Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Lowe’s charts, The great reallocation, Stumbling towards retirement, Megatrends and More

29th July 2022

Has there ever been more general public interest in inflation? It’s even reached the unusual point where the Prime Minister, Anthony Albanese, has waded in, warning the Reserve Bank against “overreach”. Typically, Prime Ministers are expected to be on their ‘best behaviour’ when it comes to influencing the independence of the Central Bank.

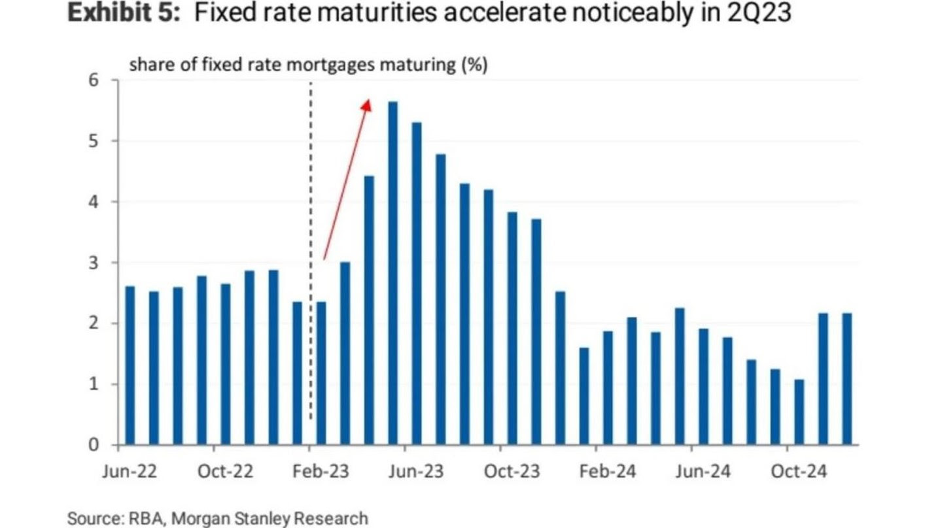

It certainly highlights how difficult it is for Central Banks right now. Their ability to raise cash rates is significantly different from pre-GFC and even pre-Covid due to the extraordinary amount of debt in the world (government, corporate and household). Returning to even a neutral rate environment is very much hampered by the fact that it will cause tremendous pressure. Inflation is a sticky business. But having the stomach to raise rates enough (so high it could trigger a recession) is not an easy ask.

Most analysts seem to think that Central Banks will remain hawkish on rates (ANZ are predicting four more 0.5% hikes over the next four months), but others are not so sure, touting a ‘stop, start’ approach as the Central Banks’ more palatable scenario. After all, if a hard landing does become imminent, it is not just the fear of recession but also a debt trap. (In gauging Governor Lowe’s thoughts on the subject, our ‘charts of the week’ may provide some useful insight).

In markets, the latest growth figures were released overnight, painting a picture of the US economy. The figures showed a contraction over the last quarter of 0.9% (annualised); economists had previously predicted an expansion of around 0.5%. Compared with the previous quarter, however, both inflation and the rate at which growth contracted have moderated. The inference being we could be seeing a bottoming out of slowing economic activity.

Investors were encouraged by this news, which partially translated to the gains seen on the S&P500, Dow Jones and Nasdaq last night. The ASX is also up and about, opening this morning 1.5% ahead for the week and finishing up 2.3% for the week (5.5% for the fortnight).

In most parts of the world, back-to-back quarters of declines in GDP define a recession, but in the US, it’s not official until economists at the National Bureau of Economic Research (NBER) deem it so. The NBER’s Business Cycle Dating Committee rejects the notion that two quarterly contractions in gross domestic product are conclusive of a recession. Instead, the group of eight economists looks at a series of monthly economic reports to see if there is “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

Speaking on this topic, Chair Powell stated, “I do not think the US is currently in a recession. And the reason is, there are just too many areas of the economy performing too well”. And he pointed to the strength of US employment in particular.

Treasury Secretary Janet Yellen also remained optimistic stating that she would “be amazed” if the NBER declared a recession.

They will certainly be feeling the political heat in the NBER committee room right now!

Chart(s) of the Week

It was of little surprise that Governor, Philip Lowe’s address to the Australian Strategic Business Forum last week, was centred around inflation.

Reiterating his recent views, he showed a number of charts as a measure that he believes inflation expectations are tempering.

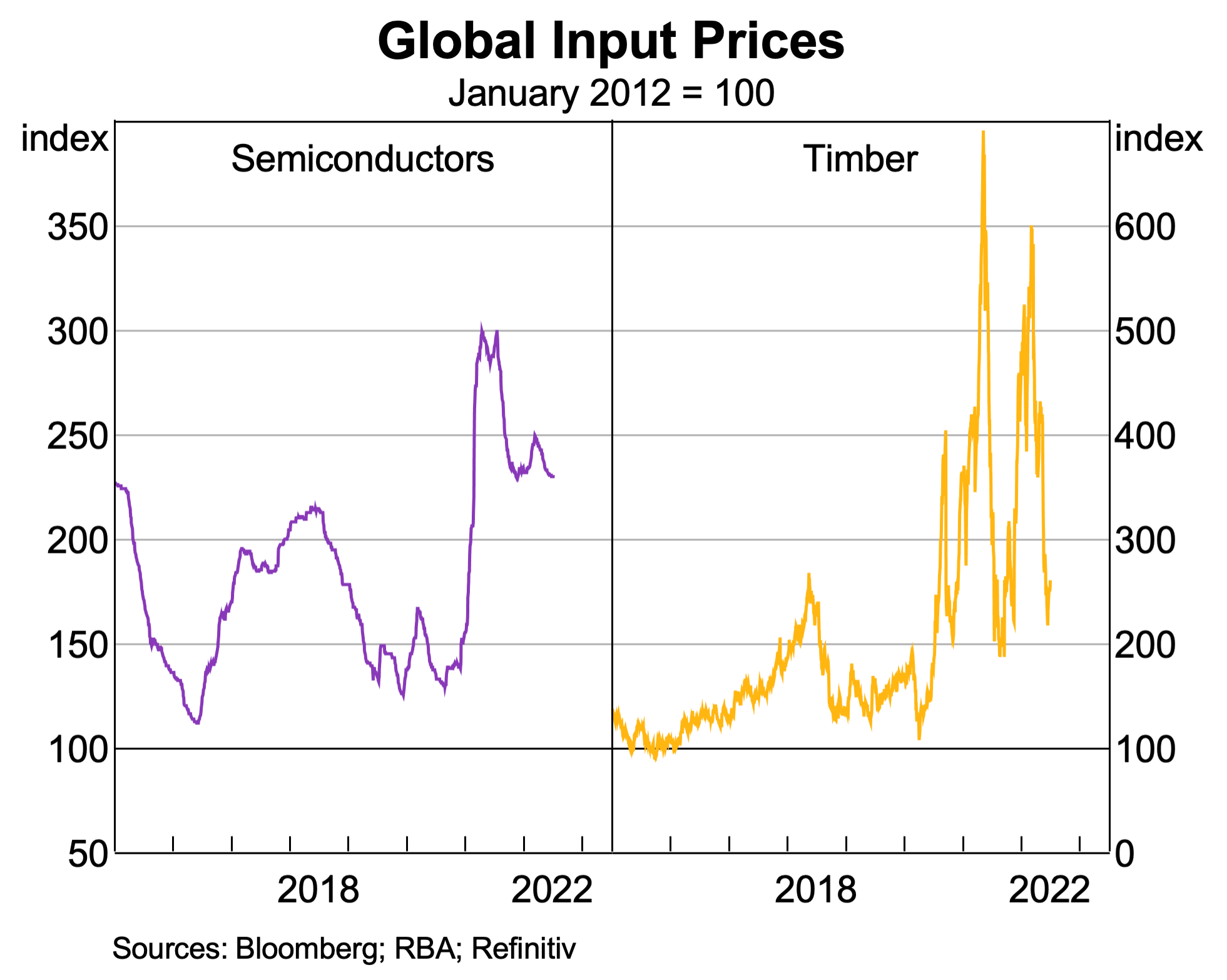

Offering some hope that supply issues are easing, he used the following chart as evidence of some re-balancing in consumer demand across products as diverse as computer chips and timber.

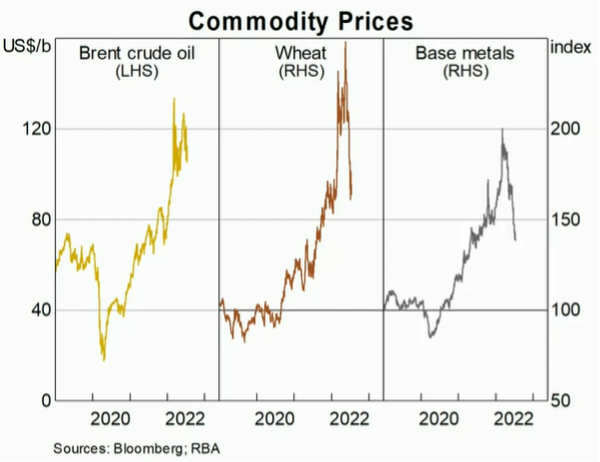

Lowe also reflected on recent declines in commodity prices. Whilst, in part, declines reflect increased concerns in economic strength (globally), if lower prices are sustained, it will ease some of the current inflation pressures.

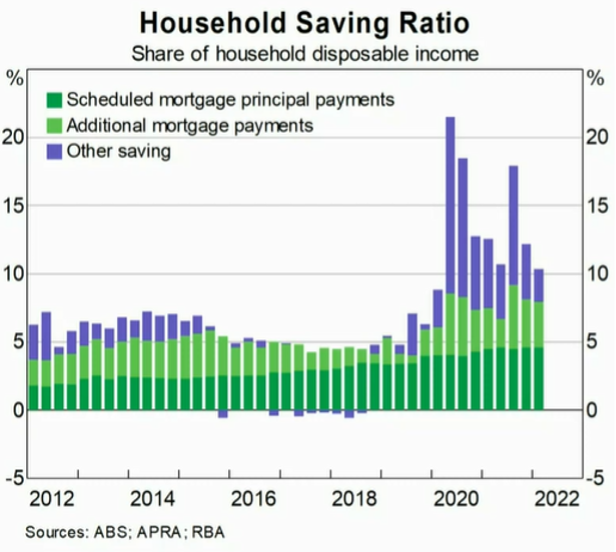

A major investment implication is the effect that rising interest rates will have on mortgages (particularly the mortgage books of our banks). Lowe used this slide to show how well positioned he believes Australian households are to withstand another rate rise.

Albeit brief, Lowe also acknowledged the issue of productivity in Australia as well as the future of money (AKA, the importance of a central bank as regulator). For economic enthusiasts, it is worth the read and a transcript of his address can be found here.

Stumbling Towards Retirement

This is a gem of an article that took LinkedIn by storm, written by Peter Bloom, a former private equity executive, on how he stumbled into retirement. Mr Bloom describes with great compassion how he overcame his greatest fear – irrelevancy. This is a must-read for anyone who is less than five years from retirement.

Part 2 – PIMCO Secular Outlook: Investment Conclusions

As promised – part 2 of key takeaways from PIMCO’s recent annual Secular Forum. For those who missed Part 1, you can catch up here.

Investment Conclusions (secular outlook – five years)

Key Messages

- Resilience (robust portfolios) over yield

- Lower return world – A more volatile macroeconomic and market environment call for realistic expectations for asset markets

- Hedge against inflation (a good video from Macquarie, titled ‘forget traditional hedges think equities’ can be found here)

- Opportunities call for active management

- Restored value in the bond market – Positive returns are expected on most bond benchmarks over the secular horizon.

Sector Opportunities

- Public Credit – Cautious on corporate credit, focus on quality.

- Private Credit – Healthy initial valuations for diversified segments such as aircraft finance, real estate lending, equipment leasing, and royalty financing

- Equities – Recognising secular themes and identifying beneficiaries of the new environment will be integral (see our article on Megatrends below).

- Emerging markets – Offer higher return potential, but selection is crucial, as volatility and geopolitical tensions may create winners and losers.

- Currencies – U.S. dollar appears overvalued, but it should serve as a perceived source of relative safety during periods of volatility.

PIMCO’s annual secular forum first began back in the 1970s and brings together some of the best financial and investment minds from across the world. This short video provides an interesting ‘glance behind the scenes’.

The Great Reallocation

What’s it going to take for Australia to make the clean energy transition in economic terms? According to National Australia Bank chairman Phil Chronican ‘Mind-bogglingly large’.

Australia must spend $70 billion on structural changes and $420 billion in new investment over the next 30 years to position its economy for growth in a low-emissions world, according to new research from Deloitte Access Economics (Commissioned by NAB).

This can be achieved by assessing the projected $20 trillion in economic investment in the Australian economy in the years to 2050 and recalibrating it.

“It is a transformation Australia can afford, with $20 trillion in investment to be spent regardless of whether the transition is made. The cost of inaction will be far greater than any new investment, both economically and environmentally.

If we get it right, the opportunities are immense,” Chronican said, but he also warned that “the scale of action needed is far broader than the Industrial Revolution and the timeline is roughly half”.

Dubbed the great reallocation the research pinpoints four economic systems that must become low emissions for a successful transition: energy, mobility, raw material manufacturing, and food and land use. Today they represent around 90 per cent of Australia’s emissions.

According to finance publication Livewire the ASX may just be home to the longest dividend-paying company in the world – Westpac (The Bank of NSW until 1982). Since it was established in 1817, it has not missed a dividend. That’s including during the 1890s banking crisis, the subsequent 1890s depression, WWI and WWII, the Great Depression and even when the bank was arguably insolvent during the aftermath of the 1990s recession.

Whilst this world record can not be verified in any official capacity, it nonetheless illustrates the stability of Australia’s banking system.

Once in a Decade Report – Megatrends

Every 10 years, the big brains of Australia’s science research agency – the CSIRO – outline their take on the ‘megatrends’ that will shape our lives in the coming decades.

The work builds on the last report (2012) by exploring how the previous megatrends have evolved as well as the new trends, impacts and drivers that have emerged over the last decade.

In short:

- We will become more digital, and that will unlock a new world of entertainment and retail options, as well as more ‘teles’ (telehealth, telework etc.).

- Adapting to climate change and unprecedented weather events, followed by living cleaner, leaner and greener, will see us adopt solutions through synthetic biology, alternative proteins and advanced recycling.

- Health challenges (ageing populations, chronic illness, mental health, and unsustainable healthcare spending) remain, but living in a post-pandemic world has exacerbated these existing health challenges and created a burning platform to respond to future risks.

- Rapid economic growth and urbanisation across Asia and the demands of a growing middle-class population are so 2012. Now… we face an uncertain future in geopolitics, characterised by disrupted patterns of global trade, geopolitical tensions and growing investment in defence.

- Last decade it was a promise of science, technology and innovation as a potential driver of opportunities… Now we look to a future in which artificial intelligence is the norm and investment in research and development explodes around the globe.

In summing up the report, CSIRO’s Dr Stefan Hajkowicz had this to say:

“We use the analogy of an ocean rip for a megatrend. The better you’re able to comprehend it and understand where it’s taking you, the better you’re able to respond and survive and thrive.”

The full report can be found here.

A Tonic For Turbulent Times

At turbulent times like this, it pays to check some basic principles, Dr Shane Oliver, AMP’s long-standing Chief Economist, reminds us of nine quick investing tips which stand the test of time.

Let the Games Begin

Today marks the first day of the 2022 Commonwealth Games in Birmingham. To celebrate, here are some classic moments of games gone by.

We wish all athletes the best and look forward to watching a competitive, fair and successful games.

Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser.