Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 28th February 2014

Investment markets and key developments over the past week

- It’s been a somewhat mixed week for global and Australian shares as indexes flirt with post-global financial crisis highs and the situation regarding Ukraine remains uncertain. Economic data continues to be rather confusing and US Federal Reserve (Fed) Chair Janet Yellen left the door open for a pause in slowing its monetary stimulus if needed. US shares rose +1.3% with the S&P 500 making a new record closing high and Eurozone shares gained +0.6%. Japanese shares fell -0.2%, Chinese shares fell -2.7% and Australian shares fell -0.6% with the latter not helped by poor business investment data. Most share markets had a solid February with gains around +4% or so.

- Reflecting mixed economic data and worries about Ukraine, bond yields mostly fell over the last week. Spanish and Italian bond yields in fact fell to around 3.5%, their lowest since early 2006 as Eurozone crisis fears continue to recede. Commodity prices were soft and the Australian dollar fell.

- Ukraine is a source of uncertainty for markets. It’s too small and its problems too specific to be a threat to global growth. The main risk is it triggers wider conflict between the West and Russia, possibly involving a Ukrainian civil war. Russia sees it as a brotherly country and is not happy at its recent swing to the West, as evident by its invasion of the Crimea (which is dominated by Russians and is the home of its Black Sea naval fleet). Much will depend on how much support Europe and the US offer Ukraine. They may be a little wary, seeing Ukraine as too close to Russia to want to get involved too heavily, particularly as the Eurozone gets 25% of its gas from Russia. Russia may also decide it cannot afford a full scale invasion. But there is still likely to be a period of uncertainty.

- Is the People’s Bank of China easing? A decline in the value of the Chinese renminbi (RMB) and a (probably related) fall in Chinese money market rates seem to have created a bit of confusion over the last week. Both of these could just be normal market noise, for example the RMB is only down -1.7% from its January high, and the People’s Bank of China could just be providing a reminder that it can be volatile and is not a one way bet higher. Then again it could signal a slightly easier stance on monetary policy, which may be consistent with recent mixed economic data and clear signs that Chinese home price growth is cooling down. Time will tell.

- More jobs layoffs in Australia. News that Qantas will lay off 5000 workers adds to the sense of gloom hanging over the Australian jobs market. But it’s worth noting that the layoffs do not reflect a lack of demand but rather competitive pressures Qantas is facing, that they will spread out over the next three years and that the coming housing construction recovery, the lower Australian dollar and improved business confidence and general hiring plans all point to a strengthening in jobs growth most likely during the second half of this year. So it’s not all doom and gloom.

- Hot internet start-ups and takeovers of such stocks with little revenue or earnings along with talk that the “number of users is the dominant driver” is all very reminiscent of 1999. Fortunately, the broader US market is a long way from late 1990s valuations or euphoria with the forward price-to-earnings ratio today at 15 times compared to 24 times at its tech boom peak and NASDAQ valuations are around one-third of tech boom peak levels.

Major global economic events and implications

- US economic data remained messy with soft readings for the Markit services conditions index, consumer confidence, some regional manufacturing conditions surveys, mortgage applications (although falls here may be partly seasonal) and jobless claims. But there was a surprisingly strong gain in new home sales, continued strength in home prices which rose +13.4% last year and slightly better than expected durable goods orders after allowing for volatile aircraft orders. Fed Chair Yellen essentially repeated her message that tapering remains on track but indicated the Fed is trying to get a handle on whether the weather is driving recent soft data or something more worrying, with the implication being that the taper could be delayed or slowed if needed.

- Eurozone confidence indicators confirmed the ongoing economic recovery but weak lending and money supply data and low inflation highlight the case for more European Central Bank stimulus.

- Japanese activity data for January was a good with very strong industrial production, a solid purchasing managers’ index (PMI) pointing to more gains ahead, stronger than expected retail sales and household spending. In addition, unemployment remains down at 3.7%, the job vacancy to applicants ratio is rising a bit and core inflation remains at +0.7% year-on-year. The main uncertainty though is around to what degree the approaching sales tax hike has pulled demand forward.

- China’s official February manufacturing PMI fell slightly to 50.2 from 50.5 confirming a modest slowing in growth, but it remains much stronger than the HSBC PMI. Both PMIs remain in the range they have been in for the last two years now which suggests that growth is continuing to bounce around +7.5% per annum.

- It was good to see Brazilian gross domestic product (GDP) growth come in stronger than expected in the December quarter leaving it up +2.3% for the year. That said Brazil’s growth isn’t what it used to be and structural challenges remain and with the central bank raising interest rates yet again there are still downside risks to Brazilian growth. Indian December quarter GDP growth at +4.7% year-on-year was stronger but still continues to slow.

Australian economic events and implications

- Australian investment data was depressingly soft, pointing to a broad based fall in investment in the December quarter and intentions data pointing to a sharp fall in business investment in 2014-15 as mining investment winds down. Comparing intentions for 2014-15 with those made a year ago for 2013-14 suggests a -17% fall in investment led by a -25% fall in mining and a -20% fall in manufacturing. However, the final outcome may not be that bad as such an approach looks to have exaggerated weakness this financial year. Secondly, investment intentions in industries outside of mining and manufacturing are starting to improve. Thirdly, the impact on overall economic growth of the slump in mining investment will be partly offset by a slump in related imports, just as the mining investment boom was partly offset by surging mining related imports. Finally, the strength in building approvals points to a strong upturn in dwelling related construction ahead.

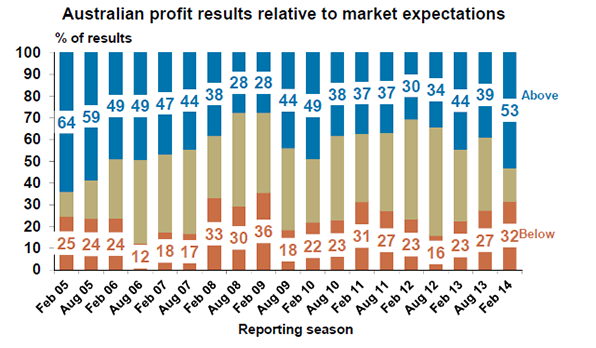

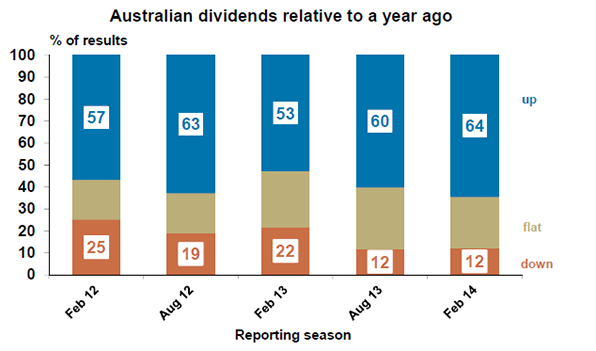

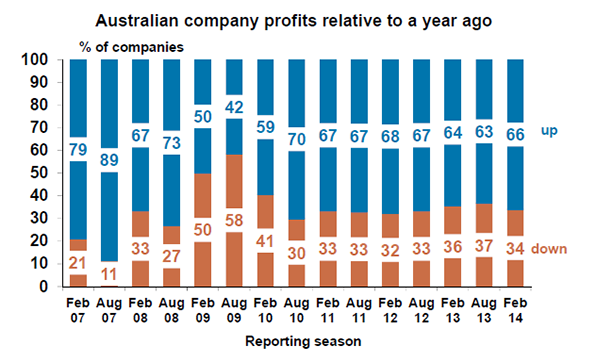

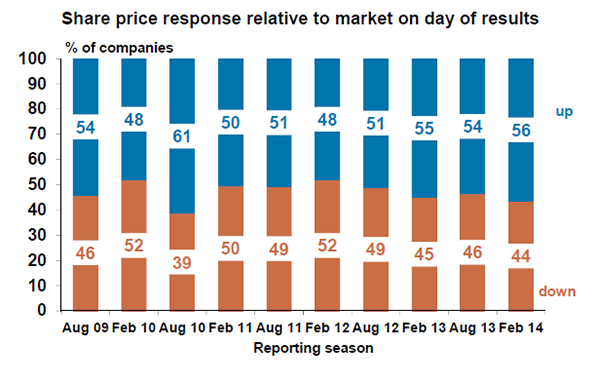

- The Australian corporate earnings season has now wrapped up. As is often the case the companies with great results often go first followed by those not doing so well. That said, overall results remain pretty good and confirm the profit cycle has now turned up with large companies, notably the resources and banks, playing a bigger role than normal in driving growth. In aggregate, 53% of companies exceeded expectations (compared to a norm of 43%); 66% of companies have seen their profits rise from a year ago (compared to a norm of 66%); 64% of companies have increased their dividends from a year ago (which is up slightly from around 62% in the last two years); and 56% of companies have seen their share price outperform the day they released results. Key themes have been a massive turnaround for the resources stocks (notably Rio Tinto and BHP Billiton) leaving the sector on track for circa +40% earnings growth this financial year, banks doing very well (with good results from the Commonwealth Bank, ANZ and National Australia Bank), help coming through from the lower Australian dollar, ongoing cost control making up for still soft revenue growth, signs of improvement from some cyclicals (like Boral, JB Hi-Fi, Fairfax and Seek) and strong growth in dividends. A +14% surge in dividends from a year ago was mainly driven by big companies such as Rio Tinto, Commonwealth Bank and Telstra. At 64% the dividend payout ratio is still not excessive for the overall market and higher dividends are usually a sign that companies are confident about the outlook. The bottom line is that Australian earnings look to be on track for growth of around +15% this financial year, with a +40% surge in resources’ profits, a +10% rise in financials’ profits and a +6% rise in profits for the rest of the market.

All charts source: AMP Capital

What to watch over the next week?

- In the US, the main focus is likely to be on February manufacturing conditions indicators (due Monday) and employment data (Friday), but unfortunately both are likely to present a confusing picture given poor weather in February. The manufacturing conditions PMIs are likely to present a divergent picture with the Institute of Supply Management index likely coming in around 52 but the broader Markit index remaining solid around 56.7 in line with its advance reading. With a snowstorm affecting some of the US when the February employment survey was undertaken, payroll growth is likely to have remained relatively soft at +150,000 and unemployment is likely to be unchanged at 6.6%.

- In the Eurozone, the European Central Bank (Thursday) may finally act on its easing bias, possibly cutting interest rates a bit further and maybe announcing a form of quantitative easing involving the purchase of bank loans. While GDP is growing again it is still gradual, lending growth remains depressed and there is a risk of deflation. The Bank of England (also Thursday) is likely to leave monetary policy unchanged.

- In China, the National People’s Congress (starting Wednesday) will likely set a growth target for this year of +7.5% , but the key focus will be on the approval and enactment of further financial deregulation and various fiscal, administrative and welfare reforms flowing from the Third Plenum last year. Chinese data for February will also start to flow with trade figures (due March 8th) likely to be looked at very closely to see whether the circa +10% growth in exports and imports reported for January continued in February.

- The Reserve Bank of Australia (RBA) is expected to leave interest rates on hold for the sixth meeting in a row (Tuesday). The RBA has clearly indicated that with growth remaining low, but tentative signs of improvement in some indicators, a period of stability in interest rates is appropriate. Since not enough has really changed since the last meeting, this remains the case. Soft jobs news and the poor business investment outlook do suggest though that our expectation for rate hikes to commence later this year may be premature with the risk being that they won’t occur till next year. Governor Steven’s Parliamentary testimony (Friday) will be watched closely for his views on the jobs and investment front.

- Meanwhile, there will be a data avalanche in Australia with the Australian Industry Group’s manufacturing PMI, house prices, new home sales and ANZ job ads all due Monday, January building approvals likely to gain +1% (Tuesday), December quarter GDP (Wednesday) expected to show just +0.3% quarterly growth (or +2.1% year-on-year) thanks in part to solid retail sales and trade offsetting poor investment, and retail sales (Thursday) expected to have fallen slightly after eight months of gains.

Outlook for markets

- This year will likely see returns from shares a bit more constrained and volatile than was the case last year, but the trend for share markets is likely to remain up nonetheless. This reflects a combination of reasonable valuations, better earnings on the back of improved economic growth and easy monetary conditions helping to entice investors to switch out of cash and bonds and into shares. With the just concluded earnings reporting season in Australia confirming that the market is on track of good earnings growth this year, the ASX 200 is on track to meet our year-end target of around 5800.

- The recent decline in global bond yields should be seen as a correction against the backdrop of a slow rising trend in yields on the back of gradually improving global growth. This will mean subdued returns from government bonds. Cash and bank deposits also continue to offer pretty poor returns given low interest rates/yields.

- The broad trend in the Australian dollar remains down on the back of softer commodity prices, a reversion to levels that offset Australia’s relatively high cost base and a decline in Australia’s growth relative to that in the US. However, short positions in the Australian dollar still remain excessive and so it could still have a bit more of a bounce before the downtrend resumes.

Source: AMP CAPITAL ‘Weekly Market Update – 28th February 2014’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer