Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View #13

Issue: Friday 24 July 2020

Gone are the days when economic policy was adjusted once each year by the government in the budget and fine-tuned once each month at meetings of the Reserve Bank board.

The COVID-19 means we haven’t had a budget in more than a year. What the Reserve Bank has been forced to do to interest rates, mean its monthly board meetings have little to no impact for the foreseeable future (Governor Philip Lowe reaffirmed this week that monetary policy is on hold for some time to come). In a COVID world there is no rule book. Government’s have the hard task of trying to manage a health, social and economic crisis, all ‘on the fly’.

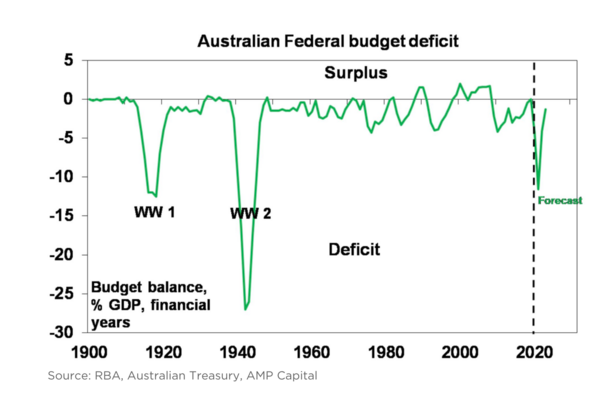

Yesterday Frydenberg delivered Australia’s Economic and Fiscal Update, the first since December’s mid-year Economic and Fiscal Outlook when budget surpluses looked just around the corner. How things have changed in six months – It came as no big surprise that we are now facing record budget deficits (with more to come).

If you don’t have the appetite to wade through the 180-page economic statement, click here to read Chief Economist, AMP Capital Shane Oliver’s summary – Key takeaways include:

- The Government expects the federal budget deficit to peak at a record $184.5bn this financial year. That’s around 9.7% of GDP, its highest since the end of WW2.

- Ultimately, it could actually be more like $220bn as the Government unveils more stimulus and revenue recovers more slowly than projected.

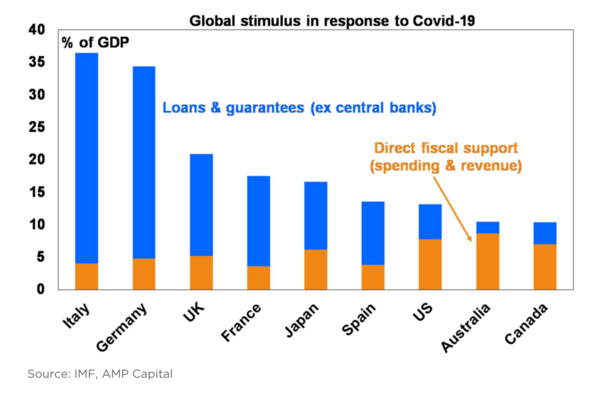

- The additional $22bn in stimulus announced over the last two weeks will help turn the fiscal cliff in October into a fiscal slope. The boost takes Australia’s total level of coronavirus related fiscal stimulus (excluding loans and guarantees) this year up to 8.7% of GDP, which is well and truly at the high end of comparable countries.

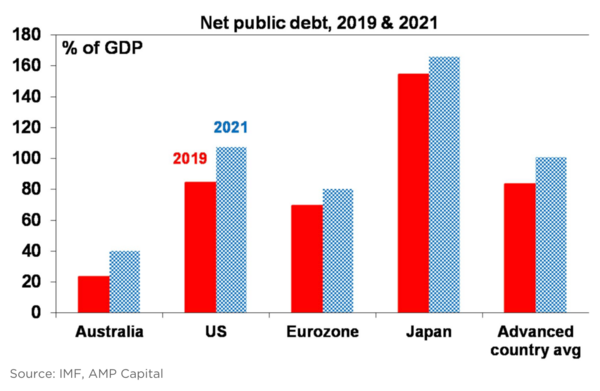

- The budget and associated debt blowout is unlikely to cause a major problem as public debt is relatively low, borrowing costs are very low, the Government is borrowing in $A’s and it’s not dependent on foreign capital. Letting the deficit rise remains the right thing to do.

What does it all mean?

There is a profound shift taking place in economics as a result of the pandemic. Much as in the 1970s when Keynesianism gave way to Milton Friedman’s austere monetarism, and in the 1990s when central banks were given their independence, so the coronavirus marks a new paradigm. It is characterised by government borrowing, money-printing and intervention in capital markets all underpinned by low inflation.

In the background, we have Modern Monetary Theory (MMT) an economic theory that proposes that money creation ought to be a useful economic tool, and that it does not automatically devalue the currency, lead to inflation, or economic chaos.

However, to embrace this radical economic theory you will have to forget what you’ve learned about budget deficits (that they’re bad) and government debt (that it burdens future generations).

Why?

Because proponents of the theory say that far from being a problem, budget deficits are often a good thing they can be the source of healthy economic growth.

Regardless of whether you believe MMT has merit or not, it does provide an explanation with regard to the actions of government in this new era. In this article (warning it is a long one) the ABC’s business reporter Gareth Hutchens unpacks how MMT is challenging the economic establishment click here to read.

Do markets need a reality check on vaccines?

The optimism of the ‘coronavirus stock market’ continued this week. It’s latest reason to rally seems to be an enthusiasm for a string of potential vaccine breakthroughs. So much so, it’s like the vaccine is almost fully developed and trialled already.

While reports of positive data from potential coronavirus treatments is good news, FDA approval (or equivalent) is still a long way off. Is the market’s celebration of each and every incremental vaccine news a case of ‘too much, too soon’?

One of the firms on a charge to develop a COVID-19 vaccine, is US pharmaceutical giant Merck & Co. Recently, their Chairman and CEO Ken Frazier was interviewed by Professor Tsedal Neeley from the Harvard Business School. Based on past data and the wisdom of experience he offers a very sage and rational perspective on the realities of vaccine development. His comments include:

- The fastest vaccine ever brought to market was for the epidemic parotitis (‘mumps’). It took (Merck) four years to produce this vaccine.

- The most recent vaccine created for a large viral outbreak was for the Ebola virus, which took 5.5 years.

- Manufacturing a vaccine for 7 billion people has never been done before. Delivering it to 7 billion people is an enormous logistical challenge, especially to those communities who cannot afford it.

- The bigger challenge to developing a vaccine is distributing it to where it is needed most. In a time of ultra-nationalism, countries want to take whatever is available and use it in their own population first rather than offering it to populations globally at greatest risk.

- We don’t want to rush the vaccine before we’ve done rigorous science. We’ve seen in the past, for example, with the swine flu, a situation where a fast-tracked vaccine did more harm than good.

- In the last quarter century, there have only been seven, truly new vaccines introduced globally at the clinical practice. There has been an enormous amount of work done in the field of prevention. Despite all this work, the world has been trying to develop a vaccine for AIDS since the early 1980s, and so far, without success.

Although, we must acknowledge that much of the current development processes for a COVID-19 vaccine are unique – most significantly an ‘open chequebook’, the US, EU and China in particular (what is $13 billion allocated to vaccines compared with the current economic loses of the world economy) – it is a hard dose reality check none-the-less.

A poignant reminder that while the world works hard to find a vaccine, for now, our best defence may simply lie with how we choose to behave. Respecting restrictions and adhering to the advice authorities prescribe, whilst not always easy, may be the best medicine.

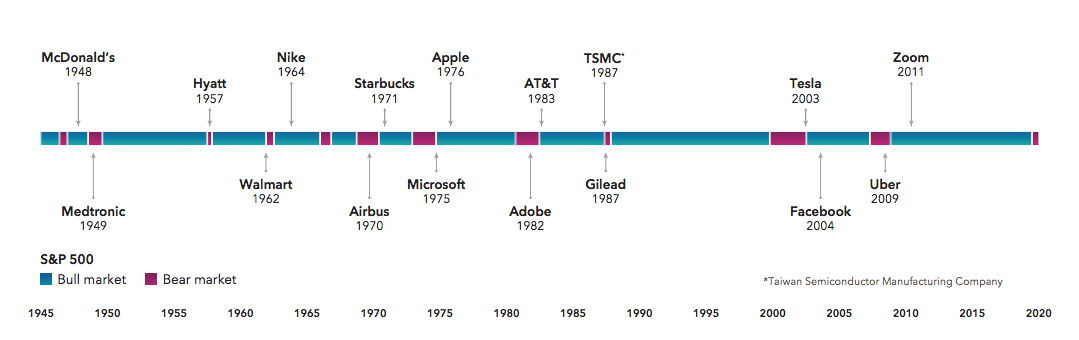

Charts of the week – How many ‘tough’ companies were started in tough times?

Quite a few. The list of examples is lengthy and impressive.

To highlight just a few: McDonald’s emerged in 1948 following a downturn caused by the US government’s demobilisation from a wartime economy. Walmart came along 14 years later, around the time of the “Flash Crash of 1962”. Airbus, Microsoft and Starbucks were founded during the stagflation era of the 1970s, a decade marked by two recessions and one of the worst bear markets in US history. Not long after that, Steve Jobs walked into his garage and started a small company called Apple.

History has shown that strong businesses find a way to survive, and even thrive, in volatile markets and difficult economic conditions. Companies that are able to adapt and grow in tough times often present attractive long-term investment opportunities.

Bottom-up, fundamental research is the key to separating these resilient companies from those likely to be left behind. Which companies will emerge as market leaders after the COVID-19 crisis? Only time, and solid research, will tell.

Sources: Capital Group, Standard & Poor’s.

Things that make you go ‘mmm…’

“You have to wonder sometimes if the regulators in Canberra really have it in for independent investors. There may not be an official policy approach to scare people away from doing their own investing but at times it sure seems like it”.

As the introductory paragraph to a recent article in the Australian (sadly requires $$ to access), these words were the result of Wealth Editor, James Kirby’s disbelief at APRA’s reporting on how each type of super investor did over the January – March quarter. On average, APRA reports that super investments fell by 7.7% for the quarter, but Self Managed Super Funds (SMSF) did the worst at 9.4%. Not only is every SMSF different (by their very nature this is their purpose) but it turns out of course that the big funds report regularly but SMSFs are not required to do so. Therefore APRA makes an “intelligent guess” instead.

Whilst in due course these numbers are adjusted to accurately reflect true performance, the problem in the meantime is that these “official” numbers get circulated and SMSF operators are made to look like dupes. It is innacurate statistical data which risks undermining people’s confidence in SMSFs. Mmm… one can only imagine what would happen if we were to take a similar approach to our own client reporting.

Early access to super extension

Individuals wanting to apply for the early release of up to $10,000 in superannuation have been given extra time to do so.

As part of yesterday’s economic update the government announced they have extended the application period to 31 December 2020 from the original deadline of 24 September.

For information on the early access to super initiative refer to our article dated 26 March 2020 by clicking here.

The latest figures show up to 2.4 million people have applied for early withdrawal of part of their superannuation, with around $25 billion worth of applications approved by the Australian Tax Office (ATO).

The early release of super is crucial for many in our community. However, the ATO is aware of people taking advantage of the measure and they are now actively taking precautions to ensure the integrity of the program.

People who apply when they are not eligible may face significant penalties. This includes the general anti-avoidance rule for income tax (entering into a scheme mainly for the purpose of obtaining a tax benefit).

More information can be found here.