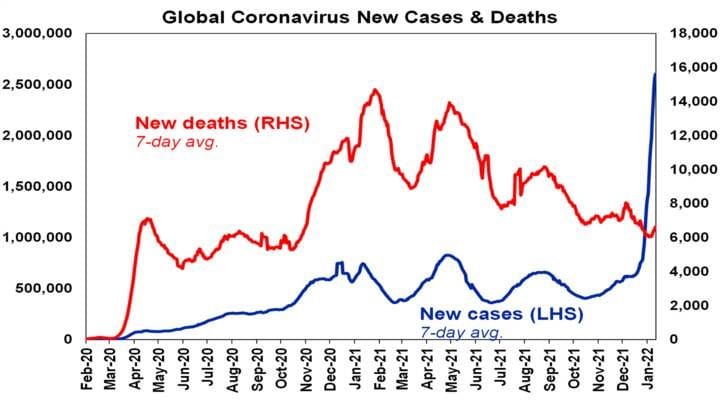

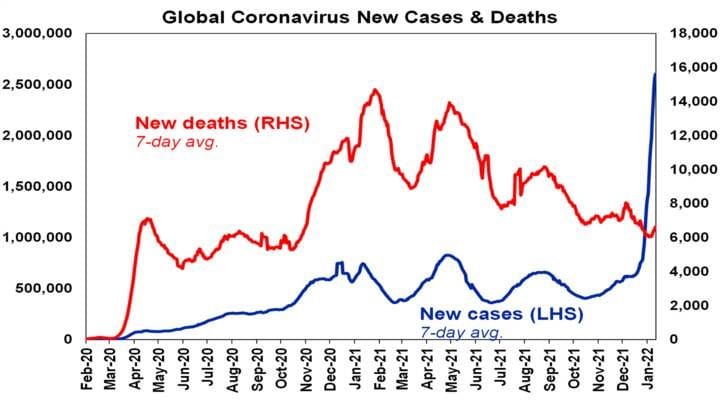

- The Omicron variant, which has come to dominate globally, has seen global coronavirus cases surge, led in particular by Europe and the US. Australia has been no exception. The bad news – which was all known in mid-December before the global surge occurred – is that it’s far more transmissible than Delta and results in prior coronavirus infection and vaccines providing much less protection against infection.

Source: ourworldindata.org, AMP

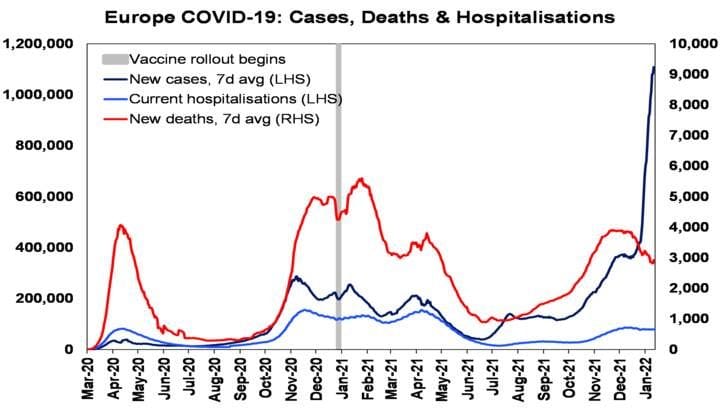

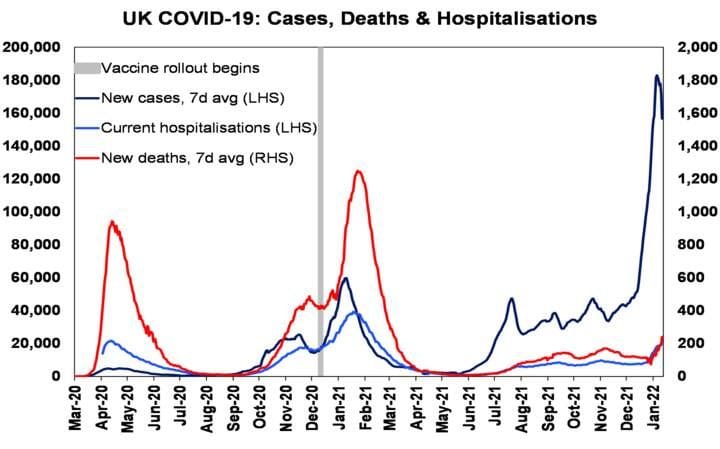

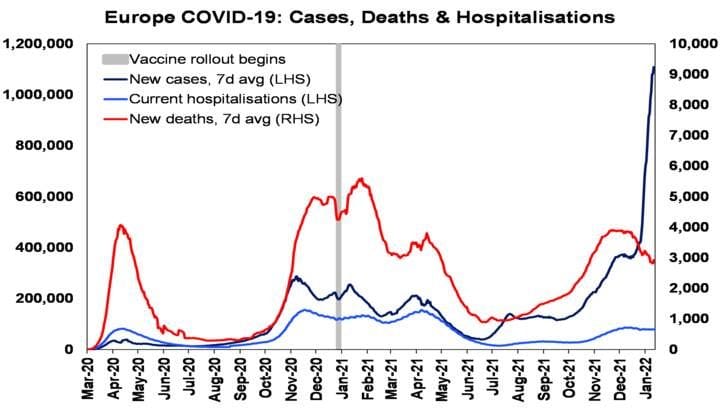

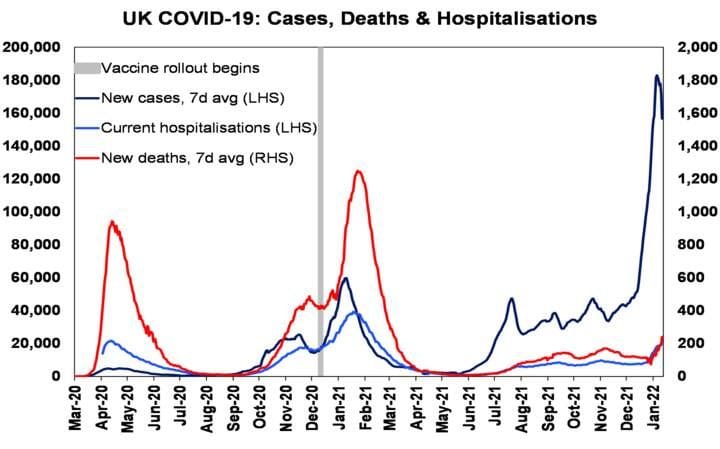

- The good news is that it’s far less harmful than Delta (maybe up to 20% less so), a booster shot from a mRNA vaccine (Pfizer or Moderna) appears to offer significant protection from infection and against severe disease and hospitalisation and new tweaked vaccines are on the way. That it is less harmful is evident in deaths and hospitalisations remaining far more subdued through this wave, even once lags are allowed for. This is evident in the chart above for deaths globally, but it’s also evident in Europe, the UK, the US, Canada and Israel. See the next charts for Europe and the UK – but they all show a similar pattern.

Source: ourworldindata.org, AMP

Source: ourworldindata.org, AMP

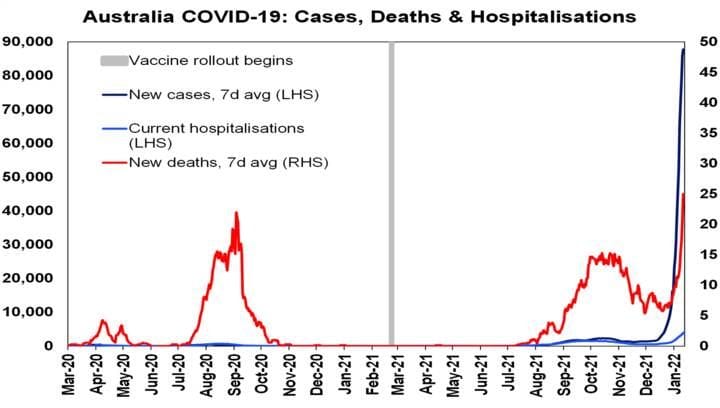

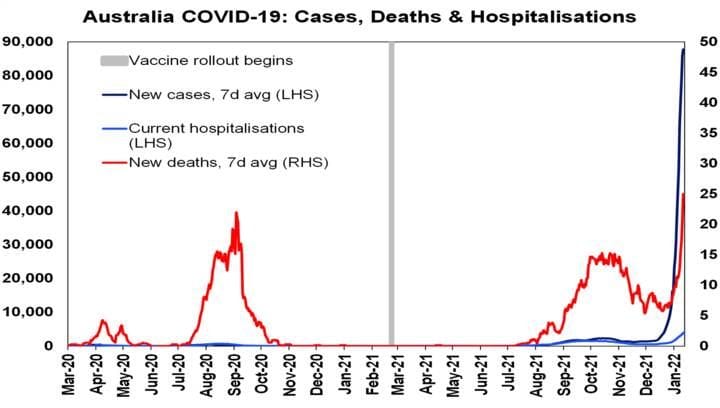

- In Australia, the greater transmissibility of Delta combined with the further removal of restrictions from November not helped by the relatively low level of prior exposure and booster shots have seen cases explode relative to the levels seen through the Delta wave. (And given problems with testing, the case data is probably massively understated.) The good news is that, as has been the case globally, Omicron is proving less harmful and so hospitalisations and deaths remain subdued relative to the surge in cases compared to previous waves. See the next chart. Data from NSW Health – albeit only up to late December shows – that whereas 4% of Delta cases ended up in hospital around 1% of confirmed and probable Omicron cases do so. And while new deaths are at record levels they are running around 13% of the level suggested by the 2020 wave reflecting protection from vaccines and Omicron being less harmful. (Its similar in the UK.)

Source: ourworldindata.org, AMP

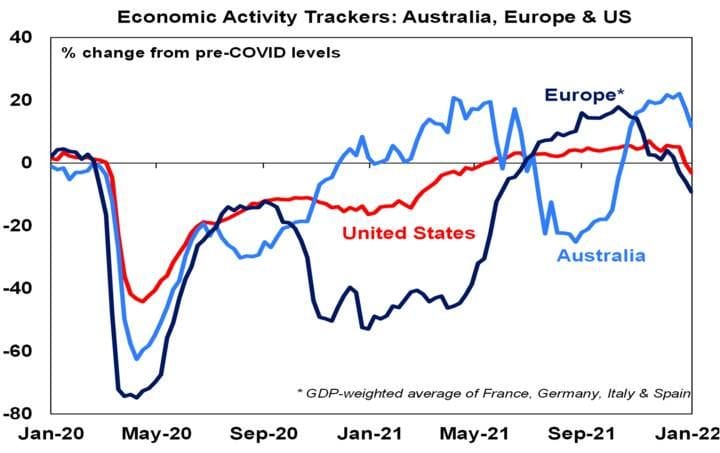

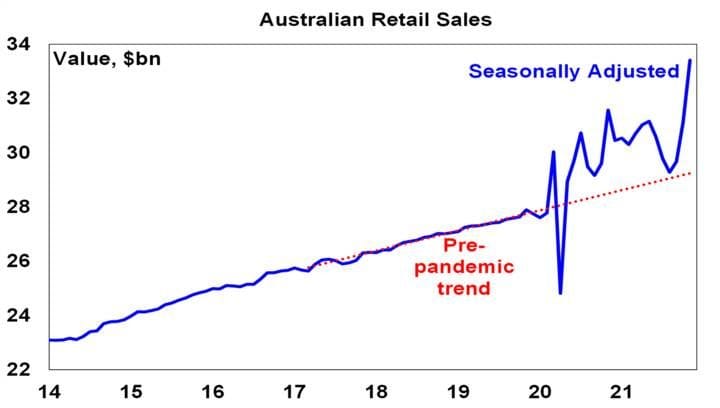

- The problem of course is that the explosion in cases is still leading to a surge in hospital cases (even though a lower proportion are getting seriously ill) leading to significant stress in the health care system. This along with the sheer number of people having to isolate is impacting both demand and supply in the economy and hence a hit to economic activity without having a formal lockdown. All of which highlights the case to have at least tried to slow down the spread with mild restrictions back in December rather than continue removing restrictions which were having little economic impact and which was feared for NSW was like playing Russian Roulette with the economic recovery. At this stage the March quarter GDP growth forecast has been revised to 0.6% from 1.6%, but this is a guesstimate and while there’s confidence in a strong post Omicron rebound in the economy resulting in growth of 4% or so through the year the risk is high that the March quarter sees GDP go backwards again given the extent of supply disruptions.

- Beyond the near-term uncertainties there are two other positives. New Omicron cases may have peaked in South Africa, the UK (see chart above), Canada and New York – of course we have less natural immunity but it could be a pointer to a peak in Omicron cases in Australia sometime in the next month or so. Secondly there remains good reason to believe that this could be the worst of yet: if Omicron with its lower virulence but greater transmissibility comes to dominate the other variants then it along with increasing levels of natural immunity, protection from vaccines and new covid treatments could put Covid-19 on to a path to becoming endemic like the common cold or flu.

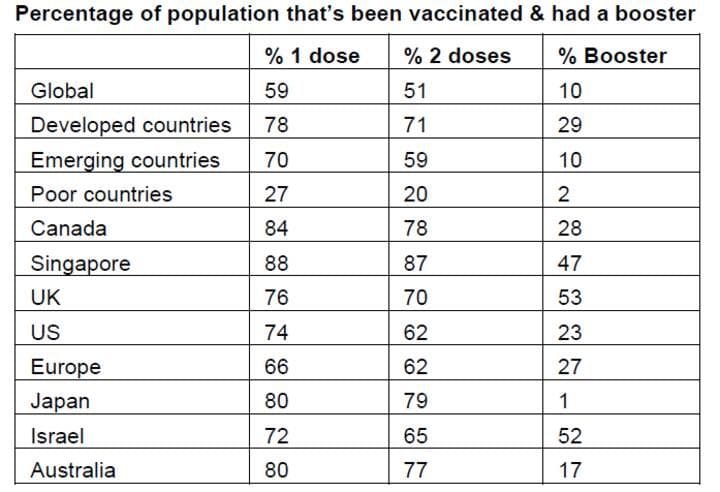

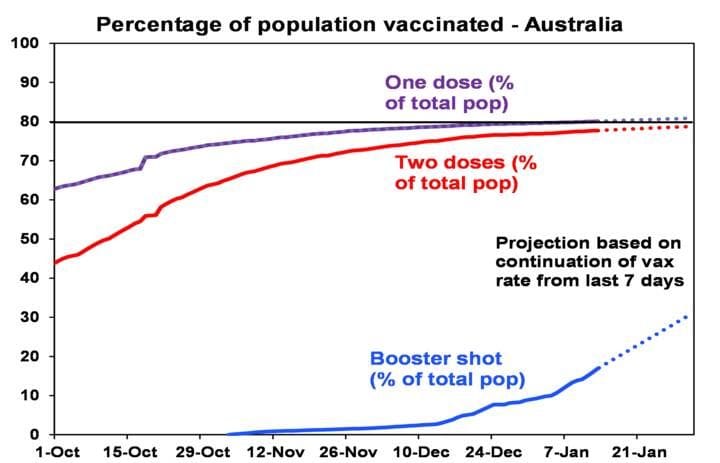

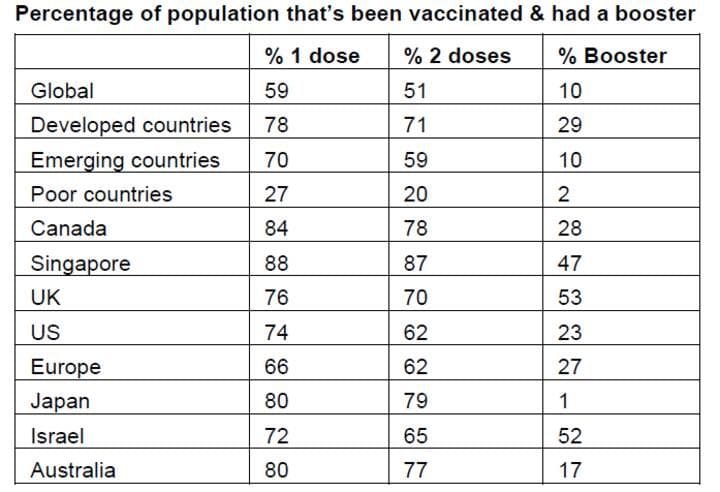

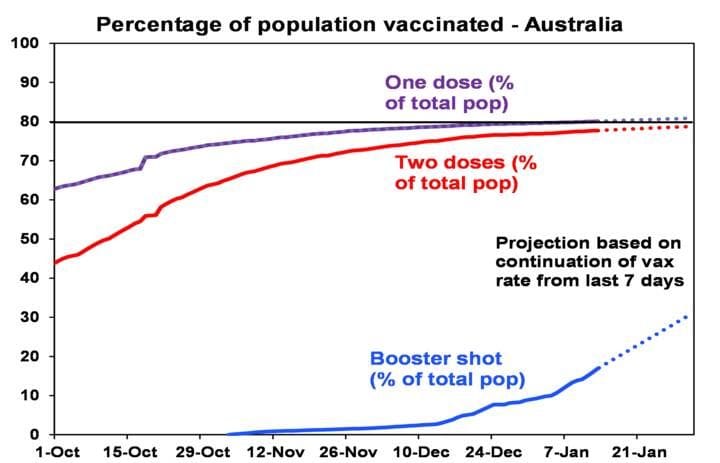

- On the vaccine front 51% of the global population have had two vaccine doses, with only 10% having had a booster shot. The risk is in poor countries where only 20% have had two doses and just 2% have had a booster. It’s in the rich world’s interest to help vaccinate poor countries to reduce the risk of more mutations. Australia at 77% double vaccinated is at the high end of developed countries. Only 17% have had a booster shot but it’s now rising rapidly.

Source: ourworldindata.org, AMP

Source: covid19data.com.au, AMP

|