell in July.

- Chinese business conditions PMIs fell in August mainly due to coronavirus restrictions weighing on services. Fortunately, with cases coming under control again restrictions are starting to be relaxed so some rebound is likely this month.

Australian economic events and implications

- Australian data was mostly strong – although given the lockdowns some of it is now a bit dated in some areas. As noted, GDP rose a stronger than expected 0.7% in the June quarter with strong growth in domestic demand – particularly for consumer spending and public demand – but detractions from trade and inventory and of course a big fall likely this quarter.

- Record current account and trade surpluses for the June quarter and June respectively are great news and indicate that Australia is not reliant on foreign capital. But the recent strength has been driven more by stronger export prices (notably for iron ore) rather than volumes and the 30% plunge in the iron ore price since July suggests that we have seen or come close to the peak in the current account and trade surpluses. That said the iron ore price still remains very high, so the surpluses are likely to remain at least for a while yet.

- Building approvals down, but housing finance and home prices up. While the ending of HomeBuilder and its pull forward of demand for new homes continues to weigh on building approvals which fell another 8.6% in July pointing to a fall in home building next year, housing finance edged up again in July as upgraders and investors offset weakness from first home buyers. The near record level of housing finance points to a likely further acceleration in housing credit growth and continued strength in home prices.

- Home price gains slowed a bit further in August according to CoreLogic but remained very strong at +1.5%mom and saw their strongest annual increase in more than 32 years. While worsening affordability and the lockdowns may have had some dampening impact on prices, monthly price growth remains stronger than was assumed before the lockdowns. Listings have generally slowed more than demand suggesting that housing market participants are generally feeling far more confident about the outlook than was the case through last year’s lockdowns. Expect capital city average home prices to rise 20% this year, with Sydney likely to be the strongest at 25% growth, before slowing to 7% growth next year.

Source: ABS, AMP Capital

What to watch over the next week?

- In the US, it will be a relatively quiet week on the data front with job openings (Wednesday) & producer prices (Friday).

- The ECB (Wednesday) may slow its bond buying a bit but is likely to remain dovish. While some hawkish Eurozone central bankers are arguing for a reduction in ECB bond buying as a result of the improving outlook, this may just see a slowing in its “significantly higher” pandemic bond buying back to the levels seen earlier this year before the spike in bond yields, but with the ECB otherwise likely to remain patient given issues around Delta, Chinese growth and the Fed’s taper.

- Chinese August data is expected to show a further slight moderation in export and import growth (Tuesday) and flat CPI inflation (Thursday) at 1%yoy but a slight fall in producer price inflation to 8.9%yoy. Credit data may also be released.

- In Australia, the RBA is expected to delay the tapering of its bond buying and continue it at the rate of $5bn a week until a review early next year. In fact, there is a case to increase bond buying. At its last meeting it indicated that it “would be prepared to act in response to further bad news on the health front should that lead to a more significant setback for the economic recovery”. Since then the extension and/or addition of lockdowns in NSW, Victoria and the ACT constitute a “significant setback” which mean that GDP growth this year could now come in around zero which is well down from the RBA’s 4%. And the initial part of the recovery is likely to be more subdued against a backdrop of high numbers of coronavirus cases. So, the level of economic activity will be far lower and the level of unemployment far higher through 2022 than the RBA was assuming a month ago. Delaying the taper and maybe even increasing bond buying to say $6bn a week may not result in a big boost to 2022 growth and the heavy lifting will have to come from fiscal policy, but it will help. It also won’t look so good for the RBA to be reducing stimulus by proceeding with the taper at a time when the economic outlook has deteriorated significantly.

- On the data front in Australia, expect a fall in ANZ job ads and further weakness in payroll jobs (Thursday).

Outlook for investment markets

- Shares remain vulnerable to a short-term correction with possible triggers being coronavirus, the inflation scare and US taper talk, likely US tax hikes and a debt ceiling standoff and geopolitical risks. But looking through the short-term noise, the combination of improving global growth and earnings helped by more fiscal stimulus, vaccines ultimately allowing a more sustained reopening and still low interest rates augurs well for shares over the next 12 months.

- Expect the rising trend in bond yields to resume as it becomes clear the global recovery is continuing resulting in capital losses and poor returns from bonds over the next 12 months.

- Unlisted commercial property may still see some weakness in retail and office returns but industrial is likely to be strong. Unlisted infrastructure is expected to see solid returns.

- Australian home prices look likely to rise by around 20% this year before slowing to around 7% next year, being boosted by ultra-low mortgage rates, economic recovery and FOMO, but expect a progressive slowing in the pace of gains as poor affordability impacts, government home buyer incentives are cut back, fixed mortgage rates rise, macro prudential tightening kicks in and immigration remains down relative to normal. The lockdowns have increased short term uncertainty though.

- Cash and bank deposits are likely to provide poor returns, given the ultra-low cash rate of 0.1%. The setback from coronavirus lockdowns could push the first rate hike back into 2024.

- Although the $A could pull back further in response to the latest coronavirus outbreaks, the threats posed to global and Australian growth and falling iron ore prices, a rising trend is likely over the next 12 months helped by strong commodity prices and a cyclical decline in the US dollar, probably taking the $A up to around $US0.80.

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer