Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 20th January 2023

Investment markets and key developments

After rising solidly in the first two weeks of the year, US and European share markets pulled back over the last week on the back of recession and earnings worries and hawkish ECB comments. Falls were curtailed by a strong rally on Friday though helped by more optimistic Fed comments with US shares ending down 0.7% for the week and Eurozone shares down 0.5%. Japanese shares rose 1.7% though and Chinese shares rose 2.6%. And the Australian share market rose 1.7%, its third weekly gain in a row, to be just 2.3% below its all-time high. Bond yields were little changed in the US and Europe but fell further in Japan and Australia. Oil and metal prices rose but iron ore prices fell slightly. The $A rose slightly, briefly rising above $US0.70, with the $US down slightly.

The news flow has been somewhat better so far this year. Last year ended poorly for investors not helped by hawkish commentary and moves from central banks in December – notably the Fed, ECB and Bank of Japan – and uncertainty about China’s reopening. But the news flow so far this year has been somewhat more positive with:

- inflationary pressures continuing to show signs of receding with further falls in US and European inflation rates in December and business survey price indicators pointing down;

- resilient economic data in Europe;

- signs that the surge in cases in China may have peaked with optimism about Chinese growth this year leading to some lessening in global recession risks;

- a continuing decline in the $US which takes pressure off Asian and emerging countries;

- a somewhat less hawkish tone from most Fed speakers with more talking of downshifting further to 0.25% hikes and Fed Vice-Chair Brainard and Governor Waller leaning incrementally dovish and a bit more optimistic on the outlook; and

- the tensions with China appear to be easing a bit – with eg signs of an easing in China’s trade restrictions on Australian products.

Our Pipeline Inflation Indicator continues to point to a further sharp fall in US inflation in the months ahead. And with US inflation leading other countries’, including Australia’s, inflation rates on the way up its decline points to a fall in Australia and elsewhere too. Views that US inflation will slow faster than the Fed is expecting, so see the Fed Fund’s rate topping out earlier (probably in March) and lower than its “dot plot” is indicating.

Source: Bloomberg, AMP

US recession risk is high, but if there is one it’s likely to be mild. Weak US business surveys, leading indicators, retail sales and industrial production along with the inverted yield curve indicate that the risk of a US recession remains high, posing a threat to earnings and hence share markets. With the Fed getting closer to easing up on the brakes though and an absence of major imbalances beyond inflation, any recession should be mild.

Source: Bloomberg, AMP

A better outlook for markets, albeit with lots of bumps along the way. A re-test of 2022 share market lows remains a risk on the back of recession and earnings worries and maybe US debt ceiling brinkmanship around mid-year, but the combination of falling inflation, central banks becoming less hawkish and global growth holding up better than feared is expected to result in stronger share markets this year and some further decline in bond yields. This is likely to favour non-US shares, including the Australian share market, over US shares.

Australian economic data so far this year has been mixed with weak housing data, still poor consumer confidence and some signs of a slowing in the jobs market but strong retail sales and still high inflation, albeit monthly inflation data has not been as high as feared. Views that the RBA has done enough rate hikes to bring inflation back to target and that it should and will pause in February to avoid the risk of unnecessarily tipping the economy into recession. The monthly jobs and inflation data (pointing to December quarter inflation coming in below RBA expectations) are consistent with the RBA pausing. But the strength of retail sales as indicated by the ABS for November and from corporate reports suggests a still high risk of another 0.25% hike in February. Interestingly, the futures market has only priced in a 60% probability of a 0.25% hike in February and now sees the cash rate peaking at just over 3.5% compared to 4% at the start of the year. Of course, there is more inflation data to come in the week ahead and December retail sales data the week after, all before the next RBA meeting.

Coronavirus update

New global Covid cases have fallen over the last few weeks, and deaths which had been rising in lagged response to the rise in cases look to be rolling over too. Note that this should be seen as the world ex China given the latter’s erratic data releases lately. New case data in most countries has also become less reliable (with reduced reporting), but death data is still reliable.

Source: ourworldindata.org, AMP

China saw a sharp spike in new cases, hospitalisations and deaths following reopening in December but the initial wave now appears to have peaked, albeit there could be another (probably smaller) wave as city dwellers travel back to their families in regional areas with the China New Year. After the initial disruption to economic activity flowing from the surge in cases (which is likely to have been far less disruptive than continuing with zero Covid and lockdowns) Chinese growth is likely to rebound, particularly from the June quarter.

New cases and hospitalisations in Australia appear to have slowed. While the new case data is less reliable now (with many not reporting and harder access to PCR tests), the rollover in hospitalisations is a positive sign. Deaths appear to be starting to rollover too.

Source: covidlive.com.au, AMP

Economic activity trackers

Our Economic Activity Trackers have fallen back after holiday period spikes in hotel and restaurant bookings drove them higher.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

US economic data releases over the last week were mostly weak. Industrial production fell slightly in December, manufacturing conditions rose in the Philadelphia region but remain weak and they fell sharply in the New York region and retail sales fell another 1.1% after falling 1% in November. NAHB home builder conditions rose slightly but remain very weak and housing starts & existing home sales fell further. Initial jobless claims fell but continuing claims rose suggesting it’s taking longer for laid off workers to find jobs and anecdotes of job layoffs continue to build. Easing inflation pressures were evident in a further fall in capacity utilisation, further falls in most price pressure indicators in business surveys and another fall in producer price inflation to 5.5%yoy.

The US December quarter earnings reporting season is now underway. Consensus earnings expectations are for a 2.5% fall in earnings on a year ago. So far only 69% of results have come in better than expected which is well below the norm of 76%, but only 11% of US S&P 500 companies have reported so far. And the average beat is running around 4% so earnings growth for the quarter could end up being around flat.

UK CPI inflation fell slightly to 10.5%yoy, with core unchanged at 6.3%yoy. Both remain high but look to have peaked.

The minutes from the last ECB meeting and comments by President Lagarde were hawkish, although it should be noted that the ECB was late to the tightening cycle compared to the US.

The Bank of Japan left monetary policy on hold. This was in line with economists’ expectations but surprised many investors who thought that it might further expand the range around its 10 year bond yield target. Inflation above target will keep the market speculating on further tightening steps – but the BoJ is right to be cautious and slow to adjust: US inflation is already slowing; slower global growth will reduce inflation pressures; while Japanese inflation at 4%yoy is now well above the 2% target, core inflation (measured as inflation ex energy and food) at 1.6% is still below target; and the BoJ does not expect inflation to stay above target from next year. Nevertheless, the likelihood of some tightening when a new BoJ Governor takes over in April is high and this could involve abandoning yield curve control. This in turn points to a strong Yen this year and underperforming Japanese share and bond markets.

China’s economy hit by Covid in the December quarter, but by less than expected and on track for a growth rebound this year. Due to lockdowns then a surge in Covid cases, GDP growth was zero with annual growth slowing to 2.9%yoy, and industrial production, retail sales and property investment were weak – albeit not as weak as feared (particularly retail sales) – with property prices continuing to fall. Another Covid wave associated with Lunar New Year travel may lead to a rough March quarter, but with virtually all Covid restrictions now abolished, reopening and stimulus measures are likely to sharply boost growth this year to around 6%.

Source: Bloomberg, AMP

China’s population is now falling and below that of India. 2022 saw China’s population fall for the first time since 1961 as births have steadily fallen in recent years despite the removal of the “one child policy”. The stalling working age population and its likely decline ahead means that potential growth in China has probably stepped down from around 10% or so in the 2000s to around 4-5% now with this assuming that productivity growth remains reasonably strong (which it should do given that per capita GDP is still reasonably low by developed country standards, but will be questionable if Government involvement in the economy continues to increase reducing dynamism). Interestingly, India’s population (1.417bn) has now likely surpassed that of China (1.412bn) and its economic growth rate has been surpassing China’s lately.

Source: China National Bureau of Statistics, AMP

The slowdown in China’s potential growth is not as big a negative for Australia as some may fear as: 1/ the slowdown in growth has already been occurring over the last decade with no major damage to Australian growth; 2/ China’s economy is far bigger than in the 2000s so 4-5% growth now is equivalent to 10% back then in terms of commodity demand; and 3/ just as China surpassed Japan as our biggest export market in the last few decades, India may eventually do the same with China.

Australian economic events and implications

Australian jobs data was weaker than expected in December. Employment fell by 15,000, unemployment was unchanged at 3.5% (with November being revised up) and underemployment rose to 6.1%. The jobs market is still very tight but it’s showing signs of softening at the margin: unemployment and underemployment are looking like they have bottomed; job vacancies look to have rolled over with ABS job vacancies down for two quarters in a row and SEEK’s new job ad index well down from its highs; and the rapid return of foreign workers will help bring down job vacancies and ease labour market pressure.

Source: ABS, AMP

As a result, while the “Jobs Gap” (ie labour demand less labour supply as a percentage of labour supply) is still tight, it looks to be rolling over. And it should always be remembered that the jobs market is a lagging indicator and will be the last to turn down in a slowdown.

Source: ABS, AMP

Consumer confidence rose in January but remains very weak.

Source: ABS, AMP

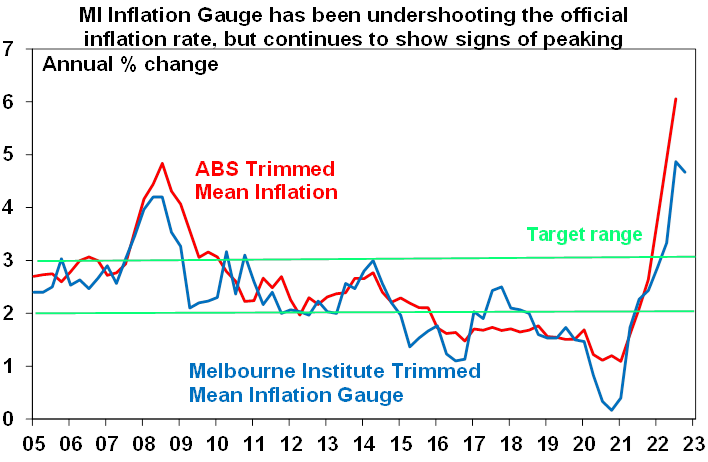

The Melbourne Institute’s Inflation Gauge for December rose a relatively weak 0.2%mom at both a headline and trimmed mean level. It’s been undershooting the official inflation rate for a while now but like the ABS’ monthly Inflation Indicator is showing signs of peaking and suggests that December quarter inflation as measured by the ABS will come in below the RBA’s expectation for a 2%qoq or 8%yoy rise.

Source: Melbourne Institute, AMP

What to watch over the next week?

In the US, December quarter GDP (Thursday) is expected to show GDP growth of around 2.6% annualised, after 3.2% growth in the September quarter and core private consumption deflator inflation for December (Friday) is expected to fall further to 4.4%yoy. Business conditions PMIs for January (Tuesday) are likely to remain weak, underlying durable goods orders (Thursday) are likely to fall and home sales data are likely to remain weak. The December quarter earnings reporting season will start to ramp up with the consensus expecting earnings to be down 2.5% compared to a year ago. Earnings growth is likely to have remained strong for energy and industrial stocks but negative for consumer discretionary, tech and telcos.

Eurozone and Japanese business conditions PMIs for January will also be released on Tuesday.

In Australia, the focus is likely to be on December quarter inflation data (Wednesday) which is expected to show a rise of 1.6%qoq taking annual inflation to 7.5%yoy, with trimmed mean inflation rising 1.5%qoq or 6.5%yoy. The main driver of the further rise in inflation is likely to be a sharp increase in utility prices as various state subsidies expire. Rents and dwelling costs will also show further solid rises. This will be highest rate of inflation since 1990, but the good news is that monthly inflation data for October and November has come in a bit weaker than expected suggesting that inflation may not have reached the 8%yoy level forecast by the RBA. With improving supply, falling international freight costs and slowing demand this is likely to be the peak in inflation and expect inflation to fall below 4%yoy by year end. In other data, the NAB business confidence index for December and the business conditions PMI for January (both Tuesday) are likely to remain soft, and producer price inflation data will be released Friday.

Outlook for investment markets

2023 is likely to see easing inflation pressures, central banks moving to get off the brakes and economic growth weakening but proving stronger than feared. This along with improved valuations should make for better returns in 2023. But there are likely to be bumps on the way – particularly regarding recession risks and raising the US debt ceiling around mid year – & this could involve a retest of 2022 lows or new lows in shares before the upswing resumes.

Global shares are expected to return around 7%. The post mid-term election year normally results in above average gains in US shares, but US shares are likely to remain a relative underperformer compared to non-US shares reflecting still higher price to earnings multiples (17.5 times forward earnings in the US versus 12 times forward earnings for non-US shares). The $US is also likely to weaken which should benefit emerging and Asian shares.

Australian shares are likely to outperform again, helped by stronger economic growth than in other developed countries and ultimately stronger growth in China supporting commodity prices and as investors continue to like the grossed-up dividend yield of around 5.5%. Expect the ASX 200 to end 2023 at around 7,600.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows and central banks become less hawkish.

Unlisted commercial property and infrastructure are expected to see slower returns, reflecting the lagged impact of weaker share markets and higher bond yields (on valuations).

Australian home prices are likely to fall another 9% or so as rate hikes continue to impact, resulting in a top to bottom fall of 15-20%, but with prices expected to bottom around the September quarter, ahead of gains late in the year as the RBA moves toward rate cuts.

Cash and bank deposits are expected to provide returns of around 3%, reflecting the back up in interest rates through 2022.

A rising trend in the $A is likely over the next 12 months, reflecting a downtrend in the now overvalued $US, the Fed moving to cut rates and solid commodity prices helped by stronger Chinese growth.

Source: AMP ‘Weekly Market Update’