Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Market Updates, Super Tax Adjustment, Retirement Risks & more…

| 16th May 2025 |

Australian Market UpdateOur market outperformed the US and global markets in April, rising by 3.6% and being broad-based. This was buoyed by the relatively low direct impact from US tariffs and improved domestic inflation data, which supported expectations for further RBA easing. Commodity prices were mixed, with gold rising sharply and oil prices falling, while the Australian Dollar (AUD) rose against the US Dollar (USD) (maintaining 64 cents since month end) as investors shifted away from US assets amidst the uncertainty. Australian REITs (Real Estate Investment Trusts) jumped by more than 6.0% after a poor recent period, while GREITs declined by 0.4%. Global Infrastructure achieved a small positive return for April while being one of the top-performing asset classes over the 12-month period. Australian Bonds rose 1.7% over the month. The Australian bond market was less volatile than the US, with bond yields declining to 4.17% by month-end. This largely reflected the improved inflation picture and the prospect of further RBA rate cuts. Our View remains that cuts will be fewer and slower than markets are pricing in but this is one where we would be happy to be wrong. Australia’s headline inflation rate for the March quarter was 2.4%, while the core trimmed mean measure rose 0.7% for the quarter, taking the annual rate to 2.9%. This marked the first time core inflation had returned to the RBA target zone since December 2021, providing room for potential RBA easing. The NAB business survey indicated that while overall business conditions remained subdued, there had been a noticeable uptick in forward orders in recent months, potentially signalling a gradual economic recovery. |

Global Market UpdateTrump’s first 100 days passed with the worst stock market performance of any presidential term since Gerald Ford in 1974. His “Liberation Day” trade tariffs caused US stocks to decline more than 10% in two days at the start of April – something only witnessed during the 2008 Financial Crisis and the March 2020 COVID shutdown since the millennium. The market may have staged a breath-taking recovery after tariff rates were reduced – helped by strong earnings from Microsoft and Facebook – but a number of forward-looking indicators would warn against complacency. The odds of a 2025 recession remain elevated, and there is still speculation that empty shelves will be seen in US stores, with Chinese container bookings down 50% and threatening to cause layoffs across the transportation and supply chain. It is notable that there has been an uptick in orders since Trump announced his “deal” with China a week ago. US GDP for the March quarter contracted by 0.3%, primarily dragged down by a surge in imports ahead of the tariffs. On a brighter note, core inflation was flat for the month, bringing the 12-month rate down to 2.6% from 3.0%. This positive inflation news contrasted with the economic uncertainty caused by tariffs. The US Federal Reserve has been reluctant to cut interest rates with the inflation outlook so uncertain, not so the Bank of England, which is expected to do cut again in coming months. Europe outperformed the US, benefiting from more expansive fiscal policy, lower inflation, and cheaper valuations. April ended with the FTSE 100 rising for 15 days in a row to mark its longest-ever winning streak. European stocks have been a bright spot this year, with the STOXX 50 index rising 11% in sterling terms. The German government has approved a massive spending plan focused on defence, national infrastructure and climate initiatives. The German DAX index has gained 19% this year as a result, with the IMF forecasting a long-term boost to economic growth. The Japanese stock market remains fairly subdued: down very slightly this year, despite ongoing attempts to make improvements in the corporate governance and capital structure of major firms, which has led to record levels of share buybacks. It is worth noting however, that the Nikkei was up 100% over 5 years to the end 2024! Emerging markets have had positive returns, led by Mexico, Hong Kong and Brazil, while China has underperformed. Mexico currently has the benefit of avoiding tariffs on exports covered by the United States-Mexico-Canada Agreement which Trump established in his first term. Financial markets are said to hate uncertainty, but April may have shown that plain old bad news (high tariffs) is much worse than a wide range of possible outcomes (messy negotiations). The relief rally of the past few weeks has approached record proportions. In the current landscape, a diversified investment approach, remaining disciplined and staying the course remain essential to navigating these evolving and volatile financial markets. |

Super threat returns with Albanese and Chalmers |

|

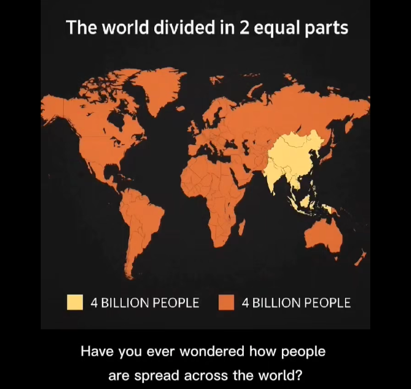

This is the approximate number of people living in Asia. Making it the most populous continent, accounting for nearly 50% of the global population.

The world’ s population has surpassed 8 billion, yet it is far from evenly spread across the globe. A compelling map visualises this by dividing the Earth into two halves—each home to roughly 4 billion people. One of these halves, shaded in yellow, covers a relatively small section of Asia, including nations such as China, India, Indonesia, Bangladesh, and nearby regions. The other half, in orange, spans the rest of the entire planet. What is remarkable is the sheer population density packed into 20% of the world’s landmass. Asia’s dominance in human concentration has profound implications— not only culturally and politically, but also economically and financially. As a resource miner and financial hub Australia is perfectly positioned to benefit from the rising living standard of 50% of the world population. Retirement risks that shouldn’t be overlooked

Retirement brings with it some obvious financial concerns—chief among them running out of money (longevity risk) or retiring during a market downturn (sequencing risk). We have covered these risks in previous additions but we thought is useful to package them together with some less visible threats that can undermine your financial security. Here are six to consider:

Australians are living longer, with many retirees needing income that lasts 20 to 30 years. A layered income strategy—using superannuation, annuities, and the age pension—can help ensure a sustainable income stream. Government-backed programs such as the Home Equity Access Scheme also allow retirees to tap into home equity at relatively low interest rates.

Market losses early in retirement can be particularly damaging. Diversification, asset allocation, and a bucketing strategy (setting aside cash for short-term needs) can reduce the need to sell assets in downturns. Financial advice can also keep retirees from making panic-driven decisions.

Portfolios should align with each retiree’s risk tolerance. Being overly conservative can hinder growth and reduce income over time. While some may explore private credit or inflation-linked assets, others rely on traditional diversification across shares, bonds, and cash.

Inflation erodes purchasing power—especially in areas such as healthcare, which consistently outpaces the Consumer Price Index (CPI). Shares and property can act as hedges, and the age pension and Commonwealth Seniors Health Card help provide some inflation protection.

Living too frugally or investing too defensively can lower quality of life and erode financial well-being over time. It’s essential to build confidence in spending by planning that strikes a balance between growth and security.

From home repairs and health costs to financially assisting adult children, surprise expenses are common. Setting up and maintaining an ‘emergency or contingency fund and discussing potential financial commitments with family are ways to minimise impacts. Divorce later in life— a growing trend in Australia—can further stretch retirement budgets. Ultimately, retirement planning should go beyond just saving and investing—it’s about managing a broad range of evolving risks. Having your financial adviser regularly review your strategy is key to ensuring peace of mind and financial independence throughout retirement. |

Friday Funny

|