- Share markets were hit over the last week as Ukraine tensions escalated and then Russia invaded Ukraine. Although Russia has indicated it does not plan to occupy Ukraine it has indicated that its attack is aimed at its “demilitarization and denazification.” While US shares saw a small bounce on Wednesday on hopes that a worsening of the energy crisis would be averted, this still left US and global shares below the lows they saw in January. Australian shares were also dragged down with retailers, materials and financials hit the hardest more than offsetting gains in defensive sectors like consumer staples and utilities. Oil prices pushed higher as the conflict escalated with West Texas Intermediate rising above $US100/barrel briefly before pulling back a bit. Long term bond yields were mixed with fear of higher inflation being offset by safe haven buying. Metal prices rose but the $A was little changed despite safe haven buying pushing up the $US.

- From their bull market highs late last year or early this year US shares have now fallen 12%, Nasdaq has fallen 19% and global shares have fallen 10%. To their lows in January Australian shares fell 10%, but they are currently about 2% above that low.

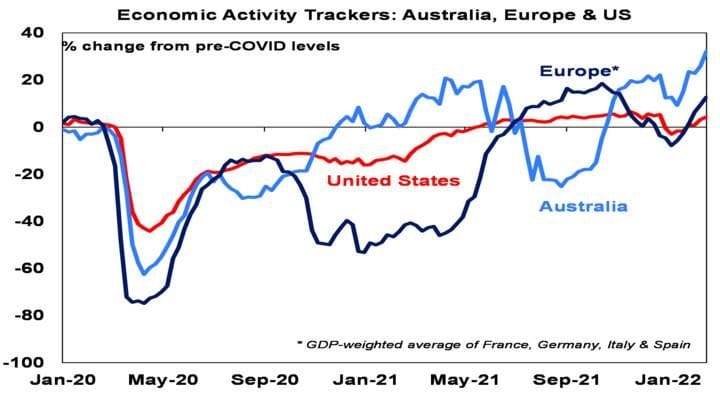

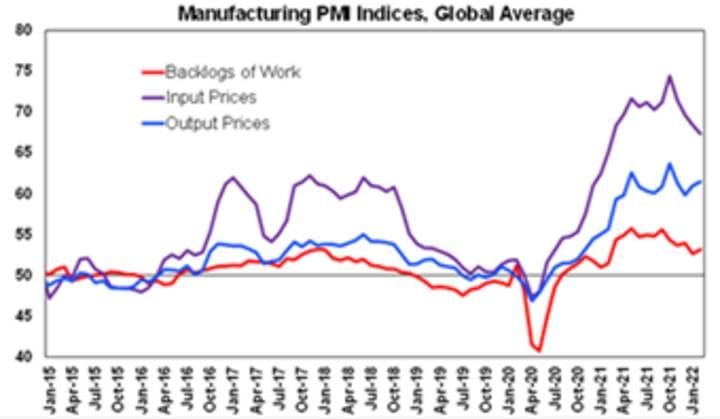

- The market reaction to the Ukraine conflict reflects a fear of the unknown about how far the conflict will go, how severe sanctions will ultimately be and uncertainty about how severe the economic impact will be with the main threat being through higher energy prices. In terms of latter the key risk is that Russia (which accounts for around 30% of European gas imports) cuts off its supply of gas to Europe when prices are already very high, with a potential flow on to oil demand at a time when conflict may threaten oil supply. In short, investors are worried about a stagflationary shock to Europe and, to a lesser degree, the global economy generally.

- With uncertainty over the conflict remaining high the risk is that shares face further weakness in the short term. As markets fall, defensive trades like utilities, health and consumer staples along with energy and hedges like gold (which has been a far better hedge through this crisis than Bitcoin which just seems to bounce around with shares) will likely outperform. If the conflict is limited to Ukraine with Russian gas still flowing to Europe and NATO not getting involved, then the economic fallout will be limited, and further share market falls may be no more than another 5% or so. Of course, if gas is cut off and NATO countries get involved then the plunge in share markets could be much deeper (like another 15% or so).

- However, there are several points to make in relation to all of this:

- First, Russia is aiming to neutralise Ukraine to prevent it from joining NATO and the conflict there could go on for a while until this is achieved.

- Russia has no interest in war. NATO and President Biden continue to stress that the US will not engage in military conflict with Russia just as it managed to avoid it right through the Cold War and ever since. The presence of nuclear weapons on both sides remains a huge deterrent here.

- While western sanctions on Russia targeting banks, financing, individuals and technology transfer will have a significant impact on Russia, the Russian energy sector has been excluded with both the US and Europe seeking to avoid a further sustained surge in energy prices (both oil and gas). Germany has halted approval of the Nord Stream 2 pipeline, but no gas is flowing through it anyway.

- European exports to Russia are just 0.7% of its GDP and US exports to Russia and Ukraine are less than 0.2% of its GDP so the direct impact on them from say a collapse in the Russian economy would be small. The main threat will come via a short term hit to confidence (which is likely to be brief if the conflict is contained to Ukraine) and higher energy prices.

- The US economy is less vulnerable on the energy front than Europe as it produces and exports more energy than it consumes and imports. There is a high-risk Russia could cut off the flow of gas to Europe but with the sanctions carving out the Russian energy sector and Russia needing the revenue it’s unlikely to do so – about a third of Russian government revenue comes from the energy sector. But energy prices are likely to be higher than otherwise reflecting a risk premium as long as uncertainty remains high around the conflict and therefore the risk of supply disruption. The same will likely apply to other commodity prices including foodstuffs as Ukraine is a significant food producer.

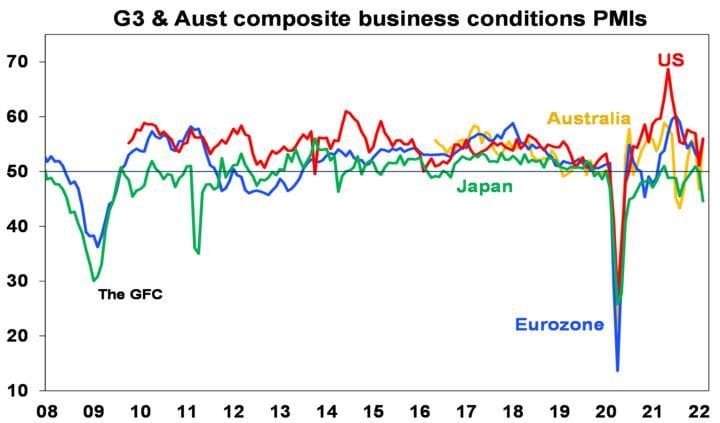

- On balance, providing the conflict is limited to Ukraine, NATO troops stay out, and Russian gas is not cut off the conflict is unlikely to significantly damage global growth but is more of a threat to inflation.

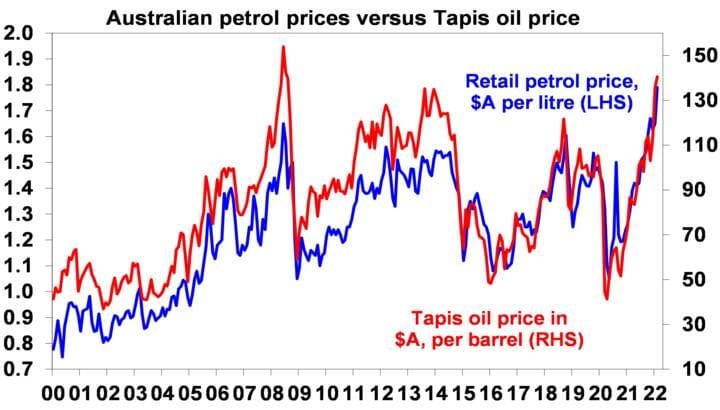

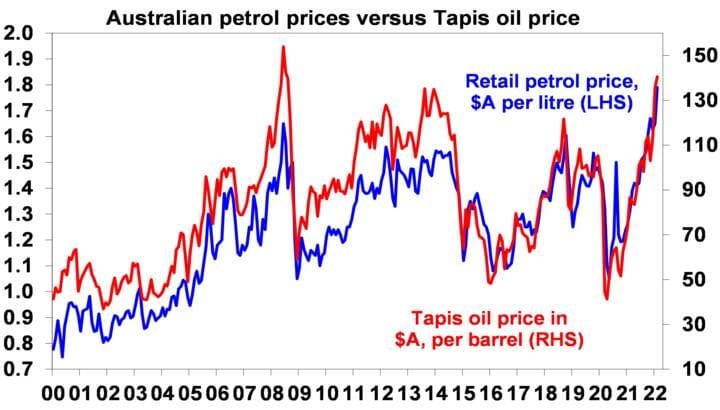

- Australia’s trade links with Russia are trivial – with exports to Russia accounting for less than 0.1% of GDP and the sanctions on it will have little economic impact on us. However, the main impacts will be three-fold. First, a positive boost to national income via higher energy and commodity prices as export earnings will see a boost. Second, a higher cost of living mainly via the further boost to oil and hence petrol prices (which could easily spike another 10-20 cents a litre in the next two weeks). And third, a hit to economic activity if global growth slows hitting confidence and export demand. But as noted above the latter is likely to be relatively minor.

Source: Bloomberg, AMP

- Of course, no one really knows for sure how this will all unfold. But there is a long history of various crisis events impacting share markets (major events in wars, terrorist attacks, financial crisis, etc) and the pattern is the same – an initial sharp fall followed by a rebound. Based on multiple crisis since 1940 the average decline in US shares has been about 6% (albeit with a wide range) but six months later the market has been up 9% on average and then up 15% on average one year after that. The same is likely to apply this time as well but trying to time this will be very hard so the best approach is for investors to stick to an appropriate long term investment strategy.

- The Ukraine crisis is unlikely to stop central bank monetary tightening, but it may prevent rapid tightening moves. The uncertainty and hit to confidence it provides in the short term will probably help head off a 0.5% rate hike next month in the US and may at the margin help delay RBA tightening. But as noted above, ultimately the hit to economic activity globally and in Australia is likely to be limited and the upwards pressure it adds to energy prices and wider commodity prices will reinforce the case for monetary tightening. So, there are no changes to interest rate expectations.

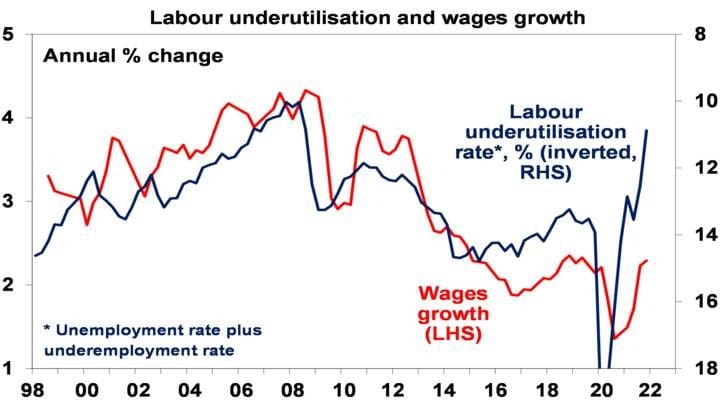

- In Australia, December quarter wages growth at 0.7%qoq and 2.3%yoy was not strong enough to advance the case for a June RBA rate hike, so it’s likely to see the first hike as coming in August. Of course, another significant upside surprise on inflation for the March quarter (due in late April) and a further acceleration in wages growth in the March quarter (due in late May) and a continuing fall in unemployment could tilt the scales to a June hike but we are not there yet.

|