Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

Weekly Market Update – 15th August 2014

Investment markets and key developments over the past week

- Share markets moved higher over the last week as some soft economic data highlighted the need for continued easy global monetary conditions and as geopolitical risks receded a bit. The Australian share market was also supported by good profit results. US and European shares rose 1.2%, Japanese shares gained 3.7%, Chinese shares rose 1.5% and the Australian share market rose 2.4%. Bond yields fell, with the German bond yields falling 10 basis points to just 0.95% and Eurozone peripheral country bond yields falling even more sharply. Commodity prices generally fell but the $A rose slightly on expectations that the Fed’s first rate hike might be pushed out further and as confidence readings in Australia improved.

- The past week saw a slight reduction in geopolitical risks with President Putin sounding somewhat more constructive regarding Ukraine and Iraqi PM Nouri al-Maliki stepping down hopefully clearing the way for a more inclusive Iraqi government. But as we saw Friday regarding Ukraine they can easily flare up again.

- A key concern for investors this year has been about when the Fed will start to raise interest rates as part of a broader sign that the period of ultra-easy global monetary conditions is coming to an end. However, it’s clear that the global economic recovery remains very much a two steps forward, one step back affair and this was clearly evident over the last week with poor June quarter GDP data for both the Eurozone and Japan, disappointing US retail sales data suggesting September quarter GDP growth could slip back below 3% and Chinese July data coming in weaker than expected. And of course various geopolitical events continue to wax and wane and the threat from Ebola remains in the background. Against this backdrop its hard to see the Fed wanting to rock the boat any time soon with talk of higher interest rates, let alone actual rate hikes, and other central banks are likely to maintain ultra-easy policy and may even have to ease further. As if to highlight this point, both Korea and Chile cut interest rates in the last week.

Major global economic events and implications

- US economic data provided a mixed picture with a further rise in job vacancies and small business optimism and solid growth in industrial production, but continued softness in mortgage applications, lower consumer sentiment and flat July retail sales. There was nothing to budge Fed Chair Janet Yellen from her positive but cautious perspective regarding the US economy and her reluctance to rush into raising interest rates.

- The Eurozone was weaker than expected in the June quarter with growth stalling as slight declines in Germany and Italy offset gains in most other countries including Spain and Portugal. This was disappointing given that the level of business conditions PMIs points to growth running around 0.4% quarter on quarter. Nevertheless, continuing sub-par growth, poor growth in bank lending and inflation of just 0.4% year on year and the impact on confidence and trade from the Ukraine crisis highlights that the ECB needs to do more.

- In the UK, the Bank of England’s inflation report revised down its wage growth forecasts yet again implying the first BoE rate hike is getting pushed out.

- The Japanese economy went backwards in the June quarter. While this expected given the sales tax hike and forward looking indicators point up, there’s still a way to go before Abenomics can be declared victorious.

- Chinese data for July was softer than expected but still looks consistent with GDP growth around 7.5% this year. Growth in activity indicators, monetary aggregates and credit all slowed from June, but remain solid with industrial production up 9% year on year and credit up 15.8% year on year and in a range consistent with the Government’s growth target. With interbank lending rates having fallen lately it looks like monetary conditions have been eased again this month. What does seem clear though is that while China is not going to have a bust it won’t be going back to last decade’s booming growth rates either.

Australian economic events and implications

- Australian economic data provided a mixed bag. The good news was that business conditions and confidence both rose in July to reasonable levels, consumer confidence has continued to recover from its Budget related scare and house prices are continuing to rise but at roughly half the rate over the first six months of the year compared to the last six months of last year. Against this, wages growth remains at a record low with real wages continuing to decline which is bad news for household income but good news for inflation. The bottom line is that the economy is nowhere near as weak as feared and if anything appears to be picking up pace after what looks to have been a poor June quarter but it’ s a long way from being strong and the low rate of growth in wages and the slowing in house price appreciation provides plenty of scope for the RBA to keep interest rates on hold.

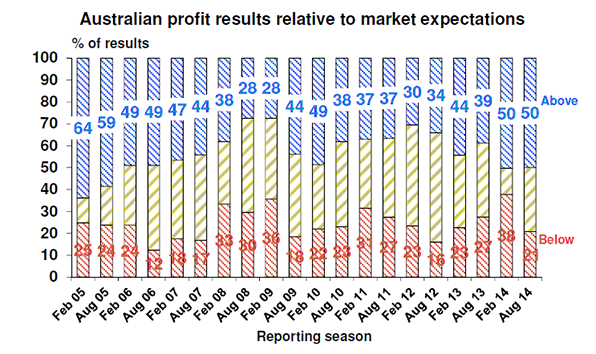

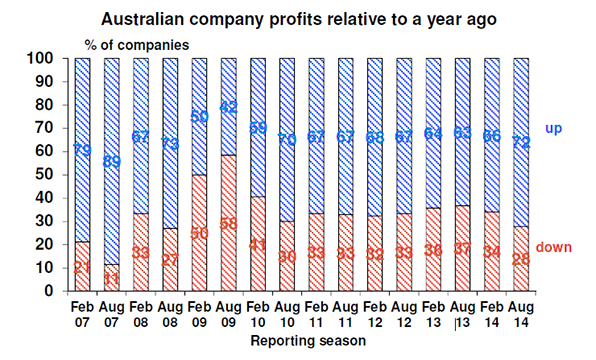

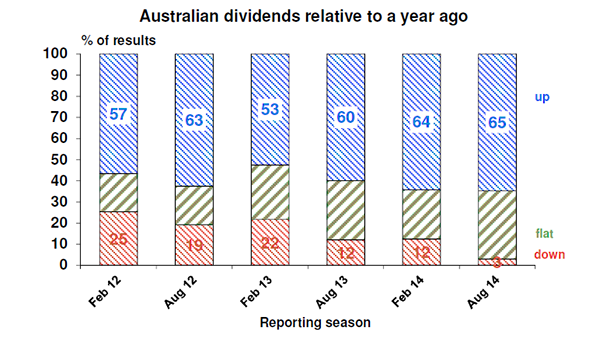

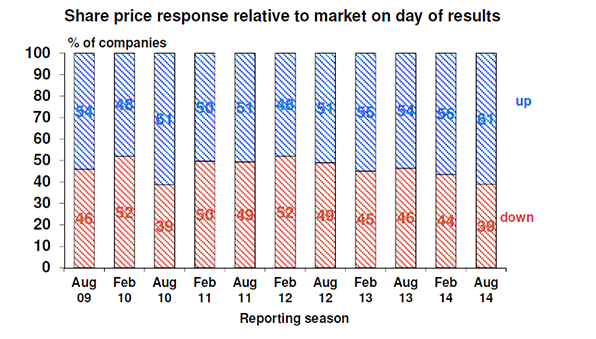

- We are now one quarter through the June half profit reporting season and while it’s dangerous to draw any firm conclusions early on given the tendency for well performing companies to report up front, the results to date have been reasonably good. 50% of companies have exceeded expectations (compared to a norm of 43%); 72% of companies have seen their profits rise from a year ago (compared to a norm of 66%); 63% of companies have increased their dividends from a year ago (up slightly from around 62% in the last two years); and 59% of companies have seen their share price outperform the market on the day they released results. Key themes have been continued strength for resources (notably Rio), banks doing well (with good results from CBA), ongoing cost control making up for still soft revenue growth and strong growth in dividends. The bottom line is that Australian earnings look to be on track to have increased by around 12% last financial year, with a 28% surge in resources’ profits, a 10% rise in bank profits and a 3% rise in profits for the rest of the market.

What to watch over the next week?

- In the US, July inflation data (Tuesday) is expected to confirm that inflation remains benign with headline inflation of 2% year on year and core inflation of 1.9% year on year and the Fed’s Jackson Hole symposium (Thursday and Friday) titled “Re-Evaluating Labor Market Dynamics” is likely to see the Fed Chair Yellen and the core leadership of the Fed stick to their positive but cautious assessment regarding the state of the US economy and specifically the assessment that considerable labour market slack remains, all of which is likely to reinforce expectations that a shift to monetary tightening is still a long way off. The minutes from the Fed’s last meeting (Wednesday) will also be released). On the economic activity front, we expect a modest further rise in the home builder’s conditions index (Monday), solid gains in housing starts and permits (Tuesday) after the weakness seen in June, a slight fall in existing home sales (Thursday) and continued solid reading from the Markit manufacturing conditions PMI (also Thursday).

- In the Eurozone, the focus will be on July manufacturing and services conditions PMIs (Thursday) – a further improvement would be nice but recent poor headlines and the Russian trade sanctions risk driving a slight fall. ECB President Draghi’s speech at Jackson Hole will also be watched for clues regarding further ECB easing.

- In Japan, the Markit manufacturing PMI for July (Thursday) will be watched for further signs of improvement following its tax hike induced weakness.

- China’s HSBC flash manufacturing PMI for July (Thursday) is likely to hold around June levels.

- In Australia, the minutes from the RBA’s last Board meeting (Tuesday) and Governor Steven’s Semi-Annual Parliamentary testimony (Thursday) are likely to confirm that rates will remain on hold, but with a slight dovish bias. Of particular interest will be the Governor’s comments on the $A which may see a bit more follow on jawboning from his comments in early July in an effort to push it lower.

- It will also be the busiest week of the Australian June half profit reporting season with 90 major companies due to report, including BHP, Stockland, IAG, Toll Holdings, Coca-Cola Amatil, Origin and AMP. Consensus earnings estimates for 2013-14 are for 12% growth and for 2014-15 are more modest at +5%.

Outlook for markets

- The correction seen in shares over the last few weeks is a healthy development serving to relieve a bit of complacency that had started to build up during the first half. More broadly the trend in shares is likely to remain up and, while it’s impossible to be sure given uncertainties around various geopolitical risks, we may have already seen the low. Valuations were not onerous at recent highs, global earnings are continuing to improve on the back of gradually improving economic growth, monetary conditions are set to remain easy for some time and there is no sign of the euphoria that comes with major share market tops. Our year-end target for the ASX 200 remains 5800.

- Low bond yields, e.g. 10 year yields of just 0.5% in Japan and 3.3% in Australia, will likely mean soft returns from government bonds.

- The combination of soft commodity prices, the likelihood the Fed will start raising interest rates ahead of the RBA and relatively high costs in Australia are expected to see the broad trend in the $A remain down. Expect to see $US0.80 in the next few years, but as always with currencies getting the timing right is going to be hard.

Source: AMP CAPITAL ‘Weekly Market Update’

AMP Capital Investors Limited and AMP Capital Funds Management Limited Disclaimer