Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

The Story: Federal Budget 2014/15

In this edition of The Story we summarise Joe Hockey’s 2014 Budget.

We are currently reviewing and assessing the implications, risks and opportunities of this budget and in the following days will bring you our conclusion in The Verdict.

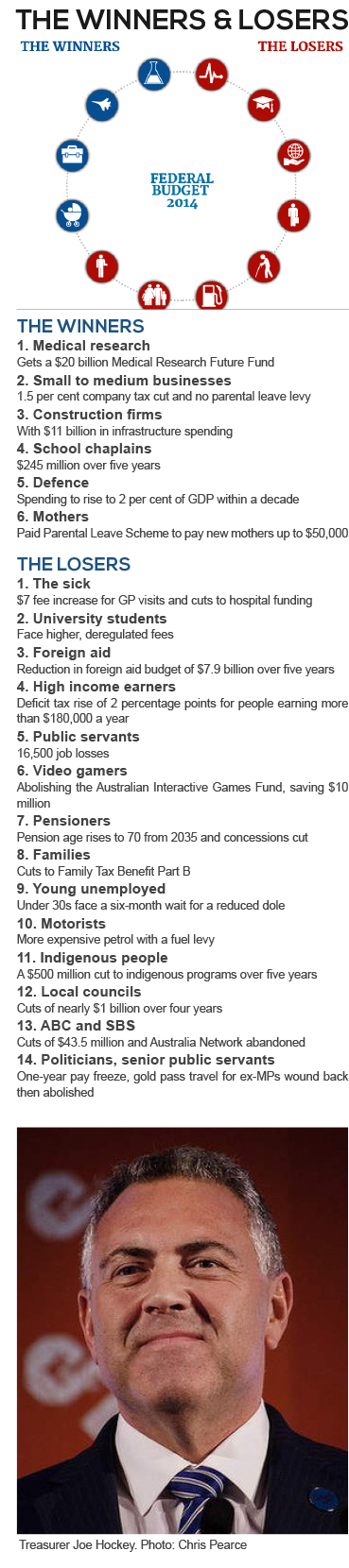

Overnight treasurer Joe Hockey delivered his first budget, vowing to end the age of entitlement

“ prosperity is not a gift it has to be earned, so now it is our turn to contribute, now it is our turn to build”

his debut budget predicts a tapering defecit, just under $30 billion this year to just under $3 billion in 2017/18 and as warned, getting there will hurt.

In Health

- From July 1 2015, patients will pay $7 to visit the GP. The money saved will go into the creation of a medical research future fund with a forecasted worth of $20 billion by 2020.

- Medicines (prescription drugs) will cost us $5 more.

- Spending on hospitals will be cut by $2 billion dollars.

In Education

- Deregulation will allow universities to set their own fees from 2015.

There will be government support for diplomas courses.

From 2016 university loans will have to be paid back from a lower salary ($50,638), saving 3.2 billion dollars.

For families

- Indexation of Family Tax Benefits (FTB) payment rates will be frozen for two years until 1 July 2016. This will affect the maximum and base rates of FTB Part A and FTB Part B.

- The end of year supplement for both FTB Part A and Part B will decrease. Indexation of these supplements will also cease from 1 July 2015.

- Currently, families do not receive a reduction below the base rate of FTB Part A until annual family income reaches $94,316 plus $3,796 per child. From 1 July 2015 the $3,796 per child add-on to the allowed income will cease.

- Currently, FTB Part A families receive a large family supplement which is payable for their third and each subsequent child. From 1 July 2015, this payment will apply for the fourth and subsequent children in a family.

- The current primary income earner limit of $150,000 pa will reduce to $100,000 pa. From July 1, 2015 FTB Part B will also cease to be paid to families once their youngest child reaches six years of age.

- The indexation of the fuel exise will start in August, with the money raised put back into roads.

For older Australians

- The pension age will increase to 70 years by 2035 and payments to the pension will be linked to inflation.

- Untaxed superannuation will be included in the income test for the Commonwealth Seniors Health Card (CSHC). All superannuation account-based income streams held by CSHS holders as of January 1, 2015 will be grandfathered and any income/lump sums from these income streams will not be assessed.

- For holders of the CSHC, the Seniors Supplementwill be removed.

- From 20th September, 2017 the deeming thresholds for means tested payments will be reset to $30,000 for singles and $50,000 for couples (both pensioners and allowees).

In Welfare

- Disability support will be tied to inflation.

- Under 35’s will have their payments reviewed.

- Under 25’s will receive a lower dole payment.

- Under 30’s will not be eligible for the dole for the first 6 months of unemployment.

- From January 1, 2015 the minimum age to qualify for Newstart Allowance and Sickness Allowance will increase to 25 years for new applicants.

- From September 1, 2017, certain social security payments will be indexed by the CPI. These include; bereavement allowance, age pension, disability support pension, carer payment, some Department of Veterans’ Affairs pensions.

In Superannuation

- From July 1, 2014 the schedule for increasing the Superannuation Guarantee (SG) rate will change. This will increase from 9.25% to 9.5% from 1 July 2014 as currently legislated. The rate will remain at 9.5% until 30 June 2018 and then increase by 0.5% each year until it reaches 12% in 2022-23.

In Tax

- The ‘Temporary Budget Repair Levy’, a debt tax of 2% for those earning over $180,000 p.a. will reap $3.1 billion dollars over 3 years.

- Company tax cut of 1.5%.

- Company tax increase of 1.5% on the nation’s top 3000 firms to fund the paid parental leave scheme.

- The FBT rate has already risen to 47% as a consequence of the increase in the Medicare levy and an additional rise to a total of 49% is now proposed. This proposal aims to broadly prevent anyone liable

- for the proposed deficit levy from swapping taxable income (taxed at 49%) for fringe benefits taxed at the lower rate of 47%. The increase in the FBT rate to 49% will occur from 1 April 2015 to 31 March 2017 (aligning with the FBT years).

- From July 1, 2014 the Dependent Spouse tax offset to be abolished.

- From July 1, 2014 the Mature Age Worker tax offset to be abolished.

- From July 1, 2014 the First Home Saver Accounts scheme to end

The biggest saving of all

- The freeze on the planned increase to overseas aid worth $7.6 billion dollars.

Over time the structural savings are significant some $80 billion dollars over the next decade in health & education alone. However with the states expected to pick up the slack, it could be reasonable to predict the case for increasing the gst is gathering speed.