Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Morrison’s $500,000 backflip – “mostly” good news for superannuation.

Note: This article was updated 21 September 2016 to include further clarity with regard to transitional rules.

The Federal Government has made significant changes to its superannuation package, including dumping plans for their controversial $500,000 lifetime cap proposal. Although the revisions (and the package as a whole) are yet to be legislated, the announcements certainly bring it a step closer to reality.

Below we have summarised the changes and what they mean for you.

What’s changed?

- Proposal for a lifetime cap of $500,000 on non-concessional contributions, backdated to 2007 has been scrapped.

- The mechanism for making concessional and non-concessional contributions will revert to current rules. However, come 1 July 2017 the amount of non-concessional contributions you can make (per financial year) will be reduced from $180,000 to $100,000.

- Individuals aged under 65 can continue to bring forward 3 years worth of non-concessional contributions ($300,000 down from $540,000 from July 1, 2017). *** September 21, 2016 the Government provided further clarity on how the proposed bring forward and the $1.6 million eligibility threshold will work, please refer end of article.

This revised plan leaves pre-budget rules in place until June 30, 2017.

Note: At this stage the proposed $1.6 million Superannuation transfer balance cap has not been removed (for more information on this proposal please refer to our Budget report – click here).

This announcement is a welcome reprieve for many Australians, particularly those approaching retirement – their plans (based on the strategy of the day) now remain somewhat intact.

- In Scott Morrison’s own words “the budget debt must be arrested” meaning the money has to come from somewhere. The fiscal cost of removing the $500,000 cap ($400 million in revenue over four years) will be recouped through;

- i) The scrapping of the proposal to remove restrictions around minimum work requirements on people aged between 65 and 74 wishing to make voluntary contributions.

As per current legislation, individuals aged 65- 75 years will once again have to satisfy a work test (and cannot use the ”bring forward rule”) – an unfair complexity we think! This group stands to lose the most from this backflip. For example; where couples might want to equalise their balances to avoid the $1.6m cap.

- ii) Delaying by 12 months (from July 1, 2017 to July 1, 2018) plans to allow people with interrupted work patterns to roll over unused concessional contributions from the previous year.

It has always been our belief that the average worker would find it hard to take advantage of this rule anyway. We understand it’s purpose and we like the spirit, but we do question the reality. For example: how many mothers returning to work (often part-time) have excess income after mortgage payments, car payments, school fees and so on… with which to make additional super payments? To this end we believe delaying this measure by 12 months will have minimal impact.

We are pleased (but not surprised) that the $500,000 lifetime cap on non-concessional contributions has been ‘retrospectively argued away’. Morrison’s compromise, approved by the party room yesterday has gained the government valuable momentum in helping to create the view that progress of legislation, is in fact possible in the senate.

$6.3 billion over four years may not be a large amount in the context of a budget spend of around $400 billion a year but to Jenifer Hewett’s point (Australian Financial Review, 14th Sept 2016) “with both sides engaged in a conspiracy of silence over the real size of the budget task, it’s convenient for both to sell the notion of a substantive breakthrough as well as the sort of bipartisan compromise that is popular with voters”.

***

Stop Press: 21 September, 2016

Bring forward Non Concessional Contributions (NCCs) – transitional rules clarified

The Government has provided further clarity on how the proposed bring forward and the $1.6 million eligibility threshold will work.

Bring-forward NCCs – transitional arrangements

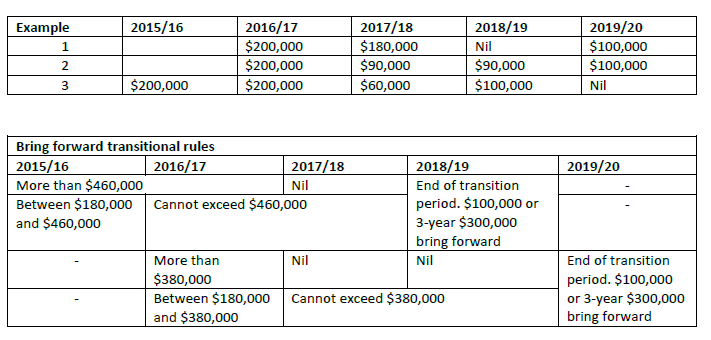

Where an individual has triggered the bring forward in 2015/16 or 2016/17 but has not used it fully by 30 June 2017, transitional rules will apply.

Where an individual triggers the bring forward in 2016/17, the transitional cap is $380,000 (the current annual cap of $180,000 plus $100,000 annual cap in 2017/18 and 2018/19). See examples 1 and 2 in the table below.

If an individual triggers the bring forward in 2015/16, the transitional cap is $460,000 (the current annual cap of $180,000 in 2015/16 and 2016/17 plus $100,000 annual cap in 2017/18). See example 3 in the table below.

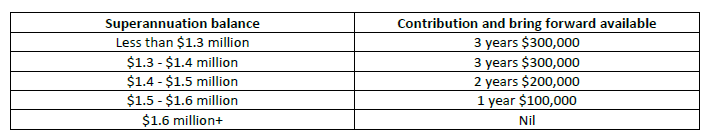

$1.6 million eligibility threshold

Individuals are unable to make further NCCs where their total superannuation balance is $1.6 million or more (tested at 30 June of previous financial year). Where an individual’s balance is close to $1.6 million, they can only make a contribution or use the bring forward to take their balance to $1.6 million but not beyond.

Note: these measures are not yet legislated. Draft legislation is expected in the next few weeks.