Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Compare pears with pears, not apples

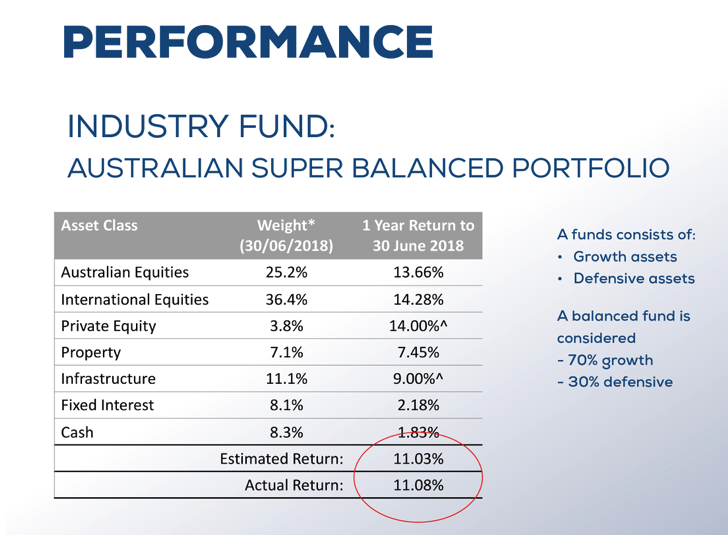

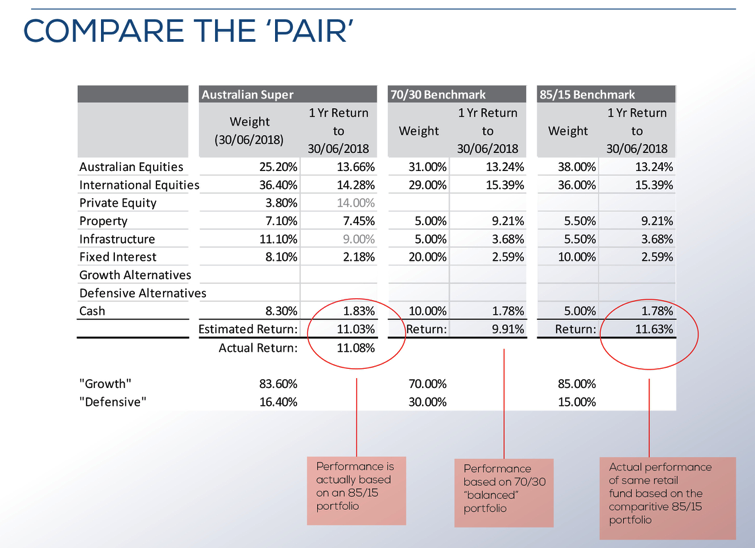

Australia’s Industry Super Funds have been running the highly effective ‘compare the pair’ campaign for many years. However, Zenith (a leading research consulting firm) argue in a recent paper that ‘this comparison is not straightforward and is often misleading’.

Zenith’s research focus on what constitutes a ‘Balanced’ Super Fund portfolio. They argue that most people’s definition of ‘balanced’ is something like a 60/40 mix of Growth and Defensive assets. However, the so-called Balanced Option of Industry Super Fund, Host Plus, contains a staggering 93% exposure to Growth assets (largely equities, property and infrastructure). The largest Industry Super Fund, Australian Super, has 79% growth assets in its Balanced option. This means that in rising markets, they are likely to outperform, but may leave investors highly exposed in falling markets.

Zenith conclude by urging investors to look under the hood and compare pears with pears, not apples!