Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Babe Ruth, A Golden Opportunity, Faux-retirement and More

We started these fortnightly missives to help keep our community informed during last year’s lockdown. So much has happened in the 18 months since. Both the economy and markets have staged remarkable recoveries, but here we are faced with a lockdown once again.

As we contemplate what to do with ourselves over the coming days (our thoughts are with all those in Victoria and NSW who must endure much longer), at least we can be thankful to have the Olympics to keep us company. We wish all the athletes the best of luck in Tokyo in what will be a strange crowdless event.

Congratulations to Brisbane on their successful bid for 2032. It is hard to believe it has been 21 years since Sydney!

A golden opportunity for golden years

It is worth recapping the new rules for super that came into effect from the start of this month.

Since 1 July, the superannuation guarantee (SG) has increased from 9.5 per cent to 10 per cent (and will rise to 12 per cent in 0.5 percentage point increments each year to 2025) the annual concessional cap increased from $25,000 to $27,500, allowing Australians to tax-effectively add an extra $2,500 into their superannuation fund.

Small change, big payoff!

For those willing to proactively take steps to boost their savings for retirement, the changes can have a significant impact.

- For a 35-year-old full-time employee earning just over $89,000 per annum (the average weekly ordinary time earnings for an adult full-time employee), the SG changes could result in an extra $76,626 at retirement (age 67).

- For a 45-year-old, the SG increases add almost $46,000 to their retirement savings. Making additional annual contributions up to the concessional contributions cap (via a salary sacrifice or personal deductible contributions – Your annual tax return perhaps?) could increase their retirement savings at age 67 up to $427,000.

- For pre-retiree clients, the SG increase will also mean significant gains. For instance, the retirement balance at age 67 for a client aged 50 will jump by $32,000. While the benefit is further amplified if you add in salary sacrificing (up to the cap each year), increasing this extra benefit substantially to $314,000.

But, these numbers only tell half the story.

Not only do these changes mean higher retirement savings, but you can expect extra personal superannuation pension income for each additional dollar of super contribution.

By way of example, a pre-retiree aged 50 who takes advantage of the opportunity can expect to draw an extra $1,958 per annum in retirement.

A golden opportunity for your golden years, indeed!

Things that make you go mmm…

He’s done it again. Elon Musk has caused cryptocurrency Dodgecoin to surge in price following an endorsement tweet (obtuse as it may have been).

It’s a strange time when tweeting messages about absolutely nothing can influence (manipulate?) equity markets while the likes of Warren Buffett’s insightful thoughts are criticised because he’s ‘old school’. Mmm…

10 things I learned in my faux-retirement

It can be argued that the concept of retiring once you reach a certain age is an outdated one.

Research shows that fewer than half of all workers in Australia retire at age 65. Moreover, of those still working, a quarter does not have any plans to retire at all.

Of course, working longer is not always by choice; we are living longer, have a better quality of life, but that also costs more money. And, if the federal government’s latest intergenerational report has taught us anything (read here), it’s that anyone over the age of 65 who wants to work, has the enthusiasm, experience and skills to contribute in a meaningful way are certainly to be encouraged.

Regardless of your retirement age, however, this unwritten chapter can be a daunting one. Will playing golf every day or travelling around the country in an RV actually be as fun as you had imagined? A new concept gaining popularity is ‘faux retirement’ or, in other words, a test-run to get a sense of the lifestyle aspect of not working.

Christine Benz is a leading Morningstar writer, and as the company has a sabbatical scheme that allows employees a solid break every four years, she reflects on what she learned in a complete change of pace. It’s an insightful look at how she felt she was ‘trialling’ her eventual retirement.

How rich was Babe Ruth

An entertaining look at the lesson learned when translating yesterday’s dollars in terms of Babe Ruth’s wages. The famous baseball player’s highest salary came in 1930 and 1931, at $80,000 US.In the first instance, Ruth’s salary is translated in the customary way – adjusted by the Consumer Price Index (CPI), returning an estimate of $1.37million in today’s dollars (not overly impressive).

Next, the author takes a look at what Ruth could have bought with his salary. How much of today’s money would be required to fill the same shopping lists? But, again, his salary doesn’t astonish.Finally, Ruth’s $80,000 is translated to investment markets, determining that the salary would have secured two one-millionths of all publicly listed US stocks at the time. Attempt to corner that much of the US equity market today, and you are looking at around $92 million!

What is remarkable (in hindsight) is how investment prices appreciated so much more aggressively than did the costs of consumer goods and services.Read the full article here.

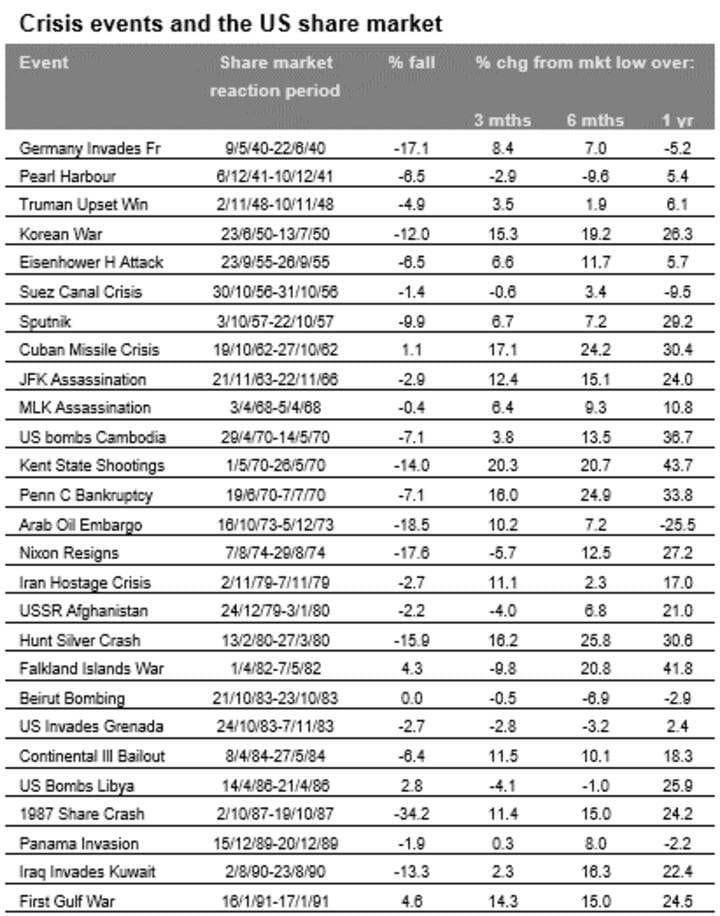

Chart of the week

One of the big surprises of this recovery is how quickly jobs came back. This has led to some wage pressures and perceptions that spare capacity has been used up. However, labour underutilisation rates are still relatively high and labour markets are still distorted by the pandemic, eg, by enhanced unemployment benefits in the US & by the closed international border in Australia.

Even without the latest coronavirus-related uncertainties, in our view, it still looks like we have a fair way to go to full employment and hence sustained decent wages growth and inflation targets. Expect to hear a lot more about transitional inflation over the coming months, and keep an eye out for bond market reactions for any surprises.

SA emerging leader scholarship

FinSec Partners in various capacities have been the proud supporter of ‘behind closed doors’ for many years now.

behind closed doors is a leadership and professional development, peer coaching and mentoring company that connects businesswomen and female entrepreneurs with broader networks. The organisation established in 2008 provides a safe and confidential environment for women, offering powerful learning opportunities to reflect, be empowered and drive real change in their organisations.

We are pleased to announce that in 2021 we are taking our support of behind closed doors one step further and will be sponsoring the South Australian emerging leader scholarship. This program will enable a female non-executive leader in the For Purpose/Not-For-Profit sector to join this most respected national community of businesswomen.

Should this opportunity apply to your family or friends, we warmly invite you to share the below links amongst your networks.To apply: Applicants must email Melissa@behindcloseddoors.com with their CV and a covering email on what winning the scholarship would mean to them and their organisation.

Share on LinkedIn by clicking here

To learn more about behind closed doors please click here

Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser.

| We have enjoyed receiving much positive feedback in relation to this publication. Many have asked if they can share with family and friends and we would be delighted if you did! To ensure the integrity of the links please forward via the ‘send to a friend’ link at the very bottom of this email. |

|