Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 3rd June 2022

Investment markets and key developments over the past week

- Share markets mostly rose again in the past week as the rebound from oversold levels continued partly on hopes that some cooling in demand will take pressure of inflation and central banks, and as China started to reopen. European shares were little changed but US, Japanese, Chinese and Australian shares rose. The gains in Australian shares were let by resources, consumer staples and industrials offsetting falls in utilities where surging energy prices weighed. However, bond yields rose as did oil, copper and iron ore prices. The rise in the oil price came despite OPEC agreeing to increase oil production by 648,000 barrels a day for July and August and reflected scepticism that all members will be able to achieve it at the same time that US oil stockpiles fell and the EU announced a partial ban on Russian oil imports. The $A rose as the $US fell.

- Share markets have had a nice rebound from oversold lows, but investment markets generally remain in a bit of a no man’s land at present. The critical issue for markets is whether inflation can be brought under control by central banks without generating a recession. It can be – at least it’s unlikely to see a recession for the next 18 months – but right now the jury remains out. On the negative side of the equation over the last week:

-

- Rising global energy prices pose a threat to the “peak inflation” scenario – with the EU’s ban on the two thirds of Russian oil that it imports by sea and China’s reopening being the latest source of upwards pressure on oil prices. The EU move raises the risk that Russia will cut off some more of its gas exports to Europe in retaliation.

-

- More generally risks remain around the war in Ukraine potentially widening and Russia’s response to Finland and Sweden seeking to join NATO.

-

- US economic activity data remains mostly strong – suggesting its too early to be confident that the Fed will be able to be less hawkish from September. Consistent with this Fed Vice Chair Brainard noted that a 0.25% or 0.5% hike is September is more likely than no change.

-

- The Bank of Canada (like the RBNZ the week before) hiked rates by 0.5% warning of more hikes before inflation peaks, highlighting again that central banks are getting more hawkish.

-

- Another stronger than expected rise in Eurozone inflation to US levels has increased expectations that the ECB’s first rate hike will be 0.5%.

- On the positive side though:

-

- There are more indications that the US jobs market may be cooling a bit – with the Fed’s Beige Book referring to anecdotes of hiring freezes and wage increases leveling off.

-

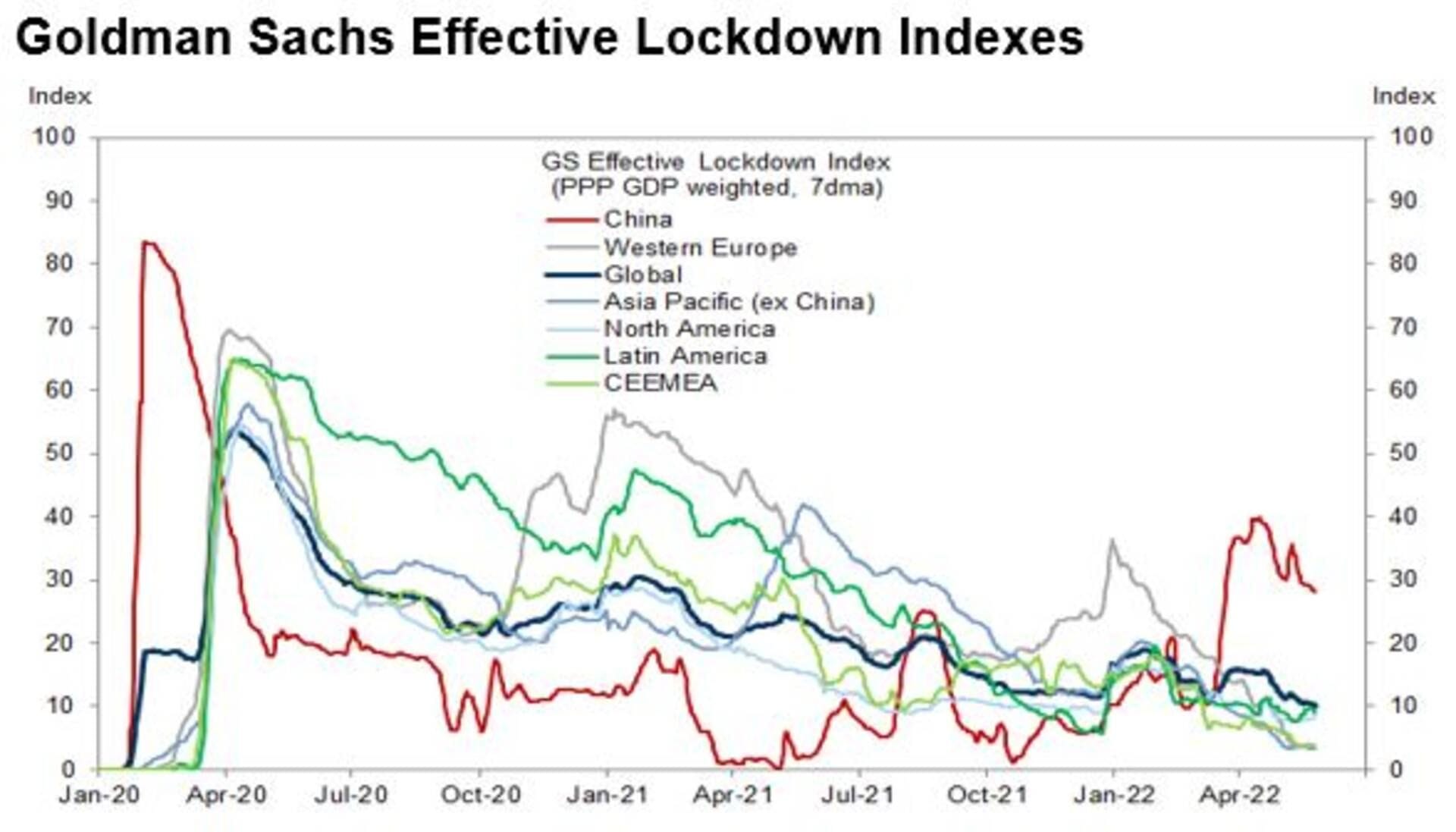

- China’s reopening following a decline in its covid cases will start to take pressure off global supply chains. Goldman Sach’s Effective Lockdown Index for China had been falling into the end of May and is likely to fall further following the reopening in Shanghai from 1 June.

Source: Goldman Sachs Investment Research

-

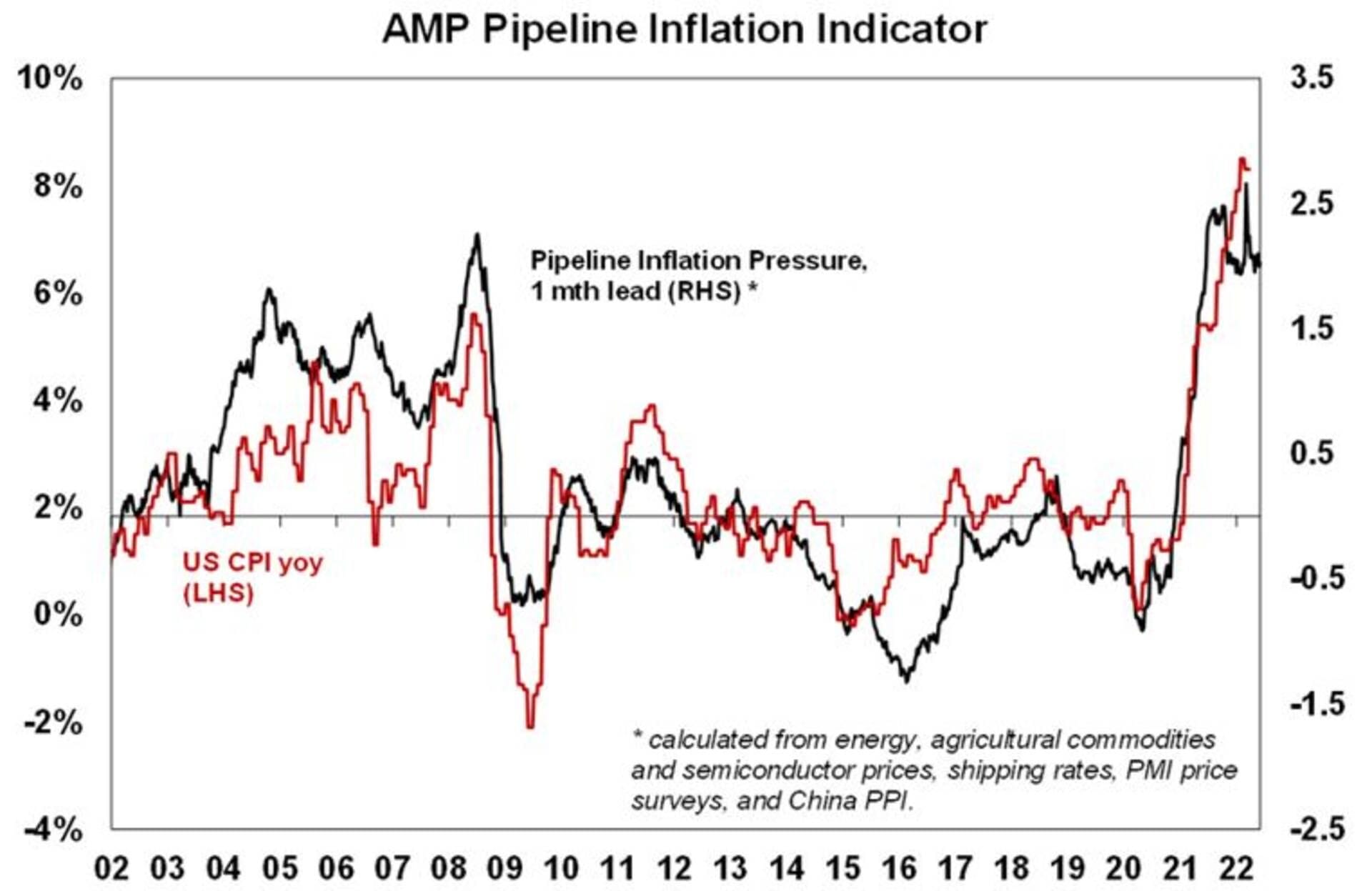

- The Pipeline Inflation Indicator continues to point to a peaking in US inflation.

- The Inflation Pipeline Indicator is based on commodity prices, shipping rates and PMI price components.

Source: Macrobond, AMP

-

- Reliable indicators of recession have yet to signal one is on the way – eg in the US the 10 year less Fed Funds rate yield curve is yet to invert and the Fed Funds rate is still less than nominal GDP growth. It’s the same in Australia.

-

- Forward price to earnings multiples have fallen sharply since the start of the year – down from 22 times to 17 times now in the US and down from 19 times to 15 times in global and Australian shares – making shares cheaper. This has been due to falling share prices and rising earnings.

- The bottom line is that while shares are likely to be higher on a 6-12 month horizon, it remains too early to be confident that we have seen the highs for bond yields and the lows for shares in the near term.

- As Australia’s new Treasurer has pointed out Australia has lots of challenges – high inflation, falling real wages, surging energy prices, rising rents, skill shortages and a high budget deficit and public debt. And we urgently need to implement policies to boost productivity. Since this may require some pain it makes sense to openly acknowledge the challenges – like Hawke and Keating did in the 1980s. That said, Australia’s economic problems on these fronts are mostly minor compared to many comparable countries and there is also a danger that too much negative talk will only weaken confidence and make the situation worse. The last thing we want to do is “talk ourselves into a recession”.

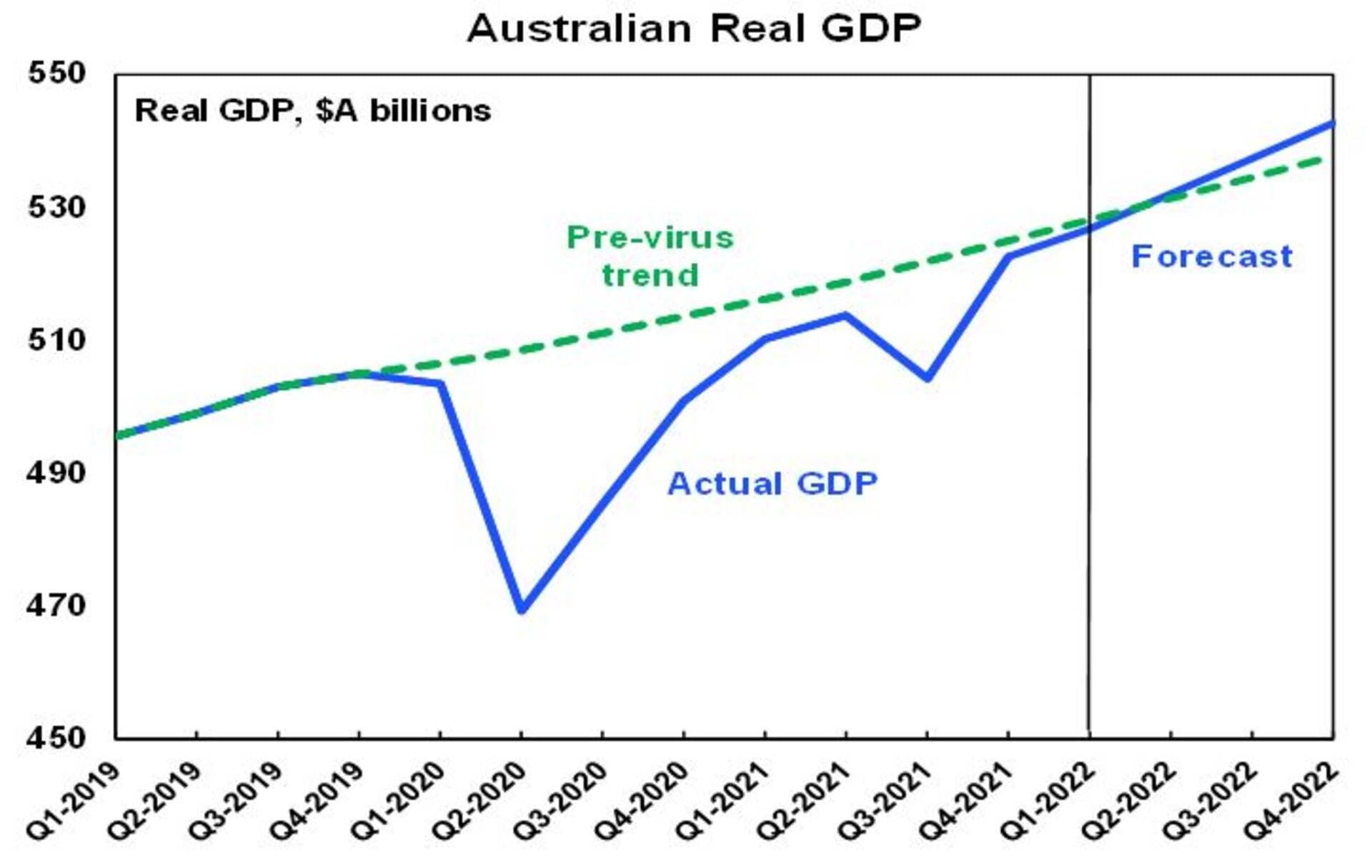

- On this front, Australian March quarter GDP data was far more good news than bad. Sure, it highlights some of the problems facing the economy. But to have the economy grow 0.8%qoq in the quarter after 3.6% growth in the December quarter and despite the hit from Omicron in January, supply constraints, floods and reopening driving a surge in imports (which knocked 1.5 percentage points off growth) is good news. It was better than many – including the RBA’s implied forecasts – were expecting. Cost of living pressures and rising mortgage rates will constrain growth but ongoing reopening, still high household savings with a roughly $250bn excess saving buffer, strong business investment plans and a big pipeline of residential construction to be completed leave us continuing to expect 3.5 to 4% GDP growth through the course of this year.

Source: ABS, AMP

- What’s driving the surge in energy costs in Australia? Put simply coal drives about two thirds of electricity generation in the Australian electricity grid. Coal prices are up something like fourfold on a year ago reflecting global recovery and more recently the war in Ukraine. At the same time numerous coal fired power generators are out of action for maintenance. The combination has led to more demand for gas at a time when its international price has also skyrocketed because of the issues in Europe. So the wholesale cost of electricity has gone up four fold or so since January. This drives about one third of the retail price of electricity and the Australian Energy Regulator is allowing energy retailers to raise prices to their customers with 10% plus increases. And of course, the gas price has also skyrocketed. If sustained this could all add roughly 0.5 to 0.75% to inflation this year. Getting the out of action coal generators back online will help but it’s likely the pressure will continue at least through winter. The longer-term solution is to get more cheaper sustainables (with adequate “battery” storage into the mix) with the new Government targeting that to be 82% of electricity supply by 2030. Of course, we should have started much earlier!

Coronavirus update

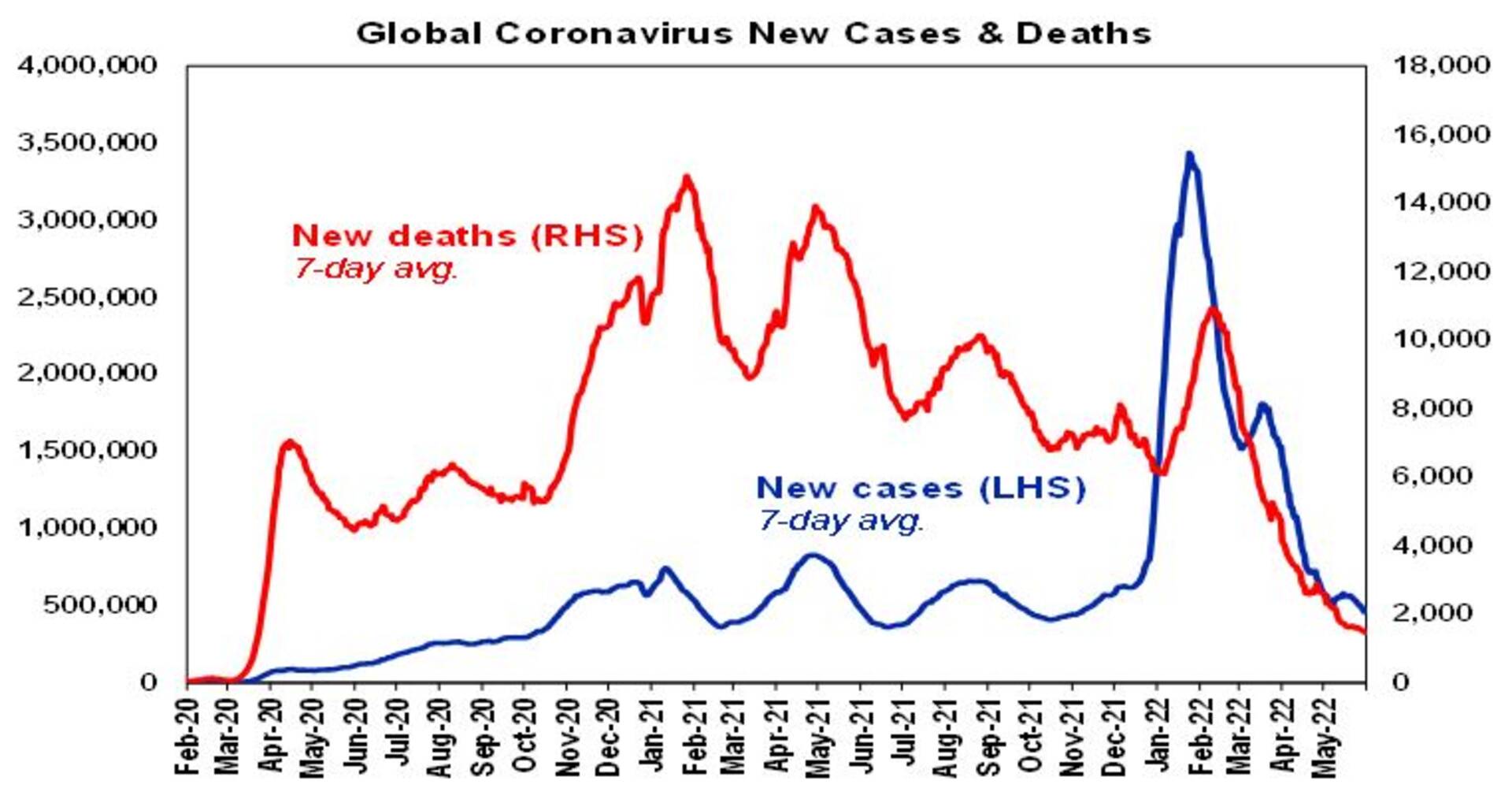

- New global Covid cases fell again over the last week with decline in Europe, the US and Asia.

Source: ourworldindata.org, AMP

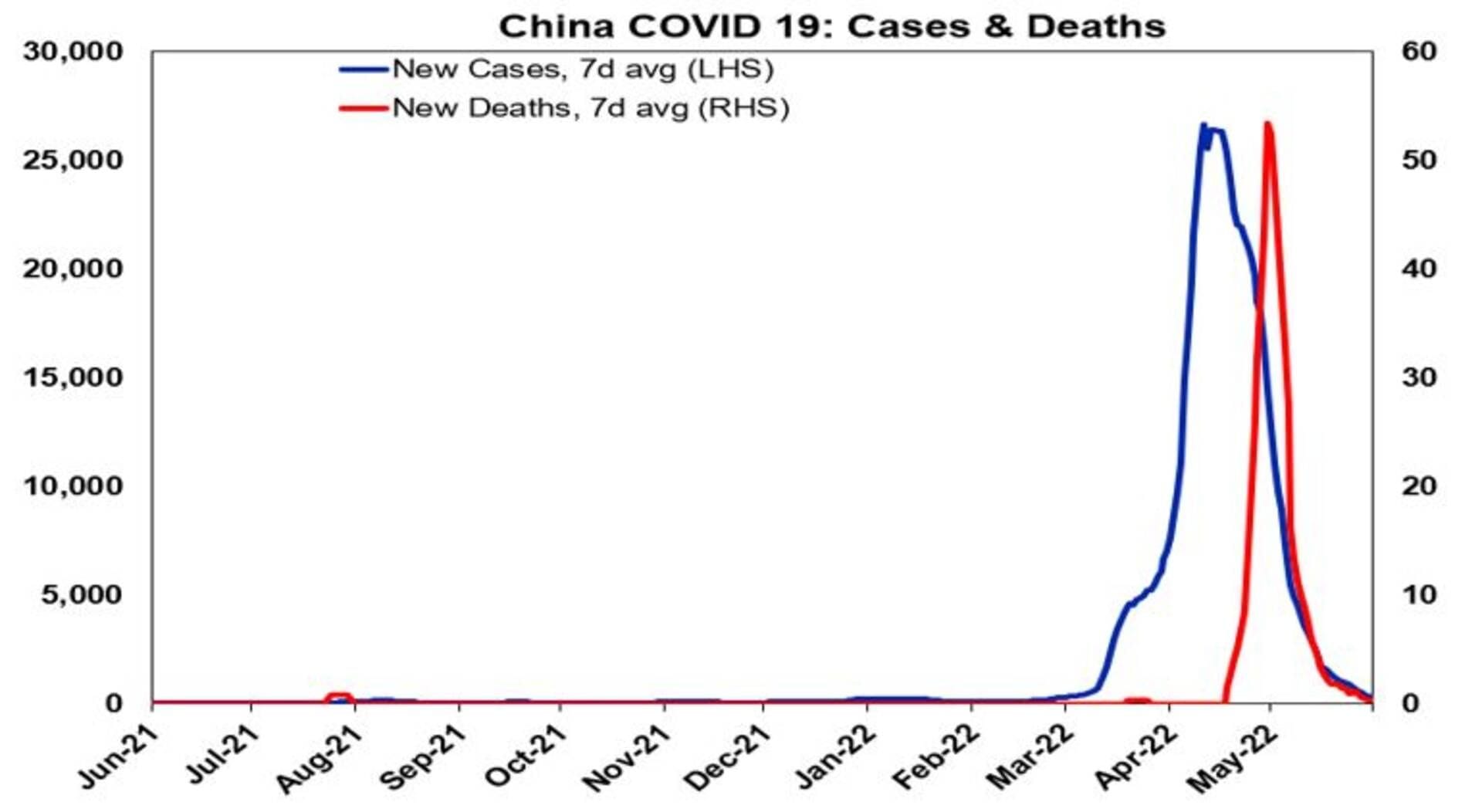

- China has seen a sharp fall in new cases and deaths enabling reopening – although the risk remains of renewed lockdowns given China’s zero covid policy, Omicron’s high transmissibility, the low vaccination rate amongst older Chinese and Chinese vaccines being less effective against Omicron.

Source: ourworldindata.org, AMP

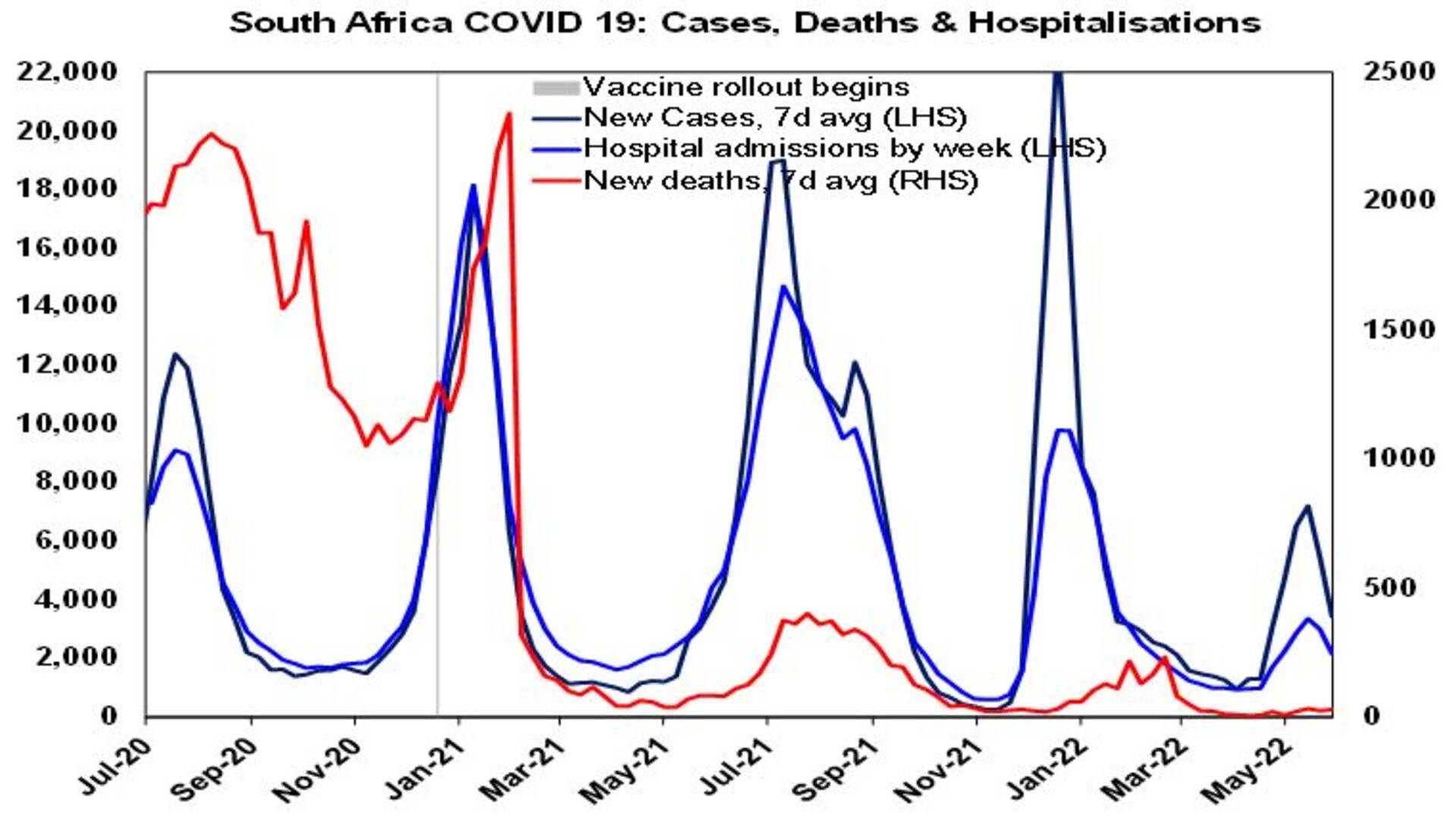

- New cases in Australia have continued to decline. While some epidemiologists are warning of a winter spike with Omicron sub-variants (BA.4 & BA.5), South Africa’s experience with such variants augurs well with new cases rolling over and hospitalisations & deaths remaining relatively subdued.

Source: ourworldindata.org, AMP

Economic activity trackers

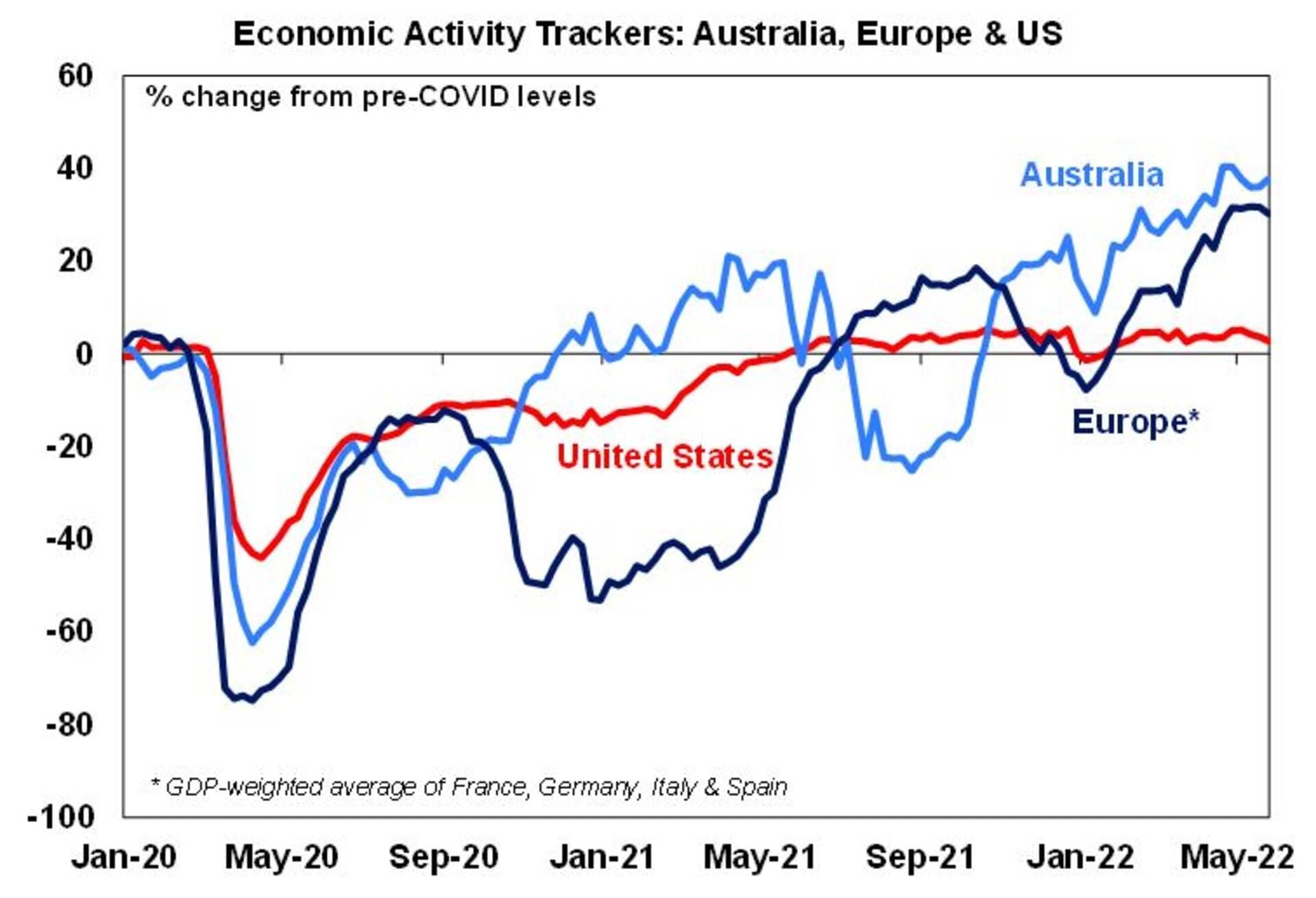

- The Australian Economic Activity Tracker rose over the last week and remains strong. The US and European Trackers both slowed a bit.

Based on weekly data for e.g. job ads, restaurant bookings, confidence, mobility, credit & debit card transactions, retail foot traffic, hotel bookings. Source: AMP

Major global economic events and implications

- US economic data releases were generally stronger than expected. The Conference Board’s measure of consumer confidence fell in May but by less than expected and it remains reasonably solid supported by the strong jobs market in contrast to the University of Michigan consumer sentiment measure which is being depressed by tighter financial conditions. Meanwhile, the ISM manufacturing conditions index unexpectedly rose and remains strong, the ratio of job openings to unemployment remains high and home prices continued to surge in March (up 21%yoy). Other jobs data was mixed with jobless claims down again but the ADP employment survey rising far less than expected in May. The Fed’s Beige Book noted that while inflation was “strong or robust” it observed some signs that it may be in the process of slowing. The ISM survey also reported improved delivery times.

- The Bank of Canada raised its key interest rate by 0.5% to 1.5% as widely expected with the Bank noting that “interest rates will need to rise further”, its “prepared to act more forcefully if needed”, inflation is likely to move even higher, there is a risk of higher inflation becoming entrenched and the labour market remains robust.

- Eurozone unemployment was unchanged at 6.8% in April and economic confidence rose 0.1pts to a level which is just above where it was pre pandemic. Inflation rose more than expected to 8.1%yoy in May with core inflation rising to 3.8%yoy which puts more pressure on the ECB with more talk that July’s rate hike could now be 0.5%.

- Japanese economic data was mostly good. Industrial production fell but unemployment declined, retail sales rose and consumer confidence rose.

- Chinese business conditions PMI’s rebounded in May, albeit to still weak levels as covid cases declined. Restrictions have now started to ease and the Chinese Government announced more stimulus measures with the latest focussed on boosting infrastructure spending.

Australian economic events and implications

- Australia’s March quarter GDP growth of 0.8% was good news. It was driven by strength in consumer spending (which is almost back to its pre-covid trend), equipment investment, public spending and a rebuilding in inventories offsetting a detraction from trade and a fall in construction which was hit by production constraints and bad weather. Wage indicators in the national accounts were mixed but are probably too distorted by compositional change and a Covid related hit to hours worked to have any impact on RBA thinking particularly given that its business liaison and various business surveys point to stronger wages growth ahead.

- April trade data saw an unexpected rebound in the trade surplus and with two months of falling imports suggests that net exports may contribute positively to GDP growth this quarter after the big detraction last quarter.

- Home building approvals fell again in April but a huge backlog of homes approved and commenced but not yet completed (due to the impact of supply constraints, labour shortages and bad weather) point to strong home building activity for a while yet.

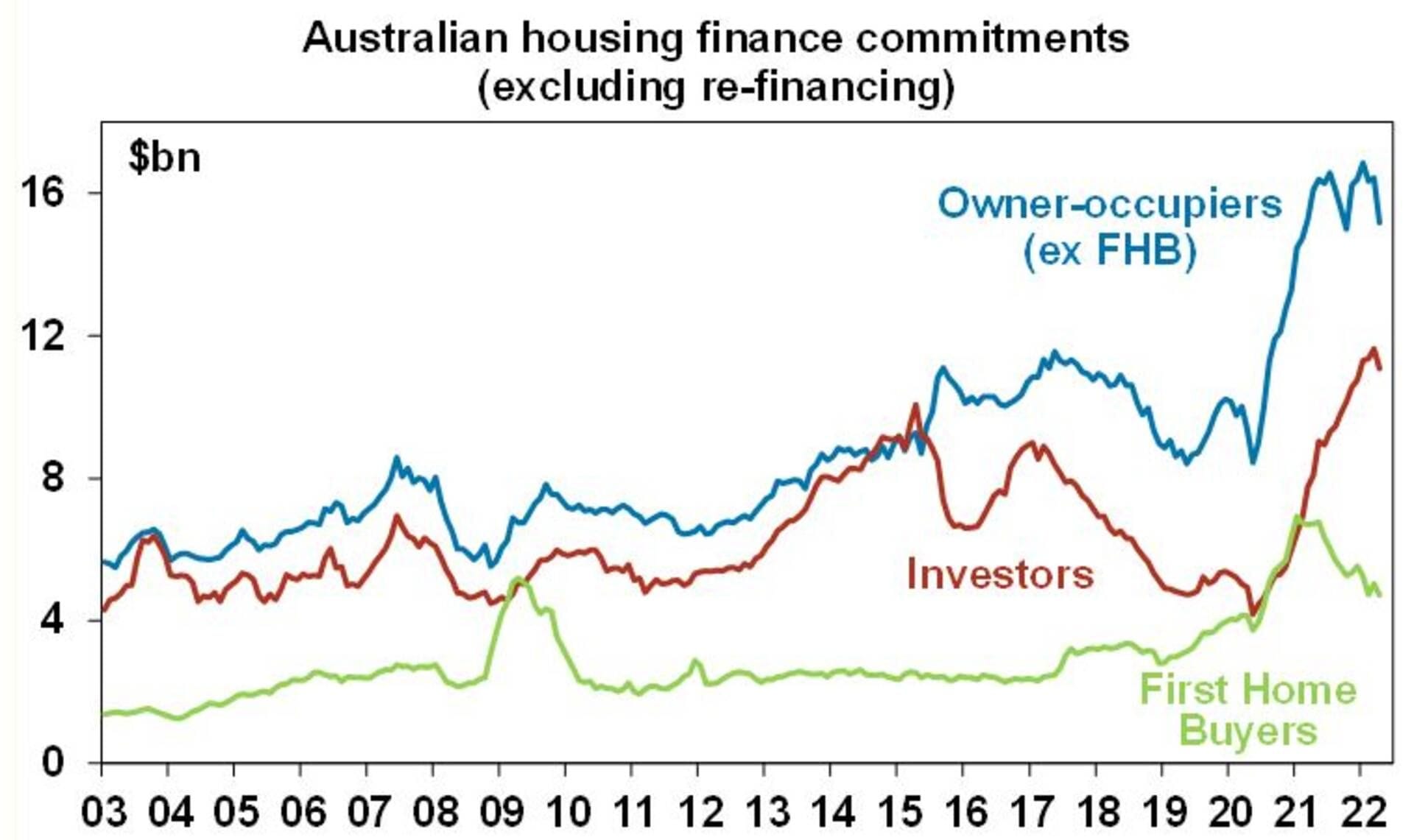

- Meanwhile housing finance fell a sharper than expected 4.8% in April adding to evidence that the housing cycle is turning down. The fall occurred before the RBA’s rate hike but reflects the impact of the surge in fixed rates which had been accounting for nearly 50% of new home financing at the height of the property boom. That said housing finance is still very high.

Source: ABS, AMP

- Australian home prices fell 0.1% in May with more weakness ahead. After a near 30% surge from their pandemic lows property prices are now starting to fall led by Sydney and Melbourne as the drivers of the boom – particularly ultra-low mortgage rates – go in reverse. Continue to expect a 10% to 15% decline in home prices over the next 18 months or so. The downturn in the property market is good news for the RBA as it indicates that its monetary tightening – which has been underway since last year with the abandonment of cheap bank funding and the 0.1% bond yield target – is getting traction and falling prices will help dampen consumer spending (via negative wealth effects) which will in turn help take pressure off inflation. So ultimately it should help limit how much the RBA needs to raise rates by – continue to see the peak in the cash rate being around 2-2.5% next year, rather than the 3.5% plus that the money market is predicting.

What to watch over the next week?

- In the US, CPI inflation data for May will be watched for further evidence of “peak inflation”. The CPI is expected to rise 0.7%mom thanks to higher energy prices, but this will still see year on year inflation fall slightly again to 8.2% from 8.3% in April. Core inflation is expected to slow further to 0.5%mom or 5.9%yoy from 0.6%mom and 6.2%yoy in April. Of course, this will still leave inflation too high and won’t stop the Fed hiking by 0.5% at each of the next two meetings but it may not add to expectations for more aggressive Fed hikes. The renewed rise in oil prices is the main threat though.

- The ECB is expected to confirm on Thursday that quantitative easing will stop at the end of the month consistent with President Lagarde’s recent blog. This will leave it on track to start raising interest rates at its July meeting. While it’s likely to acknowledge risks to the growth outlook it’s likely to be more focussed on the blowout in inflation and may intimate that a 0.5% hike could be on the table for July.

- Chinese data for May is likely to show a pick-up in export and import growth (Thursday), a slight rise in CPI inflation to 2.2%yoy due to higher food and energy prices, but a fall in producer price inflation to 6.5%yoy.

- In Australia, the Reserve Bank (Tuesday) is expected to raise its cash rate by 0.4% taking it to 0.75%. The clear messages from the RBA since its May meeting are that: it’s concerned about a rise in inflation psychology (or expectations); bigger rate hikes are not off the table as it seriously considered a 0.4% hike in May but opted for a “business as usual” 0.25% hike; and that more rate hikes are on the way. Since the last meeting: March quarter wages data was on the soft side but was in line with RBA expectations; the fall in unemployment to 3.85% in April along with numerous business surveys and the RBA’s own business liaison point to an acceleration in wages growth; March quarter GDP growth was strong and was around or slightly stronger than the RBA’s own implied forecasts; news of inflationary pressure continues to mount notably with a rebound in petrol prices and reports of surging power prices and rents. As a result, RBA concerns about rising inflation psychology are likely to have increased arguing for a step up in the pace of tightening in June in order to get on top of inflation – just as we have been seeing in New Zealand, Canada and likely soon in the US – and so expect a 0.4% hiking taking the cash rate to 0.75%. There is a risk it could even opt for a 0.5% hike. Either way by year end it is likely to continue to see the cash rate rising to between 1.5% and 2% with a peak of 2% to 2.5% next year.

- On the data front it’s a relatively quiet week in Australia but the Melbourne Institute’s Inflation Gauge for May (Monday) will no doubt be watched closely in terms of ongoing inflation pressures.

Outlook for investment markets

- Shares are likely to see continued short term volatility as central banks continue to tighten to combat high inflation, the war in Ukraine continues and fears of recession remain. However, it is likely to see shares providing reasonable returns on a 6-12 month horizon as global recovery ultimately continues, profit growth slows but remains solid and interest rates rise but not to onerous levels.

- Still relatively low yields & the risk of a further rise in bond yields points to constrained returns from bonds.

- Unlisted commercial property may see some weakness in retail and office returns (as online retail activity remains well above pre-covid levels and office occupancy remains well below pre-covid levels), but industrial property is likely to be strong. Unlisted infrastructure is expected to see solid returns.

- Australian home prices are expected to fall further as poor affordability and rising mortgage rates impact. Expect a 10 to 15% top to bottom fall in prices over the next 18 months but with a large variation between regions. Sydney and Melbourne prices are already falling.

- Cash and bank deposits are likely to provide poor returns, given the still low cash rate of just 0.35% at present but they should improve as the RBA raises interest rates further.

- The $A could remain volatile in the short term as global uncertainties persist. However, a rising trend in the $A is likely over the next 12 months helped by strong commodity prices, probably taking it to around $US0.80.

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer