Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

The Problem with Free Advice

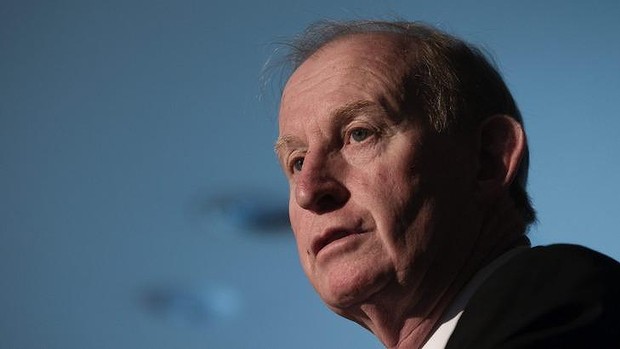

Financial Systems Inquiry chair David Murray voiced his “concerns about ‘excessive complexity’ in the sale of financial advice and laments the lack of a ‘best practice model’ for paying financial advisers” in comments he made at a public forum in Sydney last night.

The message at the heart of Mr Murray’s comments is a good one, all financial advice should focus solely on the outcome of the client it is prescribed for. “While it is simplistic to say people don’t die from their financial services, if they are badly designed, what has been very clear to us in the public forums we have held, is the degree of suffering from people who do lose substantially is very significant”.

His comparison of Financial advice to Medical services may hit a raw nerve with some, but his analogies are spot on. In short, for the same reason we would be horrified to hear that a doctor diagnosed a patient via email or prescribed medicine over the phone, appropriate financial advice (advice in the best interests of the client) can not be administered without a thorough examination of the individual by a qualified practitioner … perhaps not literally but you understand the intent.

Professional advisers study hard and extensively to give innovative and strategic advice, this is undermined again and again by those that are trained in selling a product.

Good advisers are also committed to disclosure and transparency and like any fair and reasonable business, they work for a fee based on the value of the service they provide – If you are receiving something at a perceived ‘no cost’ then yes, it’s probably safe to say there may be a conflict of interest.

Here at FinSec we very much support the call for a clearer distinction between what is classified financial advice and what is factual or sales information. As an industry, only then will we be in a position to repair it’s reputation and more Australians can start to have the trust to benefit from what it really has to offer.

It’s fair to say that occasionally it would be nice to see some press focusing on the ‘good guys’, the advice firms that do choose to work in an open architecture, choose from a broad list of products and are qualified salaried professionals – But it’s not the good news that sells!