Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 28th November 2014

Investment markets and key developments over the past week

- Shares had a positive week helped by mostly good economic data as the Chinese easing and expectations for more easing in Europe continued to impact. However, energy stocks were hammered as the global oil price plunged in response to a decision by the OPEC not to cut back production levels. US shares rose 0.7%, European shares gained 1.6%, Japanese shares rose 0.6% and Chinese shares surged 7.9%. Australian shares rose just 0.2% as falls in energy stocks limited gains. OPECs failure to reach agreement saw the oil price plunge below $US70/barrel, its lowest since 2010. The plunging oil price also pushed bond yields sharply lower as it depresses inflation. Most commodity prices fell, with the iron ore price falling below $70/tonne and this along with another Reserve Bank of Australia (RBA) comment that the Australian dollar is too high saw the Australian dollar fall further.

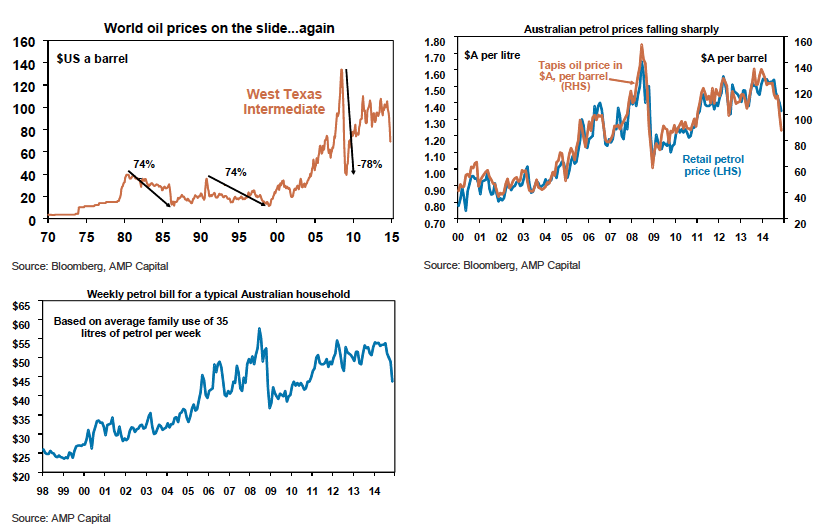

- How far the oil price will fall is anyones guess (just as its rise last decade was), but history tells us that it can fall considerably more than might be expected until supply is finally cut back. In the 1980s and 1990s the oil price fell more than 70% before the bottom was hit (chart at left below). More recently oil prices plunged 78% though the global financial crisis, but the fall was short lived and supply in recent years has expanded not fallen as a result of the US shale oil revolution. So a fall back to around $US40/barrel is not out of the question.

- The 37% plunge in the global oil price since June is bad for energy producing companies and countries but, since its mainly due to excess supply as opposed to weak demand, its a huge positive for the global economy generally. Rough estimates suggest a boost to growth in industrialised countries and in Australia of around 0.3-0.4% if the fall is sustained. It will also bear down on inflation, which in turn will mean more pressure on China, Japan and Europe to ease further and a further delay in the timing of the first US Federal Reserve rate hike and likewise for the RBA. For Australian households, the plunge in the global oil price adjusted for moves in the Australian dollar indicates that petrol prices have further to fall to around $A1.25/litre (chart at right below). This will translate to roughly a $10 a week saving for the average family petrol bill since June (chart below).

- Guarding against ‘chronic pessimism’. A few years ago we thought the RBA was being a bit complacent with regard to Australia’s economic outlook in describing the glass as half full. At the time the benefits to the broader economy from the mining boom were being overstated and interest rates were too high at a time when the high Australian dollar was causing much pain. Advance forward to now and we agree with RBA Deputy Governor Phil Lowe’s comment that we need to guard against “chronic pessimism”. Sure the mining investment boom is deflating rapidly, but this has allowed interest rates to fall to more appropriate levels and the Australian dollar to fall, all of which is allowing those sectors of the economy that were in virtual recession a few years ago – home construction, retailing, manufacturing, tourism, higher education, etc – to start to recover. This return to more balanced growth is to be welcomed. While the easy days of last decade prior to the global financial crisis are long gone as evident in the Budget woes in Canberra, the Australian economy is not set for dog days or in the ‘danger zone’.

Major global economic events and implications

- US data was a mixed bag but remains consistent with solid but hardly booming growth. September quarter GDP was surprisingly revised up to a 3.9% pace from 3.5% but this was mainly due to a greater contribution from inventories. Meanwhile, personal spending was softer than expected in October, but consumer confidence remains around seven year highs and indications are positive for Christmas holiday spending. Durable goods orders were weaker than expected, but still point to a gradual improvement in business investment. Housing data was mixed with house prices rising moderately, new home sales up, but pending sales down. While the private consumption deflator rose 1.6% over the year to October which was a bit more than expected it is likely to soften as lower commodity prices feed through.

- European data was a bit better than expected with greater economic sentiment & signs growth in lending is improving. However, inflation remained very low at just 0.3% in November and is set to fall further in the months ahead, highlighting the need for aggressive European Central Bank (ECB) quantitative easing.

- Japanese data also bettered expectations for jobs, unemployment, household spending & industrial production.

Australian economic events and implications

- Australian data provided some positive surprises. While September quarter construction activity fell pretty much as expected, plant and equipment investment surprisingly rose and capital expenditure (capex) intentions for 2014-15 implied a slightly less negative outlook than was the case three months ago. In particular while investment in mining and manufacturing is continuing to decline, investment in other selected industries has been growing for three quarters in a row and capex intentions point to further growth ahead. In other words, business investment overall is not collapsing as many had feared and there is clear evidence that a rebalancing from mining investment to non-mining investment is underway. This is good news for continuing growth in the economy. New home sales picked up in October and are continuing to run at a solid level consistent with ongoing strength in dwelling investment, despite a temporary setback in the September quarter. Finally, credit growth is continuing to perk up, but lending to housing investors arguably remains too strong for RBA comfort.

What to watch over the next week?

- In the US, expect continued solid readings for the ISM manufacturing conditions index (Monday) and non-manufacturing conditions index (Wednesday), although the former might fall a bit from the very high reading seen in October, and another solid gain in November payrolls (Friday) of around 230,000 with unemployment unchanged at 5.8%. Signs that the stronger jobs market is feeding through to stronger wages growth will also be looked for in wage earnings data to be released Friday.

- In Europe, all eyes will be on the European Central Bank meeting (Thursday), where there is some chance that its QE asset purchase program will be widened to include corporate bonds. Recent comments from President Draghi suggest this is likely but the timing of the announcement is unclear because the ECB may prefer to wait to see how its next Targeted Long Term Refinancing Operation (TLTRO) auction of cheap bank financing goes on December 11. Either way its just a matter of timing. Final Purchasing Managers Index (PMI) readings for December (due Monday and Wednesday) will be watched for any signs of upwards revision after the soft readings initially reported.

- China’s official manufacturing PMI for November is likely to soften a bit consistent with the softer HSBC flash PMI already reported. Note though its just gyrating up and down in the same range its been in for a few years now.

- In Australia, the Reserve Bank (Tuesday) is likely to yet again leave interest rates on hold at 2.5%. Speeches by various RBA officials including Governor Stevens since the last meeting indicate a high degree of comfort with rates remaining at current low levels as the Australian dollar is still too high, growth remains sub-par and inflation benign. The accompanying statement is likely to repeat that a “period of stability” remains prudent for interest rates. This will mark the 17th month of rates at 2.5%, which is still less than the previous record of 20 months when rates were flat at 7.5% between December 1994 and July 1996, However, the record is likely to be surpassed early next year.

On the data front, the highlight is likely to be September quarter GDP growth (Wednesday) which is likely to show that growth remains just below trend at 0.7% quarter on quarter (or 3.1% year on year) supported by solid contributions from consumer spending and trade but weak readings for construction activity. Meanwhile, expect modest gains to be reported in November house prices (Monday), a bounce back in building approvals for October (Tuesday), a weak gain in October retail sales (Thursday) and another sizeable trade deficit (Thursday).

Outlook for markets

- Equities are well placed to see gains into year end and through next year as the cyclical bull market that started in 2011 remains alive and well. November and December are both seasonally strong months for US and global shares as we run into the Santa rally, and seasonal strength in Australian equities usually commences in December. More fundamentally: valuations particularly against the reality of low bond yields are good; monetary policy is set to remain easy with quantitative easing (QE) in Europe and Japan and rate cuts in China replacing QE in the US, and rate hikes in the US and Australia being a long way off; and investor sentiment is far from euphoric. Australian equities are likely to remain a relative laggard though as commodity price weakness continues to impact, but the positive global lead, Chinese monetary easing and the lower Australian dollar should help push Australian equities up into year end and through next year.

- Low bond yields will likely mean soft medium term returns from government bonds. That said, in a world of too much saving, spare capacity and low inflation its hard to get too bearish on bonds.

- The Australian dollar is likely to head even lower over the year ahead with the US dollar trending up, weak commodity prices and the Australian dollar still too high given Australias high cost base. $US0.75-0.80 is likely to be seen in the next year or so. A relatively greater fall in the Australian/US exchange rate is necessary as the Australian dollar is unlikely to fall much against the Yen and Euro given their monetary stimulus programs.

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer