Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Market Updates, Beating the Super Tax, Mortgage Refinance Surge & more….

| 13th June 2025 |

Australian Market UpdateWith the Federal Election in the rear view mirror along with an interest rate cut in late May, Australian financial markets have continued to be strong in recent weeks as if they can see the positive in everything. After rallying in May, the ASX 200 has traded notably higher by mid-June, moving above 8600 points this week, with energy and technology stocks leading the rise.

Virgin Australia is also set to return to the ASX later this month (trading as of June 24) with a $685 million initial public offering (IPO), seen as a potential catalyst for renewed interest in public listings after ASIC have removed some red tape to make it easier. The IPO is priced at $2.90 per share, valuing the airline at approximately $2 billion. Overall positive market sentiment has been supported by tailwinds from Wall Street and expectations of further RBA interest rate cuts, following softer-than-expected GDP data. Expectations of company profits have also lifted. The RBA’s cut in May, anticipated mainly due to inflation remaining within its 2-3% target range, reflected the view that risks to inflation have balanced. Despite the cut, the RBA still expressed caution, citing considerable uncertainty regarding global trade policy and its potential impact on our economic activity. Despite a surprising increase of 89,000 in employment figures (predominantly in jobs funded with government money), markets continue to price in further RBA easing, with expectations of at least three additional cuts by year-end. We see 2 cuts but with an unusual cut of 35bps to realign with traditional quarters. Household consumption in early 2025 appeared a little weaker than expected although consumer confidence, according to the Westpac-Melbourne Institute consumer sentiment index, rose by 2.2% to 92.1 in May 2025, showing a modest recovery despite remaining below the neutral 100 threshold. Inflation data for April showed the headline rate rising 0.2% month-on-month, bringing the annual rate to 2.3% year-on-year, the lowest since February 2021. Core inflation rose 0.2% MoM, keeping the annual rate at 2.8% YoY, aligning with market forecasts. Wages growth increased slightly in the March quarter but was lower than a year ago, with subdued productivity growth keeping unit labour costs elevated. This will move up further in the new financial year after the Fair Work Commission raised the minimum wage for workers by 3.5% from 1 July. The Australian dollar (AUD) has stayed relatively stable reaching around 0.652 USD this week after a period of fluctuation. This appreciation against the USD has been amid broad-based US dollar weakness and positive results from US-China trade talks. In contrast, the AUD has depreciated against several other advanced economy currencies, reflecting Australian yields having declined more than in those economies and concerns about the global growth outlook, particularly related to the Chinese economy. On the whole, Australian financial markets have demonstrated remarkable resilience, particularly in equities, supported by an RBA that has commenced an easing cycle in response to moderating inflation and a softer domestic growth outlook. However, global trade policy uncertainties and a weakening US economy continue to cast a shadow, influencing market sentiment and the Australian dollar’s performance against various currencies. |

Global Market Update

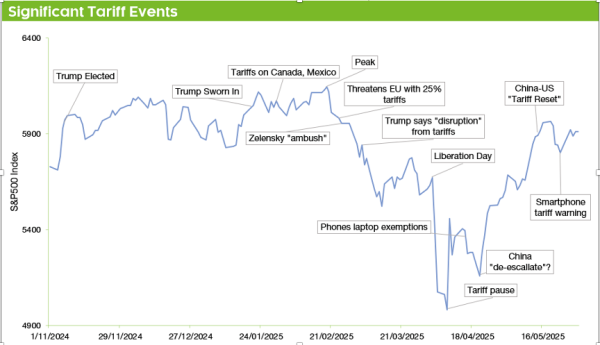

The “on-again/off-again” nature of US tariff policy and ongoing US-China trade talks have been a central driver of global market sentiment and volatility in recent weeks. The pausing or reduction of some tariffs has generally led to relief rallies. While some central banks have begun to cut rates, the US Federal Reserve’s path remains a key focus, with market expectations for further cuts being scaled back compared to earlier in the year. Persistent inflation risks, alongside concerns about slowing global economic growth, continue to influence investor decisions. European markets have also been influenced by trade talks and inflation data, with mixed performance. Asian stocks, particularly the Hang Seng and KOSPI, were buoyed by optimism surrounding US-China negotiations. Taiwan and South Korea have performed strongly due to high demand for technology and excitement around developments in artificial intelligence. We continue to focus on diversification across assets and geographies, with traditional safe havens like gold and cash being key. US financial markets have generally shown a positive trend, reacting to easing trade tensions with China – the 90-day de-escalation of tariffs announced mid-May significantly boosted market sentiment – cooling inflation data and resilient corporate earnings. Lower inflation in the US was overshadowed by tax cut extensions, rising jobless claims and a Moody’s downgrade. The US Federal Reserve held rates steady and signalled fewer cuts ahead. The S&P 500 has been stronger, approaching new record highs. May closed 6.3% higher than April and has continued to gain in early June, being less than 2% away from a fresh record at the start of this week. The tech-heavy Nasdaq has been a significant gainer, with its best month in two years in May, rising 9.7%. It has also continued its upward trajectory into June, trading at its highest level in over three months. This rally has been significantly fuelled by chipmakers like Nvidia, Intel, AMD, and Broadcom, as well as other major tech firms such as Alphabet and Meta Platforms. The “Magnificent Seven” tech stocks have reported 27.7% earnings growth. Conversely, Tesla whilst having recovered some ground since its depths in April, remains 33% below its December euphoria. The Dow (only 30 stocks) however, has had a mixed performance, with some large-cap companies dragging it down. However, it also saw a 4.2% gain in May and has shown modest gains in early June, although it still trails the other major indices in year-to-date performance highlighting the reilience of the tech sector against the wider economy. After the RBA cut its rate in May, the Bank of England cut its rate to 4.25%, followed by the European Central Bank, which then signalled a summer pause. In Japan, long-term bond yields, particularly 30- and 40-year JGBs, hit record highs. The Euro and British Pound have shown strength against the US dollar, with market participants seemingly pivoting away from the USD amid tariff uncertainties and concerns about the US economy. The Japanese Yen has been weakest amidst widespread strong risk appetite. Platinum prices have surged, up 35% year-to-date, supported by tightening fundamentals. Silver also rallied to a 13-year high, seen as relatively cheap compared to gold. Meanwhile, crude oil has shown recent strength after a period of volatility, trading above US$65; however, the Bank of America predicts that the Saudis are preparing for a prolonged price war to regain market share. |

Beating the $3million Superannuation Tax – Should you stay in your fund or go? |

|

That is the year on year increase in the CBA share price!! Commonwealth Bank (CBA) shares have reached $182 – an 18% rise since the start of the year and 40% year on year. Its market capitalisation is now $302 billion and criticism continues to mount that Australia’s industry super funds are potentially distorting equity markets and inflating the CBA’s share price and value. Australian investment leaders, including PM Capital’s Paul Moore, argue the size and benchmark-driven behaviour of these funds are contributing to mispricing across the Australian Securities Exchange (ASX). Moore voiced his concerns at the recent Stockbrokers and Investment Advisers Association Conference, in Sydney, saying “size kills,” adding that industry funds are the primary reason for CBA’s high valuation. Analysts are starting to believe these gains are increasingly disconnected from the bank’s underlying financial health. The influence of super funds, particularly on large-cap stocks like CBA, is significant. The current price-to-earnings ratio for CBA ranges between 25 and 27, which is comparable to tech giants like Apple and Amazon, according to Moore. He noted, “CBA’ s growth rate is only 1 or 2 per cent,” which raises questions about the justification for such high valuations. Moore also compared CBA’s multiples to those of its global peers, pointing out that CBA trades at more than double the multiple of JP Morgan, which stands at just 13 times earnings. Furthermore, he likened CBA to Lloyd’s Bank in the UK, which has a similar earnings profile but is valued at only a third of CBA’s worth. It’s PE is also double that of its Australian peer group Westpac, ANZ or NAB. Cameron Gleeson from Betashares agreed that large super funds are a dominant force in the market but suggested that it isn’ t solely passive investing that has driven CBA’s price surge. He also noted that the “Your Super Your Future” legislation introduced in 2020 has benchmarking guidelines that make it difficult for big super funds not to own certain large stocks for fear of underperforming the benchmark, regardless of the perceived inflated value of the company. The Reserve Bank of Australia has raised alarms about the growing influence of the $4 trillion superannuation sector, warning that its sheer scale could pose systemic risks to the financial system. A recent KPMG report predicts that the number of mega-funds—those managing over $100 billion— will continue to rise, highlighting the increasing concentration of power in the superannuation sector. Recent history suggests a rate cut will drive refinancing surge

Market commentators are expecting a big jump in refinancing activity in the coming weeks, given that numerous borrowers switched home loans earlier in the year following the previous cash rate cut, in February, by the Reserve Bank of Australia. Equifax, a credit reporting agency, has reported that the number of mortgage applications in the first quarter of 2025 was 5.2% higher than the same quarter the year before. Refinancers played a major role in that increase, with refinancing accounting for 37% of mortgage demand in the month of March. 3 key things to consider before refinancing your home loan:

|

Friday Funny

|